Industrial Radiography Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Industrial Radiography Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

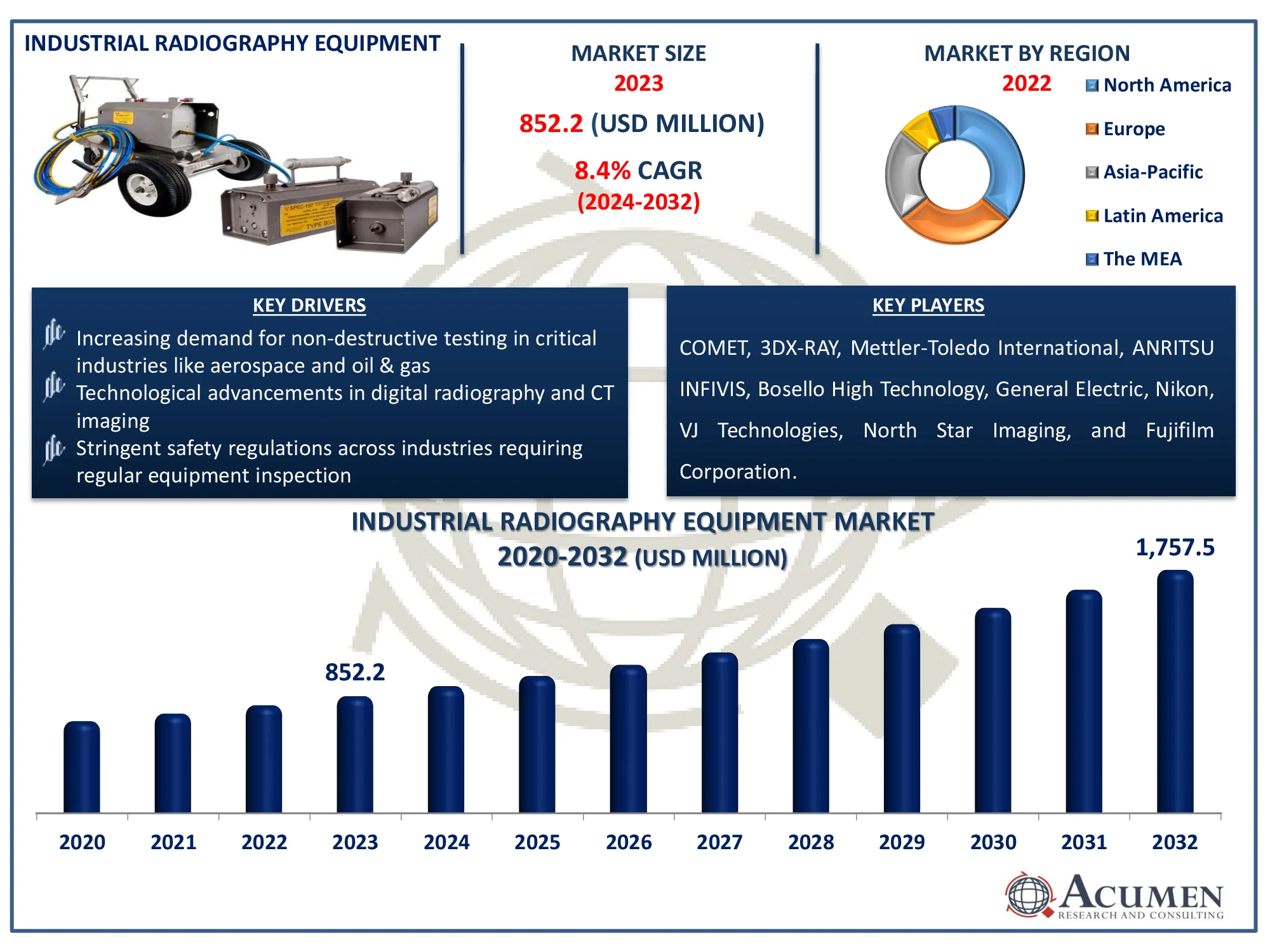

Request Sample Report

The Global Industrial Radiography Equipment Market Size accounted for USD 852.2 Million in 2023 and is estimated to achieve a market size of USD 1,757.5 Million by 2032 growing at a CAGR of 8.4% from 2024 to 2032.

