Granola Market | Acumen Research and Consulting

Granola Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

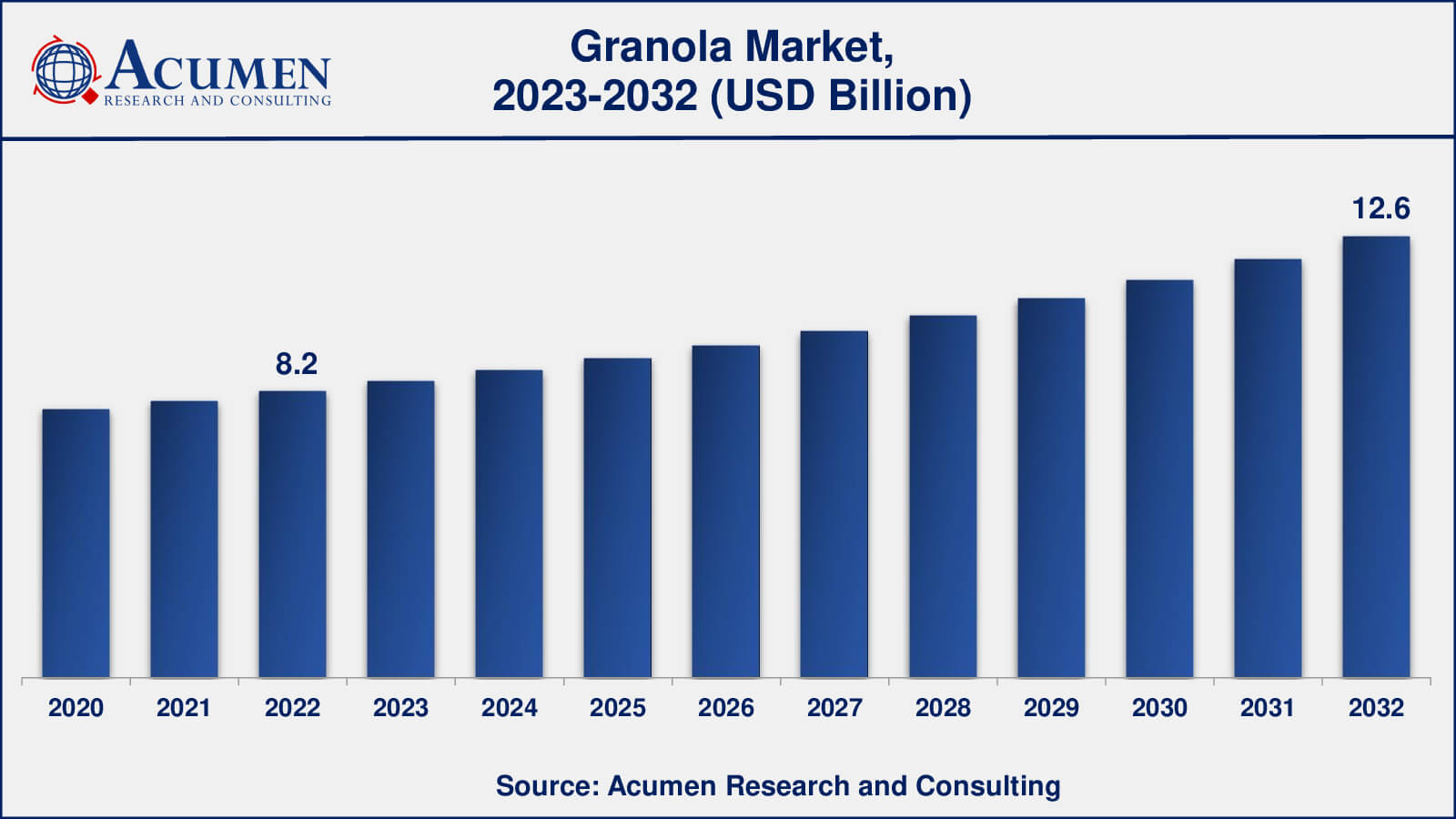

The global Granola Market size was valued at USD 8.2 Billion in 2022 and is projected to attain USD 12.6 Billion by 2032 mounting at a CAGR of 4.5% from 2023 to 2032.

