Home Fitness Market | Acumen Research and Consulting

Home Fitness Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 – 2030

Published :

Report ID:

Pages :

Format :

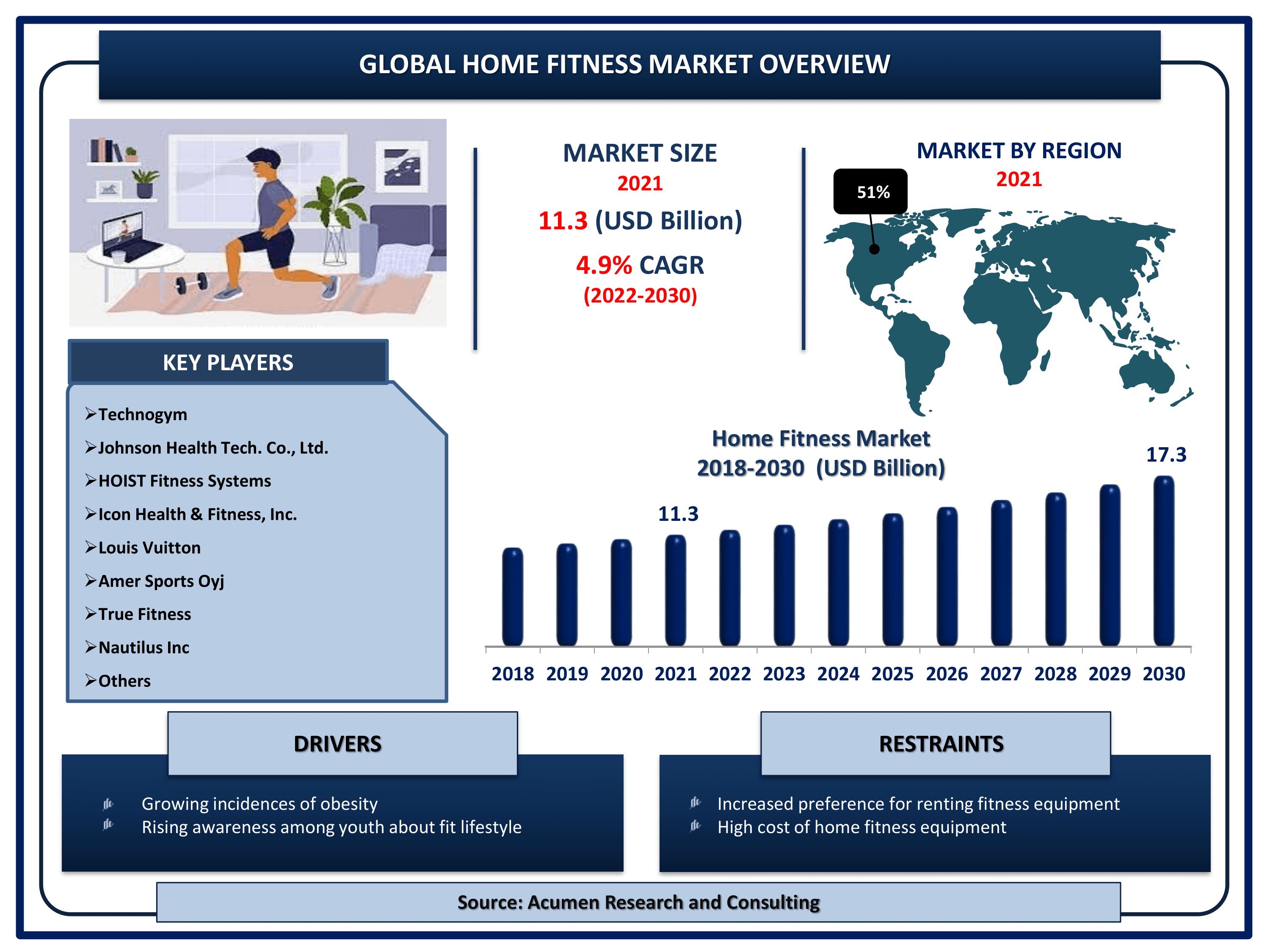

The Global Home Fitness Market Size accounted for USD 11.3 Billion in 2021 and is projected to achieve a market size of USD 17.3 Billion by 2030 rising at a CAGR of 4.9% from 2022 to 2030. Growing fitness enthusiast among the world is the primary factor that is driving the home fitness market share. The advent of COVID-19 pandemic played a significant role in home fitness equipment sales since 2020. Growth in home fitness increased exponentially due to the lockdown measures, closure of gyms, and restriction on travel. The increasing demand for virtual fitness and digitalization is a popular home fitness market trend that is fueling the demand during the forecast timeframe from 2022 to 2030.

