Hospital Lights Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Hospital Lights Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

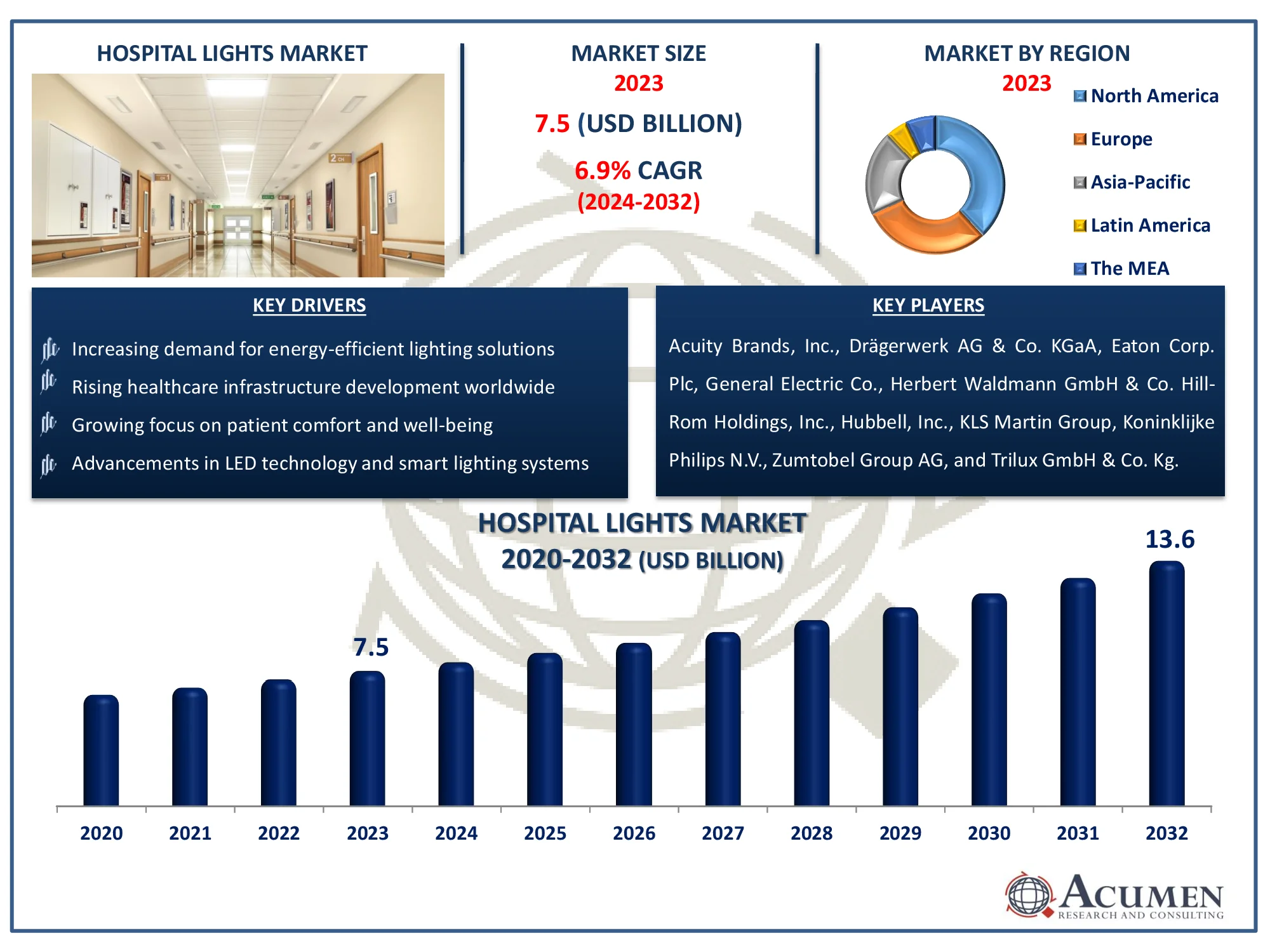

The Global Hospital Lights Market Size accounted for USD 7.5 Billion in 2023 and is estimated to achieve a market size of USD 13.6 Billion by 2032 growing at a CAGR of 6.9% from 2024 to 2032.

