Hemorrhoid Treatment Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Hemorrhoid Treatment Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

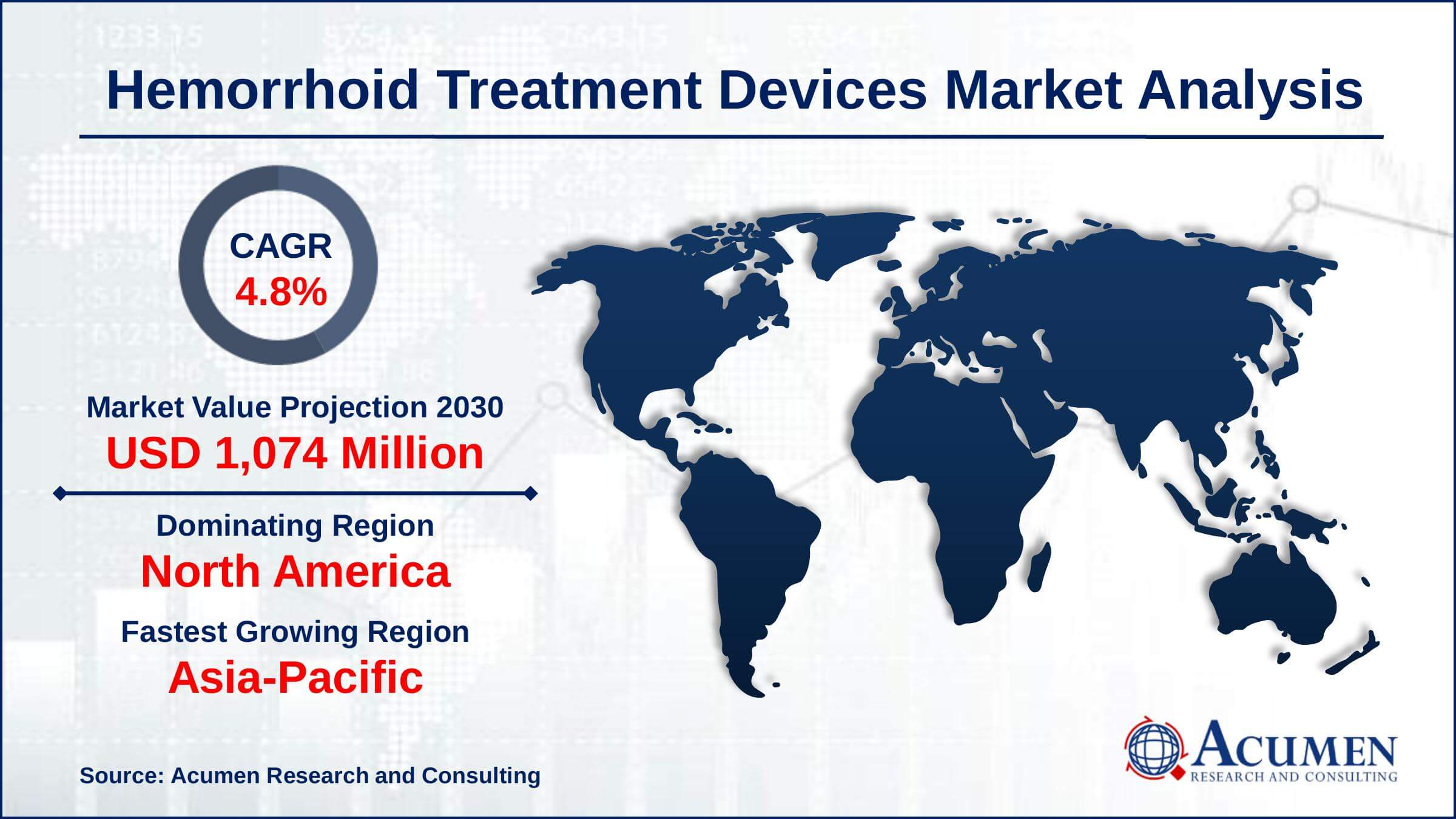

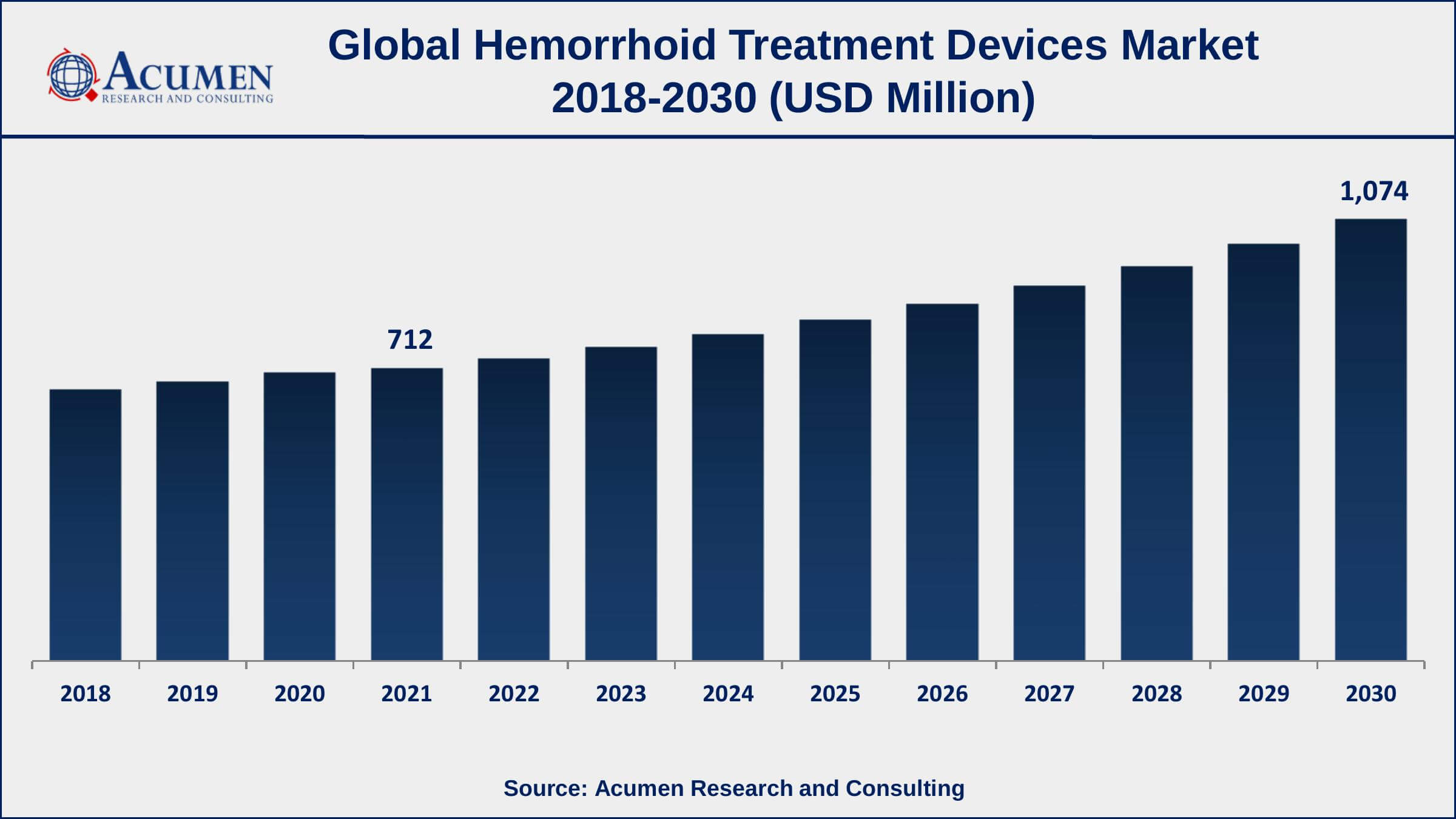

The Global Hemorrhoid Treatment Devices Market Size accounted for USD 712 Million in 2021 and is estimated to achieve a market size of USD 1,074 Million by 2030 growing at a CAGR of 4.8% from 2022 to 2030. The rise in hemorrhoid recurrence, as well as technological innovations, patient awareness, and healthcare spending, are propelling the global hemorrhoid treatment devices market value. Furthermore, increased demand for combination therapies & radiofrequency ablation treatment has gained traction in the worldwide hemorrhoid treatment devices market growth.

Hemorrhoid Treatment Devices Market Report Key Highlights

- Global hemorrhoid treatment devices market revenue is estimated to expand by USD 1,074 million by 2030, with a 4.8% CAGR from 2022 to 2030.

