Fitness Equipment Market | Acumen Research and Consulting

Fitness Equipment Market

Published :

Report ID:

Pages :

Format :

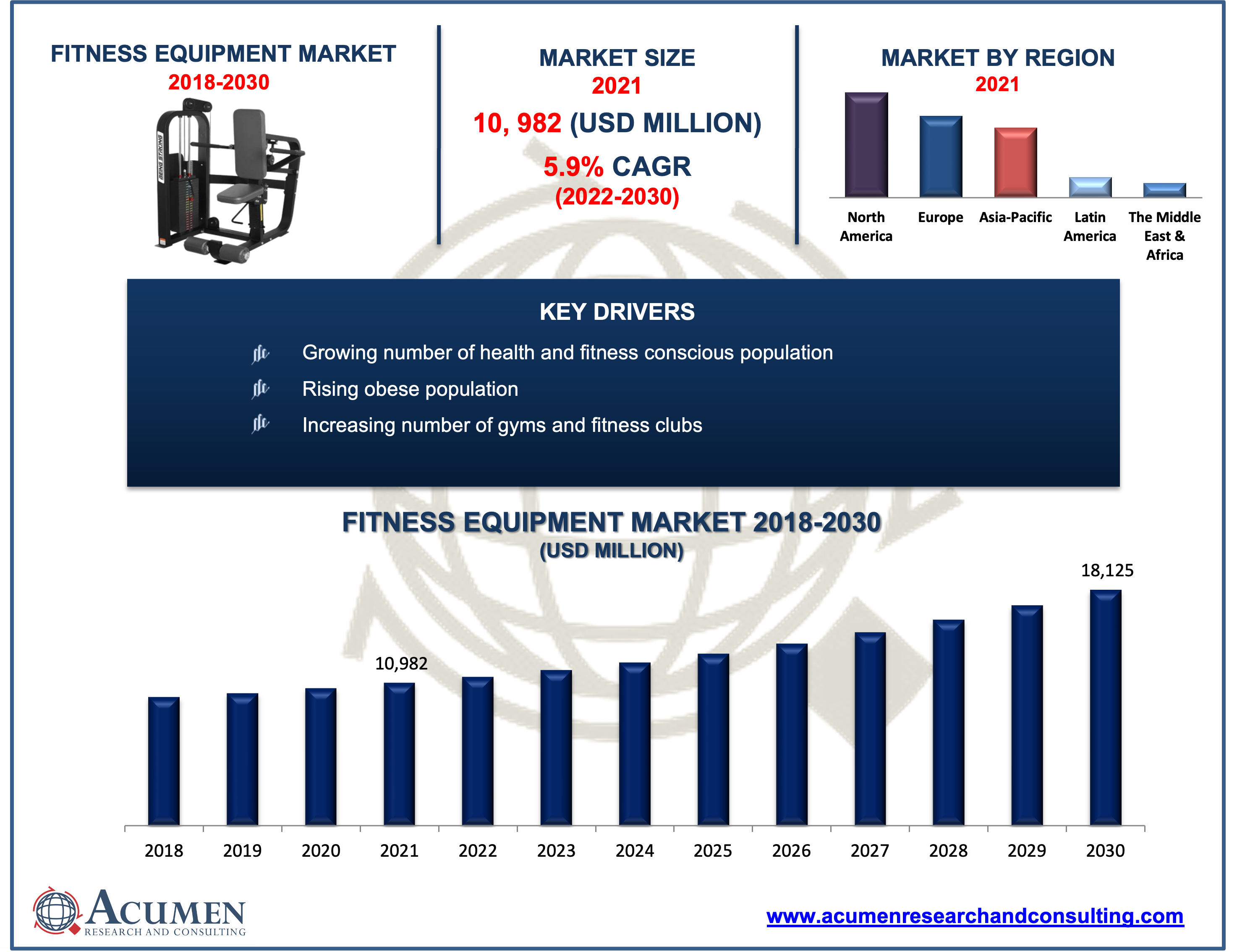

The Global Fitness Equipment Market size accounted for US$ 10,982 Mn in 2021 and is estimated to reach US$ 18,125 Mn by 2030, with a significant CAGR of 5.9% from 2022 to 2030.

Physical fitness is a crucial factor in maintaining a healthy lifestyle. Fitness equipment that are used for physical exercise or training are on a high demand from past few years. Fitness equipment is designed to help athletes and others improve and optimize their fitness. Fitness machines nowadays are outfitted with a variety of features ranging from heart monitors to portable calorie trackers. Treadmills, weightlifting machines, cross trainers, rowing machines, spinning bikes, and other fitness machines can help people stay in shape.

