E-commerce Electronics Market

Published :

Report ID:

Pages :

Format :

E-commerce Electronics Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

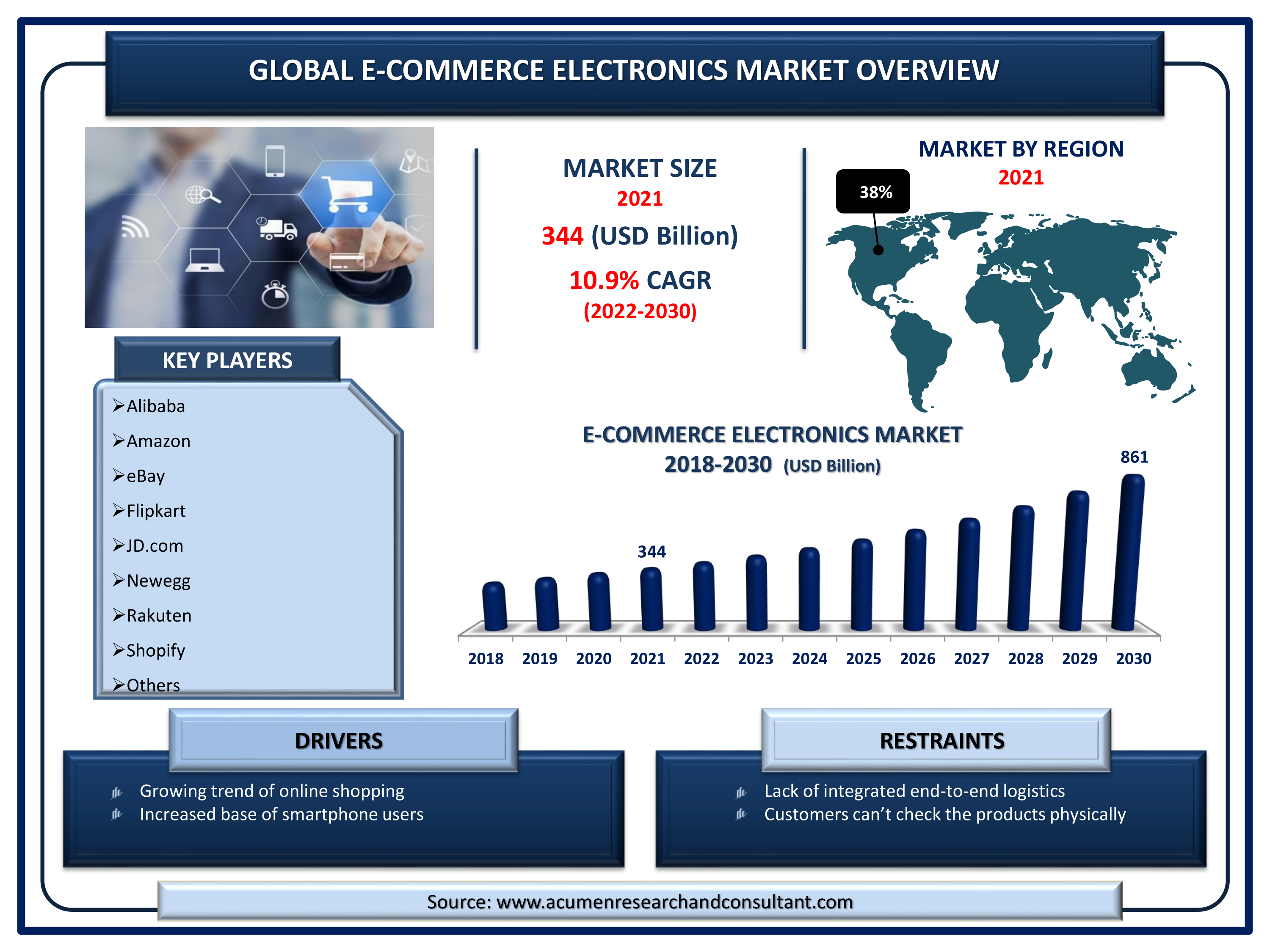

The global market for e-commerce electronics accounted for US$ 344 Bn in 2021 and is estimated to reach US$ 861 Bn by 2030, with a significant CAGR of 10.9% from 2022 to 2030.

Ecommerce electronic is a business strategy that allows businesses and consumers to buy/sell goods and services over the internet. E-commerce can be done on smartphones, computers, laptops/tablets, and other smart devices as it operates in four important market categories. The consumer electronics sector is one of the most dynamic and innovative in the world. Major electronics companies are constantly producing the next best electronic item, making their goods more user-friendly, advanced, and developing new ways to assist or entertain their clients. Electronics are frequently a well-thought-out investment.