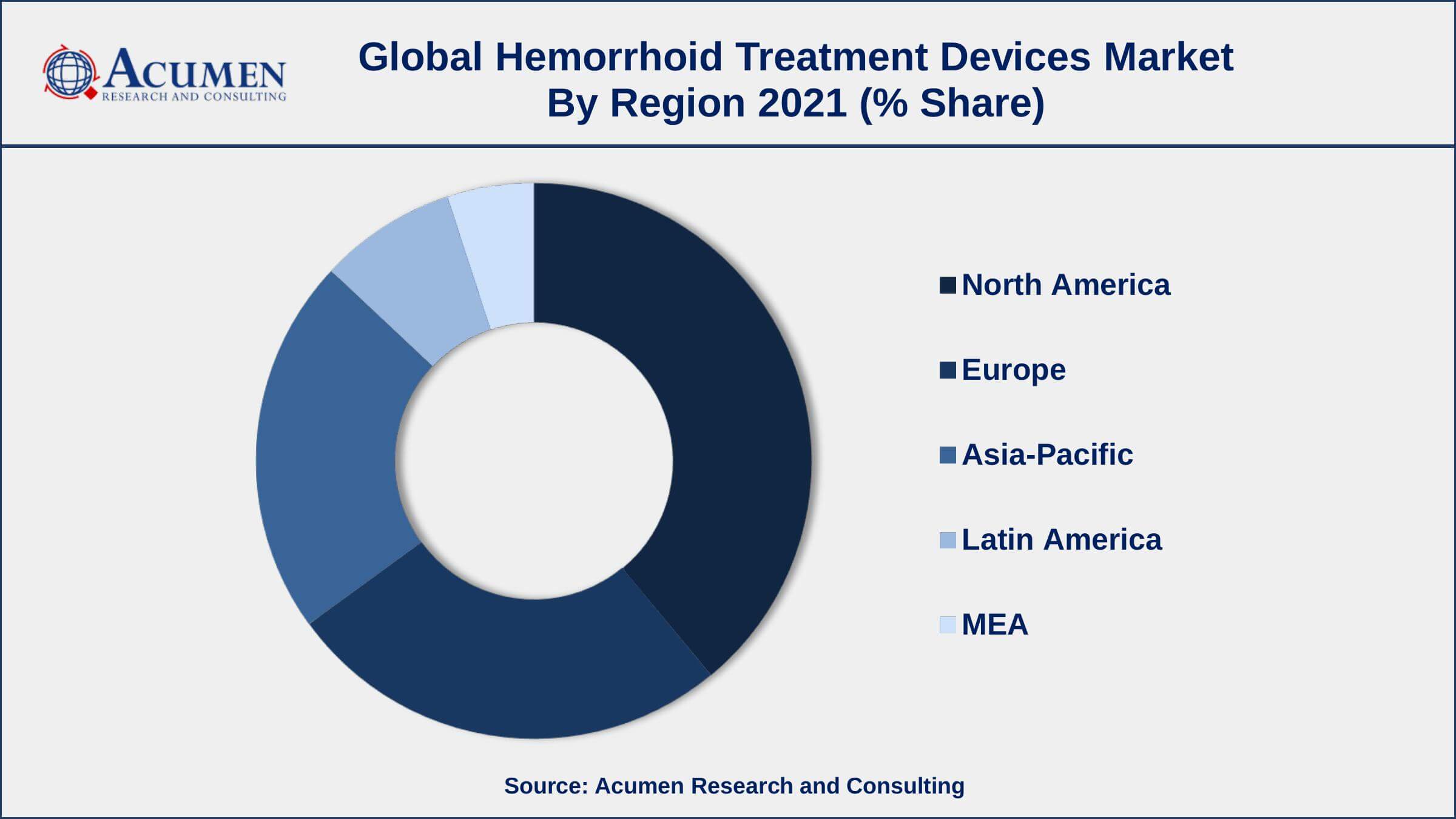

- North America hemorrhoid treatment devices market share accounted for over 39% of total market shares in 2021

- Asia-Pacific Hemorrhoid Treatment Devices market growth will observe highest CAGR from 2022 to 2030

- Based on device type, band ligators segment accounted for over 29% of the overall market share in 2021