Home Fitness Market Report Statistics

- Global home fitness market revenue is estimated to reach USD 17.3 Billion by 2030 with a CAGR of 4.9% from 2022 to 2030

- North America home fitness market share accounted for over 51% shares in 2021

- Owing to the advent of COVID-19 pandemic, 40% of Americans exercised at home for the first time

- According to our analysis, 54% of Americans who frequently work out at their homes have bought fitness equipment

- Asia-Pacific home fitness market growth will register fastest CAGR from 2022 to 2030

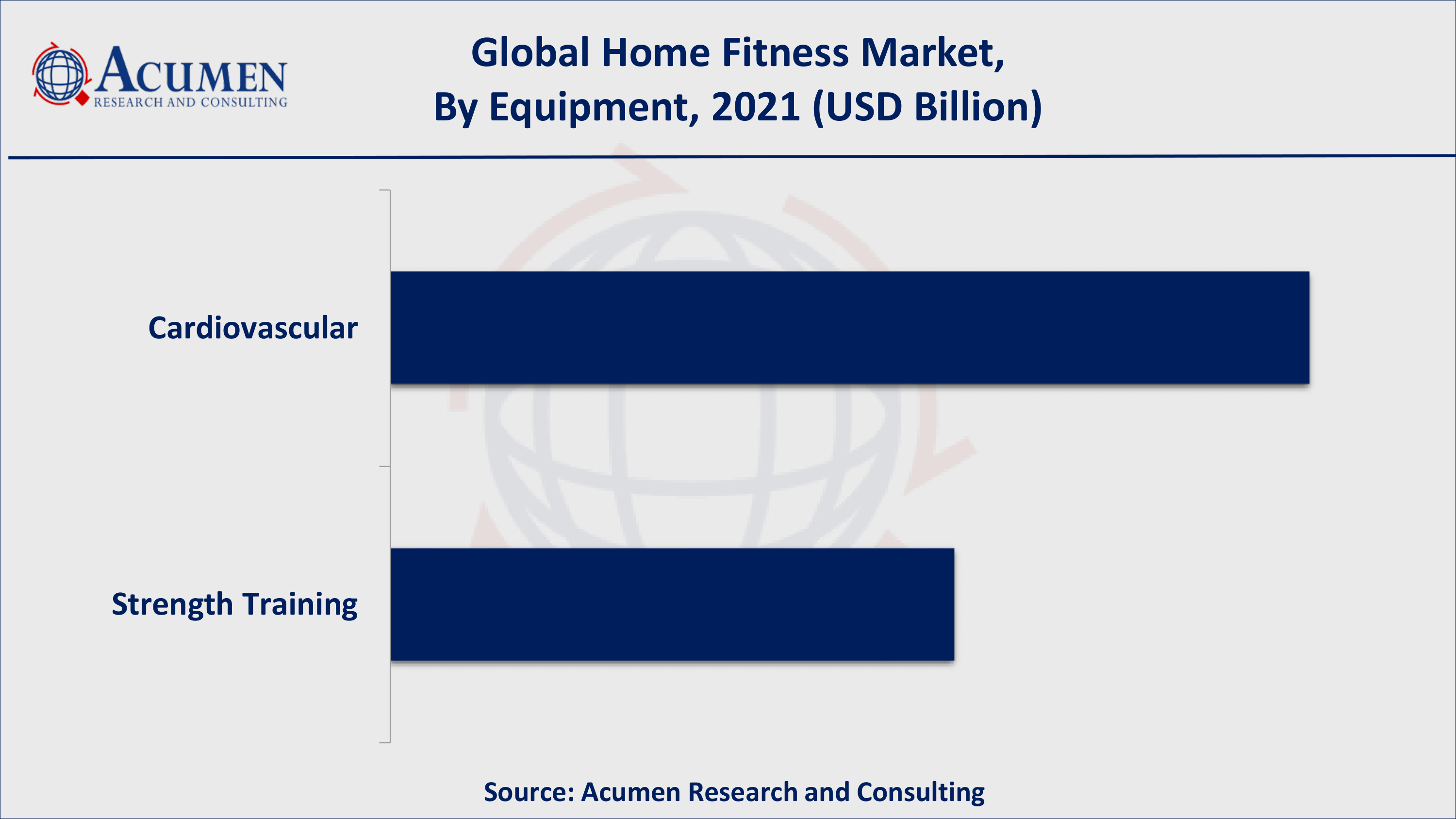

- Based on equipment, cardiovascular gathered over 62% of the overall market share in 2021

