Healthcare Robots Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Healthcare Robots Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

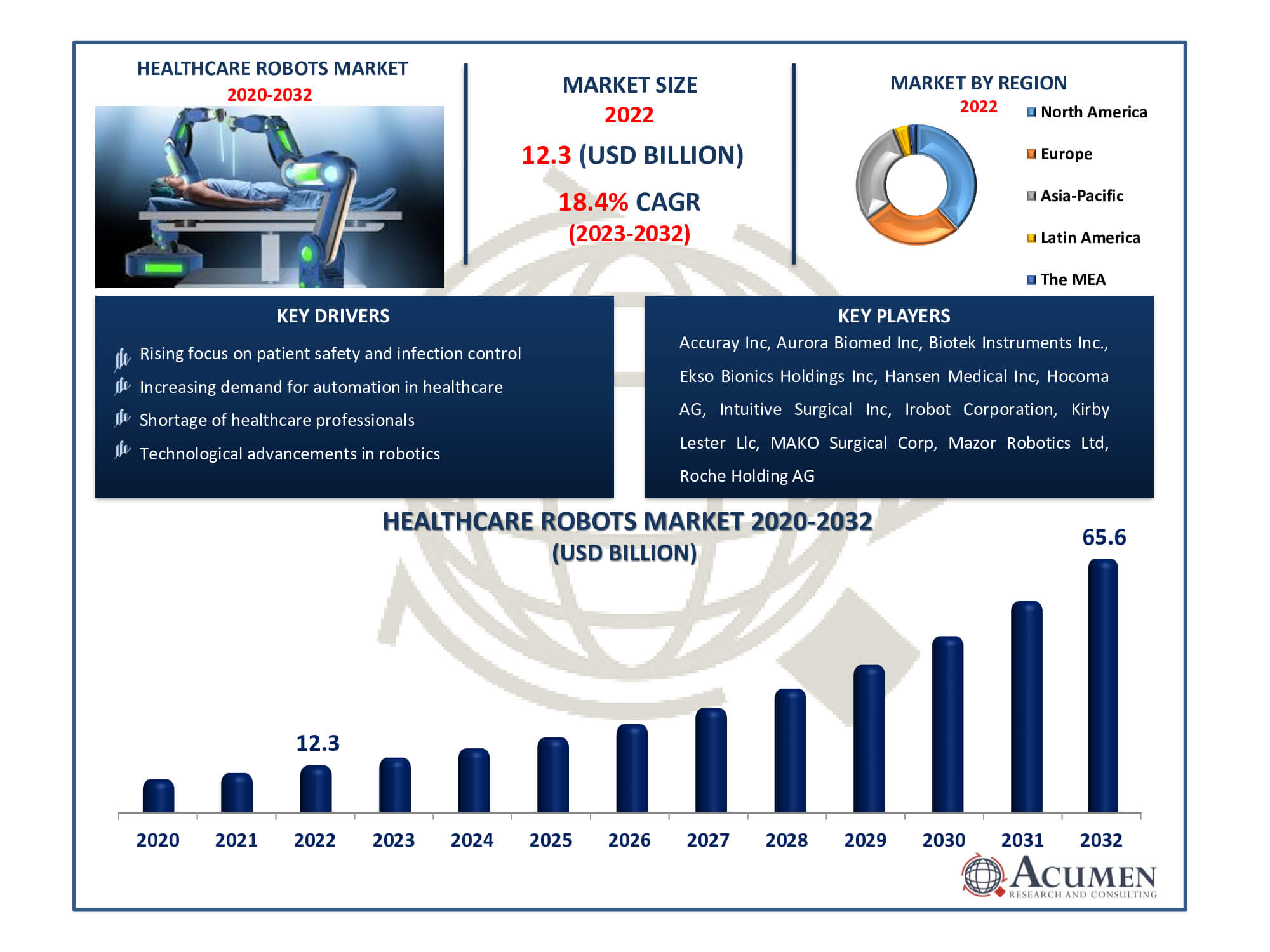

The Healthcare Robots Market Size accounted for USD 12.3 Billion in 2022 and is estimated to achieve a market size of USD 65.6 Billion by 2032 growing at a CAGR of 18.4% from 2023 to 2032.

