Hydraulic Turbine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Hydraulic Turbine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

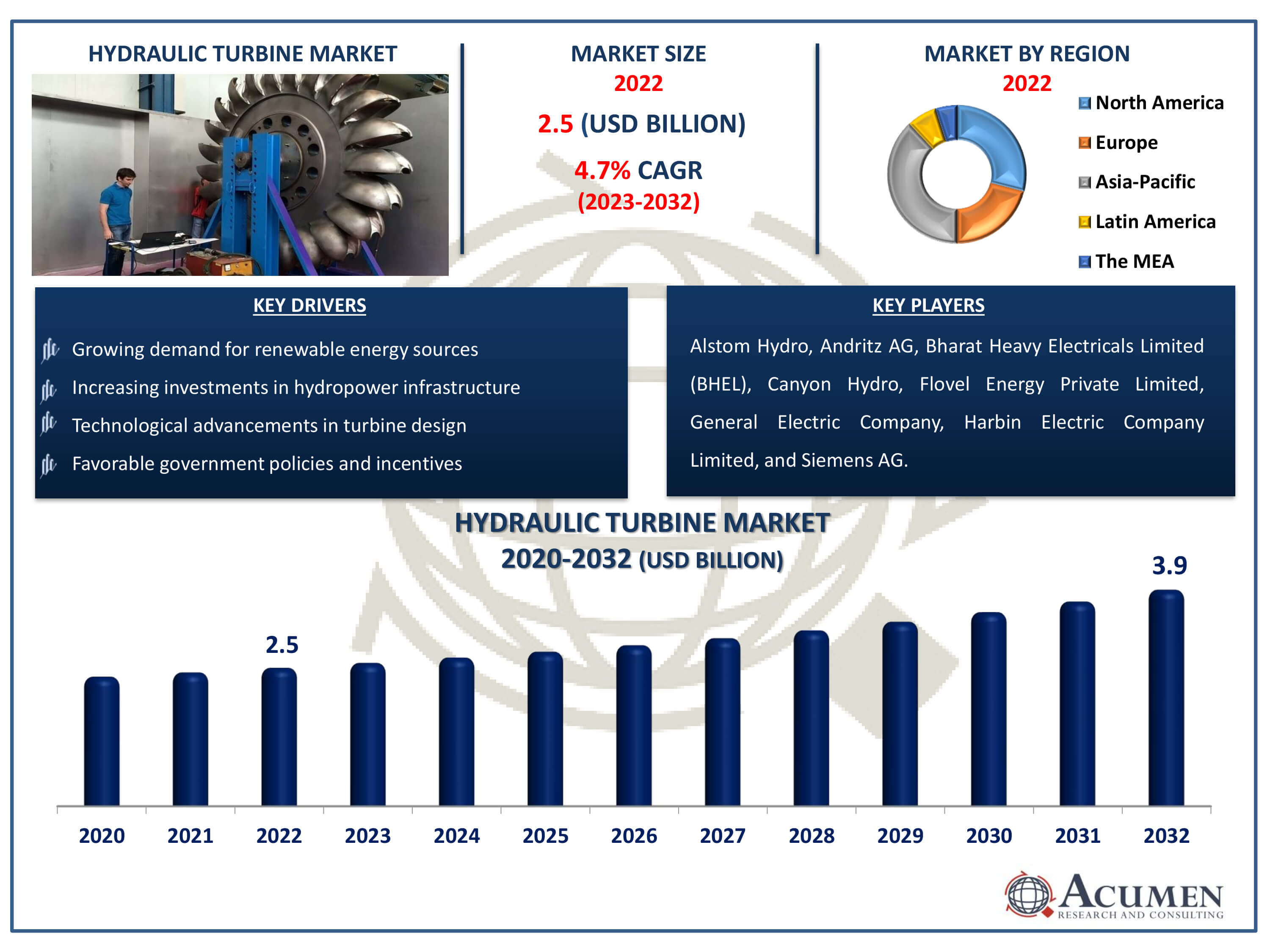

The Hydraulic Turbine Market Size accounted for USD 2.5 Billion in 2022 and is estimated to achieve a market size of USD 3.9 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

Hydraulic Turbine Market Highlights

- Global hydraulic turbine market revenue is poised to garner USD 3.9 billion by 2032 with a CAGR of 4.7% from 2023 to 2032

