Industrial Rubber Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Industrial Rubber Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

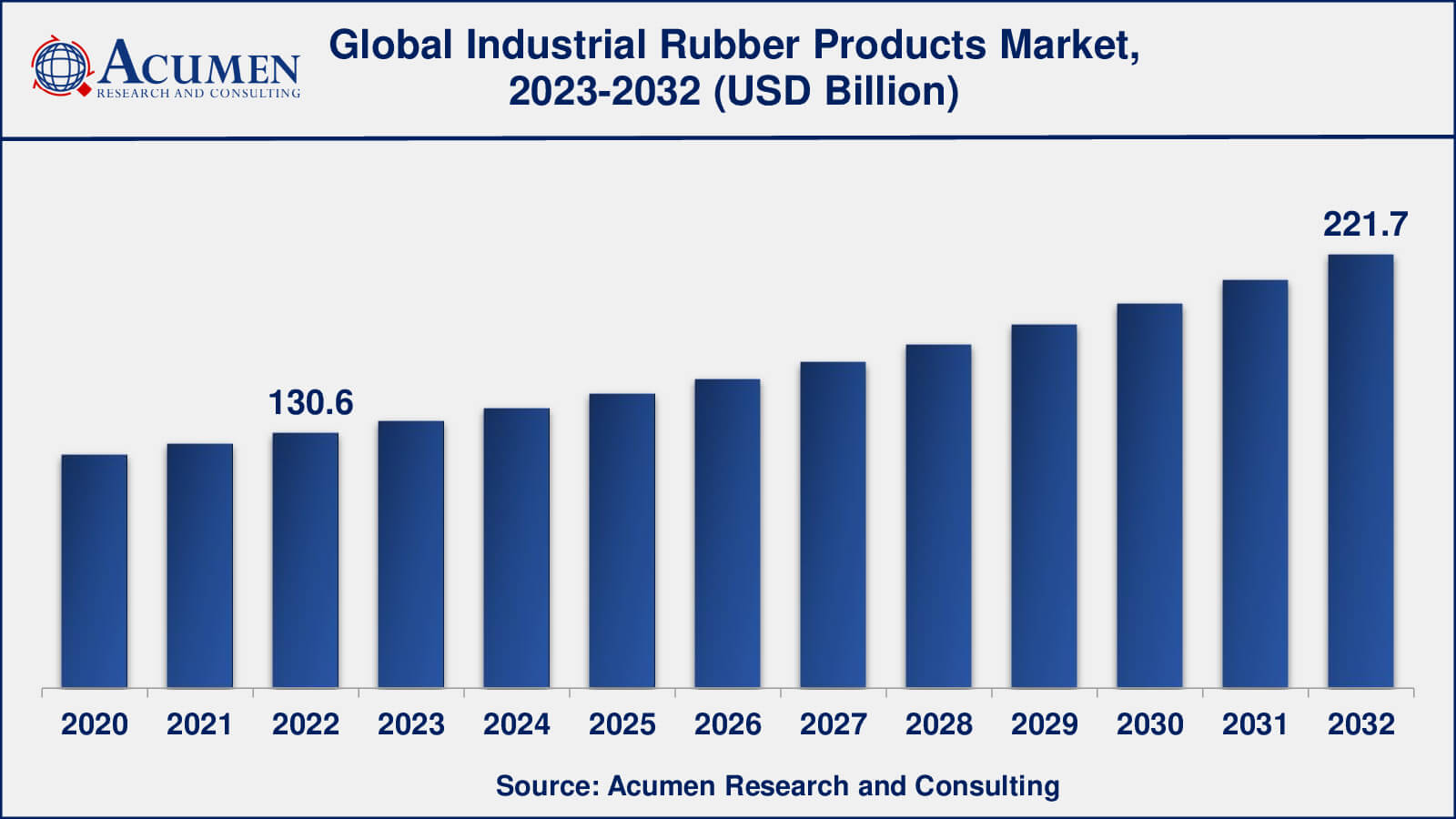

The Global Industrial Rubber Products Market Size accounted for USD 130.6 Billion in 2022 and is estimated to achieve a market size of USD 221.7 Billion by 2032 growing at a CAGR of 5.5% from 2023 to 2032.