- Increasing number of vegans and rising health concerns fuels the global home fitness equipment market value

The fast pace of modern life has resulted in unimaginable physical and psychological stress on the human body and mind. As a result, the demand for qualified fitness instructors has soared. This career path has emerged as a result of growing health and fitness awareness. The concept of fitness has undergone a radical transformation. Fitness has emerged as a lucrative business opportunity as well as a long-term career option. Not only do the elite and wealthy want to stay fit, but a large portion of the population has been bitten by the fitness bug. Physical fitness is about more than just staying healthy; it's also about looking good and living an active lifestyle.

Global Home Fitness Equipment Market Dynamics

Market Drivers

- Growing incidences of obesity

- Rising awareness among youth about fit lifestyle

- Rising government initiatives to promote healthy lifestyles

Market Restraints

- Increased preference for renting fitness equipment

- High cost of home fitness equipment

Market Opportunities

- Rising use of virtual reality fitness

- Development of connected fitness device technology

Home Fitness Market Report Coverage

| Market | Home Fitness Market |

| Home Fitness Market Size 2021 | USD 11.3 Billion |

| Home Fitness Market Forecast 2030 | USD 17.3 Billion |

| Home Fitness Market CAGR During 2022 - 2030 | 4.9% |

| Home Fitness Market Analysis Period | 2018 - 2030 |

| Home Fitness Market Base Year | 2021 |

| Home Fitness Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Equipment, By Sales Channel, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Technogym, Johnson Health Tech. Co., Ltd., HOIST Fitness Systems, Icon Health & Fitness, Inc., Amer Sports Oyj, True Fitness, Nautilus Inc., Tonal Systems, Core Health & Fitness, LLC, among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Impact of COVID-19 on Home Fitness Equipment Market Value

During the lockdown, gyms and fitness studios had no choice but to increase their digital presence. Many began to offer virtual classes, allowing members to access services from the convenience of their own homes. According to a World Economic Forum report, health and fitness app downloads increased by 46% worldwide between Q1 and Q2 2020. India experienced the greatest increase in downloads, with a 156% increase. This equates to 58 million new active users, or nearly the entire population of Italy. The Middle East and North Africa (MENA) region saw the second-highest growth in downloads, increasing by 55%, followed by Asia-Pacific, which increased by 47%. Lockdown also motivated people to upgrade their home gyms and purchase home fitness equipment. Peloton, an exercise equipment company, has grown in popularity this year, and it expects to double its sales in 2020, with an estimated US$1.8 Bn in revenue by the end of the year.

Home Fitness Market Dynamics

Big Calls for "Digitalization/Virtual Fitness" Fuel the Growth of Global Home Fitness Market

Gyms and fitness studios were forced to close or go digital during the lockdown. This makes sense given that India had the world's largest lockdown, requiring 1.3 billion people to remain indoors from March 25 to May 2020. That's a lot of people who were unexpectedly confined to their homes. Global downloads of health and fitness apps increased by 46%. India saw the greatest increase in downloads, with a 156% increase. Home fitness apps have been in the market for a long time, but their popularity has increased dramatically in the last few months. Companies saw an increase in revenue by providing virtual fitness through a digital medium. Overall, 2019 was a prosperous year for the fitness industry. According to The IHRSA Global Report, which was released in May, the global industry revenue totaled US$94 Bn, and as a result, Apartment are on track to reach 230 million members by 2030.

Increasing Health Complications among the Ever Growing Population Aid the Demand for Global Home Fitness Equipment Market

The growing number of obese people increases the demand for the product, as it is an important tool in helping people lose weight at their own pace. Furthermore, growing awareness of the lack of physical activity has resulted in a variety of health issues such as diabetes, cancer, heart disease, and others. As a result, the demand for home fitness has increased. According to the Centers for Disease Control and Prevention (CDC) data released in September 2019, a lack of physical activity contributes to heart disease, cancer, and type 2 diabetes. But apart from that, a lack of physical activity is associated with an annual healthcare cost of US$ 117 Bn.

