Glycerol Monostearate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Glycerol Monostearate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

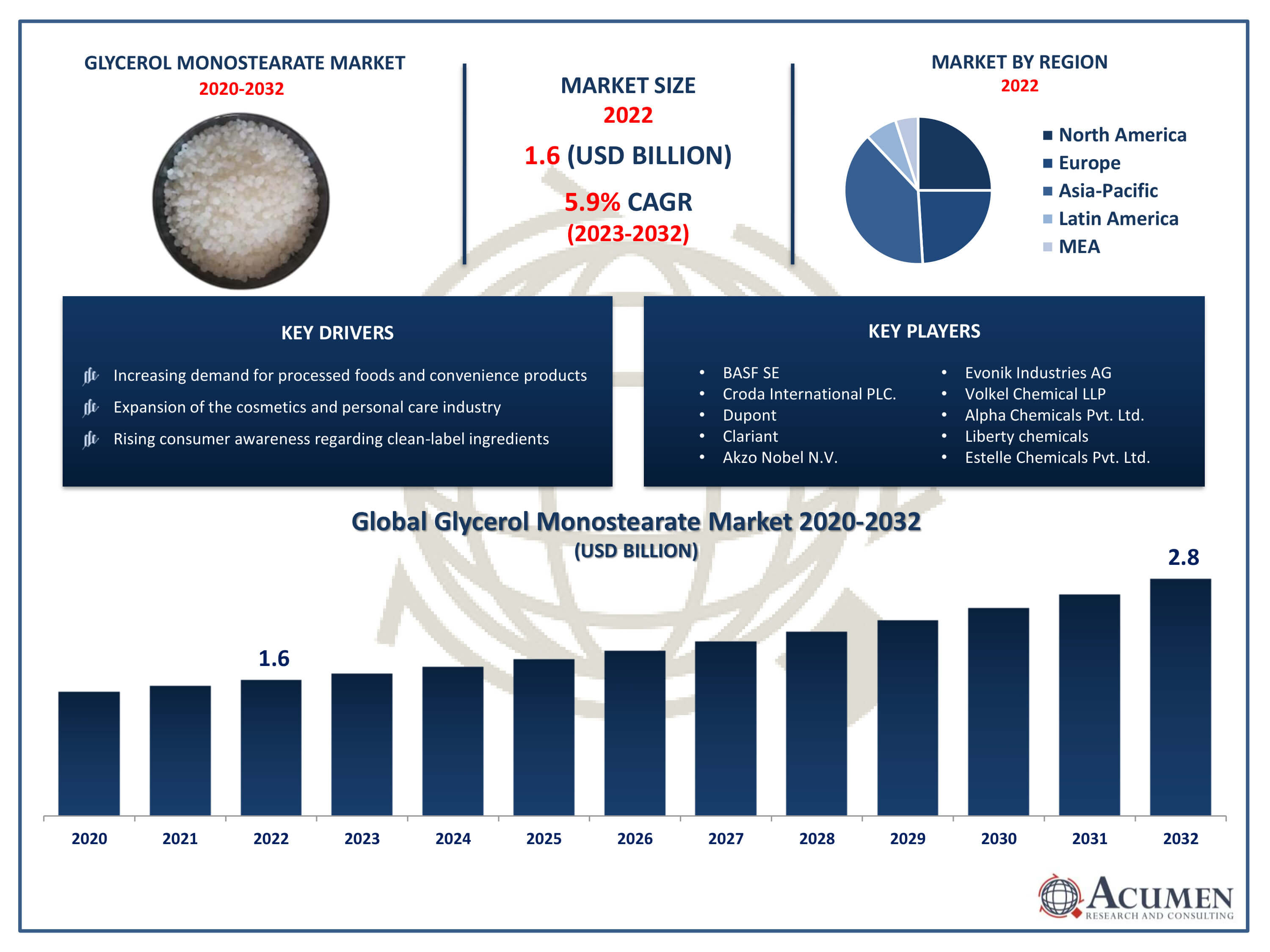

The Glycerol Monostearate Market Size accounted for USD 1.6 Billion in 2022 and is projected to achieve a market size of USD 2.8 Billion by 2032 growing at a CAGR of 5.9% from 2023 to 2032.

