Industrial Hemp Market | Acumen Research and Consulting

Industrial Hemp Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

The Industrial Hemp Market Size accounted for USD 6.4 Billion in 2022 and is estimated to achieve a market size of USD 39.3 Billion by 2032 growing at a CAGR of 20.2% from 2023 to 2032.

Industrial Hemp Market Highlights

- Global industrial hemp market revenue is poised to garner USD 39.3 billion by 2032 with a CAGR of 20.2% from 2023 to 2032

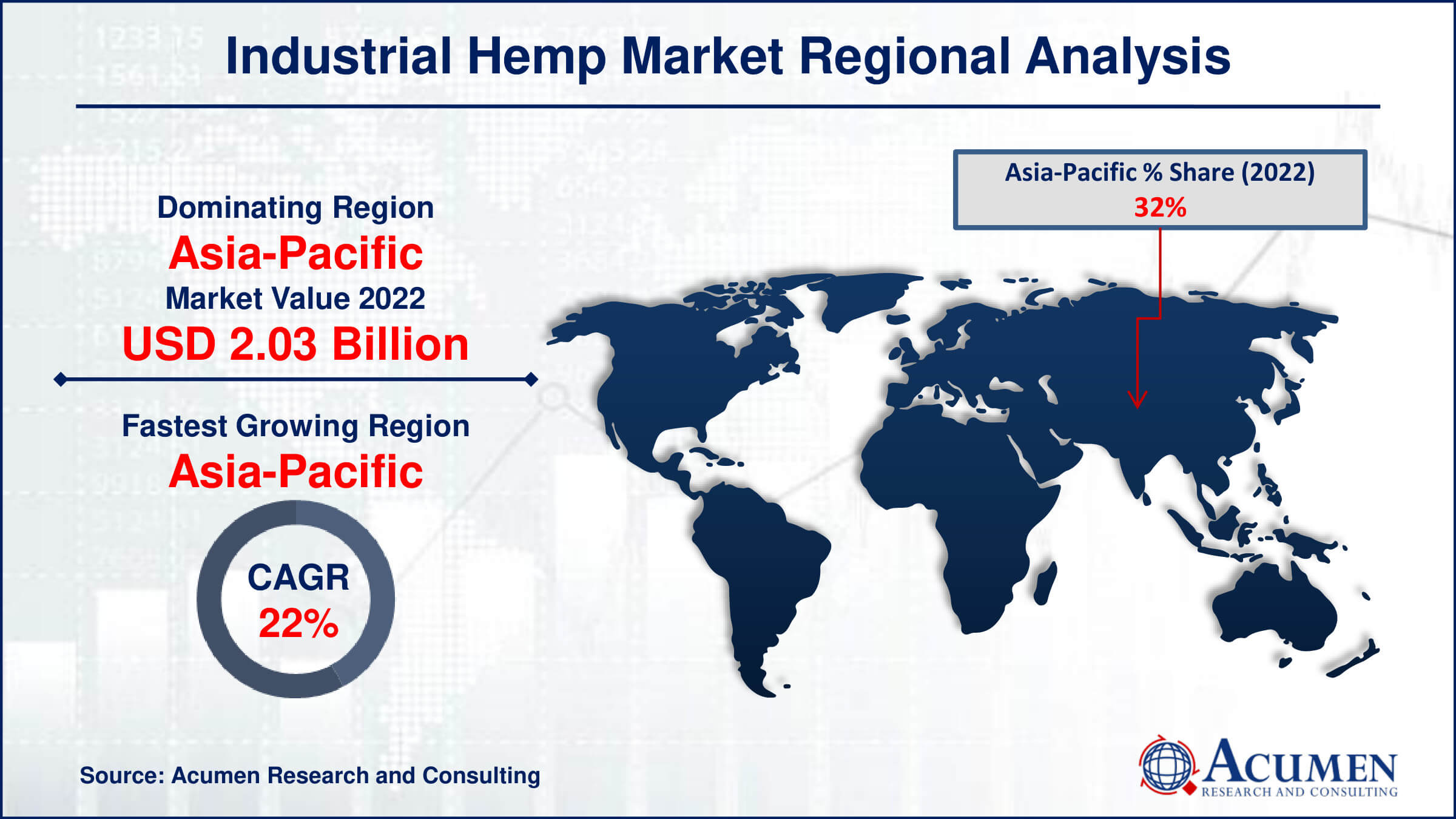

- Asia-Pacific industrial hemp market value occupied around USD 2 billion in 2022

