Hydrogenated Nitrile Butadiene Rubber Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Hydrogenated Nitrile Butadiene Rubber Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

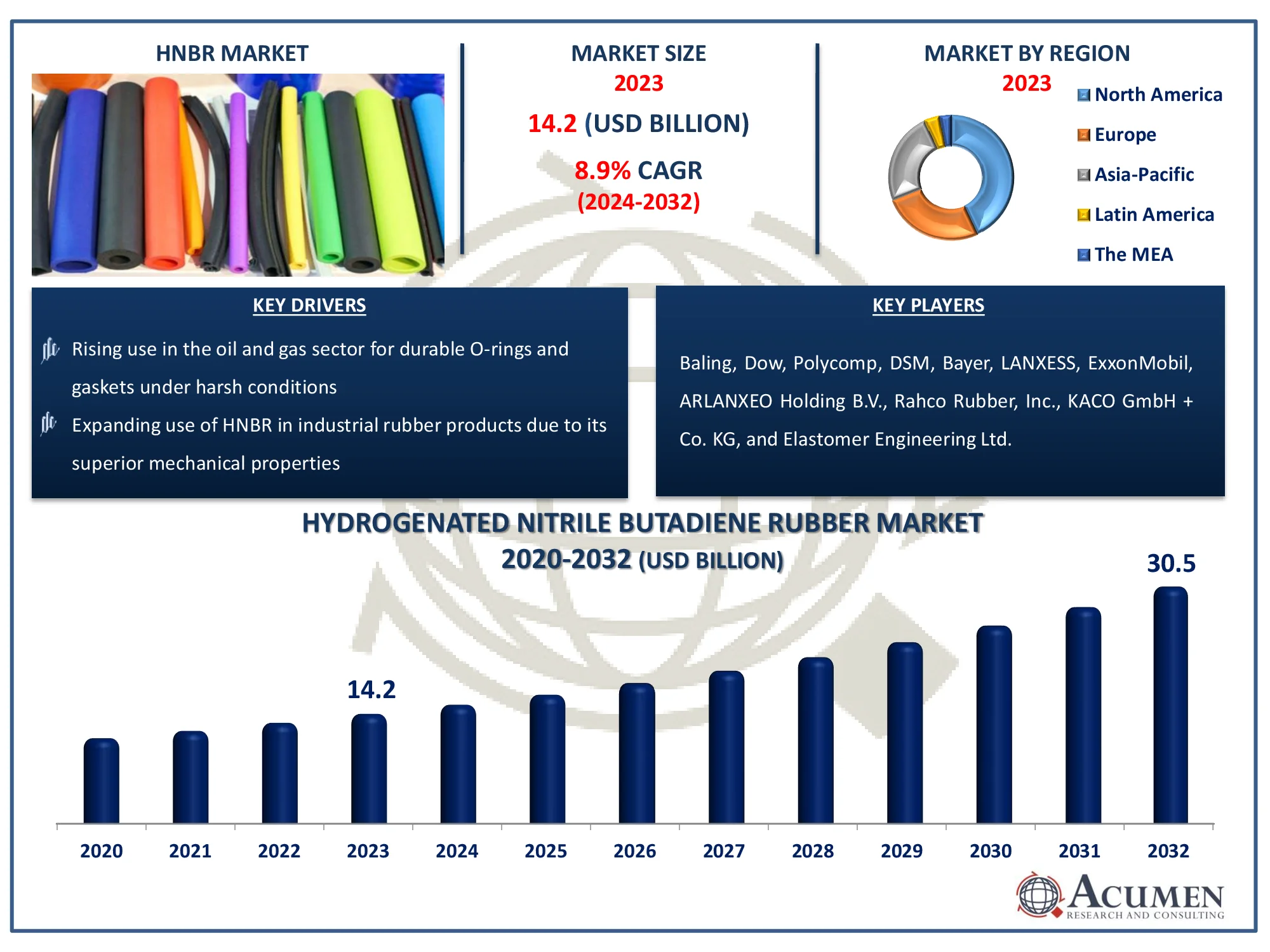

The Global Hydrogenated Nitrile Butadiene Rubber Market Size accounted for USD 14.2 Billion in 2023 and is estimated to achieve a market size of USD 30.5 Billion by 2032 growing at a CAGR of 8.9% from 2024 to 2032.