Industrial Rubber Products Market Highlights

- Global industrial rubber products market revenue is poised to garner USD 221.7 billion by 2032 with a CAGR of 5.5% from 2023 to 2032

- Asia-Pacific industrial rubber products market value occupied more than USD 52 million in 2022

- Asia-Pacific industrial rubber products market growth will record a CAGR of around 6% from 2023 to 2032

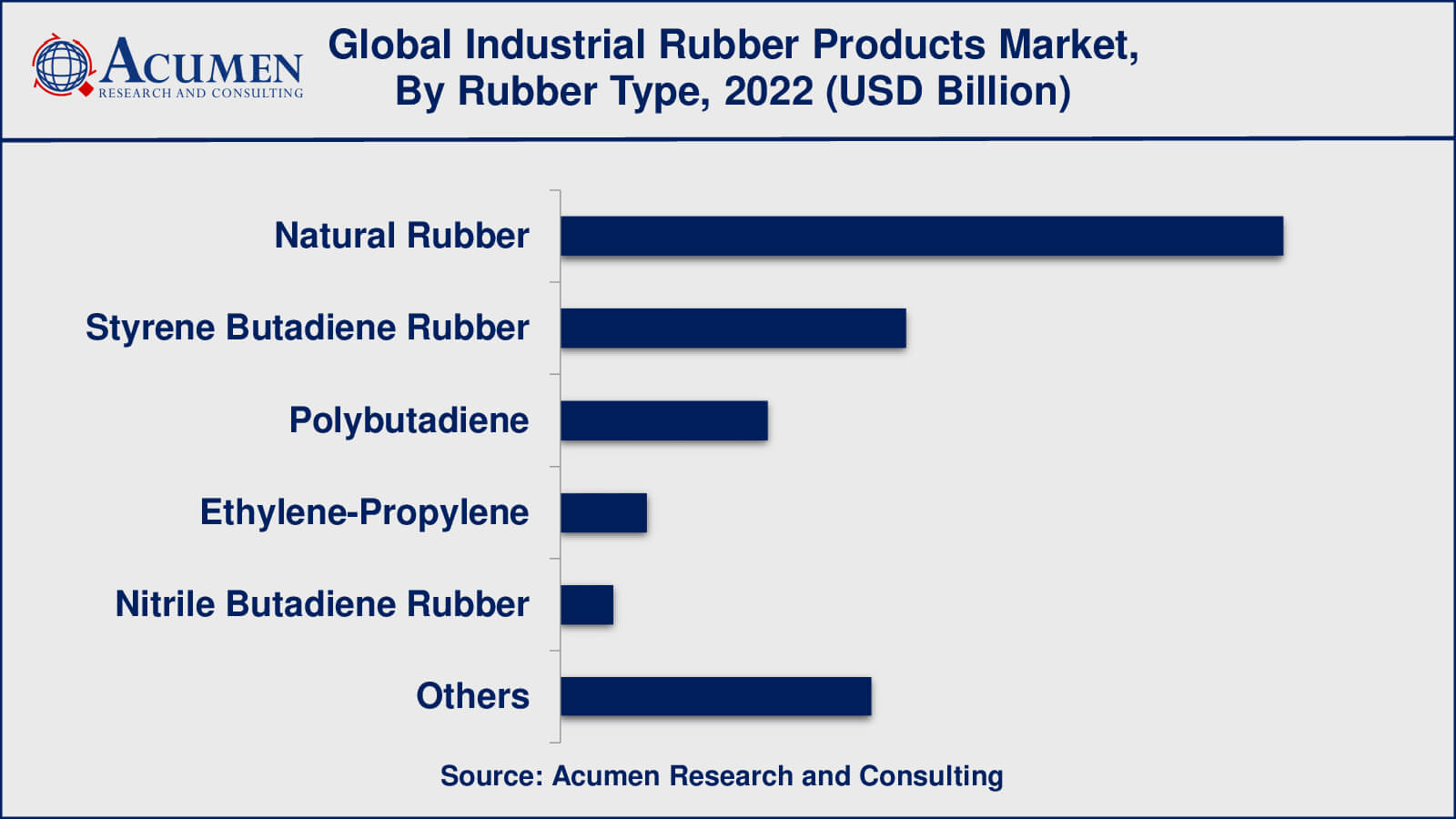

- Among rubber type, the natural rubber sub-segment generated US$ 54.9 billion revenue in 2022

