Agrochemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Agrochemicals Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

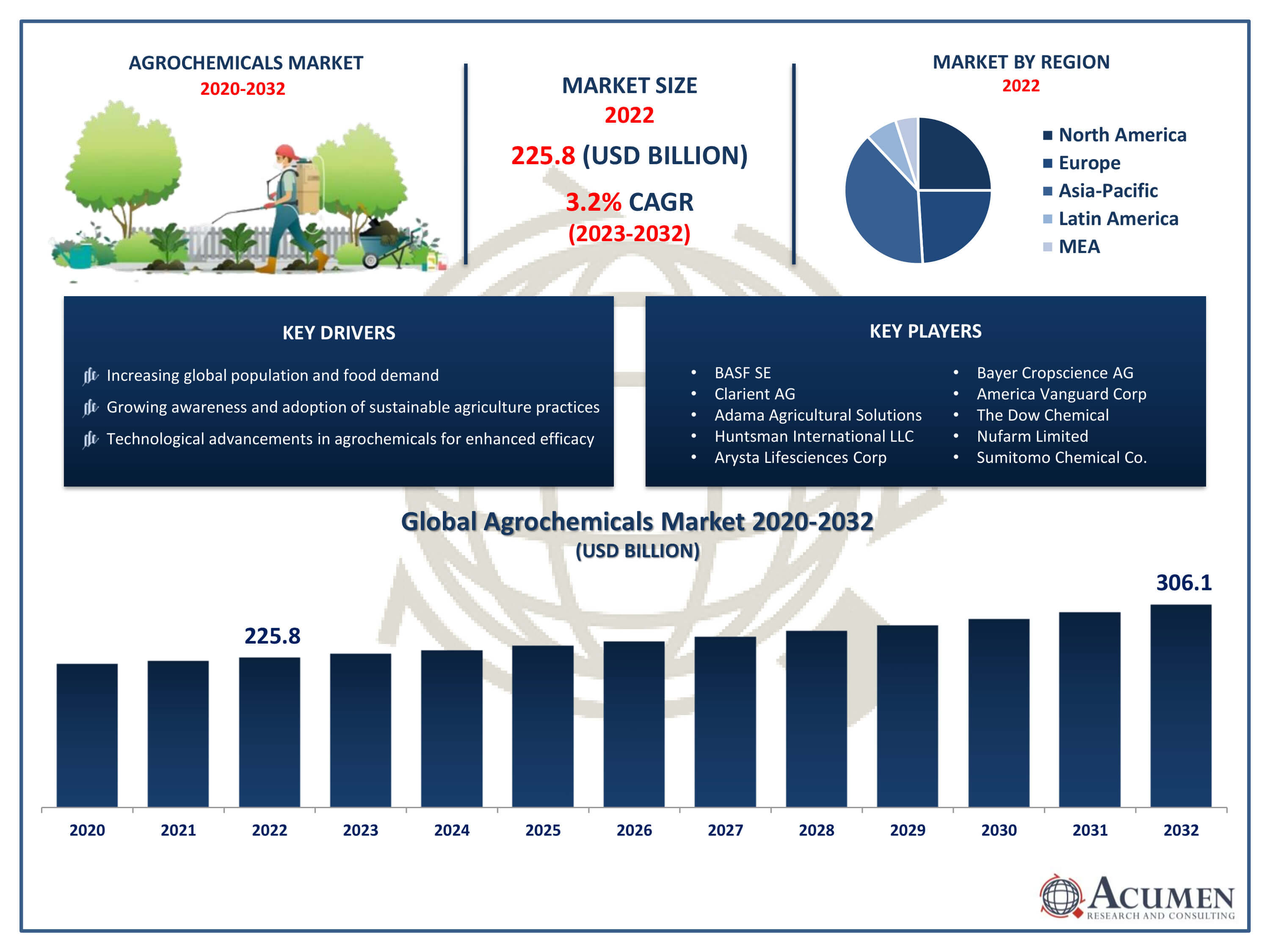

The Agrochemicals Market Size accounted for USD 225.8 Billion in 2022 and is projected to achieve a market size of USD 306.1 Billion by 2032 growing at a CAGR of 3.2% from 2023 to 2032.