Hydrogenated Nitrile Butadiene Rubber Market Highlights

- Global hydrogenated nitrile butadiene rubber market revenue is poised to garner USD 30.5 billion by 2032 with a CAGR of 8.9% from 2024 to 2032

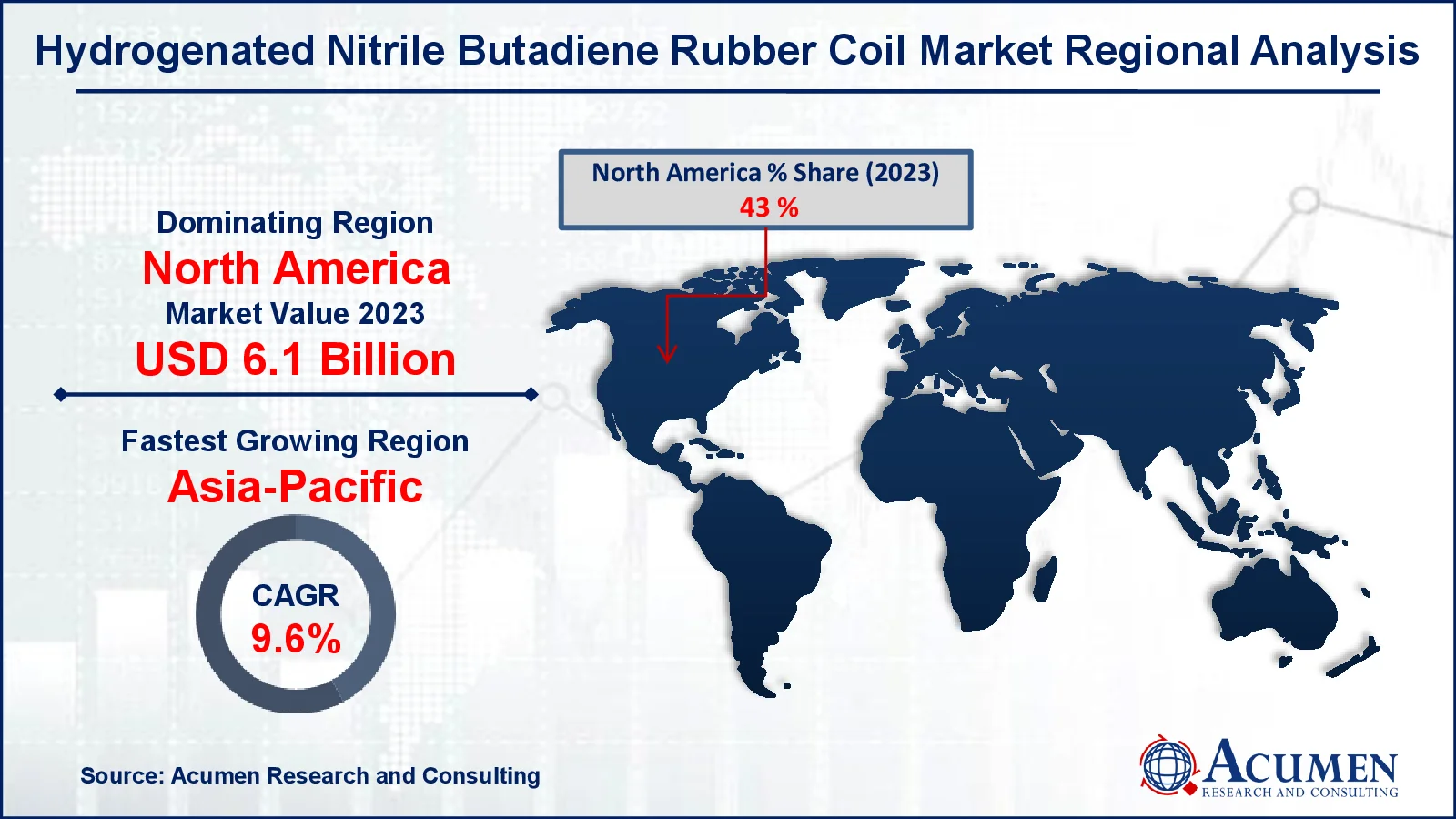

- North America hydrogenated nitrile butadiene rubber market value occupied around USD 6.1 billion in 2023