Market Growth Drivers:

· Growing number of health and fitness conscious population

· Rising obese population

· Surge in number of chronic disorders

· Increasing number of gyms and fitness clubs

Market Restraints:

- High cost of fitness equipment

- Rising demand for resale of used fitness equipment

Market Opportunities:

· Growing government initiatives to promote a healthier lifestyle

- Increase in concerns over health amid COVID-19 pandemic

Report Coverage

| Market | Fitness Equipment Market |

| Market Size 2021 | US$ 10,982 Mn |

| Market Forecast 2030 | US$ 18,125 Mn |

| CAGR | 5.9% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Anta Sports, Core Health and Fitness, LLC, ICON Health & Fitness, Inc., Johnson Health Tech Co., Ltd., Nautilus, Inc., Impulse (Qingdao) Health Tech Co., Ltd., Peloton, Technogym S.p.A, Torque Fitness, LLC. and TRUE Fitness Technology, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Market Dynamics

The growing health and fitness-conscious population throughout the world is the prominent factor that is driving the fitness equipment market growth. People all around the world have become more self-aware of the necessity of leading a healthy lifestyle in the last few years. As a result, fitness has become a trend for millions of people, resulting in a rapid expansion of the global fitness industry's size and popularity. Even though the vast majority of people are now more sedentary, an increasing number of people are choosing a more active lifestyle.

Another significant factor that fuels the market growth includes the rising number of the obese population. For instance, according to the WHO, over 650 million adults were obese or overweight in 2016. Among them, more than 1.9 billion adults (39% adults) aged 18 and over were overweight in 2016. In addition to that, people with chronic diseases such as diabetes, cardiovascular disease, and high blood pressure are advised to begin exercising in order to achieve a healthy lifestyle and lessen the negative effects of their disease on their bodies. These factors are increasing the demand for new gyms and fitness centers, resulting in strong growth potential for the fitness equipment industry.

However, the high costs of this equipment are making low and middle-income populations reluctant to purchase them. Thus, it is creating a roadblock to widespread growth, especially in emerging economies. The rising demand for the resale of used fitness equipment is also one of the restraining factors for the market growth. Furthermore, increasing government initiatives to promote a healthier lifestyle is expected to create numerous growth prospects for the industry in the coming years. For instance, to 'revive' sports culture and infrastructure in India, the Ministry of Youth Affairs & Sports amalgamated three schemes — the National Sports Talent Search Scheme, Urban Sports Infrastructure Scheme, and the Rajiv Gandhi Khel Abhiyan — into the Khelo India Movement in 2016. This initiative has raised significant awareness about fitness among the youth in India, eventually driving them to join fitness clubs, sports clubs, and gyms.

Fitness Equipment Market Segmentation

The global fitness equipment market is segmented based on type, end-use, and geography.