Granola Market Highlights

- Global granola market revenue is poised to garner USD 12.6 billion by 2032 with a CAGR of 4.5% from 2023 to 2032

- North America granola market value occupied around USD 3.7 billion in 2022

- Asia-Pacific granola market growth will record a CAGR of more than 5% from 2023 to 2032

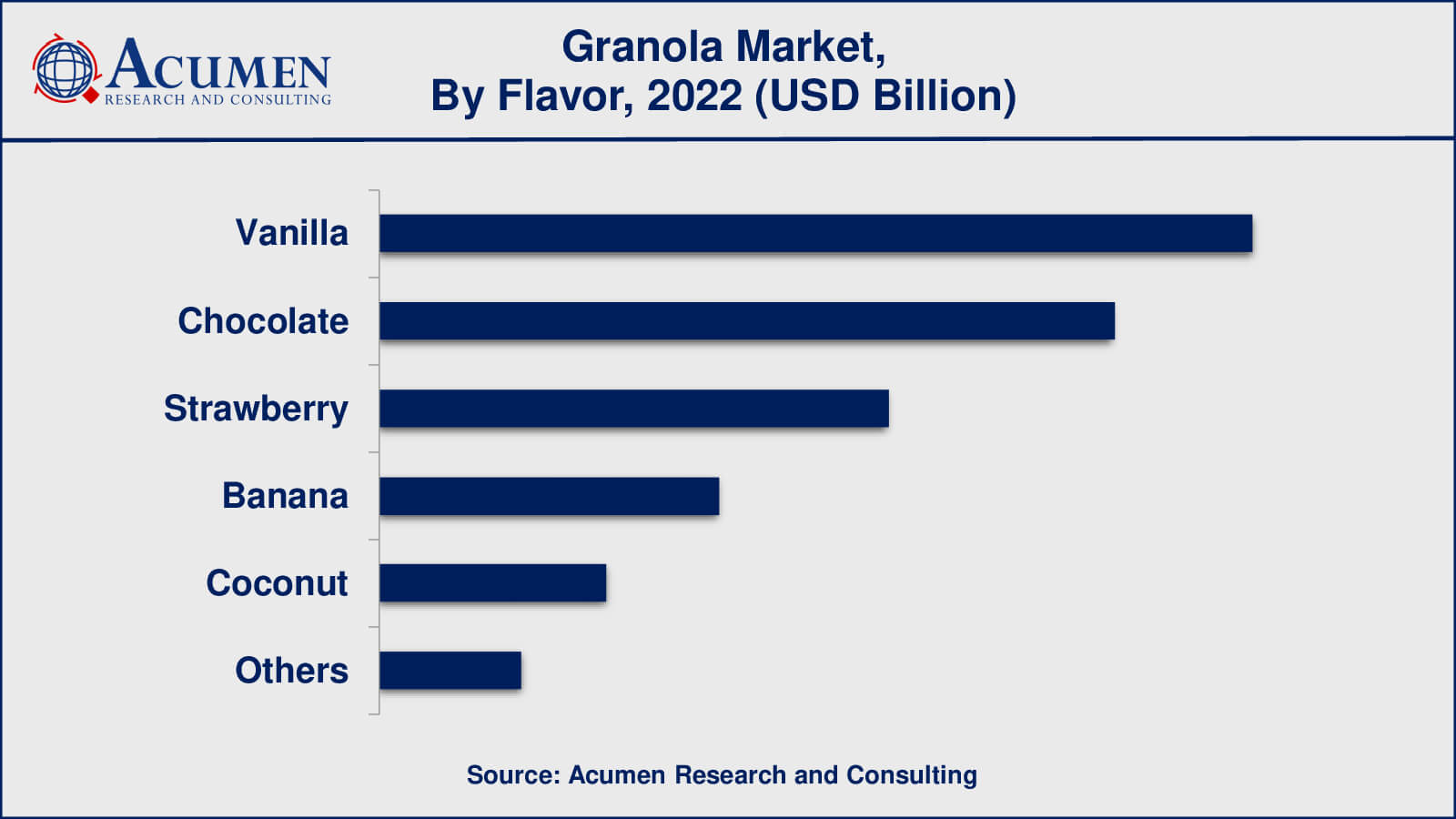

- Among flavors, the vanilla sub-segment occupied over US$ 2.5 million revenue in 2022