- Asia-Pacific industrial hemp market growth will record a CAGR of more than 22% from 2023 to 2032

- Among product, the seeds sub-segment generated over US$ 1.9 billion revenue in 2022

- Based on application, the textile sub-segment generated around 26% share in 2022

- Shifting consumer preferences towards natural and organic products is a popular industrial hemp market trend that fuels the industry demand

Hemp, or industrial hemp, is a strain of the Cannabis sativa species. It is cultivated specifically for industrial uses and purposes. Industrial hemp is predominantly found in the northern hemisphere and is refined for a wide range of commercial applications, including food, paints, insulation, medicine, textiles, paper, personal care, and more. Typically grown in temperate zones as an annual crop from seed, industrial hemp can reach heights of up to 16 feet. It is distinct from the cannabis plant used for recreational and medical purposes. Unlike marijuana, industrial hemp does not require a license to grow for various purposes.

Global Industrial Hemp Market Dynamics

Market Drivers

- Increasing awareness of sustainability and eco-friendly products

- Expanding legalization and regulations favoring hemp cultivation

- Growing applications in diverse industries, from textiles to healthcare

- Rising consumer preference for hemp-based products due to their nutritional and medicinal benefits

Market Restraints

- Regulatory inconsistencies and varying legal frameworks

- Limited infrastructure for processing and extraction poses

- Illegal and unregulated use of hemp for recreational purposes

Market Opportunities

- Innovations in hemp processing technologies

- Increasing research and development for novel applications

- Expanding global trade agreements

Industrial Hemp Market Report Coverage

| Market | Industrial Hemp Market |

| Industrial Hemp Market Size 2022 | USD 6.4 Billion |

| Industrial Hemp Market Forecast 2032 | USD 39.3 Billion |

| Industrial Hemp Market CAGR During 2023 - 2032 | 20.4% |

| Industrial Hemp Market Analysis Period | 2020 - 2032 |

| Industrial Hemp Market Base Year |

2022 |

| Industrial Hemp Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Plains Industrial Hemp Processing Ltd., Hemp Inc., Hempflax Group B.V., Ecofibre Ltd., Aurora Cannabis Inc., Marijuana Company of America, Inc., South Hemp Tecno S.R.L., GenCanna, Hempro International, GmbH & Co. KG, and MH Medical Hemp |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Industrial Hemp Market Insights

The global industrial hemp market is currently operating in the introductory phase of its industry life cycle and is expected to gain momentum in growth over the coming years. The rising use of industrial hemp in various end-use industries such as animal care, textiles, automotive, furniture, food and beverages, paper, construction materials, personal care, and others is driving the market's expansion. The increasing demand for industrial hemp-based foods, including salad dressings, cooking oils, dairy products, and a range of food items, is boosting its adoption in the food and beverage industry. The slowly growing use of industrial hemp in bakery products is expected to create new growth opportunities in the coming industrial hemp industry forecast period.

Essential skin benefits associated with industrial hemp products, such as anti-aging properties, moisturization, and skin cell repair, are contributing to the overall market growth. Hemp-based food products contain rich amounts of essential nutrients that help maintain insulin balance, cardiac function, mood stability, and skin and joint health. Due to these reasons, the adoption of industrial hemp in the food & beverage and personal care industries is witnessing a rapid rise. Consequently, many countries are commercially cultivating this plant. In the textile industry, companies are adopting sustainable approaches to offer solutions to consumers, with hemp fibers being one of the widely used options. This is because hemp-based fibers are environmentally friendly, enabling companies to provide sustainable solutions to consumers.

Pulp obtained from the hemp plant is increasingly used in paper production, which finds applications in cigarette filters, banknotes, technical filter papers, and specialty papers. These factors collectively drive the demand for the industrial hemp oil market. However, the growth of this market is restrained by the illegal application of industrial hemp, mainly aimed at recreational purposes. This factor could further hamper the growth of this market over the forecast period. Nevertheless, the expanding application scope of industrial hemp is anticipated to offer new growth opportunities in industrial hemp market forecast period.

Industrial Hemp Market Segmentation

The worldwide market for industrial hemp is split based on product, source, application, and geography.