Industrial Radiography Equipment Market Highlights

- The global industrial radiography equipment market is projected to reach USD 1,757.5 million by 2032, with a CAGR of 8.4% from 2024 to 2032

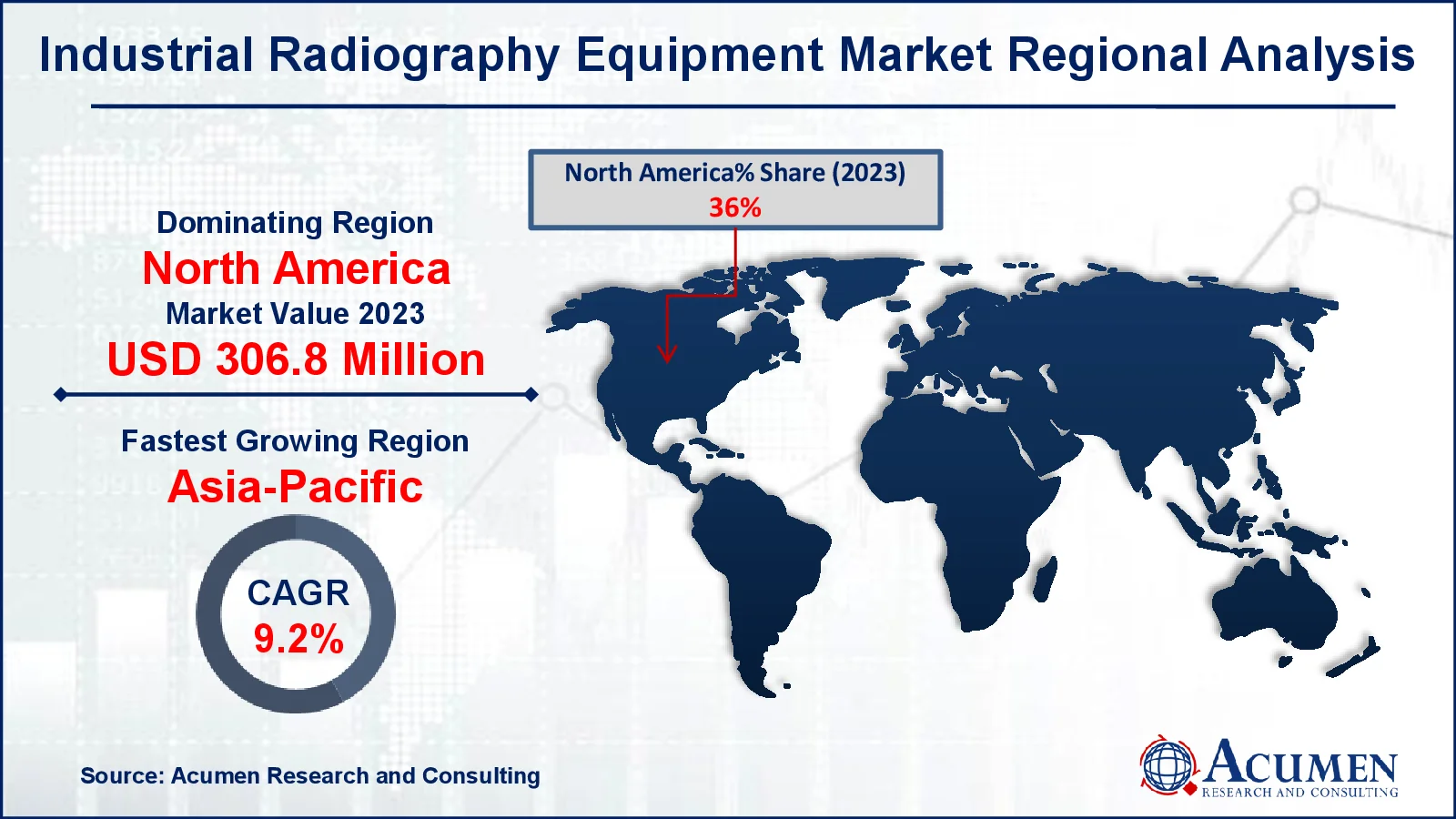

- The North America industrial radiography equipment market was valued at approximately USD 306.8 million in 2023