Hospital Lights Market Highlights

- Global hospital lights market revenue is poised to garner USD 13.6 billion by 2032 with a CAGR of 6.9% from 2024 to 2032

- North America hospital lights market value occupied around USD 2.8 billion in 2023

- Asia-Pacific hospital lights market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product, the surface-mounted lights generator sub-segment generated more than USD 2.2 billion revenue in 2023

- Based on point of use, the patient wards, and ICUs sub-segment generated around 40% market share in 2023

- Growing adoption of UV-C lighting for sterilization and infection control is a popular hospital lights market trend that fuels the industry demand

Hospital lights play an important role in healthcare, enhancing both the staff's abilities and the patient experience to provide the necessary level of care. Their major goal is not only to maintain a specific quality of care, but also to improve the care environment and save expenses by conserving energy and increasing operational efficiency. Furthermore, the primary goal of hospital lighting is to ensure safety to those who use the buildings. It also produces a serene environment suitable to the interests of the occupants, allowing work and other activities to be carried out peacefully within the structure.

Global Hospital Lights Market Dynamics

Market Drivers

- Increasing demand for energy-efficient lighting solutions

- Rising healthcare infrastructure development worldwide

- Growing focus on patient comfort and well-being

- Advancements in LED technology and smart lighting systems

Market Restraints

- High initial cost of installation and maintenance

- Regulatory challenges and compliance issues

- Limited awareness in developing regions

Market Opportunities

- Expansion in emerging markets with rising healthcare investments

- Integration of IoT and AI in hospital lighting systems

- Development of sustainable and eco-friendly lighting solutions

Hospital Lights Market Report Coverage

| Market | Hospital Lights Market |

| Hospital Lights Market Size 2022 |

USD 7.5 Billion |

| Hospital Lights Market Forecast 2032 | USD 13.6 Billion |

| Hospital Lights Market CAGR During 2023 - 2032 | 6.9% |

| Hospital Lights Market Analysis Period | 2020 - 2032 |

| Hospital Lights Market Base Year |

2022 |

| Hospital Lights Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Technique, By Point of Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Acuity Brands, Inc., Drägerwerk AG & Co. KGaA, Eaton Corp. Plc, General Electric Co., Herbert Waldmann GmbH & Co., Hill-Rom Holdings, Inc., Hubbell, Inc., KLS Martin Group, Koninklijke Philips N.V., Zumtobel Group AG, and Trilux GmbH & Co. Kg. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hospital Lights Market Insights

The key drivers expected to drive the hospital lighting market are increased use of power-saving lighting systems in hospitals due to advancements in sophisticated product technology and product design, as well as low emissions that result in reduced global warming. Furthermore, LED lighting has several advantages over traditional lighting options, including low power consumption, low maintenance requirements, safety, long lifespan, and design flexibility. Due to the benefits provided by LED lighting systems, they are rapidly replacing traditional lighting systems in the healthcare sector, driving the hospital lighting market.

Furthermore, in hospitals nowadays, both artificial lights and daylight systems, such as lamps in lobbies, hallways, and light fixtures, are used, resulting in a more efficient lighting system that saves 45-70% of energy. Furthermore, the high cost of hospital lighting may limit future growth. However, technological developments in lighting technologies provide a fresh chance for the hospital lights market to contribute to global growth.

There is an increasing demand for energy-efficient lighting solutions. Because hospitals function around the clock, they require lighting systems that use as little energy as possible while providing appropriate illumination levels. Energy-efficient lighting, such as LED technology, not only saves money on electricity but also lasts longer, lowering maintenance costs. Furthermore, governments and regulatory agencies around the world are promoting green efforts, including the use of energy-saving technologies in healthcare institutions. This push for sustainability, combined with the cost savings, is encouraging hospitals to change their lighting systems to more energy-efficient models.

Hospital Lights Market Segmentation

The worldwide market for hospital lights is split based on product, technique, point of use, and geography.

Hospital Lights Market By Product

- Surface-Mounted Lights

- Troffers

- Surgical Lamps

- Others

According to hospital lights industry analysis, the surface-mounted lights category is the largest in the market due to its versatility and broad use in a variety of hospital settings. These lights are often mounted directly to ceilings or walls, providing uniform and effective illumination in spaces like as patient rooms, halls, and operating theatres. Their design enables easy integration into existing hospital infrastructures, making them a popular choice for restorations and new builds. Surface-mounted lights also provide more control over illumination levels, which improves patient comfort and reduces eye strain for medical professionals. Furthermore, advances in LED technology have made these lights more energy-efficient and long-lasting, encouraging their widespread use in hospitals. Their ability to provide continuous, high-quality lighting across a variety of contexts makes them an essential component of hospital lighting solutions.

