Synthetic Pyridine Market | Acumen Research and Consulting

Synthetic Pyridine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

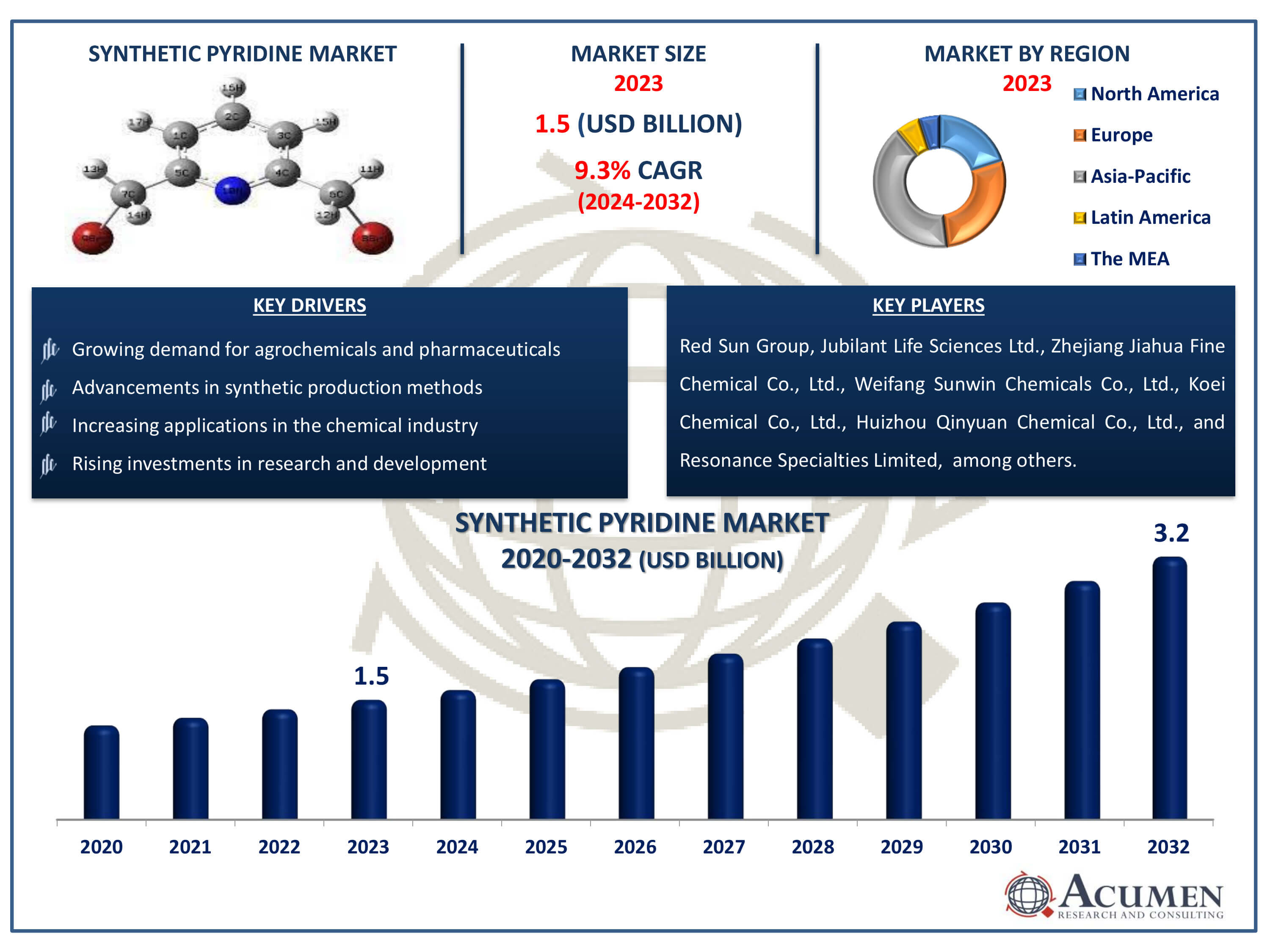

The Synthetic Pyridine Market Size accounted for USD 1.5 Billion in 2023 and is estimated to achieve a market size of USD 3.2 Billion by 2032 growing at a CAGR of 9.3% from 2024 to 2032.

