Healthcare Reimbursement Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Healthcare Reimbursement Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

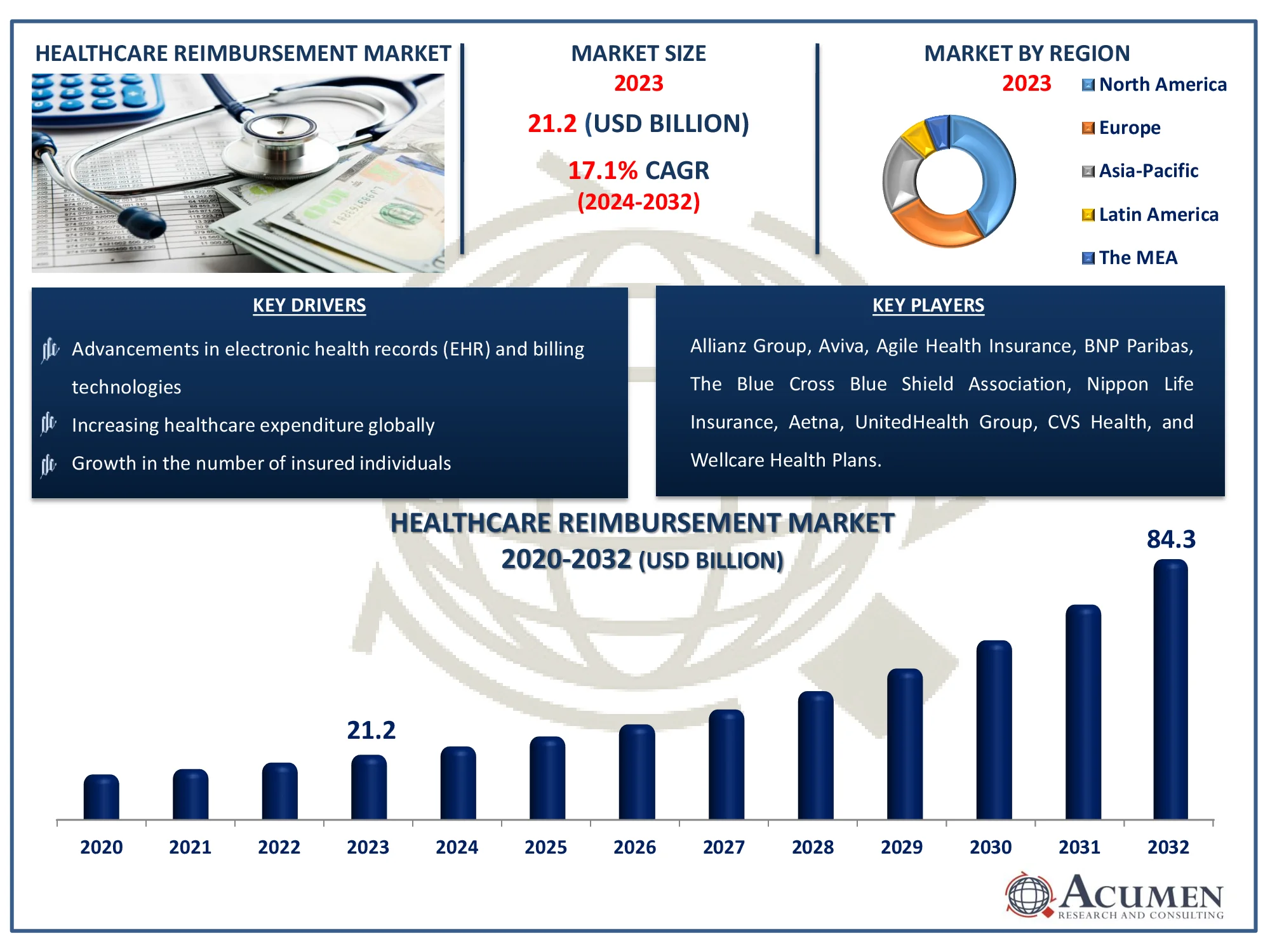

The Global Healthcare Reimbursement Market Size accounted for USD 21.2 Billion in 2023 and is estimated to achieve a market size of USD 84.3 Billion by 2032 growing at a CAGR of 17.1% from 2024 to 2032.