Market by Type

· Strength Training Equipment

o Free Weights

o Other Machines

· Cardiovascular Training Equipment

o Stationary Cycles

o Treadmills

o Elliptical and Others

· Other Equipment

o Body Analyzers

o Activity Monitors

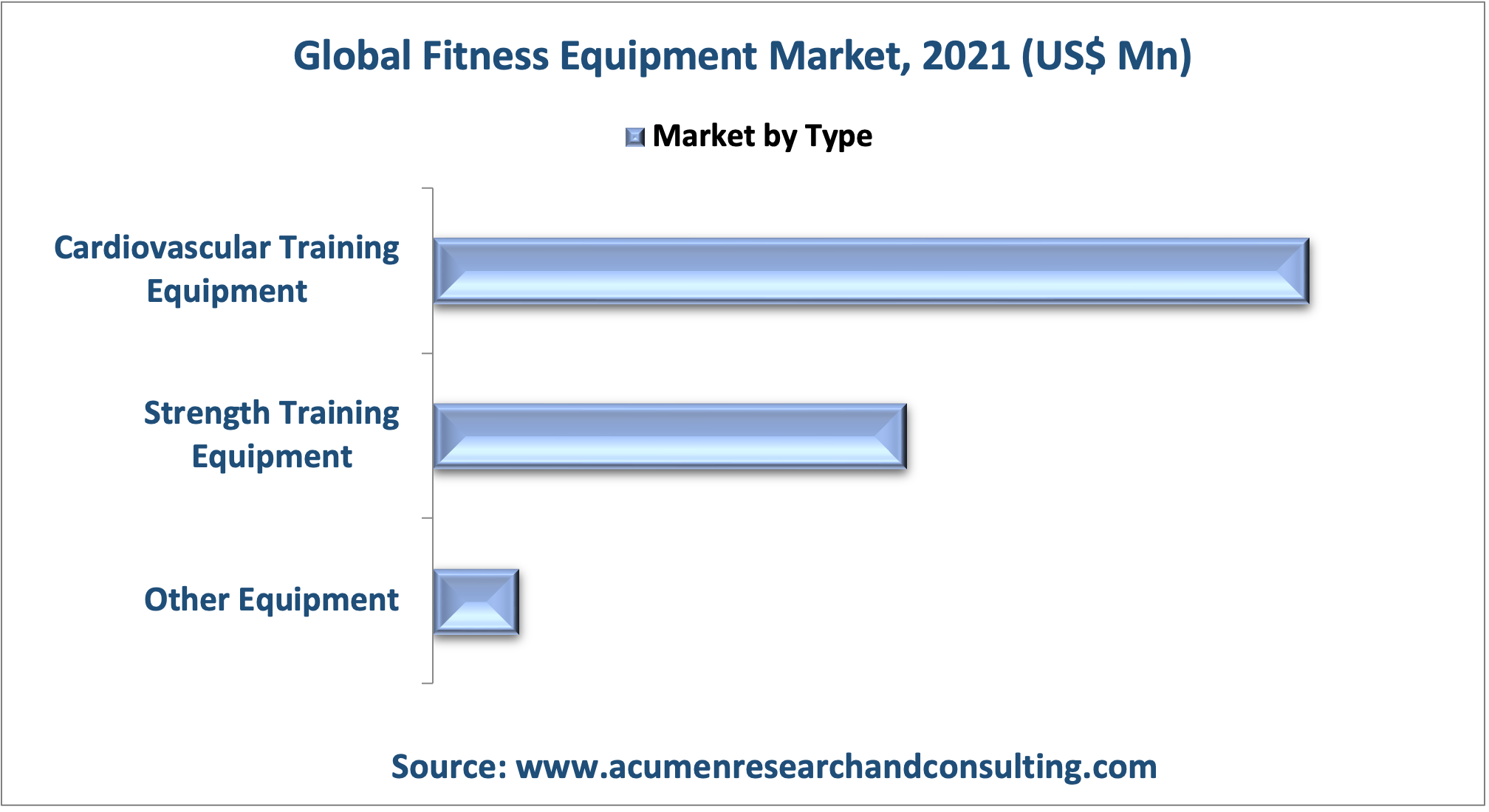

Based on type, the cardiovascular training equipment segment gathered the maximum market share in 2021. Cardiovascular training equipment is a type of fitness equipment that is used to keep the body fit and avoid ailments. The rising awareness of health and the trends of corporate fitness and wellness programs offered by corporations for their employees are the main drivers of this segment. The rise in obesity in developed countries, as well as the rapid growth of in-house gyms and personal trainers, is driving this market. In addition, cardiovascular exercise is suggested for almost everyone, even the elderly and those with chronic illnesses.