Healthcare Robots Market Highlights

- Global healthcare robots market revenue is poised to garner USD 65.6 billion by 2032 with a CAGR of 18.4% from 2023 to 2032

- North America healthcare robots market value occupied around USD 4.7 billion in 2022

- Asia-Pacific healthcare robots market growth will record a CAGR of more than 20% from 2023 to 2032

- Among product, the surgical robots sub-segment generated over US$ 7.3 billion revenue in 2022

- Based on end-user, the hospitals sub-segment generated around 67% share in 2022

- Robotic drug dispensing and medication management is a popular healthcare robots market trend that fuels the industry demand

Healthcare robots are designed to relieve medical personnel from routine tasks. They make medical procedures safer and more affordable for patients. These robots can also perform surgery accurately in tight spaces and transport hazardous substances. During surgery, surgeons can easily control the instruments with the help of these robots, similar to manipulating virtual objects in computer games. The variety of robots in the healthcare industry includes surgical robots, blood-drawing robots, disinfecting robots, robots designed to assist in various aspects of life, robots in the supply chain, nanorobots in the bloodstream (still in the development phase), and social companion robots designed to provide companionship and emotional support.

Global Healthcare Robots Market Dynamics

Market Drivers

- Increasing demand for automation in healthcare

- Shortage of healthcare professionals

- Technological advancements in robotics

- Rising focus on patient safety and infection control

Market Restraints

- High initial costs of robotic systems

- Concerns about patient data security

- Regulatory challenges and compliance

Market Opportunities

- Remote patient monitoring and telemedicine

- Robotic-assisted surgery and diagnostics

- Elderly care and support

Healthcare Robots Market Report Coverage

| Market | Healthcare Robots Market |

| Healthcare Robots Market Size 2022 | USD 12.3 Billion |

| Healthcare Robots Market Forecast 2032 | USD 65.6 Billion |

| Healthcare Robots Market CAGR During 2023 - 2032 | 18.4% |

| Healthcare Robots Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Component, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Accuray Inc., Aurora Biomed Inc., Biotek Instruments Inc., Ekso Bionics Holdings Inc, Hansen Medical Inc., Hocoma AG, Intuitive Surgical Inc., Irobot Corporation, Kirby Lester Llc, MAKO Surgical Corp, Mazor Robotics Ltd, Roche Holding AG, Titan Medical Inc, Varian Medical Systems, and ZOLL Medical Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare Robots Market Insights

The advantages associated with robot-assisted surgery and training in rehabilitation therapy, such as timely and effective results, are driving market growth. Technological advancements, an improving reimbursement scenario, increasing adoption of surgical robots, and rising funding for research activities in the medical robot sector are further accelerating market growth. Furthermore, the increasing penetration of surgical robots in ambulatory surgery centers (ASCs), emerging markets, and the ongoing development of nanotechnology robots are projected to provide potential opportunities over the forecast period from 2023 to 2032.

A factor limiting the market for healthcare robots is the high upfront cost of purchasing and deploying robotic equipment. Advanced robotic technology development, production, and integration come at a high cost, which can be difficult for healthcare organisations to afford. It could be challenging for smaller clinics and hospitals in particular to budget for these pricey equipment. The total cost may also increase with continued upgrades and maintenance. This cost barrier could prevent healthcare robots from being widely used by limiting their adoption.

The potential for robots to alleviate the scarcity of qualified medical practitioners is an opportunity in the healthcare robots market. The demand for healthcare services is rising due to an ageing population and rising healthcare requirements. Healthcare robots can assist with a variety of duties, including patient care, drug administration, and telemedicine support, to help close this staffing deficit. Robots can free up healthcare personnel to concentrate on more important and difficult areas of patient care by automating repetitive and time-consuming tasks. This improves operational effectiveness while simultaneously guaranteeing that patients receive prompt, high-quality medical care, particularly in rural or underserved areas with limited access to doctors. This chance presents healthcare robots as useful tools for tackling the changing healthcare environment.

Healthcare Robots Market Segmentation

The worldwide market for healthcare robots is split based on product, component, application, end-user, and geography.

Healthcare Robots Product

- Surgical Robots

- Rehabilitation Robots

- Telemedicine Robots

- Pharmacy and Hospital Automation Robots

- Non-Invasive Radiosurgery Robots

- Robotic Catheters

As per the healthcare robots industry analysis, surgical robots dominated the market. Surgical robots play a vital role in the field of minimally invasive procedures and precision operations, making them highly desirable for healthcare providers. These robots contribute to improved accuracy, smaller incisions, and faster patient recovery times. Surgeons benefit from the enhanced precision they offer, reducing the potential for human error during complex procedures. The growing adoption of surgical robots and the continuous advancement of robotic technology contribute to the prominence of this market segment.