Agrochemicals Market Highlights

- Global agrochemicals market revenue is expected to increase by USD 306.1 billion by 2032, with a 3.2% CAGR from 2023 to 2032

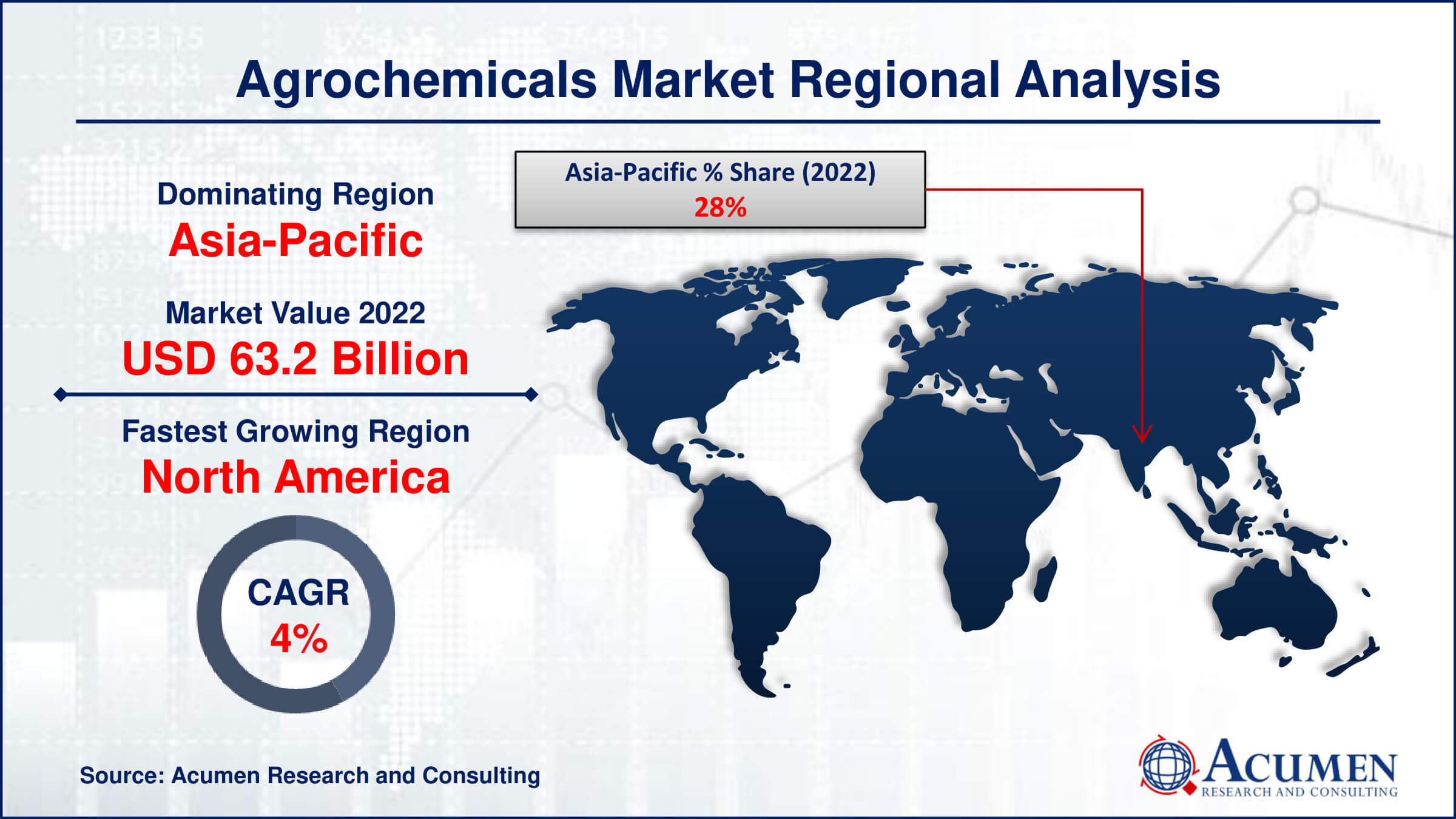

- Asia-Pacific region led with more than 28% of agrochemicals market share in 2022

- North America agrochemicals market growth will record a CAGR of more than 3.5% from 2023 to 2032

- By product, the fertilizers are the largest segment of the market, accounting for over 65% of the global market share

- By application, the cereals & grains are one of the largest and fastest-growing segments of the agrochemicals industry

- Increasing global population and food demand, drives the agrochemicals market value

Agrochemicals refer to a broad category of chemical products used in agriculture to enhance crop productivity and protect plants from pests, diseases, and weeds. This category encompasses fertilizers, pesticides, herbicides, fungicides, and other chemical substances essential for modern agricultural practices. Agrochemicals play a crucial role in ensuring food security and meeting the increasing global demand for agricultural products.

Agrochemicals refer to a broad category of chemical products used in agriculture to enhance crop productivity and protect plants from pests, diseases, and weeds. This category encompasses fertilizers, pesticides, herbicides, fungicides, and other chemical substances essential for modern agricultural practices. Agrochemicals play a crucial role in ensuring food security and meeting the increasing global demand for agricultural products.

The market for agrochemicals has experienced significant growth over the past few decades, driven by several factors including population growth, the expansion of agricultural lands, and advancements in farming technologies. For example, farmers can utilize drones equipped with sensors to monitor plant growth, detect disease stress, keep track of field temperature, and precisely spray pesticides or fertilizers at targeted locations in the field. Additionally, the growing need for higher crop yields to feed the burgeoning population has led to increased adoption of agrochemicals by farmers worldwide. Emerging economies, particularly in Asia and Africa, have become key markets for agrochemicals as agricultural practices evolve and modernize in these regions. For instance, according to the Asian Development Outlook (ADO) December 2023, the regional economy is now expected to grow by 4.9% in 2023, an increase from the previous forecast of 4.7% made in September.

Global Agrochemicals Market Trends

Market Drivers

- Increasing global population and food demand

- Expansion of agricultural lands and adoption of modern farming practices

- Technological advancements in agrochemicals for enhanced efficacy

- Rising disposable incomes in emerging economies, driving demand for higher quality crops