Market Players Taking a Forefront Lead in the Global Home Fitness Market by Launching New Products Worldwide

While January is traditionally the month with the highest number of downloads for health and fitness apps. Unsurprisingly, it was April, not January, in 2020 that saw the greatest increase in global downloads of health and fitness apps, with 276 million, up 80% year on year. For example, in April, mindfulness and meditation were prioritized over active workouts. Calm, sleep, meditation, and relaxation app was the highest-grossing app, earning US$8.5 Mn. Headspace, another popular mindfulness app, came in second place with US $5.5 Mn in revenue. MyFitnessPal, which is used to track your diet and exercise, came in third place. Furthermore, by June, people's attention had shifted to diet tracking and active workouts. MyFitnessPal came in first place, earning US$6.7 Mn. Calm came in second and Headspace came in third, respectively.

Home Fitness Market Segmentation

The worldwide home fitness market is split based on equipment, sales channel, end-use, and geography.

Home Fitness Market By Equipment

- Cardiovascular

- Elliptical Machines

- Treadmills

- Exercise Bikes

- Climbers

- Others

- Strength Training

- Weightlifting

- Weights

- Barbells & Ladders

- Extension Machines

- Power Racks

- Others

According to our home fitness industry analysis, the cardiovascular segment will account for the majority of the growth in the global home fitness equipment market. This increase can be attributed to the increased use of the equipment, which aids in the health of those suffering from high blood pressure, diabetes, and heart disease.

Home Fitness Market By Sales Channel

- Online

- Offline

According to home fitness market forecast, the offline segment will lead the global home fitness equipment market by capturing a reasonable market share. On the other hand, the online sales channel is anticipated to witness fastest growth rate owing to the surge in internet penetration and rising infrastructure of e-commerce channels.

Home Fitness Market By End-Use

- Household

- Apartment

- Gym in Apartment

According to end-user, the gym in apartment will dominate the global home fitness market during the forecast period, setting all-time highs. This is due to the rising trend of adding gyms as basic amenities while constructing buildings in majority of the countries. On the other hand, households segment is likely to grow at a significant growth rate owing to the COVID-19 outbreak that forced people to stay in isolation at their homes.

Home Fitness Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Home Fitness Market Regional Analysis

North America holds the lion's share of the global home fitness market and is expected to maintain this dominance throughout the forecast period. The rising number of million-dollar homes, which has resulted in the increased establishment of a home gymnasium, is expected to boost consumption in this region. Furthermore, the widespread presence of domestic players such as Life Fitness, Cybex International, Precor Incorporated, and others supports the growth of the global home fitness market.

The Asia-Pacific, on the other hand, has the fastest-growing CAGR in the global home fitness market. One of the major factors contributing to the growth of the global home fitness market is the rise in dual-income households, which has resulted in increased spending on home fitness.

Home Fitness Market Players

Some of the key home fitness companies in the market are Amer Sports Oyj, Technogym, Johnson Health Tech. Co., Ltd., Icon Health & Fitness, Inc., True Fitness, HOIST Fitness Systems, Nautilus Inc., Tonal Systems, Core Health & Fitness, LLC, and others.

Frequently Asked Questions

What is the size of global home fitness equipment market in 2021?

The market size of home fitness market in 2021 was accounted to be USD 11.3 Billion.

What is the CAGR of global home fitness market during forecast period of 2022 to 2030?

The projected CAGR of home fitness market during the analysis period of 2022 to 2030 is 4.9%.

Which are the key players operating in the market?

The prominent players of the global home fitness market are Technogym, Johnson Health Tech. Co., Ltd., HOIST Fitness Systems, Icon Health & Fitness, Inc., Amer Sports Oyj, True Fitness, Nautilus Inc., Tonal Systems, Core Health & Fitness, LLC, and others.

Which region held the dominating position in the global home fitness market?

North America held the dominating home fitness during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for home fitness during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global home fitness market?

Growing incidences of obesity, rising awareness among youth about fit lifestyle, and rising government initiatives to promote healthy lifestyles drives the growth of global home fitness market.

Which equipment held the maximum share in 2021?

Based on equipment, cardiovascular segment is expected to hold the maximum share home fitness market.