Hearables Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Hearables Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

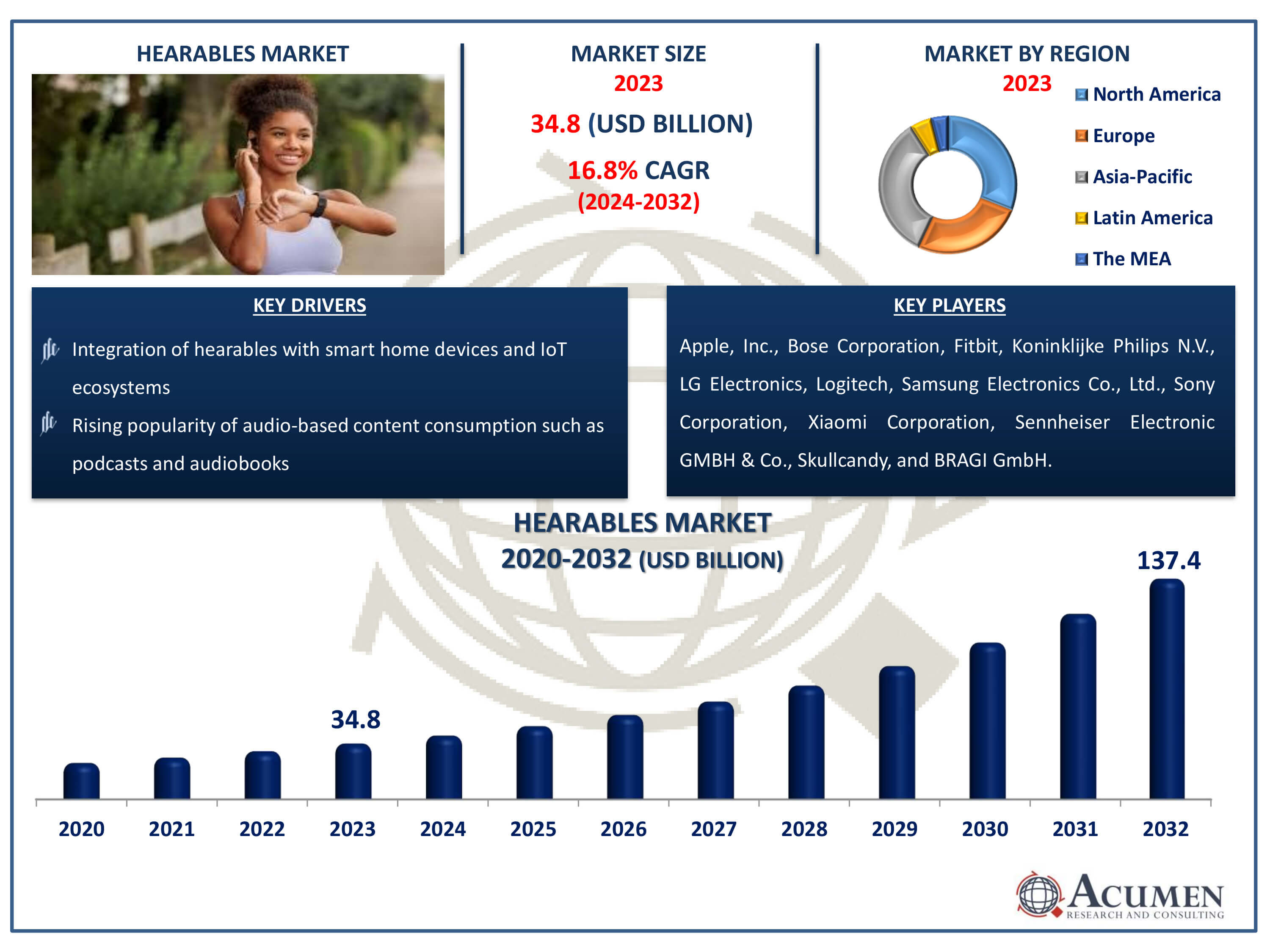

The Hearables Market Size accounted for USD 34.8 Billion in 2023 and is estimated to achieve a market size of USD 137.4 Billion by 2032 growing at a CAGR of 16.8% from 2024 to 2032.