Synthetic Pyridine Market Highlights

- Global synthetic pyridine market revenue is poised to garner USD 3.2 billion by 2032 with a CAGR of 9.3% from 2024 to 2032

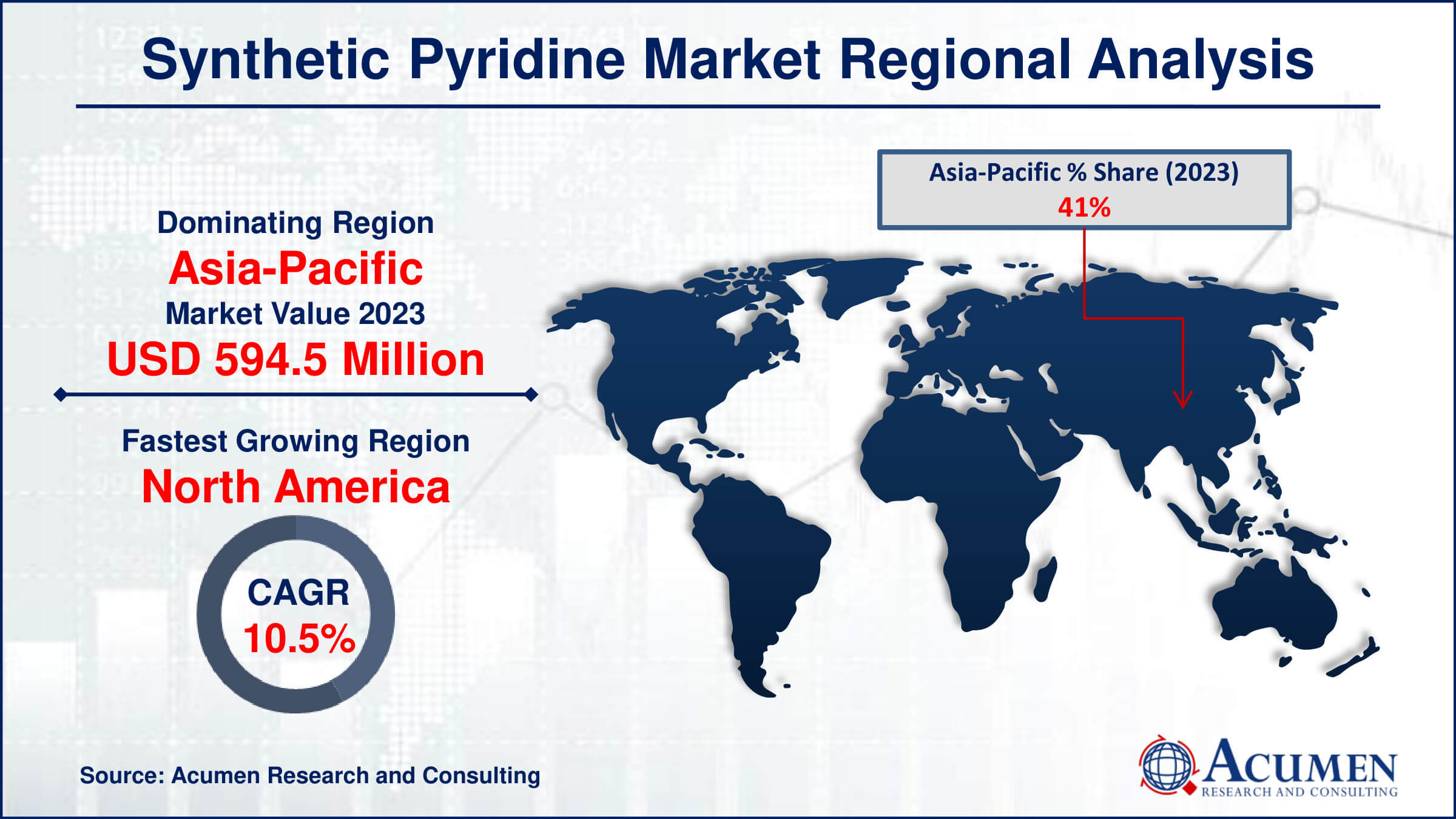

- Asia-Pacific synthetic pyridine market value occupied around USD 594.5 million in 2023

- North America synthetic pyridine market growth will record a CAGR of more than 10.5% from 2024 to 2032

- Among type, the pyridine N-oxide sub-segment generated around USD 580 million revenue in 2023

- Based on application, the agrochemicals sub-segment generated significant synthetic pyridine market share in 2023

- Potential for new applications in material sciences is a popular synthetic pyridine market trend that fuels the industry demand

Pyridine is a hazardous, flammable liquid base with a distinct, pungent odor. It is regarded as one of the parent compounds of a variety of naturally occurring organic molecules. Pyridine is a useful precursor in the manufacture of agrochemicals and medicines. Previously, pyridine was made from coal tar as a byproduct of coal gasification, which was both expensive and inefficient because coal tar only contained 0.1-0.2% pyridine after extraction. Currently, synthetic pyridine is manufactured using a variety of techniques, including Chichibabin synthesis, Bonnemann cyclization, and cobalt-catalyzed alkyne-nitrile cyclotrimerization. These contemporary approaches have increased efficiency and decreased the cost of pyridine synthesis.