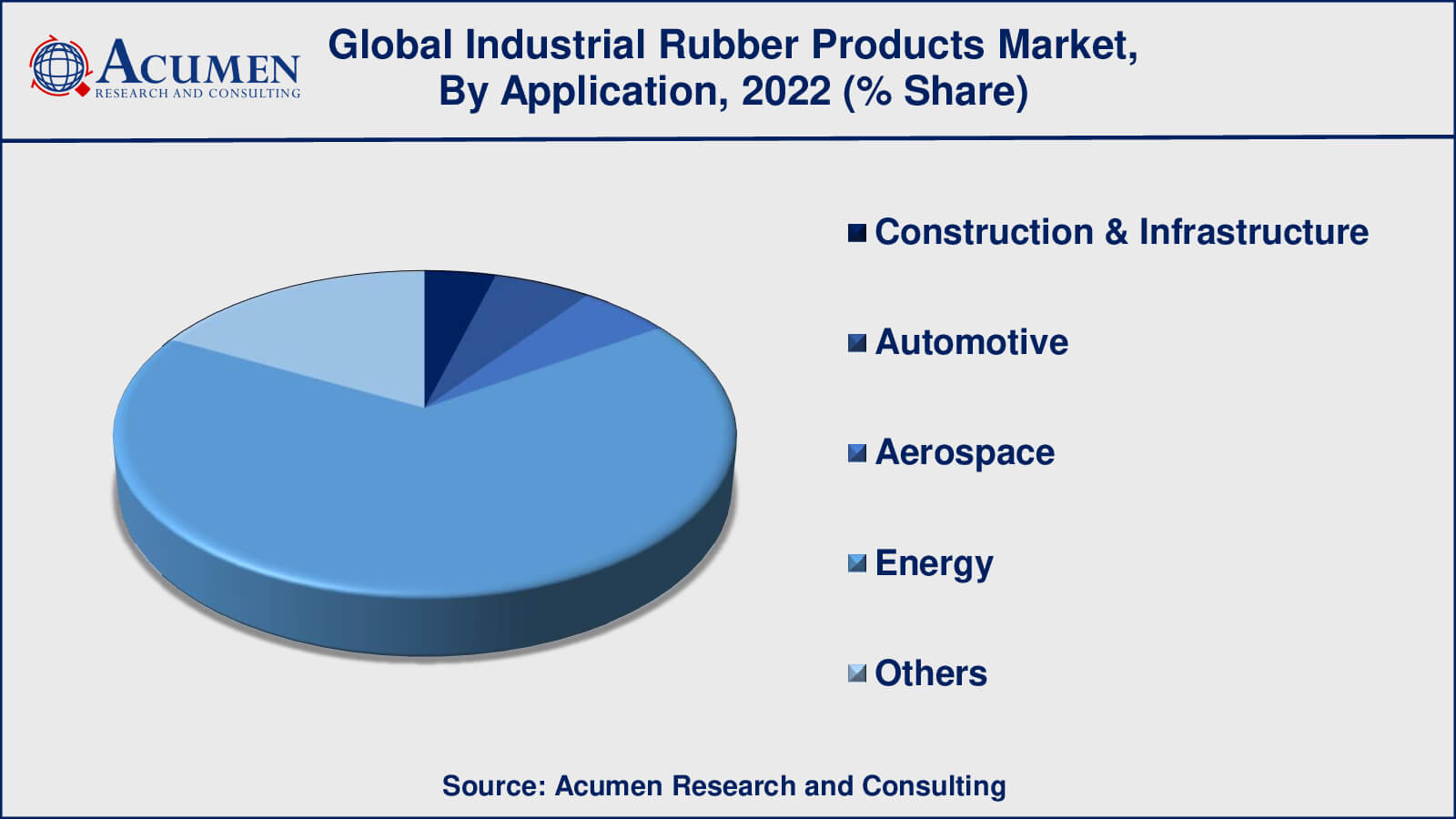

- Based application, the energy sub-segment generated around 67% share in 2022

- Rising adoption of Industry 4.0 is popular industrial rubber products market trend that fuels the industry demand