Healthcare Reimbursement Market (By Claim: Underpaid and Full Paid; By Payers: Private Payers and Public Payers; By Service Providers: Physician Office, Hospitals, Diagnostic Laboratories, and Others; By Region: North America, Europe, Asia-Pacific, Latin America, and the MEA)

Healthcare Reimbursement Market Highlights

- Global healthcare reimbursement market revenue is poised to garner USD 84.3 billion by 2032 with a CAGR of 17.1% from 2024 to 2032

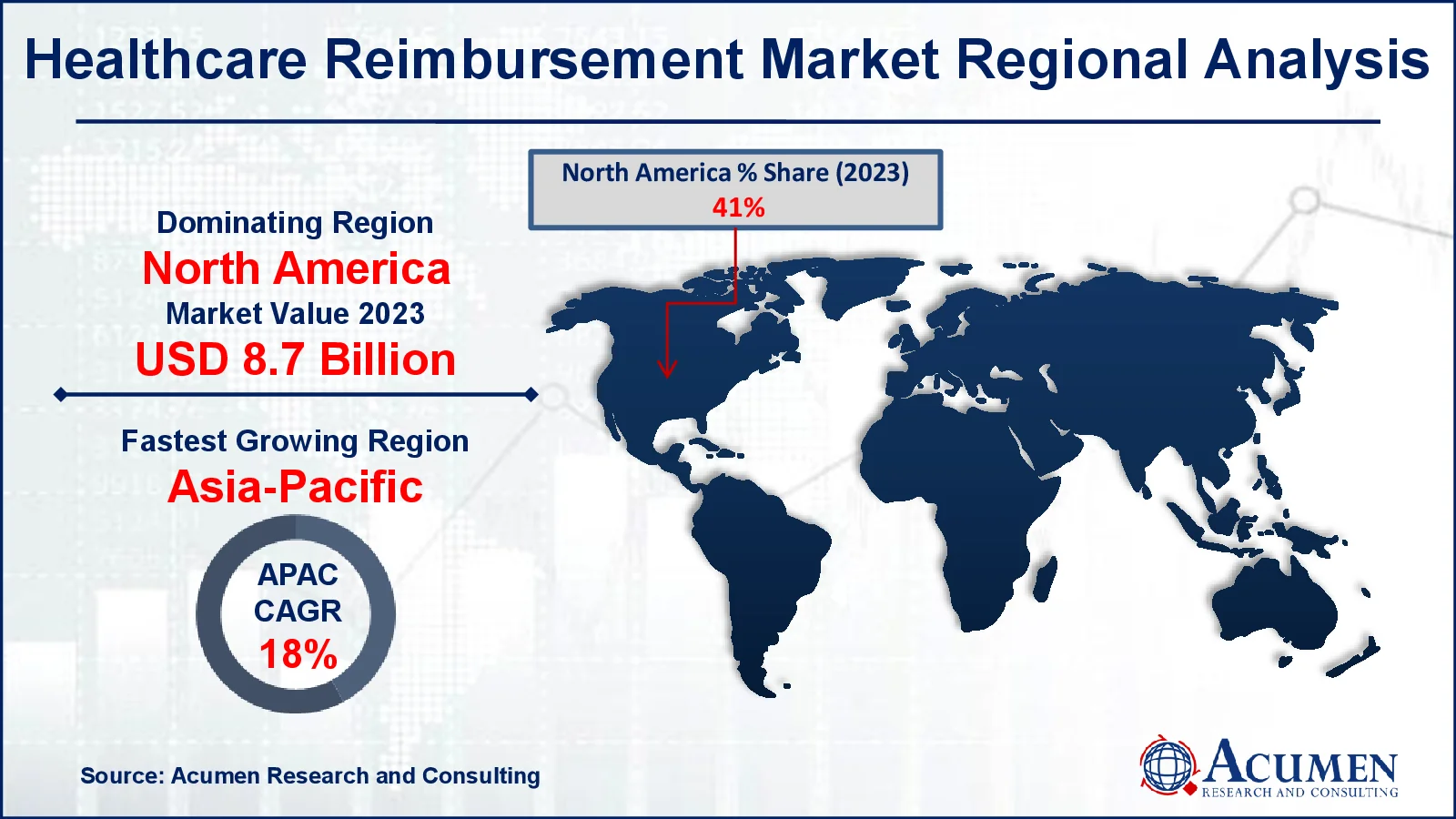

- North America healthcare reimbursement market value occupied around USD 8.7 billion in 2023