Industrial Hemp Products

- Seeds

- Fiber

- Oil

- Shivs

Within the industrial hemp market, which is a vast terrain, seeds are by far the largest contribution. Hemp seeds are highly sought-after due to their adaptability, nutritional value, and variety of uses. They supply a multitude of businesses, including as food, health, and beauty, with vital fatty acids, proteins, and other advantageous substances. Hemp seeds have become increasingly popular due to their versatility in skincare, vitamins, and food, further solidifying their market domination. Their extensive use highlights both their nutritional value and their important contribution to the expansion and vitality of the industrial hemp market.

Industrial Hemp Sources

- Conventional

- Organic

According to industrial hemp industry analysis, the conventional sourcing approach remains the dominant force. Its extensive adoption and well-established procedures within the sector are the reasons for its dominance. With its standardised methods and accessibility, conventional sourcing is in a dominant position and can meet the majority of market requests. Its widespread use is attributed to its familiarity, scalability, and frequently reduced production costs as compared to organic approaches. The industrial hemp market's direction is shaped by the entrenched infrastructure and widespread reach of conventional methods, notwithstanding the eco-friendliness and superior quality of organic procurement.

Industrial Hemp Applications

- Animal care

- Textile

- Automotive

- Furniture

- Food and Beverages

- Paper

- Construction Material

- Personal care

- Others

The textile industry stands out as the front-runner among the wide range of applications for industrial hemp, setting the standard with its significant effect. Hemp-based textiles are a popular option in the business because of its superior attributes, which include breathability, durability, and sustainability. Hemp fabrics are environmentally beneficial, which is in line with the rising demand for sustainable materials and fashion. Innovation in fabric technology is driving this segment's growth and boosting hemp's appeal and adaptability. Because of its numerous applications and substantial contributions, the industrial hemp market is driven by the textile industry, which capitalises on hemp's natural advantages.

Industrial Hemp Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Industrial Hemp Market Regional Analysis

The Asia-Pacific area is the largest and fastest growing hub in the ever expanding industrial hemp business. A number of things contribute to this domination, such as a long history of hemp production, a growth-friendly environment, and a growing focus on sustainable methods. Countries such as China, India, and Japan are important players in this regard, using their knowledge of agriculture and their advancements in technology to increase hemp production. Furthermore, the need for goods generated from hemp is fueled by the region's developing industries, which include food, construction, textiles, and personal care. This further accelerates market expansion. Hemp's importance in the Asia-Pacific market is mostly due to its cultural acceptance and historical use in a variety of applications, which has cemented its position as the industry leader in terms of both size and rate of increase.

On the other hand, the industrial hemp market's second-largest area is North America. The region's standing is supported by its changing regulatory environment, which has progressively improved in favor of hemp use and farming. The legalization of hemp production under the U.S. Farm Bill has resulted in a significant increase in interest and investment in the sector. Canada, which is well-known for its progressive hemp laws, makes a significant contribution to North America's standing by supporting a thriving hemp sector. Though it has lagged behind the Asia-Pacific region's quick growth, the region's improvements in processing technology and numerous applications across sectors such as the food, automotive, and textile industries further support its significant standing within the global industrial hemp market.

Industrial Hemp Market Players

Some of the top industrial hemp companies offered in our report include Plains Industrial Hemp Processing Ltd., Hemp Inc., Hempflax Group B.V., Ecofibre Ltd., Aurora Cannabis Inc., Marijuana Company of America, Inc., South Hemp Tecno S.R.L., GenCanna, Hempro International, GmbH & Co. KG, and MH Medical Hemp.

Frequently Asked Questions

How big is the industrial hemp market?

The market size of industrial hemp was USD 6.4 billion in 2022.

What is the CAGR of the global industrial hemp market from 2023 to 2032?

The CAGR of industrial hemp is 20.2% during the analysis period of 2023 to 2032.

Which are the key players in the industrial hemp market?

The key players operating in the global market are including Plains Industrial Hemp Processing Ltd., Hemp Inc., Hempflax Group B.V., Ecofibre Ltd., Aurora Cannabis Inc., Marijuana Company of America, Inc., South Hemp Tecno S.R.L., GenCanna, Hempro International, GmbH & Co. KG, and MH Medical Hemp

Which region dominated the global industrial hemp market share?

Asia-Pacific held the dominating position in industrial hemp industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of industrial hemp during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global industrial hemp industry?

What are the current trends and dynamics in the global industrial hemp industry?

Which product held the maximum share in 2022?

The seeds product held the maximum share of the industrial hemp industry.