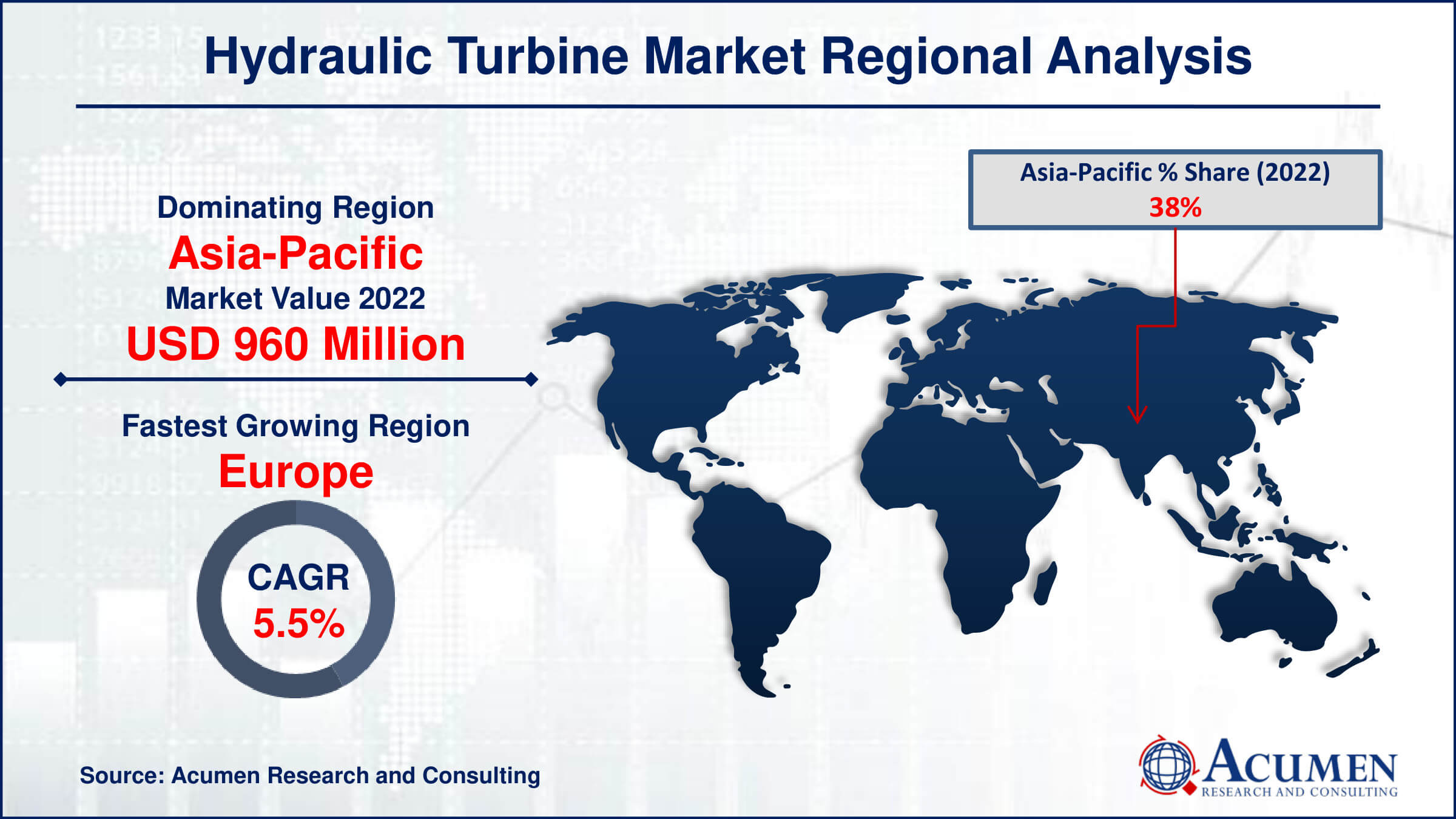

- Asia-Pacific hydraulic turbine market value occupied around USD 960 million in 2022

- Europe hydraulic turbine market growth will record a CAGR of more than 5.5% from 2023 to 2032

- Among type, the impulse turbine sub-segment generated over US$ 1.6 billion revenue in 2022

- Based on head type, the low head sub-segment generated noteworthy share in 2022

- Emerging markets and untapped hydropower potential is a popular hydraulic turbine market trend that fuels the industry demand

A hydraulic turbine is an electro-mechanical power-generating device utilized in hydropower projects. It facilitates the conversion of the kinetic energy of moving water into electricity. Hydro turbines play a pivotal role in hydropower, where water energy is harnessed for electricity generation. The turbine's design is typically straightforward, featuring a row of blades attached to a platform or rotating shaft. As water is directed across these blades, the turbine spins, transferring its rotary movement to a generator and producing electricity. The selection of a specific turbine type for hydroelectric power plants depends on factors such as the volume of flowing water and the water storage height, known as the hydraulic head. Considerations of cost and efficiency also influence the choice of turbine type.