- The Asia-Pacific industrial radiography equipment market is anticipated to grow at a CAGR of over 9.2% from 2024 to 2032

- The film-based radiography sub-segment is expected to show significant growth in 2023 based on imaging techniques

- Increased emphasis on safety and quality assurance in critical industries is driving the need for NDT solutions is the industrial radiography equipment market trend that fuels the industry demand

Industrial radiography equipment is a collection of devices and technologies used for non-destructive testing (NDT), which inspects the interior structure of materials and components without causing harm. It generally uses X-rays or gamma rays to provide images of defects, flaws, or irregularities in items like welds, castings, and pipes. Industrial radiography has a wide range of applications, including aerospace, automotive, manufacturing, oil and gas, and electronics, all of which require structural integrity and safety. This equipment is required for quality control, maintenance, and compliance with industry requirements. Overall, it improves the dependability and safety of vital infrastructure and equipment.

Global Industrial Radiography Equipment Market Dynamics

Market Drivers

- Increasing demand for non-destructive testing in critical industries like aerospace and oil & gas

- Technological advancements in digital radiography and CT imaging

- Stringent safety regulations across industries requiring regular equipment inspection

Market Restraints

- High initial cost of industrial radiography equipment

- Lack of skilled professionals for operating advanced radiography systems

- Regulatory restrictions related to radiation safety and usage

Market Opportunities

- Growing adoption of industrial radiography in emerging markets like Asia-Pacific

- Advancements in portable radiography systems for on-site inspection

- Integration of artificial intelligence (AI) for automated defect detection and analysis

Industrial Radiography Equipment Market Report Coverage

|

Market |

Industrial Radiography Equipment Market |

|

Industrial Radiography Equipment Market Size 2023 |

USD 852.2 Million |

|

Industrial Radiography Equipment Market Forecast 2032 |

USD 1,757.5 Million |

|

Industrial Radiography Equipment Market CAGR During 2024 - 2032 |

8.4% |

|

Industrial Radiography Equipment Market Analysis Period |

2020 - 2032 |

|

Industrial Radiography Equipment Market Base Year |

2023 |

|

Industrial Radiography Equipment Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Imaging Technique, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

COMET, 3DX-RAY, Mettler-Toledo International, ANRITSU INFIVIS, Bosello High Technology, General Electric, Nikon, VJ Technologies, North Star Imaging, and Fujifilm Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Radiography Equipment Market Insights

The growing radiographic potential in additive manufacturing is driving the industrial radiography equipment market. With the introduction of new technology, increased production based on 3D printing saw significant growth. As additive manufacturing has grown in popularity, so has the demand for radiographic testing.

The transition from analog to digital x-rays is a key driver of growth in the global industrial radiography equipment market. Digital X-ray systems offer enhanced output, improved image quality, faster scanning, and many storage options. Digital system images can be saved on hard disks or disks, and users have greater control over the quality of the images produced.

Although digital X-rays are more expensive than analog X-rays, the high return on investment motivates end users to upgrade their X-rays. The need for improved testing and measurement in tube assemblies, multi-layered printed circuit boards, and semiconductor chips drives up the need for industrial x-ray equipment.

The high initial cost of industrial radiography equipment makes it difficult for smaller businesses to invest in these sophisticated systems. This can limit the technology's adoption, particularly in businesses with constrained budgets. As a result, market growth is slowing due to the affordability hurdle.

Advances in portable radiography devices are making it easier for enterprises to undertake on-site inspections, particularly in rural or difficult-to-access locations. These devices are lighter, easier to travel, and produce faster results than typical fixed equipment. This lowers downtime and increases efficiency, making them ideal for industries such as oil and gas, construction, and manufacturing. As more companies embrace portable systems, demand for industrial radiography equipment is likely to rise.