- Growing awareness and adoption of sustainable agriculture practices

Market Restraints

- Regulatory pressures and concerns regarding environmental and health impacts

- Resistance development in pests and weeds against conventional agrochemicals

Market Opportunities

- Development of novel formulations and biotechnological solutions

- Integration of digital technologies for precision agriculture

Agrochemicals Market Report Coverage

| Market | Agrochemicals Market |

| Agrochemicals Market Size 2022 | USD 225.8 Billion |

| Agrochemicals Market Forecast 2032 | USD 306.1 Billion |

| Agrochemicals Market CAGR During 2023 - 2032 | 3.2% |

| Agrochemicals Market Analysis Period | 2020 - 2032 |

| Agrochemicals Market Base Year |

2022 |

| Agrochemicals Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Clarient AG, Adama Agricultural Solutions Ltd., Huntsman International LLC, Arysta Lifesciences Corporation, Bayer Cropscience AG, America Vanguard Corporation, The Dow Chemical, Nufarm Limited, Jiangsu Yangnong Chemical Group Co. Ltd, and Sumitomo Chemical Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Agrochemicals encompass a diverse range of chemical substances utilized in agriculture to enhance crop production and protect plants from pests, diseases, and weeds. These chemicals play a vital role in modern agricultural practices, ensuring higher yields and improved quality of agricultural products. Agrochemicals are broadly categorized into fertilizers, pesticides, herbicides, fungicides, and plant growth regulators, each serving specific purposes in optimizing crop growth and health. Fertilizers are one of the primary types of agrochemicals, providing essential nutrients such as nitrogen, phosphorus, and potassium to plants for healthy growth and development. Pesticides, including insecticides, fungicides, and herbicides, are crucial for controlling pests, fungal diseases, and weeds that can significantly impact crop yield and quality. Herbicides specifically target unwanted plant species, while fungicides protect crops from fungal infections. Additionally, plant growth regulators are used to regulate plant growth processes such as flowering, fruit set, and ripening, thereby optimizing crop production and harvest quality.

The agrochemicals market has been experiencing steady growth driven by several factors. One significant driver is the increasing global population, which necessitates higher food production. For instance, in 2023, China achieved a record-breaking grain output of 695.41 million tonnes, marking a 1.3 percent increase compared to the previous year. As a result, farmers are under pressure to maximize crop yields, leading to greater adoption of agrochemicals such as fertilizers, pesticides, and herbicides. Additionally, the expansion of agricultural lands and the adoption of modern farming practices further contribute to the demand for agrochemicals. These practices often involve the use of advanced technologies and genetically modified crops, which require specialized agrochemical inputs for optimal growth and protection against pests and diseases.

Moreover, technological advancements in agrochemicals have played a crucial role in driving market growth. For instance, in February 2022, Adama introduced Timeline® FX, an advanced foliar herbicide for cereals with a broad application window. This spring herbicide features three active ingredients with complementary modes of action, along with a built-in adjuvant, to effectively control both broadleaf and grass weeds in cereal crops. Companies in the agrochemical sector continually innovate to develop new formulations with improved efficacy and environmental sustainability. For instance, there has been a growing emphasis on the development of organic pesticides and specialty fertilizers to meet the increasing demand for eco-friendly agricultural solutions.

Agrochemicals Market Segmentation

The global agrochemicals market segmentation is based on product, application, and geography.

Agrochemicals Market By Product

- Fertilizers

- Potassic

- Nitrogenous

- Phosphatic

- Secondary Fertilizers

- Others

- Plant Growth Regulators

- Crop Protection Chemicals

- Fungicides

- Herbicides

- Insecticides

- Others

- Others

In terms of products, the fertilizers segment accounted for the largest market share in 2022. One of the primary drivers of this segment is the increasing demand for food globally, driven by population growth and changing dietary preferences. Fertilizers play a crucial role in enhancing crop yields by providing essential nutrients to plants, thereby improving soil fertility and productivity. With the expansion of agricultural lands and the need to maximize output per hectare, farmers are increasingly relying on fertilizers to meet the growing demand for food and feed crops.

Moreover, advancements in fertilizer technologies have contributed to the segment's growth. Companies in the agrochemical industry have been investing in research and development and collaborating to develop innovative fertilizer formulations that offer improved nutrient uptake efficiency and environmental sustainability. For instance, in January 2022, Yara and Lantmännen entered into a commercial agreement to introduce fossil-free fertilizers to the market. This collaboration led to a contract for green fertilizers, produced by Yara and distributed by Lantmännen in Sweden starting in 2023. Additionally, the adoption of precision agriculture techniques, such as soil testing and nutrient mapping, has further fueled the demand for fertilizers as farmers seek to optimize nutrient management practices and minimize input wastage.