Hospital Lights Market By Technique

- Fluorescent

- Halogen

- LED

- Others

The LED category is predicted to be the most significant in the hospital lighting market forecast period, owing to its multiple advantages over previous lighting technologies. LEDs are extremely energy-efficient, using substantially less electricity than fluorescent and halogen lights, which is critical in hospitals' 24-hour operations environment. They also have a longer lifespan, which reduces the number and expense of replacements. LEDs offer excellent brightness and color rendering, making them ideal for medical situations where precise illumination is required for accurate diagnosis and treatment. Additionally, LEDs produce less heat, making the setting more comfortable for both patients and healthcare providers. The growing trend of sustainability and energy conservation in healthcare institutions accelerates the migration to LED lighting, making it the most promising segment in the hospital lighting market.

Hospital Lights Market By Point of Use

- Operating Rooms

- Patient Wards, and ICUs

- Examination Rooms

- Others

Patient wards and ICUs are rising as the leading segment in the hospital lights market, owing to the critical role lighting plays in patient care and recovery. Lighting in these environments must be versatile, offering both intense, focused illumination for medical procedures and softer, ambient lighting for patient comfort and relaxation. The growing emphasis on improving patient experience, particularly in recovery areas, has raised demand for innovative lighting solutions in wards and ICUs. These lights frequently include dimming and color tuning features to provide a relaxing environment, which can help reduce patient tension and enhance sleep quality. Furthermore, the growing number of hospitals and healthcare facilities around the world, driven by rising healthcare demand, contributes to the segment's significance.

Hospital Lights Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hospital Lights Market Regional Analysis

In terms of hospital lights market analysis, North America dominates the industry, owing to superior healthcare infrastructure and early adoption of innovative technology. The region's emphasis on energy economy and sustainability, combined with strict restrictions, has sped the transition to LED and smart lighting systems. The presence of significant industry players, as well as rising healthcare spending, help to drive the hospital lights market forward. Furthermore, continuous hospital renovations and the construction of new healthcare facilities to suit the rising demand for healthcare services help to drive hospital lights market expansion in North America.

The Asia-Pacific region is predicted to have the quickest growth in the hospital lighting industry forecast period due to increasing urbanization, increased healthcare investments, and developing healthcare infrastructure in emerging economies such as China and India. The region's growing middle-class population and rising frequency of chronic ailments are pushing up demand for modern, well-equipped hospitals. Governments in the region are also working to improve healthcare access, which has resulted in the construction of new hospitals as well as the refurbishment of existing ones. LED lighting solutions are especially popular in Asia-Pacific, because to their low cost and high energy efficiency.

Hospital Lights Market Players

Some of the top hospital lights market companies offered in our report includes Acuity Brands, Inc., Drägerwerk AG & Co. KGaA, Eaton Corp. Plc, General Electric Co., Herbert Waldmann GmbH & Co. Hill-Rom Holdings, Inc., Hubbell, Inc., KLS Martin Group, Koninklijke Philips N.V., Zumtobel Group AG, and Trilux GmbH & Co. Kg.

Frequently Asked Questions

How big is the hospital lights market?

The hospital lights market size was valued at USD 7.5 billion in 2023.

What is the CAGR of the global hospital lights market from 2024 to 2032?

The CAGR of hospital lights is 6.9% during the analysis period of 2024 to 2032.

Which are the key players in the hospital lights market?

The key players operating in the global market are including Acuity Brands, Inc., Drägerwerk AG & Co. KGaA, Eaton Corp. Plc, General Electric Co., Herbert Waldmann GmbH & Co. Hill-Rom Holdings, Inc., Hubbell, Inc., KLS Martin Group, Koninklijke Philips N.V., Zumtobel Group AG, and Trilux GmbH & Co. Kg.

Which region dominated the global hospital lights market share?

North America held the dominating position in hospital lights industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of hospital lights during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global hospital lights industry?

The current trends and dynamics in the hospital lights industry include increasing demand for energy-efficient lighting solutions, rising healthcare infrastructure development worldwide, growing focus on patient comfort and well-being, and advancements in LED technology and smart lighting systems.

Which point of use held the maximum share in 2023?

The patient wards, and ICUs point of use held the maximum share of the hospital lights industry.