Industrial Radiography Equipment Market Segmentation

The worldwide market for industrial radiography equipment is split based on imaging technique, application, and geography.

Industrial Radiography Equipment Imaging Technique

- Digital Radiography

- Direct Radiography

- Computed Tomography

- Computed Radiography

- Film-based Radiography

According to the industrial radiography equipment industry analysis, film-based radiography shows robust growth because of its proven ability to detect faults in materials and structures. It employs photographic film to capture X-ray or gamma-ray images, yielding high-quality visual examination findings. Despite the emergence of digital alternatives such as direct radiography and computed tomography, film-based technologies are still widely used in industries that require high precision, such as aerospace, manufacturing, and oil and gas.

Industrial Radiography Equipment Application

- Aerospace & Defense

- Automotive & Transportation

- Manufacturing

- Oil & Gas

- Electronics

- Others

According to the industrial radiography equipment market forecast, the oil and gas industry expected to grow in forecast year because it requires non-destructive testing (NDT) for pipeline inspections, welding checks, and pressure vessel analysis. Ensure the structural integrity of components to avoid leaks, accidents, and costly downtimes. Industrial radiography is commonly employed in this industry to detect flaws such as corrosion, cracks, and weld defects in metal structures. Its dependability and accuracy make it critical for preserving safety and operating efficiency in oil and gas exploration, production, and processing.

Industrial Radiography Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Radiography Equipment Market Regional Analysis

For several reasons, North America is projected to lead the worldwide industrial radiography equipment market, due to its strong aerospace and defense sectors, which demand high non-destructive testing regulations. The region benefits from cutting-edge technology advancements, considerable infrastructure investments, and a solid regulatory environment that prioritizes safety and quality. This sector's growth is primarily driven by rising demand for industrial X-rays from a range of businesses in the region, including semiconductor, oil and gas, and manufacturing.

Industrial X-rays are becoming increasingly common in Asia Pacific, particularly in rising economies like China and India. The rising semiconductor sector and its miniaturization are driving the region's growing demand for electronic components. The growing need for non-destructive testing in the manufacturing, automotive, and energy industries is propelling market expansion. Furthermore, the region's growing technological breakthroughs and investments in safety laws encourage the adoption of industrial radiography systems in Asian-region.

Industrial Radiography Equipment Market Players

Some of the top industrial radiography equipment companies offered in our report includes COMET, 3DX-RAY, Mettler-Toledo International, ANRITSU INFIVIS, Bosello High Technology, General Electric, Nikon, VJ Technologies, North Star Imaging, and Fujifilm Corporation.

Frequently Asked Questions

How big is the industrial radiography equipment market?

The industrial radiography equipment market size was valued at USD 852.2 million in 2023.

What is the CAGR of the global industrial radiography equipment market from 2024 to 2032?

The CAGR of industrial radiography equipment is 8.4% during the analysis period of 2024 to 2032.

Which are the key players in the industrial radiography equipment market?

The key players operating in the global market are including COMET, 3DX-RAY, Mettler-Toledo International, ANRITSU INFIVIS, Bosello High Technology, General Electric, Nikon, VJ Technologies, North Star Imaging, and Fujifilm Corporation

Which region dominated the global industrial radiography equipment market share?

North America held the dominating position in industrial radiography equipment industry during the analysis period of 2024 to 2032.

North America held the dominating position in industrial radiography equipment industry during the analysis period of 2024 to 2032.

Asia-Pacific region exhibited fastest growing CAGR for market of industrial radiography equipment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global industrial radiography equipment industry?

The current trends and dynamics in the industrial radiography equipment industry include increasing demand for non-destructive testing in critical industries like aerospace and oil & gas, technological advancements in digital radiography and CT imaging, and stringent safety regulations across industries requiring regular equipment inspection

Which application held the maximum share in 2023?

The oil & gas holds the maximum share of the industrial radiography equipment industry.