Market Growth Drivers

- Growing trend of online shopping

- Increasing base of smartphone users

- Faster internet connectivity

Market Restraints

- Lack of integrated end-to-end logistics

- Customers can’t check the product physically

Market Opportunities

- Growth in digital marketing industry

- Growing ecommerce adoption due to significant discounts offered on products purchase

Report Coverage

| Market | E-commerce Electronics Market |

| Market Size 2021 | US$ 344 Bn |

| Market Forecast 2028 | US$ 861 Bn |

| CAGR | 10.9% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Business Model, By Pricing Model, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alibaba, Amazon, eBay, Flipkart, JD.com, Newegg, Rakuten, Shopify, Target, and Walmart. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Market Dynamics

The increasing trend of online shopping has created a boom in the e-commerce electronics industry. Due to the expansion of the internet and increased mobile connectivity, the online retail market is on the rise. Electronic gadget sales have increased dramatically since the introduction of e-commerce, owing mostly to the spread of the internet and increased mobile connectivity. Consumers and sellers both benefit from online retailing. The advantages of online sales include speed to market, cost savings, and scale.

E-commerce allows a seller to price and ship products competitively to a worldwide audience. This is one of the most significant benefits of the e-commerce industry. As a result, shoppers from all around the world can purchase their preferred electronic device. The development of internet access, even in distant parts of many low and middle-income countries, has allowed buyers to choose their products. This has had a favorable impact on the global market's progress.

By providing cheaper and more effective distribution channels for their products or services, e-commerce has allowed firms such as small business to obtain access to and build a bigger market presence. The way individuals purchase and consume products and services has changed as a result of e-commerce. People are increasingly using their computers and smart devices to place orders for things that can be delivered quickly to their homes. As a result, the retail scene has been disrupted.

Market Segmentation

The global e-commerce electronics market is segmented based on product, business model, pricing model, and geography.

Market By Product

- Smartphones

- Computers

- Laptops/Tablets

- Audio Devices

- Wearables

- Other Electronic Devices

Among them, the smartphones segment held the largest market share in 2021. According to a report by Ericsson, the number of mobile phone subscriptions worldwide has surpassed six billion, with several hundred million more predicted in the next years. The countries with the most smartphone users are China, India, and the United States. However, computers and television sets have expanded far faster than cellphones in worldwide consumer electronics sales over the last three years, owing to COVID-19 restrictions and greater time spent working and learning from home. As a result, smartphones' percentage of total sales has plummeted.

Market By Business Model

- Business To Business (B2B)

- Consumer to Business (C2B)

- Business To Consumer (B2C)

- Consumer to Consumer (C2C)

Among them, the business-to-consumer segment held a noteworthy market share in 2021. B2C (business-to-consumer) e-commerce, sometimes known as retail e-commerce, is a sales paradigm in which internet firms sell to consumers. Amazon is a well-known example of a B2C retail platform. Apart from the shipping and delivery processes, e-commerce sales are almost fully conducted over the internet, providing sellers and buyers with the convenience and freedom to conduct transactions at any time and from any location. Because of the simplicity of purchasing and selling online vs traditional sales, B2C e-commerce has become one of the fastest expanding sectors in the global economy.

Market By Pricing Model

- Medium Cost Products

- High End Products

- Low-Cost Products

Based on the pricing model, the low-cost products segment is expected to hold a significant share. Low-cost products are easily picked and are popular in low and medium-income countries. However, due to the rising disposable income in emerging economies, the demand for medium-cost products is on a rise. Furthermore, in developed economies the scenario is different. Consumers in developed countries go for high-end products due to high disposable income and a preference to acquire the latest technologically advanced electronic equipment.

E-commerce Electronics Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The increasing number of smartphone users in the Asia-Pacific region, fuels the regional market growth

The regional segmentation is given as North America, Latin America, Asia-Pacific, Europe, and the Middle East & Africa (MEA). Based on regional analysis, the Asia-Pacific region is anticipated to grow with the fastest rate throughout the forecast period 2022 – 2030. The high growth in the region is attributed to the growing population coupled with the increasing number of smartphone users in the region. According to the India Brand Equity Fund (IBEF), the smartphone shipments reached more than 170 million in 2021 in India. Smartphones have become the most popular gadget not just in India, but globally, due to the continual need to be connected. People, especially those who live in urban areas and have hectic lifestyles, have become accustomed to communicating on the go. However, the North America region accounted for a significant share in 2021 due to the growth in disposable incomes, increasing spending capacity, and preference of high-end devices.

Competitive Landscape

Some of the top vendors offered in the professional report include Alibaba, Amazon, eBay, Flipkart, JD.com, Newegg, Rakuten, Shopify, Target, and Walmart.

Frequently Asked Questions

How much was the estimated value of the global e-commerce electronics market in 2021?

The estimated value of global e-commerce electronics market in 2021 was accounted to be US$ 344 Bn.

What will be the projected CAGR for global e-commerce electronics market during forecast period of 2022 to 2030?

The projected CAGR of e-commerce electronics market during the analysis period of 2022 to 2030 is 10.9%.

Which are the prominent competitors operating in the market?

The prominent players of the global e-commerce electronics market involve Alibaba, Amazon, eBay, Flipkart, JD.com, Newegg, Rakuten, Shopify, Target, and Walmart.

Which region held the dominating position in the global e-commerce electronics market?

North America held the dominating share for e-commerce electronics during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for e-commerce electronics during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global e-commerce electronics market?

Growing trend of online sales, increasing base of smartphone users, and faster internet connectivity all contribute to the expansion of the worldwide e-commerce electronics market.

By segment product, which sub-segment held the maximum share?

Based on product, smartphones segment held the maximum share for e-commerce electronics market in 2021.