Glycerol Monostearate Market Highlights

- Global glycerol monostearate market revenue is expected to increase by USD 2.8 Billion by 2032, with a 5.9% CAGR from 2023 to 2032

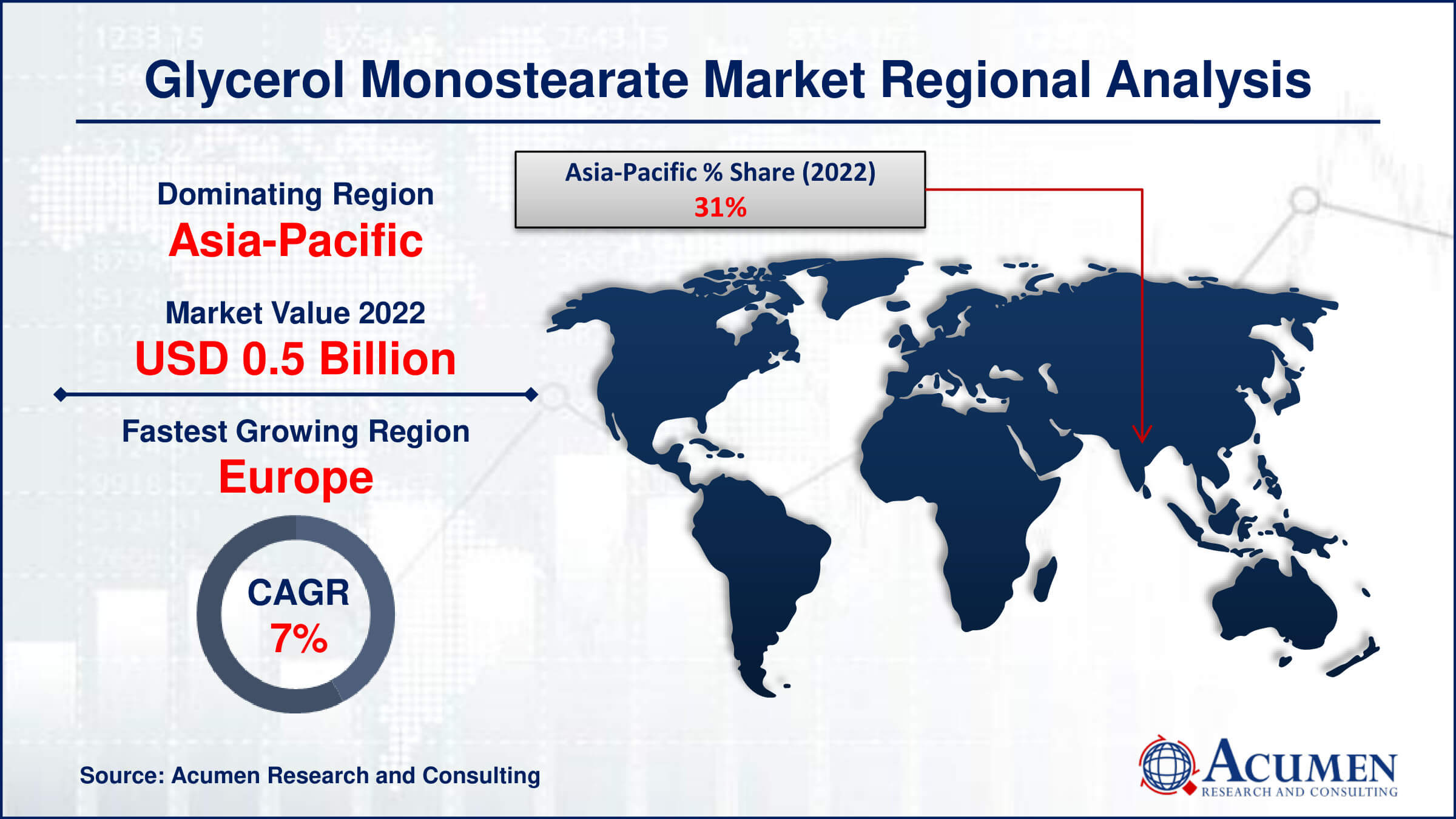

- Asia-Pacific region led with more than 31% of glycerol monostearate market share in 2022

- Europe glycerol monostearate market growth will record a CAGR of more than 6.6% from 2023 to 2032

- By application, the emulsifier segment captured more than 41% of revenue share in 2022.

- By end-use, the food & beverages segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for processed foods and convenience products, drives the glycerol monostearate market value

Glycerol monostearate (GMS) is a compound commonly used as an emulsifier, thickening agent, and stabilizer in various industries, including food, pharmaceuticals, and cosmetics. It is derived from natural fats, typically from vegetable oils or animal fats. GMS is produced by the esterification of glycerol with stearic acid, resulting in a versatile compound with diverse applications.