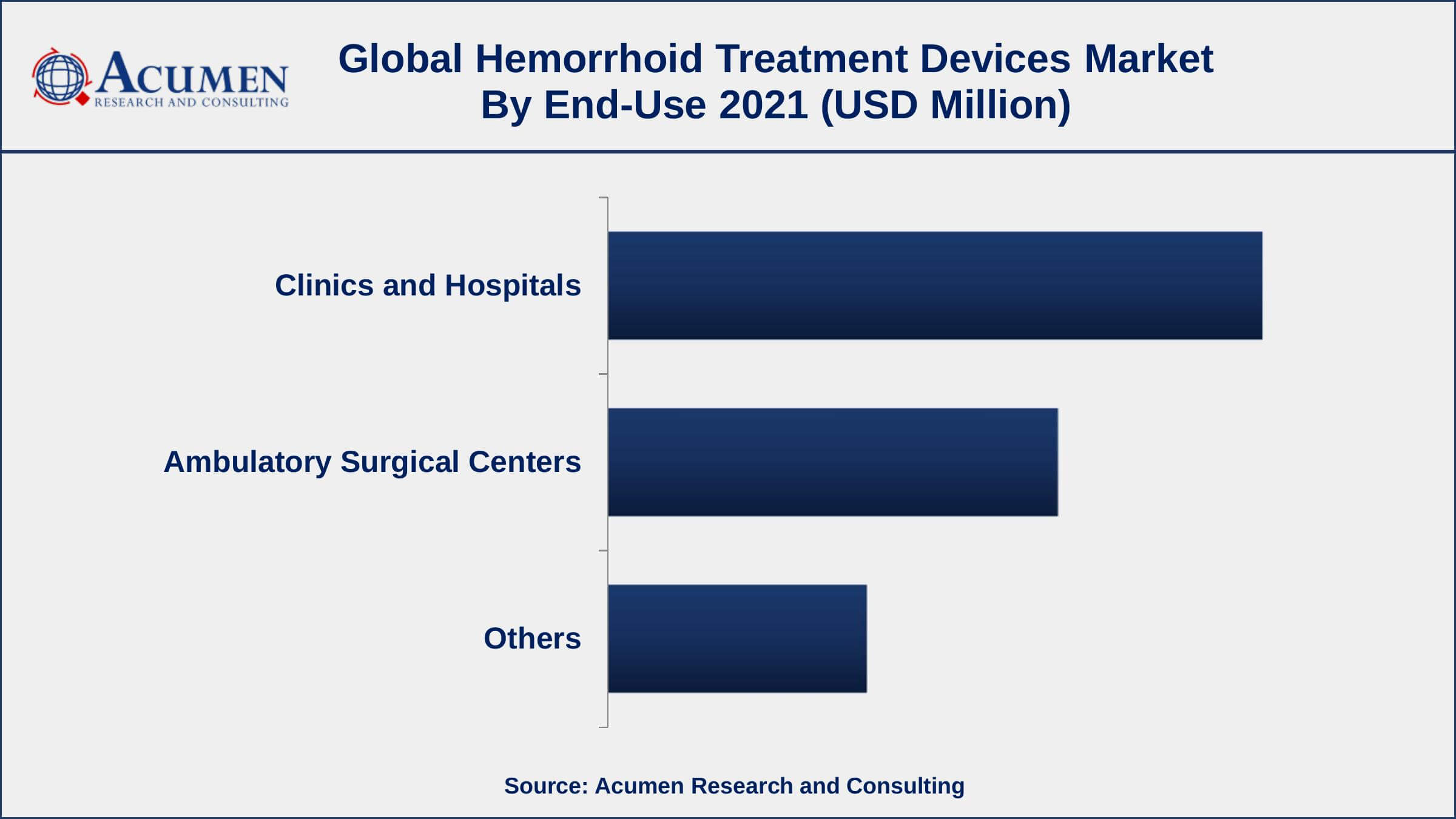

- Among end-use, hospitals & clinics segment engaged more than 48% of the total market share

- Rising incidence of hemorrhoids, drives the hemorrhoid treatment devices market size

Hemorrhoids are characterized by inflammation and swelling of the anal canal and cause patients irritation, pain, and itching. Today, a range of products, like home remedies, and topical ointments of different strengths and compositions, seek to relieve various patients. The products offer temporary relief from direct applications and must be used for a limited time. Products like coils provide comfort and cannot be considered as a treatment while sitting.

Global Hemorrhoid Treatment Devices Market Trends

Market Drivers

- Rising incidence of hemorrhoids among the population

- Growing adoption of the sedentary lifestyle

- Increasing spending on healthcare infrastructure development

- Increase in chronic constipation cases

Market Restraints

- Availability of several drugs as alternate treatment options

- Lack of medical expertise

Market Opportunities

- Technological advances in hemorrhoid treatment technologies

- New product releases and strategic coordination among leading companies

Hemorrhoid Treatment Devices Market Report Coverage

| Market | Hemorrhoid Treatment Devices Market |

| Hemorrhoid Treatment Devices Market Size 2021 | USD 712 Million |

| Hemorrhoid Treatment Devices Market Forecast 2030 | USD 1,074 Million |

| Hemorrhoid Treatment Devices Market CAGR During 2022 - 2030 | 4.8% |

| Hemorrhoid Treatment Devices Market Analysis Period | 2018 - 2030 |

| Hemorrhoid Treatment Devices Market Base Year | 2021 |

| Hemorrhoid Treatment Devices Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Device Type, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Johnson & Johnson, Boston Scientific Corporation, Medtronic plc, CONMED Corporation, Cook Medical, Sklar Surgical Instruments, Integra LifeSciences Corporation, Surkon Medical Co., Ltd., and Medline Industries, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

The growth in hemorrhoid prominence, along with technological advances, consumer awareness, & healthcare expenditure, are influencing the global hemorrhoid treatment devices market. Due to the obvious emergence of more extensive diagnosis and treatment options, the industry has been steadily rising. Rubber band ligation has become more popular in multiple nations as a low-cost and widely used procedure for line treatments of third-degree internal hemorrhoids. In the global hemorrhoid treatment devices market, combination therapies with radiofrequency ablation technology have gained increasing attention.

