Glamping Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Glamping Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Glamping Market Size accounted for USD 3.2 Billion in 2023 and is estimated to achieve a market size of USD 8.6 Billion by 2032 growing at a CAGR of 11.9% from 2024 to 2032.

Glamping Market (By Accommodation Type: Cabins and Pods, Tents, Yurts, Tree houses, and Others; By Age Group: 18 - 32 years, 33 - 50 years, 51 - 65 years, and Above 65 years; By Size: 2-Person, 4-Person, and Others; By Application: Family travel, Couples' getaways, Solo travel, Wellness retreats, and Others; By Distribution Channel: Supermarkets and Hypermarkets, Specialty Stores, E-commerce, and Others)

Glamping Market Highlights

- Global glamping market revenue is poised to garner USD 8.6 billion by 2032 with a CAGR of 11.9% from 2024 to 2032

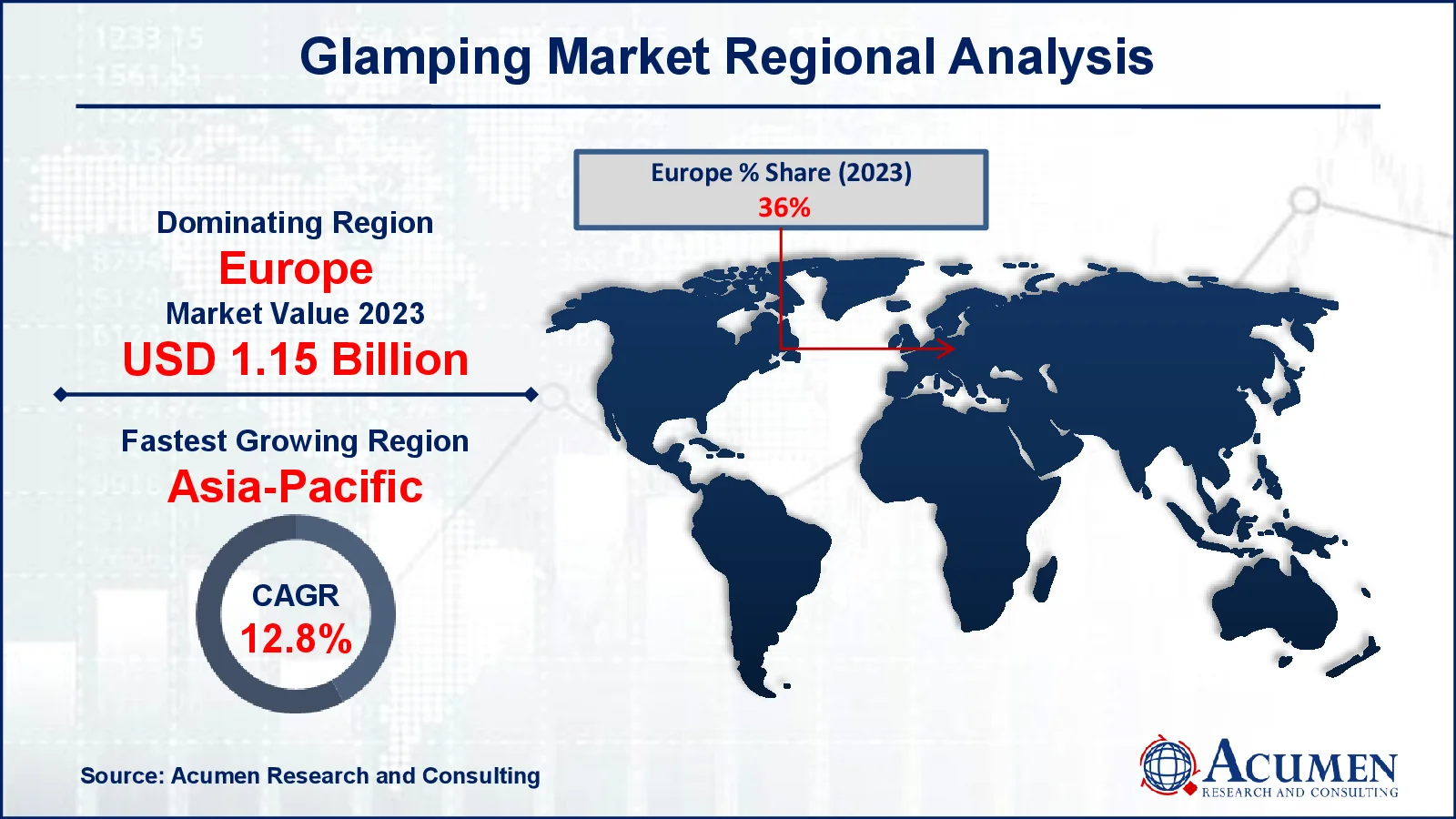

- Europe glamping market value occupied around USD 1.15 billion in 2023

- Asia-Pacific glamping market growth will record a CAGR of more than 12.8% from 2024 to 2032