- Asia-Pacific hydrogenated nitrile butadiene rubber market growth will record a CAGR of more than 9.6% from 2024 to 2032

- Among product, the HNBR solid sub-segment generated more than USD 9.5 billion revenue in 2023

- Based on end-use industry, the automotive sub-segment generated around 47% hydrogenated nitrile butadiene rubber market share in 2023

- Increasing focus on high-performance rubber in emerging markets due to rapid industrialization is a popular hydrogenated nitrile butadiene rubber market trend that fuels the industry demand

The synthetic rubber with its retention and physical strength is hydrogenated butadiene butadiene rubber following long-term exposure to chemicals, oils and heat. It is also called very saturated nitrile. The hydrogenated butadiene nitrile rubber is commonly used in automotive manufacturing to produce air conditioning O-rings. The Asia-Pacific region is projected to be the fastest-growing hydrogenated nitrile butadiene rubber Market. Countries such as China, India, and Japan are rapidly industrializing, driving demand for HNBR market in a variety of industries including automotive, oil and gas, and construction.

Global Hydrogenated Nitrile Butadiene Rubber Market Dynamics

Market Drivers

- Increasing demand from the automotive industry for sealing applications due to HNBR's heat and oil resistance

- Rising use in the oil and gas sector for durable O-rings and gaskets under harsh conditions

- Expanding use of HNBR in industrial rubber products due to its superior mechanical properties

- Growth in the aerospace industry boosting the demand for high-performance rubber materials

Market Restraints

- High production costs of HNBR compared to other rubber alternatives

- Limited availability of raw materials leading to supply chain challenges

- Environmental concerns related to the non-biodegradability of synthetic rubber

Market Opportunities

- Development of bio-based HNBR to address sustainability concerns

- Growing demand for HNBR in electric vehicles for advanced sealing and thermal management

- Expanding applications in the medical industry for durable and chemical-resistant products

Hydrogenated Nitrile Butadiene Rubber Market Report Coverage

| Market | Hydrogenated Nitrile Butadiene Rubber Market |

| Hydrogenated Nitrile Butadiene Rubber Market Size 2022 |

USD 14.2 Billion |

| Hydrogenated Nitrile Butadiene Rubber Market Forecast 2032 | USD 30.5 Billion |

| Hydrogenated Nitrile Butadiene Rubber Market CAGR During 2023 - 2032 | 8.9% |

| Hydrogenated Nitrile Butadiene Rubber Market Analysis Period | 2020 - 2032 |

| Hydrogenated Nitrile Butadiene Rubber Market Base Year |

2022 |

| Hydrogenated Nitrile Butadiene Rubber Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Baling, Dow, Polycomp, DSM, Bayer, LANXESS, ExxonMobil, ARLANXEO Holding B.V., Rahco Rubber, Inc., KACO GmbH + Co. KG, and Elastomer Engineering Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydrogenated Nitrile Butadiene Rubber Market Insights

Due to the changes in nitrile butadiene (NBR) preference towards hydrogenated nitrile butadiene rubber (HNBR), HNBR has become one of the rapidly increasing raw materials for rubber product manufacturing. The ever-growing preference of consumers for high-quality rubber has driven a shift in rubber manufacturing methods. Hydrogenated nitrile butadiene rubber is now the focal point in many automotive, building, petroleum, gas, and equipment applications due to its physical strength and excellent retention characteristics.