Healthcare Robots Component

- Safety Systems

- Locomotion Systems

- User Interface

- Software Products

- Power Resources

- Visualization Systems

Safety systems are expected to be the largest segment in the healthcare robots industry, followed by locomotion systems. Healthcare robots incorporate safety features to protect patients and medical personnel. They utilize various sensors and technologies to enhance safety and prevent accidents when performing tasks with the assistance of robots. The second-largest segment consists of robots capable of efficient movement within healthcare facilities, thanks to locomotion systems. These technologies provide robots with the ability to move and navigate, enabling them to perform tasks such as delivering supplies or assisting in surgery efficiently. Together, these two market segments dominate the healthcare robots industry due to their critical roles in functionality, safety, and efficiency. Market forecast indicate continued growth in these segments.

Healthcare Robots Application

- Neurology Applications

- Cardiology Applications

- Orthopedic Applications

- Laparoscopic Applications

- Others

The neurology applications sector of the healthcare robots market has the biggest share, mainly because sophisticated neurological treatments require a high degree of precision and efficacy. The capacities of healthcare professionals are greatly increased by these robots, improving patient outcomes and enabling more sophisticated medical operations. The part on Laparoscopic Applications comes next and is essential to minimally invasive operations. By providing improved dexterity and visualisation, laparoscopic robots lessen patient trauma. The growing requirement for accuracy and cutting-edge technology in healthcare is a major factor contributing to the dominance of the Neurology and Laparoscopic segments, underscoring their critical role in the market's sustained expansion. The growing significance of these markets in influencing the direction of healthcare robotics is corroborated by market analysis.

Healthcare Robots End-User

- Hospitals

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Other

According to the healthcare robots market, hospitals segment is expected to lead for a number of important reasons. The main healthcare facilities that provide a broad range of medical services and treatments are hospitals. Robots have shown to be extremely beneficial in improving patient care, surgical precision, and task efficiency. They are especially useful for complex diagnostic and surgical procedures. Robots are used in minimally invasive operations at ambulatory surgery centres, which makes up the second-largest category. Hospitals dominate the healthcare robots market because of their significant involvement in patient care and the need for cutting-edge technologies to guarantee better treatment results. Robots are becoming more and more common in these healthcare settings, which highlights their importance to the sector with a positive market forecast for the future.