- Among accommodation type, the cabins and pods sub-segment generated USD 1.5 billion revenue in 2023

- Based on age group, the 18 - 32 years sub-segment generated a 45% glamping market share in 2023

- Utilizing digital platforms for seamless booking and personalized experiences is a popular glamping market trend that fuels the industry demand

Glamping is a step up from traditional tent camping and typically entails staying in small, self-contained accommodations with a focus on creature comforts such as full-sized beds and cooking facilities. Glamping is typically done on specific sites or in specific locations, with the goal of reconnecting with nature. The various types of glamping available are largely related to the type of lodging. Because of its campaigning origins, traditional glamping is frequently associated with yurts and safari tents. Glamping is a relatively new arrival in the UK, filling a need for a camping experience with a hotel feel. It was originally called luxury campaigning, but it quickly changed to glamping. The concept is the same whether it is referred to as "posh camping" or "comfortable camping." UK Glamping quickly grew in popularity as more types of accommodation and vacation spots sprouted up all over the country.

Global Glamping Market Dynamics

Market Drivers

- Post-pandemic demand for luxury outdoor activities is on the rise

- Eco-tourism trends are promoting sustainable travel options

- Millennials' increasing disposable incomes drive up demand for luxury travel

- Advancements in technology provide portable luxury facilities in distant regions

Market Restraints

- Factors limiting industry growth include high construction expenditures

- Consistent revenue generation is hindered by seasonal demand fluctuations

- Regulatory restrictions prevent the development of glamping sites in protected natural regions

Market Opportunities

- Partnering with influencers and travel bloggers to enhance brand visibility

- Expanding into emerging markets with growing tourism sectors

- Offering wellness-oriented glamping experiences for health-conscious travelers

Glamping Market Report Coverage

| Market | Glamping Market |

| Glamping Market Size 2022 |

USD 3.2 Billion |

| Glamping Market Forecast 2032 | USD 8.6 Billion |

| Glamping Market CAGR During 2023 - 2032 | 11.9% |

| Glamping Market Analysis Period | 2020 - 2032 |

| Glamping Market Base Year |

2022 |

| Glamping Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Accommodation Type, By Age Group, By Size, By Application, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | PurePods, Tanja Lagoon Camp, Baillie Lodges, Tentrr, Nightfall Camp Pty Ltd., Eco Retreats, Wildman Wilderness Lodge, Under Canvas, Collective Retreats, and Paperbark Camp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Glamping Market Insights

The emergence of social media platforms for advertising; major players in the global market use such platforms to promote their services. These are tailored packages that cater to the needs of the consumer. This is one of the most important factors influencing the global glamping market's growth. Furthermore, according to a recent Arizton report, the glamping industry is expected to generate significant in revenue over the next few years due to exponential growth in an outdoor travel niche. Furthermore, the Glamping Show in the United Kingdom, one of the first industry conferences, attracts over 2,400 visitors each year and features over 100 exhibitors.

Sustainability and green practices in glamping will have 100% gains in the global market

The glamping movement promotes environmental awareness on a global scale. It provides a one-of-a-kind opportunity for glamping site owners to identify sustainable suppliers and educate tourists in an effort to reduce, reuse, and repurpose waste. Businesses at the forefront of the sustainability movement are going above and beyond to have an ecological impact while also incorporating ethical accountability into the company culture. Ecotourism, also known as green tourism or ethical tourism, has grown at an alarming rate in recent years. In glamping, ecotourism can take many forms, including the installation of solar panels, recycling, reusing materials or containers, water conservation, and much more.

COVID-19 impact on Glamping market

The impact of Covid-19 on many traditional accommodation brands, such as hotels and restaurants, whereas camping and glamping products have seen explosive demand due to their ability to provide socially distant, sanitary, and hidden escapes from the city. According to a report published by The PKF hotel experts group, when the Trump administration announced a travel ban to Europe, Getaway saw a 400 percent increase in bookings, and many outposts were nearly sold out throughout the summer. Bookings for Collective Retreats increased by nearly 10% in 2020 compared to 2019. According to Kampgrounds of America (KOA), 20% of their visitors are first-time campers, with many of them opting to ease into the outdoors world by renting cabins or RVs. When compared to the previous five-year running average, Wyoming State Parks saw a 160 percent increase from April to May 2020So far in 2020, Pennsylvania State Parks have received over one million more visitors than in all of 2019. Since April, RV Share, a motor home rental website, has reported a 1,600% increase in bookings. According to Tourism Economics, adventure travel is expected to recover quickly based on summer 2020 demand, while overall U.S. travel market spending is expected to recover to 2019 levels in 2024.