Agrochemicals Market By Application

- Cereals & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Others

According to the agrochemicals market forecast, the cereals & grains segment is expected to witness significant growth in the coming years. One of the primary drivers of this segment isthe increasing demand for cereals and grains globally, fueled by population growth, and changing dietary patterns particularly in emerging economies. Cereals and grains are staple food crops that form the foundation of the human diet, making them critical for food security. As a result, farmers are under pressure to maximize yields and protect crops from pests, diseases, and weeds, leading to a higher demand for agrochemical inputs. Furthermore, advancements in agricultural technologies and farming practices have contributed to the growth of the cereals and grains segment. Modern agricultural techniques, including the use of genetically modified crops, precision farming, and integrated pest management strategies, have increased the efficiency and productivity of cereal and grain production. Agrochemicals such as fertilizers, pesticides, herbicides, and fungicides play a vital role in supporting these practices by providing essential nutrients, controlling pests and diseases, and managing weed competition, thereby optimizing crop yields and quality.

Agrochemicals Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Agrochemicals Market Regional Analysis

The Asia-Pacific region has emerged as a powerhouse in the global agrochemicals market, primarily due to its vast agricultural landscape, increasing population, and evolving farming practices. With countries like China, India, and Japan leading the way, the region has witnessed significant advancements in agricultural technology and has become a leading exporter of agricultural goods, driving the demand for agrochemicals. For instance, according to the International Trade Center (ITC) and the Food and Agriculture Organization (FAO), China is the leading global exporter and manufacturer of pesticides. Additionally, China stands out as a major player, being one of the world's largest producers and consumers of agrochemicals. Its vast arable land and focus on modernizing agriculture have propelled it to the forefront of the market. According to Baojing GU from the Universities of Melbourne and Zhejiang, China leads the world in agricultural pesticide usage. Moreover, the Asia-Pacific region's diverse climate and soil conditions make it suitable for a wide range of crops, necessitating the use of various agrochemicals to optimize yield and quality. Farmers in this region rely heavily on fertilizers, pesticides, and herbicides to protect crops from pests, diseases, and weeds while enhancing productivity. Additionally, supportive government policies, investments in research and development, and growing awareness about the benefits of agrochemicals have further fueled market growth in the region.

North America is the fastest-growing region in the agrochemicals market due to increasing agricultural activities and the adoption of advanced farming techniques. The demand for high-quality crops has driven the need for innovative pesticides and fertilizers. Government support and investment in research and development have also boosted market growth. For instance, the National Science Foundation (NSF) leads a $35 million federal investment in future agricultural technologies and solutions. Additionally, the expansion of biotechnology and genetically modified crops has further fueled the region's agrochemical market expansion.

Agrochemicals Market Player

Some of the top Agrochemicals Market companies offered in the professional report include BASF SE, Clarient AG, Adama Agricultural Solutions Ltd., Huntsman International LLC, Arysta Lifesciences Corporation, Bayer Cropscience AG, America Vanguard Corporation, The Dow Chemical, Nufarm Limited, Jiangsu Yangnong Chemical Group Co. Ltd, and Sumitomo Chemical Co. Ltd.

Frequently Asked Questions

How big is the agrochemicals market?

The agrochemicals market size was USD 225.8 Billion in 2022.

What is the CAGR of the global Agrochemicals Market from 2023 to 2032?

The CAGR of agrochemicals is 3.2% during the analysis period of 2023 to 2032.

Which are the key players in the Agrochemicals Market?

The key players operating in the global market are including BASF SE, Clarient AG, Adama Agricultural Solutions Ltd., Huntsman International LLC, Arysta Lifesciences Corporation, Bayer Cropscience AG, America Vanguard Corporation, The Dow Chemical, Nufarm Limited, Jiangsu Yangnong Chemical Group Co. Ltd, and Sumitomo Chemical Co. Ltd.

Which region dominated the global Agrochemicals Market share?

Asia-Pacific held the dominating position in agrochemicals industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of agrochemicals during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global agrochemicals industry?

The current trends and dynamics in the Agrochemicals Market growth include increasing global population and food demand, expansion of agricultural lands and adoption of modern farming practices, and technological advancements in agrochemicals for enhanced efficacy.

Which product held the maximum share in 2022?

The fertilizers product held the maximum share of the agrochemicals industry.