Global Hydraulic Turbine Market Dynamics

Market Drivers

- Growing demand for renewable energy sources

- Increasing investments in hydropower infrastructure

- Technological advancements in turbine design

- Favorable government policies and incentives

Market Restraints

- High initial capital costs

- Environmental concerns related to the impact on aquatic ecosystems

- Long project gestation periods and regulatory complexities

Market Opportunities

- Rising focus on small-scale hydropower projects

- Integration of digitalization and smart technologies

- Increasing global emphasis on water resource management

Hydraulic Turbine Market Report Coverage

| Market | Hydraulic Turbine Market |

| Hydraulic Turbine Market Size 2022 | USD 2.5 Billion |

| Hydraulic Turbine Market Forecast 2032 | USD 3.9 Billion |

| Hydraulic Turbine Market CAGR During 2023 - 2032 | 4.7% |

| Hydraulic Turbine Market Analysis Period | 2020 - 2032 |

| Hydraulic Turbine Market Base Year |

2022 |

| Hydraulic Turbine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Installation Site, By Head Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alstom Hydro, Andritz AG, Bharat Heavy Electricals Limited (BHEL), Canyon Hydro, Flovel Energy Private Limited, General Electric Company, Harbin Electric Company Limited, Mitsubishi Heavy Industries, Ltd., Siemens AG, The Columbia Machine Works, Inc., Toshiba Corporation, and Voith Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hydraulic Turbine Market Insights

Over the hydraulic turbine market forecast period, the sector is expected to grow significantly due to the increasing depletion of conventional energy resources. The primary drivers of the hydro turbine market include the need to replenish traditional energy reserves and the demand for alternative energy sources. Meeting the continued energy demand over the next six years will require intensive research and development, servicing, and large-scale electricity production. Private power companies are expected to play a crucial role in creating significant growth opportunities among both public organizations and large private firms.

The production of non-polluting electricity is expected to be predominantly carried out through hydraulic turbines. Common sources of energy, such as small hydropower plants, low head turbines, and waterways, employ hydro-technologies with reduced environmental impact. In the competitive hydraulic turbines industry, vendors focus on factors such as pricing, service quality, portability, efficiency, and availability. The global demand for power generation is increasing, and the hydraulic turbine market is primarily supplied by hydropower companies, which may charge more than the average market price during periods of extra seasonal demand.

Over the expected term, significant energy generators are shifting from coal to renewable or natural sources, driving the hydraulic turbines industry. Hydraulic turbines are designed for effective power generation using available sources. Impulse turbines, for example, utilize the resulting pressure when in place, directing the feed source to the turbine blades. Government initiatives to address ongoing energy shortages commonly involve improving energy generation capacity to meet household and industrial demands.

The renewable energy industry is poised to experience significant growth in the hydro turbine market over the next six years. Various global organizations are showing a strong interest in embracing and diversifying their energy portfolios with renewable energy technology. Consumer awareness of the essential impacts of global warming and coal emissions has led to concerted efforts to reduce current carbon dioxide concentrations and monitor future emission intensity by consumers and state authorities.

The demand for hydraulic turbines is driven by the substitution of gas power stations and aging coal plants with renewable energy sources. Supported by favorable public policies, the hydraulic turbines market is expected to expand substantially in the coming six years. The increasing adoption of turbines as an alternative to traditional energy sources is attributable to these policies and a commitment to environmental safety. However, environmental concerns within the hydropower sector are anticipated to hinder market growth over the projected period, along with design restrictions faced by hydraulic turbine developers.

During the hydraulic turbine industry forecast period, the vapor turbine segment is poised for significant growth in the market. The hydraulic turbines market is categorized based on end usage into industrial turbines, residential roofs, and business turbines. Industrial turbines are expected to boost the market for hydraulic turbines due to the increasing demand for alternative power sources. The energy production capacity of hydraulic turbines, classified by energy output of less than 1000 kW, 1000 kW–10,000 kW, and more than 10,000 kW, will play a crucial role in shaping the hydraulic turbines industry.

An environmental issue stands out as a major challenge hindering the development of the hydro turbine industry. In hydroelectric projects, upstream flows are impounded by reservoirs, leading to a decrease in downstream flow in waterways. This alteration in river dynamics can have adverse effects on plant and animal habitats by modifying water temperatures, and it may impact water quality by reducing oxygen content. Additionally, the diversion of natural river flow by hydropower can affect marine and downstream river species, acting as obstacles in the renewable energy industry for hydro turbine market development.

The increasing demands for renewable in developing markets presents a significant growth opportunity for hydro turbine producers. Over the next few years, emerging markets will offer potential growth opportunities in renewable energy. Hydro power is becoming a popular energy choice due to its competitiveness in countries aiming to enhance productive capacity to sustain economic growth rates. Technological flexibility further positions hydropower projects as a competitive option, particularly in supplying energy directly to businesses or industrial sectors, especially in situations where grid access is challenging, as often observed in emerging markets.