Glamping Market Segmentation

The worldwide market for glamping is split based on accommodation type, age group, size, application, distribution channels, and geography.

Glamping Accommodation Types

- Cabins and Pods

- Tents

- Yurts

- Tree houses

- Others

According to glamping industry analysis, cabins and pods are expected to dominate the overall market by capturing a significant market share during the forecast period. The increasing importance of traveling as part of an immersive experience without sacrificing luxury has influenced campers, contributing to segmental growth. Tents are expected to grow at a rapid CAGR during the forecast period. Tent accommodation is expected to be the second-largest segment in the overall glamping market.

Glamping Age Groups

- 18 - 32 years

- 33 - 50 years

- 51 - 65 years

- Above 65 years

Based on the age group type market is segmented into the 18 - 32 years, 33 - 50 years, 51 - 65 years, and above 65 years. within age group category, the 18-32 year old age group is expected to dominate the global industry in the glamping market forecast period. One of the major factors contributing to the growth of the global glamping market is the rising trend of camping among the aforementioned age group.

Glamping Sizes

- 2-Person

- 4-Person

- Others

The 4-person niche is becoming increasingly popular in the glamping market because to its ideal balance of space and social experience. This category is for small groups, families, and couples searching for more comfort and amenities during their outdoor stay. Because glamping is often tempting to those seeking extravagant and shared experiences, 4-person tents and lodges give ample space for group activities while keeping a comfortable setting. Furthermore, the growing popularity of family vacations and group trips makes this category appealing to operators. The versatility of 4-person arrangements, which may be utilized for both short trips and extended stays, boosts their popularity and creates market demand.

Glamping Applications

- Family Travel

- Couples' Getaways

- Solo Travel

- Wellness Retreats

- Others

The family travel segment is expected to dominate the glamping industry, as families seek outdoor excursions that combine nature, luxury, and comfort. Glamping hits the ideal balance, with roomy rooms appropriate for families, particularly those vacationing with children. The safety, convenience, and diversity of family-friendly activities, such as guided nature tours and group amenities, make it an appealing alternative for families looking for unique bonding moments. Furthermore, the growing interest in eco-friendly and immersive travel corresponds to family tastes, making this category a significant driver of growth in the glamping market.

Glamping Distribution Channels

- Supermarkets and Hypermarkets

- Specialty Stores

- E-commerce

- Others

Several reasons contribute to the specialty stores segment dominance in the glamping market distribution chain. For starters, these retailers may provide a more curated and specialized assortment of glamping products, responding to individual client needs and interests. Second, they frequently employ skilled individuals who can provide professional guidance and recommendations, thereby improving the consumer experience. Third, specialty retailers may provide a one-of-a-kind and immersive shopping experience by exhibiting glamping products in ways that inspire and excite potential purchasers. Finally, they can develop strong consumer ties, increasing loyalty and repeat business.

Glamping Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Glamping Market Regional Analysis

Europe is expected to dominate the global glamping market, with a significant market share during the forecast period. This is due to the holidaymakers in Europe who are attempting to give glamping a completely new face by providing the experience of a hotel among nature. After the United States, France is one of the prominent European countries that promote glamping for its people, with over 8,000 campsites spread across the country. North America, on the other hand, is expected to second largest during the glamping industry forecast period, with a CAGR of notified. Willingness to travel to less popular destinations to avoid overcrowding is one of the major factors that contribute to the growth of the regional market, which in turn contributes to the growth of the global glamping market.

Glamping Market Players

Some of the top Glamping companies offered in our report include PurePods, Tanja Lagoon Camp, Baillie Lodges, Tentrr, Nightfall Camp Pty Ltd., Eco Retreats, Wildman Wilderness Lodge, Under Canvas, Collective Retreats, and Paperbark Camp.

Frequently Asked Questions

How big is the glamping market?

The glamping market size was valued at USD 3.2 billion in 2023.

What is the CAGR of the global glamping market from 2024 to 2032?

The CAGR of glamping is 11.9% during the analysis period of 2024 to 2032.

Which are the key players in the glamping market?

The key players operating in the global market are including PurePods, Tanja Lagoon Camp, Baillie Lodges, Tentrr, Nightfall Camp Pty Ltd., Eco Retreats, Wildman Wilderness Lodge, Under Canvas, Collective Retreats, and Paperbark Camp.

Which region dominated the global glamping market share?

North America held the dominating position in glamping industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of glamping during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global glamping industry?

The current trends and dynamics in the glamping industry include post-pandemic demand for luxury outdoor activities is on the rise, eco-tourism trends are promoting sustainable travel options, millennials' increasing disposable incomes drive up demand for luxury travel, and advancements in technology provide portable luxury facilities in distant regions.

Which distribution channel held the maximum share in 2023?

The specialty stores distribution channel held the maximum share of the glamping industry.