In 2023 hydrogenated nitrile butadiene rubber market, the automotive sector alone accounted for 47%. Given its popularity and contribution to the development of the synthetic rubber sector across various industrial applications, companies are working to expand their manufacturing capacity for HNBR. Comprehensive studies of the hydrogenated nitrile butadiene rubber industry highlight the rising demand in end-use industries and the volatility in natural rubber prices, which has led to a shift towards synthetic rubber. The main trends in the hydrogenated nitrile butadiene rubber industry and their impact on major stakeholder policies are detailed in recent research.

Market landscape

A main instance of how volatility encourages development is the synthetic rubber market. When financial slowdown and price decline began hampering the natural rubber sector, the synthetic market came to light. It is now a major product catering for increasing demand as a result of industrialisation. Hydrogenated nitrile butadiene rubber finds a broad range of applications in a variety of sectors among the various synthetic rubbers on the market. The growing global competition in the automotive industry made HNBR its own prominence. In the development of timing belts, new trends in engine models called for high performance material to be integrated. Automakers have began moving away from polychloroprene, replacing it with HNBR, the main raw material for timing belts, in order to tackle this need. Not only car producers but petroleum and gas giants are looking at hydrogenated nitrile butadiene rubber for countless apps on oilfields, including screening, gaskets, down-holes, etc. Although there is still a longstanding challenge to the danger of replacement for the participants in the hydrogenated nitrile butadiene rubber market, it provides a chance to develop goods that have improved characteristics.

Market Drifts

The governments of several major rubber producers like Thailand, India, Indonesia and Sri Lanka give financial support in the form of subsidies, tax breaks, as customer duty exemptions to rubber producers. For example, rubber growers and producers have been supported by the Indian govt through numerous attempts like trade fairs and buyers' meetings.

Similarly, in Thailand a free-trade deal with rubber importing nations such as New Zealand and Australia has been endorsed by the Government for the rubber sector. These attempts are the result of increased exports of rubber from these nations to various areas of the globe, and pressure to increase rubber output. To decrease transport expenses for raw materials and boost the revenues of major tire manufacturers in North America and Europe, major nations such as China and India outsource their businesses.

The seals and gaskets sector shows a upward path, as the transport and car industries continue to be the preferred option. With 3D printing technology emerging in the manufacturing industry, the turnaround time for manufacturing seals and joints was significantly reduced. With their production capability to remain ahead of the game in the hydrogenated nitrile butadiene rubber market, the companies are building on the high demand and smooth production of seals and gaskets.

Strategies

The diversification of products to cover a variety of applications is one of the main winning strategies used by major producers in the hydrogenated nitrile butadien rubber industry. Key players are aiming to capitalize on the demand for petroleum and gas, car, construction, medical and machinery sectors. In essence, they explore the appropriate potential of expanding hydrogenated butadiene rubber applications.

In the rubber sector, the manufacturing variations depend on the user trends and the requirement of final use industries are extremely dynamic. The prices for products are set according to market circumstances, to achieve a competitive advantage over other players, leading manufacturers in the hydrogenated nitrile butadiene rubber sector. They anticipate fundamentally change in the end-use sectors and the financial circumstances under which HNBR products can be priced. This approach has helped players manage the synthetic rubber industry's volatility.

Hydrogenated Nitrile Butadiene Rubber Market Segmentation

The worldwide market for hydrogenated nitrile butadiene rubber is split based on product, application end-use industry, and geography.

Hydrogenated Nitrile Butadiene Rubber Market By Products

- HNBR Latex

- HNBR Solid

According to hydrogenated nitrile butadiene rubber industry analysis, because of its exceptional mechanical qualities and broad industrial uses, the HNBR solid category is the largest in the market for HNBR goods. HNBR Solid has great resistance to heat, oil, and chemical exposure, making it perfect for use in the automotive, oil and gas, and manufacturing industries. Its longevity in severe settings, paired with its flexibility and resilience, increases its demand in seals, gaskets, and O-rings, propelling its market prominence over HNBR Latex, which is utilized in specialist coatings and adhesives.