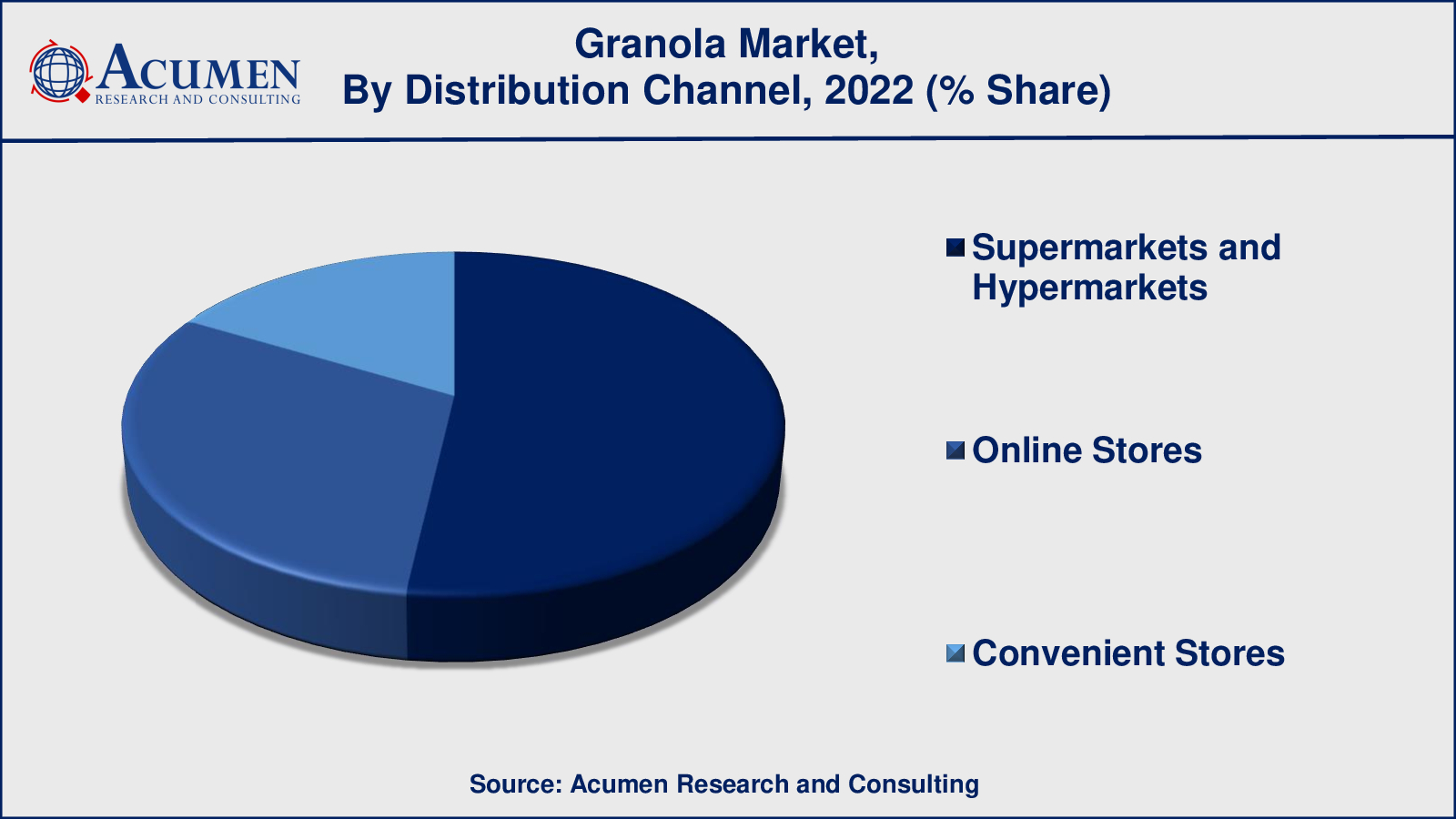

- Based on distribution channel, the supermarkets & hypermarkets sub-segment gathered around 52% share in 2022

- Collaborating with fitness centers, dietitians, or wellness influencers is a popular granola market trend that drives the industry demand

Granola is a popular and adaptable snack that is frequently connected with health and nutrition. It is often made with rolled oats, nuts, and seeds, sweeteners like as honey or maple syrup, and occasionally dried fruits. The ingredients are mixed together and cooked till crispy and golden brown. This produces a crispy and tasty combination that may be consumed in a variety of ways.

Granola's adaptability is one of its main draws. It may be eaten as a morning cereal with milk or yogurt, providing a balanced blend of carbs, protein, and healthy fats to get the day started. Granola may also be consumed on its own as a snack, giving a quick supply of energy and nutrients in between meals.

Granola's components frequently contribute to its impression as a healthier dietary alternative. Rolled oats, for example, are high in fiber and complex carbs, while nuts and seeds are high in protein and vital fats. Additionally, dried fruits may give natural sweetness as well as a variety of vitamins and minerals. Granola's nutritional composition has contributed to its popularity among those seeking healthful and nutritious meals.