Global Synthetic Pyridine Market Dynamics

Market Drivers

- Growing demand for agrochemicals and pharmaceuticals

- Advancements in synthetic production methods

- Increasing applications in the chemical industry

- Rising investments in research and development

Market Restraints

- High toxicity and environmental concerns

- Stringent regulatory requirements

- Volatility in raw material prices

Market Opportunities

- Expansion in emerging markets

- Development of eco-friendly synthesis methods

- Increasing use in biotechnological applications

Synthetic Pyridine Market Report Coverage

| Market | Synthetic Pyridine Market |

| Synthetic Pyridine Market Size 2022 | USD 1.5 Billion |

| Synthetic Pyridine Market Forecast 2032 | USD 3.2 Billion |

| Synthetic Pyridine Market CAGR During 2023 - 2032 | 9.3% |

| Synthetic Pyridine Market Analysis Period | 2020 - 2032 |

| Synthetic Pyridine Market Base Year |

2022 |

| Synthetic Pyridine Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Red Sun Group, Jubilant Life Sciences Ltd., Zhejiang Jiahua Fine Chemical Co., Ltd., Weifang Sunwin Chemicals Co., Ltd., Koei Chemical Co., Ltd., Huizhou Qinyuan Chemical Co., Ltd., Resonance Specialties Limited, Lonza Group Ltd., Shandong Luba Chemical Co., Ltd., and Vertellus Specialties Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Synthetic Pyridine Market Insights

The synthetic pyridine industry is expanding rapidly due to increased demand from many sectors, particularly pharmaceuticals and agrochemicals. Pyridine's versatility and effectiveness as a chemical precursor make it extremely valuable in many areas. In the pharmaceutical industry, pyridine derivatives play an important role in the synthesis of active pharmaceutical ingredients (APIs), which are required to manufacture a wide range of drugs. This need is fueled by the ongoing discovery of new pharmaceuticals and the rising worldwide population that requires medical treatment. Pyridine derivatives are important in the agrochemical sector because they help to create effective insecticides and herbicides. As the world's population grows, so does the need for improved agricultural output, increasing demand for agrochemicals. Pyridine-based chemicals are known for their ability to protect crops from pests and diseases, resulting in increased yields and food security.

Moreover, the food and beverage sector uses pyridine derivatives as flavoring agents to improve the taste and scent of a variety of products. This use is especially important in the manufacturing of processed and packaged goods, where consistent and appealing flavors are critical to consumer satisfaction. The market is also seeing major advances in research and development targeted at increasing the chemical characteristics of pyridine. Companies are investing in novel synthesis methods to create pyridine derivatives with increased functionality. These developments not only increase manufacturing efficiency and cost-effectiveness, but they also offer up new opportunities for the use of pyridine in a variety of industries. In addition, regulatory frameworks controlling the use of pyridine are changing, with an emphasis on environmental sustainability and safety. Companies are progressively implementing greener and more sustainable production processes in order to comply with these rules, which are projected to further impact market dynamics.

Synthetic Pyridine Market Segmentation

The worldwide market for synthetic pyridine is split based on type, application, and geography.

Synthetic Pyridine Types

- Pyridine N-oxide

- Alpha Picoline

- Beta Picoline

- Gamma Picoline

- 2-Methyl-5-Ethylpyridine (MEP)

According to synthetic pyridine industry analysis, pyridine N-oxide is by far the most common form of industry. Pyridine N-oxide is widely used in various industrial applications due to its unique chemical characteristics and adaptability. It is a necessary intermediary in the synthesis of medicines, agrochemicals, and specialty chemicals. Pyridine N-oxide derivatives are used in the pharmaceutical industry to produce antibiotics and antiviral drugs, which contribute considerably to the healthcare sector.