Hearables Market Highlights

- Global hearables market revenue is poised to garner USD 137.4 billion by 2032 with a CAGR of 16.8% from 2024 to 2032

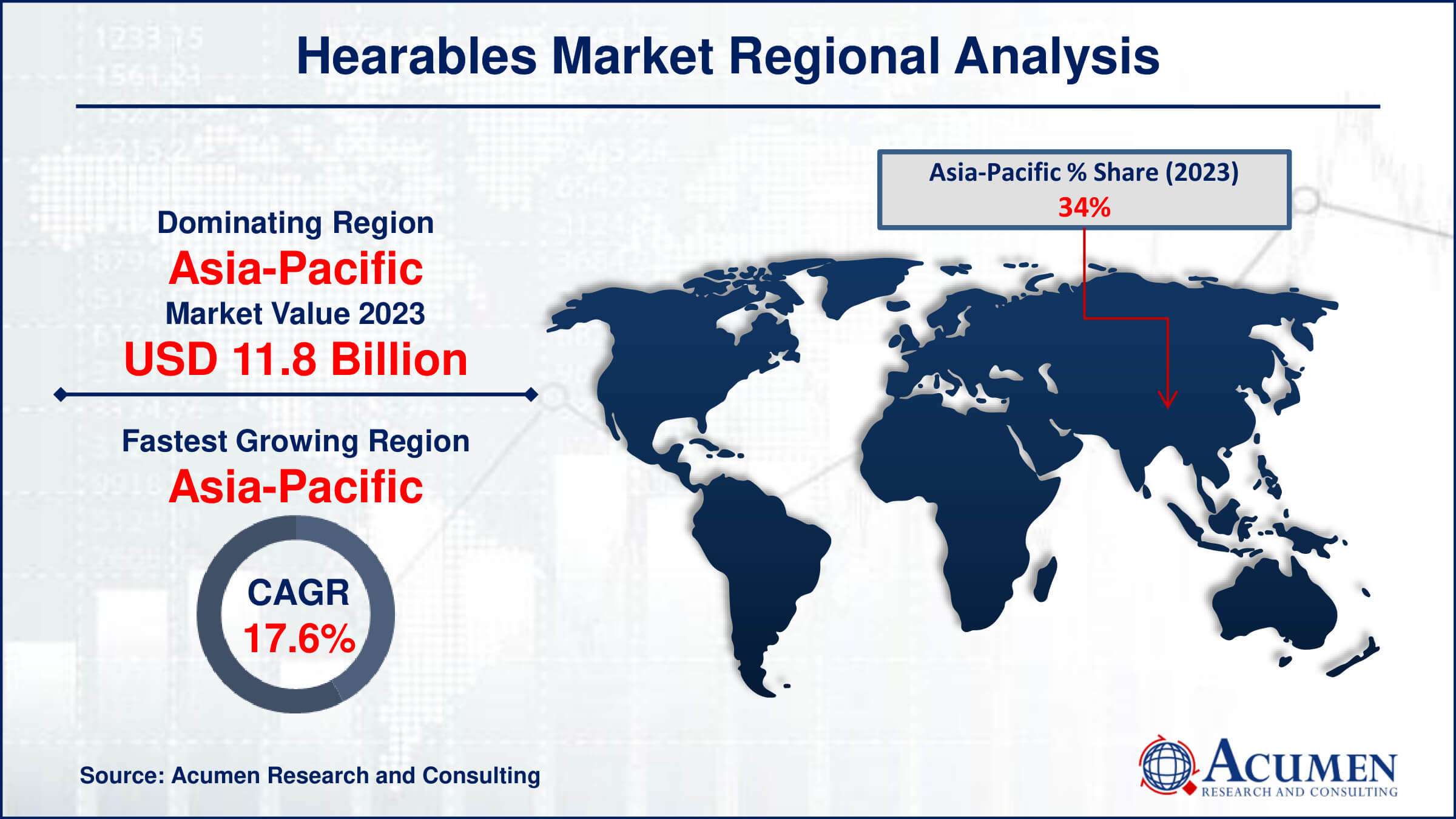

- Asia-Pacific hearables market value occupied around USD 11.8 billion in 2023

- Asia-Pacific hearables market growth will record a CAGR of more than 17.6% from 2024 to 2032

- Among type, the on ear sub-segment generated more than USD 18.1 billion revenue in 2023

- Based on end user, the consumer sub-segment generated around 55% market share in 2023

- Expansion into emerging markets is a popular hearables market trend that fuels the industry demand

Industrial devices with built-in virtual assistants and wireless networking functionality are now available for hearable devices. These tools also offer auditory aids for individuals in noisy business environments or organizations. Additionally, audacity is equipped with biometric, proximity, movement, and other sensors that capture user contexts. These smart headphones also enhance a user's listening experience. In urban environments, hearing devices are useful for coordinating between short-range and long-range teams. Wireless systems, including Bluetooth, Wi-Fi, cellular networks, and DECT, are interconnected via wireless communication technologies.