Rubber is a rough elastic polymeric substance made from the latex of hevea plant or synthetically. It is an elastic material known for its elasticity and can retain its actual shape when stretched and released. It is often used in manufacturing industrial parts or tools which reduces the industrial technical hitches such as shock wear, pressure, vibration, etc. Rubber is usually referred to as natural gum and consists of monomer units that form polymers that are heat preserved. They are tested rigorously to improve their toughness and resilience for their various industrial applications. Presently, rubber is used in a variety of industrial applications due to its unique properties and has negligible or no alternatives.

Global Industrial Rubber Products Market Dynamics

Market Drivers

- Increasing demand from end-use industries

- Growing adoption of lightweight materials

- Rising focus on safety and environmental regulations

- Growing investments in infrastructure

Market Restraints

- Volatility in raw material prices

- Slowdown in end-use industries

Market Opportunities

- Adoption of sustainable materials

- Integration of smart technologies

Industrial Rubber Products Market Report Coverage

| Market | Industrial Rubber Products Market |

| Industrial Rubber Products Market Size 2022 | USD 130.6 Billion |

| Industrial Rubber Products Market Forecast 2032 | USD 221.7 Billion |

| Industrial Rubber Products Market CAGR During 2023 - 2032 | 5.5% |

| Industrial Rubber Products Market Analysis Period | 2020 - 2032 |

| Industrial Rubber Products Market Base Year | 2022 |

| Industrial Rubber Products Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Rubber Type, By Process, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Greenville Industrial Rubber & Gasket Co, Continental AG, Bridgestone Corp, Goodyear Tire and Rubber Company, Industrial Rubber Products, Yokohama Rubber Company Ltd, Toyo Tire and Rubber Co. Ltd, Industrial Rubber & Gasket Inc., Eaton Corporation, Nok Corporation, and Sumitomo Riko Company Limited |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Rubber Products Market Insights

The unique properties of rubber and their uses have become a key element in the number of industrial machinery, which is driving the demand for rubber in industrial applications. There are certain adverse environmental effects during the manufacturing of such industrial rubber products which are highly toxic and poisonous. Such effects can be eliminated by implementing safety measures. It can be estimated that consistent growth due to the high demand for industrial rubber products, will raise its market over the forecast period.

Industrial Rubber Products Market Segmentation

The worldwide market for industrial rubber products is split based on rubber type, process, product, application and geography.

Industrial Rubber Products Market By Rubber Type

- Natural Rubber

- Styrene Butadiene Rubber

- Polybutadiene

- Ethylene-Propylene

- Nitrile Butadiene Rubber

- Others

According to the industrial rubber products industry analysis, natural rubber gathered significant amount of share in 2022. Natural rubber is derived from the sap of rubber trees and is widely used in the manufacture of tyres, automotive belts, and hoses, as well as sealants, adhesives, and roofing materials in the construction industry. SBR is a synthetic rubber used in a variety of industrial rubber products such as tyres, conveyor belts, and footwear.

Polybutadiene is a synthetic rubber that is used in the manufacture of tyres, automotive belts, and hoses, as well as sealants and adhesives in the construction industry. EPDM is a synthetic rubber that is used in a variety of industrial applications such as automotive weatherstripping, roofing materials, and electrical insulation. NBR is a synthetic rubber that is used in the production of seals, gaskets, hoses, and fuel lines due to its oil-resistant properties.

