Frozen Bakery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Frozen Bakery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

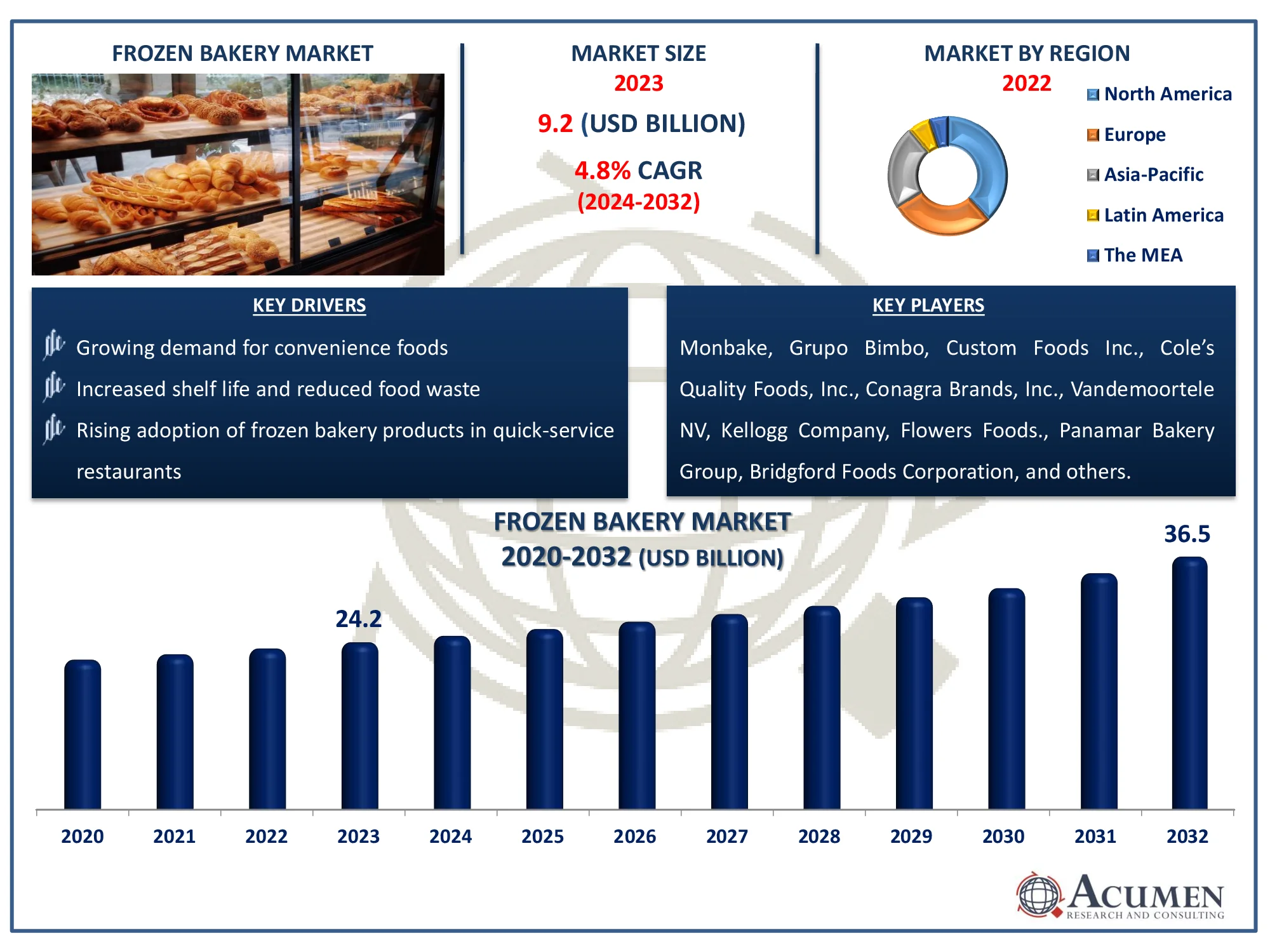

The Global Frozen Bakery Market Size accounted for USD 24.2 Billion in 2023 and is estimated to achieve a market size of USD 36.5 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Frozen Bakery Market (By Product: Breads, Doughnuts & Pies, Cakes & Pastries, Pizza, Novelties, and Others; By Form Of Consumption: Ready-to-prove, Ready-to-bake, and Fully baked; By Distribution Channel: Convenience stores, Hypermarkets & supermarkets, Online Retailers, Hotels, restaurants, and catering (HORECA), Bakery Stores, Artisans bakers, Others and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Frozen Bakery Market Highlights

- The global frozen bakery market is projected to reach USD 36.5 billion by 2032, growing at a CAGR of 4.8% from 2024 to 2032

- In 2023, North America’s frozen bakery market was valued at approximately USD 9.2 billion

- The Asia-Pacific frozen bakery market is expected to grow at a CAGR of over 5.6% from 2024 to 2032

- In 2023, the ready-to-bake segment accounted for 57% of the market share based on form of consumption

- Convenience stores generated 40% of the market share among products in 2023

- Rising focus on sustainable packaging and environmentally friendly practices is the frozen bakery market trend that fuels the industry demand

Frozen bakery products are pre-prepared items that have been frozen to keep them fresh and extend their shelf lives. Bread, pastries, cakes, and cookies are prepared, frozen, and packaged for future use. Frozen bakery items are most commonly used in the retail and food service industries, where they provide convenience and quality consistency. They are great for busy customers and organizations that require speedy preparation with minimal waste. Frozen bakery items can also be used to solve supply chain issues. The market for these items is expanding due to rising demand for convenience and the growth of the food service industry.