Global Hearables Market Dynamics

Market Drivers

- Demand for hands-free communication solutions

- Technological advancements in noise cancellation and sound quality

- Integration of hearables with smart home devices and IoT ecosystems

- Rising popularity of audio-based content consumption such as podcasts and audiobooks

Market Restraints

- Concerns over data privacy and security

- Limited battery life and charging infrastructure

- High initial costs for premium hearable devices

Market Opportunities

- Partnerships with healthcare providers for remote patient monitoring

- Innovation in design for comfort and aesthetics

- Utilization of hearables for augmented reality experiences

Hearables Market Report Coverage

| Market | Hearables Market |

| Hearables Market Size 2022 | USD 34.8 Billion |

| Hearables Market Forecast 2032 | USD 137.4 Billion |

| Hearables Market CAGR During 2023 - 2032 | 16.8% |

| Hearables Market Analysis Period | 2020 - 2032 |

| Hearables Market Base Year |

2022 |

| Hearables Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Type, By Technology, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Apple, Inc., Bose Corporation, Fitbit, Koninklijke Philips N.V., LG Electronics, Logitech, Samsung Electronics Co., Ltd., Sony Corporation, Xiaomi Corporation, Sennheiser Electronic GMBH & Co., Skullcandy, and BRAGI GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Hearables Market Insights

The market for hearing aids is expanding rapidly due to a number of factors, including the rising use of wireless headphones and improvements in infotainment systems. This growth trajectory is further accelerated by the emergence of hearable gadgets and the quick advancements in voice user experience technology. The development of electronically controlled medical equipment that may be operated remotely also contributes to the market's growth. Notwithstanding these developments, worries about the negative consequences of using headphones for extended periods of time above advised boundaries and the high price of hearing aids can obstruct further research. However, a positive trend is beginning to emerge in the industrial sector: the use of hearable devices to compensate for auditory deficits is posing a significant opportunity for major companies in the audio industry.

Over time, there have been notable technological advancements in headphones due to changing customer preferences, including the transition from wired to wireless choices. The groundbreaking impact of Bluetooth technology which enables seamless wireless networking for headphones has a notable influence on this change. Combining Bluetooth with Wi-Fi allows portable headphones to connect to other devices and headsets, increasing the ease and adaptability of the user experience. Furthermore, there are now more opportunities for linked audio experiences because to the convergence of headphones and IoT (Internet of Things) ecosystems. These developments improve consumers' overall auditory experience by allowing them to switch between different audio sources and devices with ease. The addition of sophisticated features like customized audio profiles and noise suppression enhances the allure of contemporary hearing aids.

Collaborations between audio technology companies and healthcare providers are expected to propel advancements in remote patient monitoring and customized auditory healthcare solutions as the industry develops. Additionally, developments in AI-powered audio processing might improve the usefulness and performance of hearing aids in a variety of contexts, including healthcare and entertainment.

Hearables Market Segmentation

The worldwide market for hearables is split based on product, type, technology, end user, and geography.

Hearable Products

- Headsets

- Earbuds

- Hearing Aids

According to hearables industry analysis, it is expected that the hearing aids sector would become the largest in the market. Demographic changes, particularly the ageing of the world's population, which is expected to increase the prevalence of hearing impairments, are the main drivers of this forecast. Hearing aids are no longer just analogue devices thanks to technological improvements; instead, they are now sophisticated digital solutions with individualized features and improved sound quality. Further driving the market's growth is the increased recognition and acceptance of hearing aids as necessary medical equipment. The incorporation of cutting-edge features like Bluetooth connectivity and smartphone compatibility, along with legislative actions aimed at enhancing accessibility to hearing healthcare services, are also anticipated to drive the growth of the hearables market's hearing aids sector.