Hydraulic Turbine Market Segmentation

The worldwide market for hydraulic turbine is split based on type, installation site, head type, end-user, and geography.

Hydraulic Turbine Types

- Reaction Turbine

- Francis Turbine

- Kaplan Turbine

- Bulb Turbine

- Impulse Turbine

- Cross Flow Turbine

- Pelton Turbine

According to hydraulic turbine industry analysis, with the largest market share, the impulse turbine category leads the market. This is mostly explained by impulse turbines ease of use and efficiency. Impulse turbines, as opposed to reaction turbines, use the kinetic energy of water jets and have a simple, user-friendly design. The efficiency and dependability of impulse turbines are preferred by industries, which helps explain their broad use and market dominance in the hydraulic turbine industry.

Hydraulic Turbine Installation Sites

- Large Hydro Plants

- Mini Hydro Plants

- Micro Hydro Plants

- Pico Hydro Plants

The hydraulic turbine market is dominated by the large hydro plants category. Due to their large capacity and significant electricity generation capabilities, large hydro plants are preferred. They are frequently used in large-scale hydropower projects and provide a substantial contribution to the energy system as a whole. Large hydro plants are the go-to option for supplying the increasing need for electricity due to their efficiency and scale, which has cemented their dominance in the installation site section of the hydro turbine market.

Hydraulic Turbine Head Types

- High

- Medium

- Low

The low head sector holds the biggest share in the hydraulic turbine industry. Low head turbines are made to effectively capture energy from low water head settings. These turbines are becoming a popular option for hydropower projects since they are perfect for areas with little or no natural waterfall. The Low Head section of the hydraulic turbine market is dominated in large part by this product's adaptability and capacity to function in a variety of environments.

Hydraulic Turbine End-Users

- Industrial

- Commercial

- Residential

In terms of hydraulic turbine market analysis, the industrial segment obtains the greatest position in the industry driven by significant energy demands for industrial operations. Hydraulic turbines are an ideal option for industries that demand reliable and substantial power generation. As a major factor in the industrial segment's dominance of the market, they are able to supply a dependable energy source for large-scale manufacturing and processing applications. Hydraulic turbines are the preferred option for supplying industrial end customers with energy because of their dependability and affordability.

Hydraulic Turbine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hydraulic Turbine Market Regional Analysis

Asia-Pacific's widespread use of hydropower and rising energy consumption has led to the region having the biggest share of the hydraulic turbine market. Strong hydropower investments and infrastructure development are common in nations like China and India, which greatly contribute to the market's supremacy. Additionally, the Asia-Pacific hydraulic turbine market is further propelled forward by favorable government policies that support renewable energy.

Conversely, the hydraulic turbine market is expanding at the quickest rate in Europe. The demand for hydropower solutions is driven by the implementation of strict environmental rules and the growing emphasis on sustainable energy sources. Germany and Norway are among the European nations investing in the modernization of their hydroelectric infrastructure, which is fueling the market expansion for hydraulic turbines. Europe's emphasis on clean energy and cutting-edge hydropower technologies puts the continent as a crucial hub for the market's explosive growth.

Hydraulic Turbine Market Players

Some of the top hydraulic turbine companies offered in our report includes Alstom Hydro, Andritz AG, Bharat Heavy Electricals Limited (BHEL), Canyon Hydro, Flovel Energy Private Limited, General Electric Company, Harbin Electric Company Limited, Mitsubishi Heavy Industries, Ltd., Siemens AG, The Columbia Machine Works, Inc., Toshiba Corporation, and Voith Group.

Frequently Asked Questions

How big is the hydraulic turbine market?

The hydraulic turbine market size was valued at USD 2.5 billion in 2022.

What is the CAGR of the global hydraulic turbine market from 2023 to 2032?

The CAGR of hydraulic turbine is 4.7% during the analysis period of 2023 to 2032.

Which are the key players in the hydraulic turbine market?

The key players operating in the global market are including Alstom Hydro, Andritz AG, Bharat Heavy Electricals Limited (BHEL), Canyon Hydro, Flovel Energy Private Limited, General Electric Company, Harbin Electric Company Limited, Mitsubishi Heavy Industries, Ltd., Siemens AG, The Columbia Machine Works, Inc., Toshiba Corporation, and Voith Group.

Which region dominated the global hydraulic turbine market share?

Asia-Pacific held the dominating position in hydraulic turbine industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of hydraulic turbine during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global hydraulic turbine industry?

The current trends and dynamics in the hydraulic turbine industry include growing demand for renewable energy sources, increasing investments in hydropower infrastructure, technological advancements in turbine design, and favorable government policies and incentives.

Which type held the maximum share in 2022?

The impulse turbine type held the maximum share of the hydraulic turbine industry.