Global Granola Market Dynamics

Market Drivers

- Growing consumer focus on healthy eating and nutritional benefits

- Increasing options for flavors, ingredients, and dietary preferences

- Online retail growth and e-commerce expansion

Market Restraints

- Nuts, gluten, and other allergens in granola

- High sugar levels in some granola products

- Premium positioning of some granola brands

- Competition with alternatives

Market Opportunities

- Incorporation of superfoods, probiotics, or adaptogens

- Eco-friendly packaging and sustainable sourcing

- Exploring international markets

Granola Market Report Coverage

| Market | Granola Market |

| Granola Market Size 2022 | USD 8.2 Billion |

| Granola Market Forecast 2032 | USD 12.6 Billion |

| Granola Market CAGR During 2023 - 2032 | 4.5% |

| Granola Market Analysis Period | 2020 - 2032 |

| Granola Market Base Year | 2022 |

| Granola Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Flavor, By Origin, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Clif Bar & Company, Conagra Brands, Inc., General Mills, Inc., Kellogg Company, Kraft Foods Group, Inc., Nestle S.A., Slim Fast Nutritional Food LLC, Sunny Crunch Foods Ltd., The Quaker Oats Company, Inc., and Standard Functional Foods Group, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Granola Market Insights

A dynamic interaction of many elements influences the granola market's growth, trends, and customer preferences. These dynamics reflect both the changing consumer landscape and the strategies used by industry firms.

The overall health and wellness trend is one of the driving causes behind the granola market's rise. Granola's perceived nutritional advantages connect nicely with customers' desire for nutritious and balanced meals as they grow more health-conscious. The granola's ingredient list, which includes oats, nuts, seeds, and dried fruits, appeals to these interests, promoting it as a simple and healthful option for individuals looking to enhance their nutritional choices.

Another important factor is the increase of snacking culture and the need for quick, on-the-go snacks. Granola's crunchy texture and variety of flavors make it an enticing snack option for people who lead busy lives. This corresponds to the current consumer's desire for portable, gratifying solutions that deliver consistent energy throughout the day. Granola's versatility, since it may be eaten as a cereal, blended with yogurt, or as a solo snack, contributes to its popularity across a variety of consumption situations.

However, the granola market confronts several hurdles. Concerns about allergens, notably nuts and gluten, may limit the market's expansion, since those with dietary restrictions or allergies may be unable to consume granola goods containing these ingredients. Moreover, the sugar level of various granola goods has sparked debate, raising concerns about the healthiness of specific selections. As a result, producers are looking for ways to minimize added sugars while retaining taste and appeal.

The competitive environment adds another degree of complication. Granola confronts competition not just from other health-focused items like breakfast bars and yogurt, but also from traditional meal options, as consumers seek out better snack and breakfast alternatives. For example, the popularity of granola bars has resulted in some overlap in consumer demands, with both goods focusing on convenience and nutrition.

Opportunities for innovation and growth exist within these dynamics. To cater to specific health goals, brands might integrate functional ingredients such as superfoods, probiotics, or adaptogens into their granola products. Granola makers may differentiate themselves through eco-friendly packaging and sourcing practices as the emphasis on sustainability grows. Furthermore, the globalization of markets allows granola to reach new groups with diverse taste preferences and cultural backgrounds.

Overall, the granola industry is distinguished by a careful balance between adapting to changing customer wants and tastes and addressing issues like as allergies and sugar levels. The granola market continues to change as both consumers and producers adjust to shifting trends and needs, providing new potential for growth and innovation in the health and wellness sector.

Granola Market Segmentation

The worldwide market for granola is split based on product type, flavor, origin, distribution channel, and geography.

Granola Product Types

- Bars

- Cereals

- Baked Goods

- Trail Mix

- Fruit Cups

As per the granola industry analysis, the two product categories that have traditionally dominated the granola market are granola bars and granola cereals. These two categories have continually retained a considerable portion of the market because of their appeal as handy and healthful alternatives for snacking and breakfast.

Granola bars, often known as snack bars or energy bars, are popular as on-the-go snacks or rapid energy sources. They combine the benefits of granola components in a compact and portable shape, making them popular among busy people looking for a balanced and fulfilling snack alternative. Granola bars are available in a variety of flavors and compositions to suit a wide range of tastes and nutritional requirements.

Granola cereals, on the other hand, are a popular choice for breakfast. They go well with milk or yogurt and provide a nutritious start to the day. Granola cereals have a delightful crunch as well as a combination of fibre, protein, and healthy fats, which contributes to their popularity among health-conscious customers searching for a full and delicious breakfast.