- Asia-Pacific healthcare reimbursement market growth will record a CAGR of more than 18% from 2024 to 2032

- Among payers, the private payers sub-segment generated more than USD 12.7 billion revenue in 2023

- Based on service provider, the hospitals sub-segment generated noteworthy healthcare reimbursement market share in 2023

- Growing demand for patient-centered reimbursement solutions is a popular healthcare reimbursement market trend that fuels the industry demand

Healthcare reimbursement refers to the process by which healthcare providers receive payment for the services they deliver to patients. This payment typically comes from health insurance companies, government programs, or patients themselves. The reimbursement process involves submitting claims detailing the services provided, which are then reviewed and processed by insurers or payers based on the terms of the policy or program. Payments can be based on various models, including fee-for-service, capitation, or bundled payments. Effective reimbursement ensures that providers are compensated fairly and helps maintain the financial viability of healthcare practices. It also impacts patient access to care and the overall efficiency of the healthcare system. Ensuring timely and accurate reimbursement is crucial for managing healthcare costs and optimizing service delivery.

Global Healthcare Reimbursement Market Dynamics

Market Drivers

- Increasing healthcare expenditure globally

- Growth in the number of insured individuals

- Advancements in electronic health records (EHR) and billing technologies

- Rising prevalence of chronic diseases requiring ongoing care

Market Restraints

- Complex and varying reimbursement policies across different regions

- High administrative costs and billing errors

- Delays in reimbursement processes affecting cash flow

Market Opportunities

- Expansion of value-based care models

- Integration of artificial intelligence in claim processing

- Increasing adoption of telemedicine services

Healthcare Reimbursement Market Report Coverage

| Market | Healthcare Reimbursement Market |

| Healthcare Reimbursement Market Size 2022 |

USD 21.2 Billion |

| Healthcare Reimbursement Market Forecast 2032 | USD 84.3 Billion |

| Healthcare Reimbursement Market CAGR During 2023 - 2032 | 17.1% |

| Healthcare Reimbursement Market Analysis Period | 2020 - 2032 |

| Healthcare Reimbursement Market Base Year |

2022 |

| Healthcare Reimbursement Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Claim, By Payers, By Service Provider, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allianz Group, Aviva, Agile Health Insurance, BNP Paribas, The Blue Cross Blue Shield Association, Nippon Life Insurance, Aetna, UnitedHealth Group, CVS Health, and Wellcare Health Plans. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Healthcare Reimbursement Market Insights

The global increase in healthcare expenditure is a significant driver of the healthcare reimbursement Market. As nations invest more in their healthcare systems, including funding for advanced medical technologies and expanding insurance coverage, the demand for efficient reimbursement mechanisms grows. This expenditure surge reflects a broader commitment to improving health outcomes, driving the need for robust systems to handle the increased volume and complexity of claims. Enhanced healthcare spending often translates to a greater need for sophisticated reimbursement solutions that can manage diverse and high-cost medical services effectively.

Healthcare reimbursement market is the complexity and variability of reimbursement policies across different regions. Diverse regulatory environments and differing standards between countries or even states create challenges in standardizing reimbursement processes. These variations can lead to administrative inefficiencies, increased compliance costs, and confusion among healthcare providers. The inconsistency in policies complicates the claims process and can result in delays and disputes, affecting both the provider’s revenue cycle and overall patient care quality.

The expansion of value-based care models presents a notable opportunity for the healthcare reimbursement market. This approach shifts the focus from volume-based to value-based care, emphasizing outcomes and efficiency. As healthcare systems worldwide increasingly adopt value-based care, there is a growing demand for reimbursement solutions that align with these models. These solutions facilitate performance-based incentives and reimbursement structures that reward providers for delivering high-quality, cost-effective care. The transition to value-based care encourages innovation in reimbursement processes and promotes better alignment between provider compensation and patient outcomes.

Healthcare Reimbursement Market Segmentation

The worldwide market for healthcare reimbursement is split based on claim, payers, service provider, and geography.