Hearable Types

- In Ear

- On Ear

- Over Ear

Devices that rest on the outer ear are referred to as on ear devices in the hearables industry. It's a smaller section than in ear and over ear, but because of its adaptable design and usefulness, it's becoming a dominant category. For those who want comfort without sacrificing music quality, on ear headphones provides a good compromise between mobility and quality. Because of their small size, they are comfortable to wear for extended periods of time and may be used for a variety of activities, including working out and commuting. On-ear headphones' popularity has also been enhanced by developments in wireless technology and noise-canceling capabilities, which has fueled their market expansion and made them a strong competitor in the hearables sector.

Hearable Technologies

- Wired

- Wireless

- Bluetooth

- Wi-Fi

- DECT

- Others

The wireless category surpassed the wired category to become the main force in the industry in 2023. Numerous causes contributed to this change. First of all, the need for wireless solutions was fueled by customer preferences that significantly favored mobility and ease. The smooth connection and enhanced audio quality made possible by Bluetooth technology developments further contributed to the popularity of wireless solutions. Moreover, a major factor in the segment's domination was the spread of truly wireless earbuds, which provide a tangle-free experience and improved mobility. As the need for untethered experiences grow and more devices do away with headphone connectors, the wireless market not only met but beyond customer expectations, securing its place as the top technology in the rapidly changing hearables market.

Hearables End Users

- Consumer

- Industrial

- Healthcare

- Others

With its widespread appeal, the consumer segment grew to become a dominant force in 2023 and it is expedted to grow over the hearables market forecast period, winning over consumers all over the world. This domination was supported by an ideal harmony of circumstances. First of all, earbuds and headphones have become essential lifestyle accessories due to the growing integration of smart functions like voice assistants and fitness monitoring. Second, the growing popularity of immersive audio experiences in entertainment and gaming has increased customer demand for high-caliber sound systems. Furthermore, hearables have become more widely available and practical for daily usage as a result of the increasing use of wireless technology. By combining innovation, design, and utility in a cohesive whole, the consumer sector created a catchy tune that resonated with users and solidified its dominance in the rapidly changing hearables market.

Hearables Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Hearables Market Regional Analysis

The Asia-Pacific region has emerged as the leading contributor to the hearables market, driven by the significant presence of manufacturing and construction industries. These sectors heavily rely on industrial hearables for noise cancellation and communication purposes. Meanwhile, Europe ranks second in terms of revenue. Asia-Pacific stands out as the fastest-growing region in this industry and anticipates significant growth during the predictive genetic testing and consumer wellness genomics forecast period for predictive genetic testing and consumer wellness genomics. This growth is propelled by government initiatives aimed at preventing hearing loss resulting from noise pollution in industrial settings. For instance, the expansion of manufacturing, infrastructure, and other industrial sectors has resulted in a significant number of employees being exposed to unhealthy noise levels for at least a quarter of their working time. However, this trend exacerbates the risk of severe and irreversible hearing loss caused by noise. The EU Directive 2003/10/EC regulates noise exposure in industries, aiming to mitigate unnecessary noise exposure among workers.

Hearables Market Players

Some of the top hearables companies offered in our report includes Apple, Inc., Bose Corporation, Fitbit, Koninklijke Philips N.V., LG Electronics, Logitech, Samsung Electronics Co., Ltd., Sony Corporation, Xiaomi Corporation, Sennheiser Electronic GMBH & Co., Skullcandy, and BRAGI GmbH.

Frequently Asked Questions

How big is the hearables market?

The hearables market size was valued at USD 34.8 billion in 2023.

What is the CAGR of the global hearables market from 2024 to 2032?

The CAGR of hearables is 16.8% during the analysis period of 2024 to 2032.

Which are the key players in the hearables market?

The key players operating in the global market are including Apple, Inc., Bose Corporation, Fitbit, Koninklijke Philips N.V., LG Electronics, Logitech, Samsung Electronics Co., Ltd., Sony Corporation, Xiaomi Corporation, Sennheiser Electronic GMBH & Co., Skullcandy, and BRAGI GmbH

Which region dominated the global hearables market share?

Asia-Pacific held the dominating position in hearables industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of hearables during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global hearables industry?

The current trends and dynamics in the hearables industry include demand for hands-free communication solutions, technological advancements in noise cancellation and sound quality, integration of hearables with smart home devices and iot ecosystems, and rising popularity of audio-based content consumption such as podcasts and audiobooks.

Which type held the maximum share in 2023?

The on ear types the maximum share of the hearables industry.