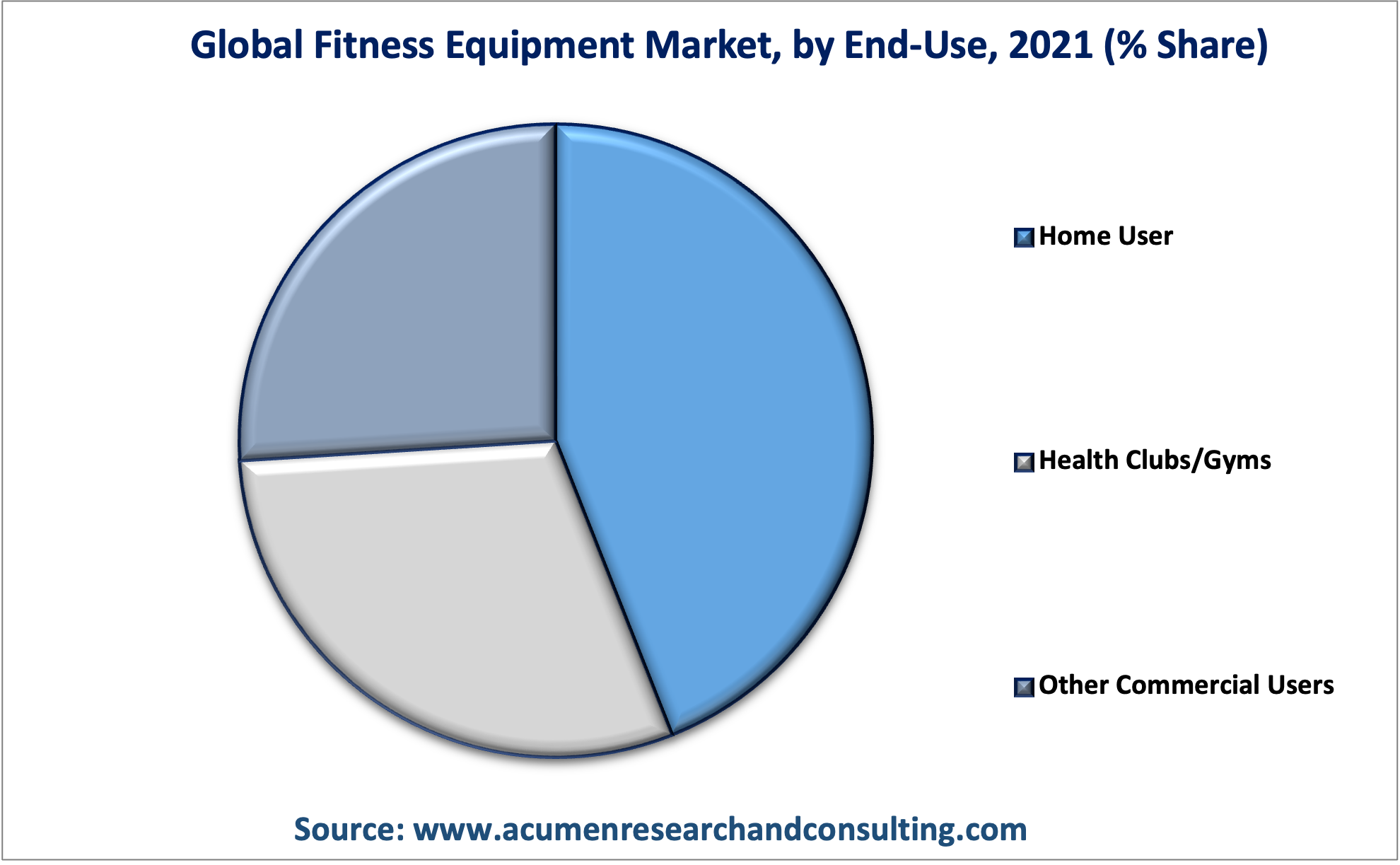

Market by End-Use

- Home Consumer

- Home

- Apartment

- Gyms in Apartment

- Health Clubs/Gyms

- Other Commercial Users

- Hotels

- Corporate offices

- Hospitals & Medical Centers

- Public Institutions (Schools, Universities, and Others)

The growth of the global home fitness equipment market is being fueled by an increase in expenditure on preventative healthcare, the convenience of utilizing equipment at home, and more awareness about living a healthy lifestyle. The growing interest in physical exercise, Covid-19-related constraints, and higher mental exhaustion as a result of these limits are projected to propel the home fitness sector forward. Furthermore, a rising number of manufacturers are investing in the development of apps that allow clients to choose their trainers for online classes or home visits to match their unique fitness needs, such as bodybuilding. All these aspects are fueling the home fitness industry.

Fitness Equipment Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· Japan

· China

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa

Rising Technological Innovations in Fitness Sector Fuels the North America Market Growth

Based on the regional segmentation, the North American region generated the maximum revenue in 2021. Some of the primary factors fueling the growth of the North American fitness equipment market include the presence of key players, an increasing base of chronic patients, the growing prevalence of the obese population, and the high pace of advancement in technology. On the other hand, the Asia-Pacific region is expected to attain the fastest CAGR during the forecast period 2022 – 2030. The high growth in the region is attributed to the increasing healthcare awareness among the population, rising per capita income, and growing healthcare expenditure.

Market Players

Some of the top vendors offered in the professional report include Anta Sports, Core Health and Fitness, LLC, ICON Health & Fitness, Inc., Johnson Health Tech Co., Ltd., Nautilus, Inc., Impulse (Qingdao) Health Tech Co., Ltd., Peloton, Technogym S.p.A, Torque Fitness, LLC. and TRUE Fitness Technology, Inc.

Frequently Asked Questions

How much was the estimated value of the global fitness equipment market in 2021?

The estimated value of global fitness equipment market in 2021 was accounted to be US$ 10,982 Mn.

What will be the projected CAGR for global fitness equipment market during forecast period of 2022 to 2030?

The projected CAGR of fitness equipment market during the analysis period of 2022 to 2030 is 5.9%.

Which are the prominent competitors operating in the market?

The prominent players of the global fitness equipment market involve Anta Sports, Core Health and Fitness, LLC, ICON Health & Fitness, Inc., Impulse (Qingdao) Health Tech Co., Ltd., Johnson Health Tech Co., Ltd., Nautilus, Inc., Peloton, Technogym S.p.A, Torque Fitness, LLC. and TRUE Fitness Technology, Inc.

Which region held the dominating position in the global fitness equipment market?

In terms of fitness equipment market share, North America held the dominating position during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for fitness equipment during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global Fitness Equipment market?

Growing number of health and fitness consciousness population, rising obese population, and surge in number of chronic disorders drives the growth of global fitness equipment market.

By segment type, which sub-segment held the maximum share?

Based on type, cardiovascular training equipment segment held the maximum share for fitness equipment market in 2021.