In the food industry, glycerol monostearate is widely employed as an emulsifier in baked goods, dairy products, confectionery, and processed foods to improve texture, consistency, and shelf life. Additionally, it is utilized as a thickening agent in ice creams and whipped toppings. In pharmaceuticals, GMS serves as an excipient in formulations to enhance the stability and dispersibility of active ingredients in medications. Moreover, GMS finds applications in cosmetics and personal care products, acting as an emollient and emulsifier in creams, lotions, and makeup items. The market for glycerol monostearate has witnessed steady growth over the past few years, driven by the increasing demand for processed foods, convenience products, and pharmaceutical formulations.

Global Glycerol Monostearate Market Trends

Market Drivers

- Increasing demand for processed foods and convenience products

- Growing adoption of glycerol monostearate as a natural emulsifier and stabilizer

- Expansion of the cosmetics and personal care industry

- Rising consumer awareness regarding clean-label ingredients

- Technological advancements enhancing the functionality of glycerol monostearate

Market Restraints

- Regulatory scrutiny on the safety and usage levels of food additives

- Fluctuating prices of raw materials such as vegetable oils

Market Opportunities

- Development of innovative formulations for specialty food and pharmaceutical applications

- Penetration into emerging markets with growing food and personal care industries

Glycerol Monostearate Market Report Coverage

| Market | Glycerol Monostearate Market |

| Glycerol Monostearate Market Size 2022 | USD 1.6 Billion |

| Glycerol Monostearate Market Forecast 2032 |

USD 2.8 Billion |

| Glycerol Monostearate Market CAGR During 2023 - 2032 | 5.9% |

| Glycerol Monostearate Market Analysis Period | 2020 - 2032 |

| Glycerol Monostearate Market Base Year |

2022 |

| Glycerol Monostearate Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Purity, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Croda International PLC., Dupont, Clariant, Akzo Nobel N.V., Evonik Industries AG, Volkel Chemical LLP, ACM chemicals, Alpha Chemicals Pvt. Ltd., Liberty chemicals, Estelle Chemicals Pvt. Ltd., and A. Schulman Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Glycerol monostearate (GMS) is a compound widely used across various industries, including food, pharmaceuticals, and cosmetics. It is a fatty acid ester derived from natural sources such as vegetable oils or animal fats. GMS is produced through the esterification of glycerol with stearic acid, resulting in a versatile compound with unique properties. One of its primary functions is as an emulsifier, aiding in the formation and stabilization of emulsions by reducing the surface tension between two immiscible phases, such as oil and water. In the food industry, glycerol monostearate serves multiple purposes. It acts as an emulsifier in baked goods, dairy products, confectionery, and processed foods, improving texture, consistency, and shelf life. Additionally, GMS is utilized as a thickening agent in ice creams, whipped toppings, and other desserts. In pharmaceutical formulations, glycerol monostearate functions as an excipient, enhancing the stability and dispersibility of active ingredients in medications.

The market for glycerol monostearate (GMS) has been experiencing robust growth over the past few years and is expected to continue expanding steadily. GMS serves as a key ingredient in various industries, including food, pharmaceuticals, and cosmetics, due to its versatility as an emulsifier, thickening agent, and stabilizer. The increasing demand for processed foods, convenience products, and pharmaceutical formulations has been a significant driver for the growth of the GMS market. As consumers seek products with improved texture, stability, and shelf life, manufacturers are turning to GMS to meet these demands effectively. Moreover, the rising consumer awareness regarding clean-label and natural ingredients has fueled the adoption of GMS derived from vegetable sources, further boosting market growth. Manufacturers are also investing in research and development to enhance the functionality of glycerol monostearate and develop innovative formulations for specialty food and pharmaceutical applications. Additionally, the expansion of the cosmetics and personal care industry, particularly in emerging markets, presents lucrative opportunities for GMS manufacturers to diversify their product portfolios and penetrate new market segments.

Glycerol Monostearate Market Segmentation

The global glycerol monostearate market segmentation is based on purity, application, end-use, and geography.

Glycerol Monostearate Market By Purity

- <90%

- >90%

According to the glycerol monostearate industry analysis, the <90% segment accounted for the largest market share in 2022. One significant driver is the burgeoning demand for clean-label and natural ingredients across various industries, including food, pharmaceuticals, and cosmetics. As consumers become increasingly conscious of the ingredients in the products they consume and use, there has been a notable shift towards GMS derived from vegetable sources, which has fueled segment growth substantially. This preference for natural emulsifiers and stabilizers has propelled manufacturers to innovate and develop new formulations to meet the evolving needs of consumers. Furthermore, the rapid expansion of the processed food industry globally has contributed significantly to the remarkable segment growth in the glycerol monostearate market. With the growing demand for convenience foods, baked goods, dairy products, and confectionery items, manufacturers are increasingly incorporating GMS into their formulations to enhance texture, consistency, and shelf life.