Granola Flavors

- Vanilla

- Chocolate

- Strawberry

- Banana

- Coconut

- Others

Vanilla and chocolate have been prominent flavors. These two basic flavors are popular across a wide spectrum of customers and are frequently used as the foundation for numerous granola variants. Vanilla-flavored granola is popular due to its versatility and mild flavor. It goes well with a variety of fruits, nuts, and seeds, making it a popular breakfast and snacking option. Vanilla's delicate sweetness may compliment a variety of toppings and mix-ins, making it appealing to a wide range of consumers.

Chocolate-flavored granola is very popular, especially among consumers who appreciate the mix of chocolaty taste and the health advantages of granola's components. Chocolate-flavored granola may deliver a delightful treat-like experience while also being considered as a healthy choice.

Granola Origins

- Conventional

- Organic

According to the granola market forecast, organic granola has grown in popularity as consumers seek healthier and more sustainable food alternatives. Organic granola is becoming more popular as people seek goods created with ingredients farmed without the use of synthetic pesticides, herbicides, or genetically modified organisms (GMOs). The organic label appeals to health-conscious consumers who value natural and ecologically friendly options. Organic granola is consistent with the larger push towards healthy eating and sustainable consumption.

Conventional granola has a long history in the market and is created with ingredients that may contain conventionally cultivated crops and non-organic components. When compared to organic alternatives, it is frequently a more cost-effective option. Some customers may value flavor and price more than organic certification.

Granola Distribution Channels

- Supermarkets and Hypermarkets

- Online Stores

- Convenient Stores

According to the granola market analysis, supermarkets and hypermarkets have traditionally been the primary distribution channels for granola products. These enormous retail establishments provide a wide variety of food goods, including granola, and are therefore widely accessible to a wide spectrum of consumers.

Supermarkets and hypermarkets offer a one-stop shopping experience for customers, offering a varied assortment of products, including granola in a variety of brands and flavors. In recent years, there has been an increase in online shopping, including e-commerce platforms. Because of the ease of home delivery and the opportunity to readily compare items and pricing, consumers are increasingly turning to online businesses to acquire granola and other food products.

Furthermore, convenience shops provide a convenient choice for on-the-go snacking, which matches well with the portable and snackable character of granola goods. While convenience shops may not be as dominant as supermarkets in terms of market share, they do service a unique customer demand and contribute to the distribution environment.

Granola Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Granola Market Regional Analysis

North America, including the United States and Canada, has historically been a major market for granola. Granola has grown in popularity as a handy and healthy snack or breakfast alternative as a result of the health and wellness movement, as well as a busy lifestyle. Granola bars and cereals are popular, and the market provides a broad variety of flavors and formulas to accommodate a wide range of dietary preferences.

European countries have also embraced the granola trend, with a growing demand for healthier snacking options. Organic granola has grown in popularity as a result of the organic and natural food movements, and customers are increasingly looking for whole grain and low-sugar choices. Granola's adaptability allows it to be paired with yogurt, which is a popular breakfast option in many European nations.

The Asia-Pacific granola market is expanding as urbanization, changing eating patterns, and increased health consciousness drive demand for quick and nutritious snacks. Unique flavors and textures are popular in nations like as Japan and South Korea, which might lead to the creation of new granola variations.

Granola Market Players

Some of the top Granola companies offered in our report includes Clif Bar & Company, Conagra Brands, Inc., General Mills, Inc., Kellogg Company, Kraft Foods Group, Inc., Nestle S.A., Slim Fast Nutritional Food LLC, Sunny Crunch Foods Ltd., The Quaker Oats Company, Inc., and Standard Functional Foods Group, Inc.

Frequently Asked Questions

What was the size of the global granola market in 2022?

The size of granola market was USD 8.2 billion in 2022.

What is the granola market CAGR from 2023 to 2032?

The granola market CAGR during the analysis period of 2023 to 2032 is 4.5%.

Which are the key players in the granola market?

The key players operating in the global granola market are Clif Bar & Company, Conagra Brands, Inc., General Mills, Inc., Kellogg Company, Kraft Foods Group, Inc., Nestle S.A., Slim Fast Nutritional Food LLC, Sunny Crunch Foods Ltd., The Quaker Oats Company, Inc., and Standard Functional Foods Group, Inc.

Which region dominated the global granola market share?

North America region held the dominating position in granola industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of granola during the analysis period of 2023 to 2032.

What are the current trends in the global granola industry?

The current trends and dynamics in the granola industry include growing consumer focus on healthy eating and nutritional benefits, increasing options for flavors, ingredients, and dietary preferences, and online retail growth and e-commerce expansion.

Which type held the maximum share in 2022?

The bars type held the maximum share of the granola industry.?