Industrial Rubber Products Market By Process

- Molded

- Extruded

- Fabricated

- Latex-Based

- Others

Molded rubber products are made by curing raw rubber material in a mould until it takes on the shape of the mould. This method is commonly used in the manufacture of automotive parts, gaskets, and seals. Extruded rubber products are made by forcing raw rubber material through a die to shape or profile it. This method is commonly used in the manufacture of tubing, seals, and weatherstripping. Fabricated rubber products are made by cutting and bonding rubber sheets, strips, or profiles to shape or product. This method is commonly used to create gaskets, seals, and custom rubber parts. Latex-based rubber products are made by pouring or dipping a liquid latex material into a mould and allowing it to solidify. This method is commonly used in the manufacture of gloves, balloons, and other consumer goods.

Industrial Rubber Products Market By Product

- Mechanical Rubber Products

- Rubber Hoses

- Rubber Belt

- Rubber Roofing

- Others

According to the industrial rubber products market forecast, the rubber hose segment is projected to hold the greatest market share owing to its widespread use in various applications such as automotive, oil & gas, and chemicals. Rubber hoses are expected to become more popular as a result of their superior properties such as flexibility, durability, and resistance to high pressure and temperature.

The rubber belt segment is also expected to have a significant market share due to increased demand for conveyor belts in industries such as mining, power generation, and food processing. According to the report, the demand for rubber roofing products is increasing due to advantages such as durability, energy efficiency, and low maintenance.

Industrial Rubber Products Market By Application

- Construction & Infrastructure

- Automotive

- Aerospace

- Energy

- Others

In recent years, the energy sector has dominated the industrial rubber products market. Hoses, gaskets, seals, and belts are common industrial rubber products used in the energy sector for a variety of applications including drilling, extraction, transportation, and refining of oil and gas. Factors such as increased exploration and production activities, rising demand for fuel and energy, and rising investments in renewable energy sources drive demand for industrial rubber products in the energy sector.

It is important to note, however, that the other industries listed, such as construction and infrastructure, automotive, aerospace, and others, have significant demand for industrial rubber products, depending on their specific needs and applications.

Industrial Rubber Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Rubber Products Market Regional Analysis

Asia-Pacific is expected to have the largest market share in the industrial rubber products market due to the growth of various end-use industries such as automotive, construction, and healthcare. India, China, and Japan are expected to dominate the market in this region.

North America is projected to hold a substantial market share in the industrial rubber products market because of the growth of the automotive, aerospace, and healthcare industries. The United States is expected to dominate the market in this region.

Europe also holds an important market share in the industrial rubber products market because of the expansion of the automotive, construction, and food and beverage industries. United Kingdom, Germany, and France are expected to dominate the market in this region.

Industrial Rubber Products Market Players

Some of the top industrial rubber products companies offered in the professional report include Greenville Industrial Rubber & Gasket Co, Continental AG, Bridgestone Corp, Goodyear Tire and Rubber Company, Industrial Rubber Products, Yokohama Rubber Company Ltd, Toyo Tire and Rubber Co. Ltd, Industrial Rubber & Gasket Inc., Eaton Corporation, Nok Corporation, and Sumitomo Riko Company Limited

Frequently Asked Questions

What was the market size of the global industrial rubber products in 2022?

The market size of industrial rubber products was USD 130.6 billion in 2022.

What is the CAGR of the global industrial rubber products market from 2023 to 2032?

The CAGR of industrial rubber products is 5.5% during the analysis period of 2023 to 2032.

Which are the key players in the industrial rubber products market?

The key players operating in the global market are including Greenville Industrial Rubber & Gasket Co, Continental AG, Bridgestone Corp, Goodyear Tire and Rubber Company, Industrial Rubber Products, Yokohama Rubber Company Ltd, Toyo Tire and Rubber Co. Ltd, Industrial Rubber & Gasket Inc., Eaton Corporation, Nok Corporation, and Sumitomo Riko Company Limited.

Which region dominated the global industrial rubber products market share?

Asia-Pacific held the dominating position in industrial rubber products industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of industrial rubber products during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global industrial rubber products industry?

The current trends and dynamics in the industrial rubber products industry include increasing demand from end-use industries, growing adoption of lightweight materials, and rising focus on safety and environmental regulations.

Which rubber type held the maximum share in 2022?

The natural rubber type held the maximum share of the industrial rubber products industry.