Furthermore, Pyridine N-oxide is widely used in agrochemicals, particularly as an active ingredient in herbicides and fungicides. Its effectiveness in crop protection boosts agricultural output and contributes to global food security efforts. This product is also used to make dyes, pigments, and other specialty compounds, which broadens its market reach. Pyridine N-oxide is in high demand due to continued advances in chemical synthesis processes and expanding uses across a wide range of industries. As firms continue to innovate and optimize manufacturing processes, the Pyridine N-oxide sector is likely to maintain its dominant position in the synthetic pyridine market, efficiently addressing the changing needs of worldwide markets.

Synthetic Pyridine Applications

- Agrochemicals

- Pharmaceuticals

- Chemicals

- Food

- Others (Dyestuffs, Alcohol)

The agrochemicals industry is expected to be the major application area for synthetic pyridine. Pyridine and its derivatives play key roles in the production of herbicides, insecticides, fungicides, and other crop protection agents. The growing world population needs increased agricultural output, driving up demand for effective agrochemicals. Pyridine compounds are recommended due to their better pest control properties and function in increasing crop yields.

The quest for sustainable farming techniques and the development of environmentally friendly agrochemicals is driving up demand for synthetic pyridine in this sector. Companies are investing significant efforts in R&D to improve the efficacy and environmental safety of pyridine-based agrochemicals. These advances produce innovative products that meet stringent regulatory criteria while also catering to the changing needs of modern agriculture. As the agrochemical sector grows, driven by the need for effective crop protection solutions, the agrochemicals segment's dominance in the synthetic pyridine market is expected to continue, emphasizing its critical role in ensuring food security and sustainable agricultural practices.

Synthetic Pyridine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Synthetic Pyridine Market Regional Analysis

In terms of synthetic pyridine market analysis, Asia-Pacific dominates the global synthetic pyridine market, owing to the region's strong agriculture and pharmaceutical industries. Countries such as China and India contribute significantly to this domination due to their extensive agricultural activities and expanding pharmaceutical manufacturing capacities. These countries' significant need for agrochemicals and medicines is driven by their big populations and growing food security and healthcare demands. Furthermore, the presence of various chemical manufacturing businesses in the region increases the availability and output of synthetic pyridine, bolstering Asia-Pacific's market leadership.

In contrast, North America has been highlighted as the fastest-growing region during the synthetic pyridine market forecast period. This region's rise is mostly due to the advanced pharmaceutical industry and the increased use of sustainable agriculture practices. The United States, in particular, is making major efforts in R&D to improve the synthesis and application of pyridine and its derivatives. Furthermore, rigorous environmental regulations are encouraging companies to produce more environmentally friendly pyridine-based agrochemicals, which will promote market growth. The growing emphasis on new and high-quality agricultural and pharmaceutical products is likely to drive up demand for synthetic pyridine in North America rapidly.

Synthetic Pyridine Market Players

Some of the top synthetic pyridine companies offered in our report includes Red Sun Group, Jubilant Life Sciences Ltd., Zhejiang Jiahua Fine Chemical Co., Ltd., Weifang Sunwin Chemicals Co., Ltd., Koei Chemical Co., Ltd., Huizhou Qinyuan Chemical Co., Ltd., Resonance Specialties Limited, Lonza Group Ltd., Shandong Luba Chemical Co., Ltd., and Vertellus Specialties Inc.

Frequently Asked Questions

How big is the synthetic pyridine market?

The synthetic pyridine market size was valued at USD 1.5 billion in 2023.

What is the CAGR of the global synthetic pyridine market from 2024 to 2032?

The CAGR of synthetic pyridine is 9.3% during the analysis period of 2024 to 2032.

Which are the key players in the synthetic pyridine market?

The key players operating in the global market are including Red Sun Group, Jubilant Life Sciences Ltd., Zhejiang Jiahua Fine Chemical Co., Ltd., Weifang Sunwin Chemicals Co., Ltd., Koei Chemical Co., Ltd., Huizhou Qinyuan Chemical Co., Ltd., Resonance Specialties Limited, Lonza Group Ltd., Shandong Luba Chemical Co., Ltd., and Vertellus Specialties Inc.

Which region dominated the global synthetic pyridine market share?

Asia-Pacific held the dominating position in synthetic pyridine industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of synthetic pyridine during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global synthetic pyridine industry?

The current trends and dynamics in the synthetic pyridine industry include growing demand for agrochemicals and pharmaceuticals, advancements in synthetic production methods, increasing applications in the chemical industry, and rising investments in research and development.

Which type held the maximum share in 2023?

The pyridine N-oxide type held the maximum share of the synthetic pyridine industry.