Healthcare Robots Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

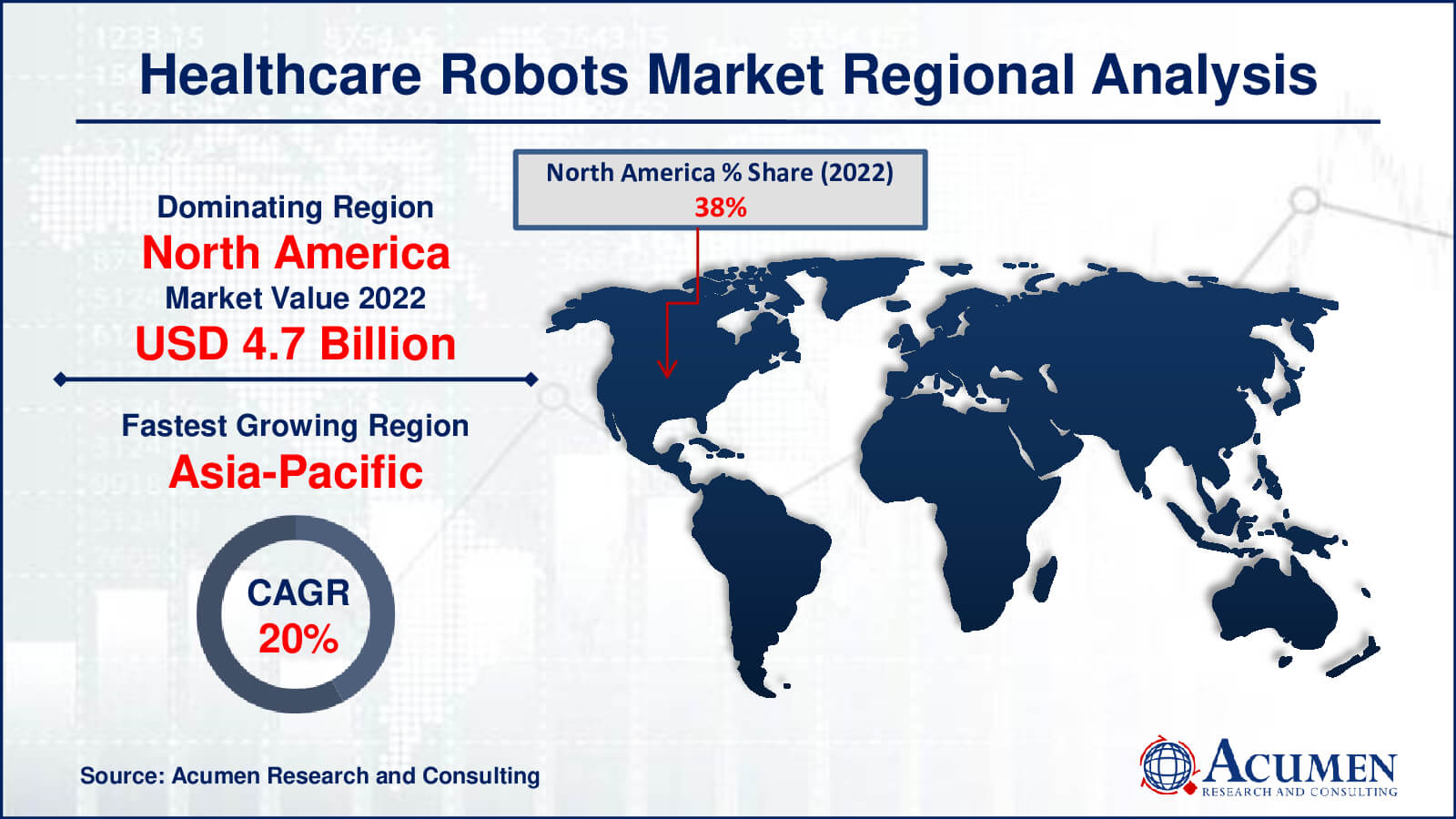

Healthcare Robots Market Regional Analysis

North America accounted for the highest revenue share in the global market. The region led the market with a major revenue share (%) in 2022 and is anticipated to maintain its dominance over the forecast period from 2023 to 2032. The well-established healthcare infrastructure of the region, coupled with enhanced patient awareness about the utility of new and innovative technologies, supports the regional market value. The U.S. contributes to the highest revenue share in the regional market due to its highly developed healthcare infrastructure.

Asia-Pacific is estimated to exhibit the fastest growth over the forecast period from 2023 to 2032. The developing healthcare IT infrastructure in developing economies primarily supports regional market growth. Increasing disposable income, which further boosts people's spending power, is expected to drive growth in the region.

Ongoing investment in the healthcare sector, particularly for the development of advanced and more effective technology that can aid in affordable and timely patient treatment, is additionally bolstering regional market growth.

Healthcare Robots Market Players

Some of the top healthcare robots companies offered in our report includes Accuray Inc, Aurora Biomed Inc, Biotek Instruments Inc., Ekso Bionics Holdings Inc, Hansen Medical Inc, Hocoma AG, Intuitive Surgical Inc, Irobot Corporation, Kirby Lester Llc, MAKO Surgical Corp, Mazor Robotics Ltd, Roche Holding AG, Titan Medical Inc, Varian Medical Systems, and ZOLL Medical Corp.

Frequently Asked Questions

How big is the healthcare robots market?

The market size of healthcare robots was USD 12.3 billion in 2022.

What is the CAGR of the global healthcare robots market from 2023 to 2032?

The CAGR of healthcare robots is 18.4% during the analysis period of 2023 to 2032.

Which are the key players in the healthcare robots market?

The key players operating in the global market are including Accuray Inc, Aurora Biomed Inc, Biotek Instruments Inc., Ekso Bionics Holdings Inc, Hansen Medical Inc, Hocoma AG, Intuitive Surgical Inc, Irobot Corporation, Kirby Lester Llc, MAKO Surgical Corp, Mazor Robotics Ltd, Roche Holding AG, Titan Medical Inc, Varian Medical Systems, and ZOLL Medical Corp.

Which region dominated the global healthcare robots market share?

North America held the dominating position in healthcare robots industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of healthcare robots during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global healthcare robots industry?

The current trends and dynamics in the healthcare robots industry include increasing demand for automation in healthcare, shortage of healthcare professionals, technological advancements in robotics, and rising focus on patient safety and infection control.

Which product held the maximum share in 2022?

The surgical robots product held the maximum share of the healthcare robots industry.