In cases where conventional non-chirurgie treatments such as belt ligation, infrared coagulation, & sclerotherapy are not preferred effective, in both internal and serious hemorrhoids. There is, however, no optimal treatment clinical consensus. Vascularity is limited in each of these treatments. Rubber band ligation is the most frequently used procedure in ambulatory settings among the methods under consideration. This method of treatment is reserved for patients who do not respond to non-operational therapies with more severe patients. The efficacy of band ligation is suggested by substantial clinical data and significant reporting compared with other methods is available. After treatment, the repetition of hemorrhoids is a major limit on band binding, which therefore limits the market growth.

Hemorrhoid Treatment Devices Market Segmentation

The worldwide hemorrhoid treatment devices market segmentation is based on the device type, end-use, and geography.

Hemorrhoid Treatment Devices Market By Device Type

- Band Ligators

- Infrared Coagulators

- Sclerotherapy Injectors

- Bipolar Probes

- Hemorrhoid Laser Probes

- Cryotherapy Devices

- Others

According to the hemorrhoid treatment devices industry analysis, the band ligators device segment is leading the global market in 2021. The band ligators segment is predicted to rise throughout the projected timeframe, owing to the growing incidence of target illness, increased research investigations, and the introduction of novel products by market participants. Band ligators provide superior treatment outcomes and effectiveness than alternative options for internal as well as severe hemorrhoids.

Hemorrhoid Treatment Devices Market By End-Use

- Clinics and Hospitals

- Ambulatory Surgical Centers

- Others

According to the hemorrhoid treatment devices market projection, the hospitals & clinics segment led the market and is predicted to grow significantly over the next few years. This increase is attributed to the availability of different technologies and services for hemorrhoid treatment. Due to the accessibility of cutting-edge innovations and exceptional medical care, clinics and hospitals are favored treatment places.

Hemorrhoid Treatment Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

North America is anticipated to govern the Hemorrhoid Treatment Devices Market

The biggest regional markets for hemorrhoid treatments are North America and Europe. However, a steadily increasing prevalence of the associated lifestyle conditions, obesity, and constipation caused by improper dietary practices will result in an increase in hemorrhoid incidence in the general population. In terms of the adoption of hemorrhoid treatment, Asia-Pacific will experience rapid growth and thus support the overall market progress. The key elements driving the Asia-Pacific market for hemorrhoid treatment instruments are increasing awareness and the disposable income of the population.

Hemorrhoid Treatment Devices Market Players

Some of the top hemorrhoid treatment devices market companies offered in the professional report includes Johnson & Johnson, Boston Scientific Corporation, Medtronic plc, CONMED Corporation, Cook Medical, Sklar Surgical Instruments, Integra LifeSciences Corporation, Surkon Medical Co., Ltd., and Medline Industries, Inc.

Frequently Asked Questions

What is the size of global hemorrhoid treatment devices market in 2021?

The estimated value of global hemorrhoid treatment devices market in 2021 was accounted to be USD 712 Million.

What is the CAGR of global hemorrhoid treatment devices market during forecast period of 2022 to 2030?

The projected CAGR hemorrhoid treatment devices market during the analysis period of 2022 to 2030 is 4.8%.

Which are the key players operating in the market?

The prominent players of the global hemorrhoid treatment devices market are Johnson & Johnson, Boston Scientific Corporation, Medtronic plc, CONMED Corporation, Cook Medical, Sklar Surgical Instruments, Integra LifeSciences Corporation, Surkon Medical Co., Ltd., and Medline Industries, Inc.

Which region held the dominating position in the global hemorrhoid treatment devices market?

North America held the dominating hemorrhoid treatment devices during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for hemorrhoid treatment devices during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global hemorrhoid treatment devices market?

Rising incidence of hemorrhoids among the population along with new product releases and strategic coordination among leading companies drives the growth of global hemorrhoid treatment devices market.

By device type segment, which sub-segment held the maximum share?

Based on device type, band ligators segment is expected to hold the maximum share of the hemorrhoid treatment devices market.