Hydrogenated Nitrile Butadiene Rubber Market By Applications

- Seals & O-Rings

- Belts & Cables

- Hoses

- Adhesives & Sealants

- Diaphragms

- Foamed Products

- Others

Seals & o-rings is predicted to be a significant section in the hydrogenated nitrile butadiene rubber market forecast period due to the material's outstanding resistance to oil, heat, and chemicals. HNBR's durability and ability to withstand extreme temperatures make it a popular choice in the automotive, aerospace, and oil and gas industries. Seals and O-rings manufactured of HNBR are extensively used in engines, pumps, and hydraulic systems to ensure long-term performance and save maintenance costs. The Seals & O-Rings market is becoming increasingly important due to increased demand across vital industries.

Hydrogenated Nitrile Butadiene Rubber Market By End-Use Industry

- Machinery

- Automotive

- Oil & Gas

- Healthcare

- Construction

- Others

The automotive category is likely to be important in the hydrogenated nitrile butadiene rubber (HNBR) market due to its widespread application in crucial components such as seals, O-rings, hoses, and belts. The excellent resistance of HNBR to heat, oil, and chemicals makes it perfect for demanding automotive applications, particularly in engines and transmission systems. As the automotive industry focuses on durability and performance in severe settings, the demand for HNBR in this sector continues to rise, resulting in its large market share.

Hydrogenated Nitrile Butadiene Rubber Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydrogenated Nitrile Butadiene Rubber Market Regional Analysis

North America dominates the hydrogenated nitrile butadiene rubber market, which is primarily driven by the established automotive and oil and gas industries. The automotive sector in the region is one of the main consumers of HNBR, with a significant need for seals, O-rings, and belts that can withstand harsh temperatures and chemicals. Furthermore, the significant oil and gas industry in nations such as the United States and Canada rely on HNBR components for drilling and refining equipment. The increased emphasis on durability, cost-efficiency, and extended maintenance intervals is driving up HNBR consumption in these industries. Furthermore, the region's advanced machinery sector drives up demand for HNBR, which is used in high-performance parts that ensure durability in difficult operating settings.

Hydrogenated Nitrile Butadiene Rubber Market Players

Some of the top hydrogenated nitrile butadiene rubber market companies offered in our report includes Baling, Dow, Polycomp, DSM, Bayer, LANXESS, ExxonMobil, ARLANXEO Holding B.V., Rahco Rubber, Inc., KACO GmbH + Co. KG, and Elastomer Engineering Ltd.

Frequently Asked Questions

How big is the hydrogenated nitrile butadiene rubber market?

The hydrogenated nitrile butadiene rubber market size was valued at USD 14.2 billion in 2023.

What is the CAGR of the global hydrogenated nitrile butadiene rubber market from 2024 to 2032?

The CAGR of hydrogenated nitrile butadiene rubber is 8.9% during the analysis period of 2024 to 2032.

Which are the key players in the hydrogenated nitrile butadiene rubber market?

The key players operating in the global market are including Baling, Dow, Polycomp, DSM, Bayer, LANXESS, ExxonMobil, ARLANXEO Holding B.V., Rahco Rubber, Inc., KACO GmbH + Co. KG, and Elastomer Engineering Ltd.

Which region dominated the global hydrogenated nitrile butadiene rubber market share?

North America held the dominating position in hydrogenated nitrile butadiene rubber industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hydrogenated nitrile butadiene rubber during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global hydrogenated nitrile butadiene rubber industry?

The current trends and dynamics in the hydrogenated nitrile butadiene rubber industry include increasing demand from the automotive industry for sealing applications due to HNBR's heat and oil resistance, rising use in the oil and gas sector for durable o-rings and gaskets under harsh conditions, expanding use of HNBR in industrial rubber products due to its superior mechanical properties, and growth in the aerospace industry boosting the demand for high-performance rubber materials.

Which application held the maximum share in 2023?

The seals & o-rings application held the notable share of the hydrogenated nitrile butadiene rubber industry.