Glycerol Monostearate Market By Application

- Emulsifier

- Preservative

- Thickener

- Others

In terms of applications, the emulsifier segment is expected to witness significant growth in the coming years. This surge can be attributed to several key factors driving the demand for emulsifiers in various industries. One significant factor is the rising consumer preference for processed foods, bakery products, and convenience items, which necessitate stable emulsions for optimal texture and shelf life. GMS, with its emulsifying properties, has emerged as a preferred choice for manufacturers seeking to enhance the quality and appeal of their products. Moreover, the growing awareness among consumers about the health and environmental implications of synthetic additives has prompted the food industry to seek natural alternatives like GMS. Derived from vegetable sources, GMS aligns with clean-label trends, contributing to its rapid adoption as an emulsifier. Additionally, the pharmaceutical and cosmetic sectors have also witnessed a surge in demand for emulsifiers like GMS, driven by the need for stable formulations and improved product efficacy.

Glycerol Monostearate Market By End-use

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

According to the glycerol monostearate market forecast, the food & beverages segment is expected to witness significant growth in the coming years. One primary driver is the increasing consumption of processed foods and convenience items worldwide. GMS is widely utilized in this sector as an emulsifier, stabilizer, and thickening agent to improve texture, consistency, and shelf life. Its versatility and effectiveness in enhancing product quality have made it a staple ingredient in a wide range of food and beverage products, including baked goods, dairy items, confectionery, and ready-to-eat meals. Moreover, the rising demand for clean-label and natural ingredients has further propelled the growth of GMS in the food and beverages segment. Consumers are increasingly seeking products with recognizable and natural ingredients, prompting manufacturers to replace synthetic additives with natural alternatives like GMS derived from vegetable sources. This trend aligns with the industry's efforts to cater to health-conscious consumers and meet regulatory standards for food safety and ingredient transparency.

Glycerol Monostearate Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Glycerol Monostearate Market Regional Analysis

The Asia-Pacific region has emerged as the dominating force in the glycerol monostearate (GMS) market, owing to several factors contributing to its rapid growth and expansion. One key driver is the region's burgeoning population, coupled with increasing urbanization and rising disposable incomes. This demographic shift has led to a surge in demand for processed foods, cosmetics, and pharmaceuticals, all of which are major end-users of GMS. As a result, manufacturers in the Asia-Pacific region are ramping up production to meet the escalating demand, thereby driving market growth. Furthermore, the region's robust manufacturing capabilities and competitive production costs have positioned it as a preferred destination for GMS production. Countries like China, India, and Indonesia boast significant manufacturing capacities for GMS, supported by a well-established supply chain and infrastructure. Additionally, the presence of a large number of multinational corporations and local players in the food, pharmaceutical, and cosmetics industries further stimulates market growth in the Asia-Pacific region. These companies leverage the region's favorable business environment, skilled workforce, and strategic partnerships to expand their presence and capture market share in the glycerol monostearate market.

Glycerol Monostearate Market Player

Some of the top glycerol monostearate market companies offered in the professional report include BASF SE, Croda International PLC., Dupont, Clariant, Akzo Nobel N.V., Evonik Industries AG, Volkel Chemical LLP, ACM chemicals, Alpha Chemicals Pvt. Ltd., Liberty chemicals, Estelle Chemicals Pvt. Ltd., and A. Schulman Inc.

Frequently Asked Questions

How big is the glycerol monostearate market?

The glycerol monostearate market size was USD 1.6Billionin 2022.

What is the CAGR of the global glycerol monostearate market from 2023 to 2032?

The CAGR of glycerol monostearate is 5.9%during the analysis period of 2023 to 2032.

Which are the key players in the glycerol monostearate market?

The key players operating in the global market are including BASF SE, Croda International PLC., Dupont, Clariant, Akzo Nobel N.V., Evonik Industries AG, Volkel Chemical LLP, ACM chemicals, Alpha Chemicals Pvt. Ltd., Liberty chemicals, Estelle Chemicals Pvt. Ltd., and A. Schulman Inc.

Which region dominated the global glycerol monostearate market share?

Asia-Pacific held the dominating position in glycerol monostearate industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of glycerol monostearate during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global glycerol monostearate industry?

The current trends and dynamics in the glycerol monostearate industry include increasing demand for processed foods and convenience products, growing adoption of glycerol monostearate as a natural emulsifier and stabilizer, and expansion of the cosmetics and personal care industry.

Which application held the maximum share in 2022?

The emulsifier application held the maximum share of the glycerol monostearate industry.