Healthcare Reimbursement Market By Claim

- Underpaid

- Full Paid

According to healthcare reimbursement industry analysis, the underpaid segment has taking notable share. This segment refers to instances where healthcare providers receive less reimbursement than the amount they are entitled to based on the services rendered. The prevalence of underpayment issues stems from complex billing systems, errors in claims processing, and discrepancies between billed amounts and insurer reimbursement rates. Providers often face significant financial strain due to these underpayments, which can affect their operational stability and patient care quality. As a result, addressing underpaid claims has become a critical priority for improving the overall efficiency and fairness of the reimbursement process. Enhanced transparency, advanced billing technologies, and more streamlined claims procedures are being developed to mitigate this issue and ensure that healthcare providers are compensated accurately.

Healthcare Reimbursement Market By Payers

- Private Payers

- Public Payers

In the healthcare reimbursement market, the private payers segment is the largest. Private payers include commercial health insurance companies and employer-sponsored insurance plans, which cover a substantial portion of healthcare expenses. This segment's dominance is driven by the broad adoption of private insurance plans and the increasing number of individuals covered by employer-based health benefits. Private payers offer diverse reimbursement models, including fee-for-service, capitation, and value-based care arrangements, which contribute to their extensive market presence. Additionally, private payers often have more flexible and varied reimbursement structures compared to public payers, catering to a wide range of healthcare services. This extensive reach and adaptability make the private payers segment a key player in the healthcare reimbursement landscape.

Healthcare Reimbursement Market By Service Providers

- Physician office

- Hospitals

- Diagnostic Laboratories

- Others

The hospitals segment is the significant category within service providers and it is expected to grow over the healthcare reimbursement market forecast period. Hospitals play a central role in the healthcare system, offering a broad range of services, from emergency care to complex surgeries and specialized treatments. Due to their comprehensive service offerings and high patient volume, hospitals represent a significant portion of healthcare expenditures and, consequently, reimbursement activities. They are major recipients of reimbursement payments from both public and private payers, given their extensive infrastructure and capacity to handle complex medical cases. Additionally, hospitals often engage in various reimbursement models, including bundled payments and value-based care arrangements, further emphasizing their central role. Their prominence in the market reflects their critical function in delivering acute and specialized care, driving substantial reimbursement flows.

Healthcare Reimbursement Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Healthcare Reimbursement Market Regional Analysis

North America commanded the market in 2023 and is anticipated to remain dominant in the coming years. The presence of a robust reimbursement structure and a large number of insurance providers are key factors benefiting the market's growth. Additionally, the Affordable Care Act in the U.S. mandates coverage, and states that did not comply faced federal penalties. This legislation acts as a significant driver for the regional market.

In contrast, the Asia-Pacific region is the fastest-growing throughout the healthcare reimbursement industry forecast period. Rapid economic development, increasing healthcare infrastructure investments, and rising insurance penetration contribute to its dynamic growth. The expanding middle class and government initiatives to improve healthcare access further accelerate the market's expansion in this region.

Healthcare Reimbursement Market Players

Some of the top healthcare reimbursement companies offered in our report includes Allianz Group, Aviva, Agile Health Insurance, BNP Paribas, The Blue Cross Blue Shield Association, Nippon Life Insurance, Aetna, UnitedHealth Group, CVS Health, and Wellcare Health Plans.

Frequently Asked Questions

How big is the healthcare reimbursement market?

The healthcare reimbursement market size was valued at USD 21.2 billion in 2023.

What is the CAGR of the global healthcare reimbursement market from 2024 to 2032?

The CAGR of healthcare reimbursement is 17.1% during the analysis period of 2024 to 2032.

Which are the key players in the healthcare reimbursement market?

The key players operating in the global market are including Allianz Group, Aviva, Agile Health Insurance, BNP Paribas, The Blue Cross Blue Shield Association, Nippon Life Insurance, Aetna, UnitedHealth Group, CVS Health, and Wellcare Health Plans.

Which region dominated the global healthcare reimbursement market share?

North America held the dominating position in healthcare reimbursement industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of healthcare reimbursement during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global healthcare reimbursement industry?

The current trends and dynamics in the healthcare reimbursement industry include increasing healthcare expenditure globally, growth in the number of insured individuals, advancements in electronic health records (EHR) and billing technologies, and rising prevalence of chronic diseases requiring ongoing care.

Which payers held the maximum share in 2023?

The private payers held the maximum share of the healthcare reimbursement industry.