Global Frozen Bakery Market Dynamics

Market Drivers

- Growing demand for convenience foods

- Increased shelf life and reduced food waste

- Rising adoption of frozen bakery products in quick-service restaurants

Market Restraints

- High transportation and storage costs

- Rising competition from fresh bakery products

- Fluctuations in raw material prices affecting profitability

Market Opportunities

- Increasing penetration in emerging markets

- Expanding product offerings with healthier ingredients

- Innovations in packaging and preservation technologies

Frozen Bakery Market Report Coverage

| Market | Frozen Bakery Market |

| Frozen Bakery Market Size 2022 |

USD 24.2 Billion |

| Frozen Bakery Market Forecast 2032 | USD 36.2 Billion |

| Frozen Bakery Market CAGR During 2023 - 2032 | 4.8% |

| Frozen Bakery Market Analysis Period | 2020 - 2032 |

| Frozen Bakery Market Base Year |

2022 |

| Frozen Bakery Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Form Of Consumption, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Monbake, Grupo Bimbo, Custom Foods Inc., Cole’s Quality Foods, Inc., Conagra Brands, Inc., Vandemoortele NV, Kellogg Company, Flowers Foods., Panamar Bakery Group, Bridgford Foods Corporation, Associated British Foods plc, and Europastry. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Frozen Bakery Market Insights

The frozen bakery products market will experience noticeable growth over the forecast period. The growing demand for processed foods, combined with a shift in consumer preferences toward prepared foods, is likely to increase demand for frozen bakery items. In comparison to traditional pastry kitchen products, these items can be stored for a longer period of time. Different advantages provided by these items, such as ease of accessibility, higher quality, longer utilization duration, an environmentally friendly assembly process, and reasonable pricing, will boost the market in the future.

The growth of a standard fresh baked products market and the diversification of energy costs will be significant governing factors for the frozen bakery products industry in the next years. High electricity rates resulted in high operational costs for frozen baked product manufacturers because the majority of their products have a short shelf life and must be maintained frozen. This could explain why some firms have established plants in nearby countries with low electricity taxes. By 2026, the previously described patterns will have a negative impact on the whole market.

Expanding product offers with healthier ingredients represents opportunity for the frozen bakery products market. Ingredients such as whole grains, reduced sugar, and natural sweeteners appeal to health-conscious consumers looking for healthier eating options. Furthermore, providing healthier alternatives might attract new client segments while increasing brand loyalty. Additionally, growing influence of ready-to-bake options in snacks further enhances market growth upward. For instance, Délifrance introduced two premium, ready-to-bake viennoiseries in December 2023 that are cinnamon and brioche buns.

Frozen Bakery Market Segmentation

The worldwide market for frozen bakery is split based on product, form of consumption, distribution channel, and geography.

Frozen Bakery Products

- Breads

- Doughnuts & Pies

- Cakes & Pastries

- Pizza

- Novelties

- Others

According to the frozen bakery industry analysis, pizza products have grown as a significant share in market, owing to their vast customer appeal and convenience. The growing need for ready-to-eat meals has increased the appeal of frozen pizzas, which provide a convenient alternative. Furthermore, advances in freezing technology and greater product quality have increased the appeal of frozen pizzas. Pizza products' significant market share is also due to their ability to accommodate to a wide range of consumer tastes, such as different toppings and crusts; this highlights the importance of frozen pizza in the larger frozen baking market.

Frozen Bakery Form of Consumptions

- Ready-To-Prove

- Ready-To-Bake

- Fully Baked

According to the frozen bakery industry analysis, the ready-to-bake category dominates the market since it is convenient for busy consumers. Products such as pre-made dough and frozen bread only require baking, making meal preparation easier. The convenience of keeping these products for later use contributes to their popularity. Ready-to-bake goods are popular among many consumers due to their convenience and flexibility.

Frozen Bakery Distribution Channels

- Convenience Stores

- Hypermarkets & Supermarkets

- Hotels, Restaurants, Aand Catering (HoReCa)

- Bakery Stores

- Artisans Bakers

- Online Retailers

- Others

According to the frozen bakery market forecast, convinience stores play an important role in product marketing and distribution, accounting for 40% of the total share in 2023, and are expected to grow significantly in the coming years. Because of the product's ease of accessibility and people's hectic lifestyles, accommodation stores have grown in popularity. Fabricators benefit from such accomodation stores since they can exhibit their diverse product assortment on a single platform. As a result, the global market will continue to grow in the future. Hotels, restaurants, and catering end-clients are expected to grow slowly throughout the forecast period. The area includes drive-thru food businesses as well as family restaurants and lodgings that offer food, requiring less time to prepare and resulting in minimal table time.

Frozen Bakery Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Frozen Bakery Market Regional Analysis

For several reasons, in 2023, North America earned more than USD 9.2 billion in the global frozen bakery products industry and is expected to grow at a rapid pace. Because of increased processed food demand and changing consumer habits, the business sectors in the United States and Canada will thrive. For instance, in August 2023, General Mills announced a USD 49 million investment to expand its frozen dough plant capacity in Missouri, United States. The plant is slated to be completed in early 2024, and the facility expansion will enable for the production of almost 1 billion pounds of frozen dough products each year. This strategy will increase the plant space by over 30,000 square feet and assist fulfill the growing demand for frozen bakery products in the food service channel across the United States. Furthermore, the improved nutrition culture and expectations for everyday luxuries, combined with local financial development, will expand the frozen bakery showcase in the future.

The Asia-Pacific region is developing as the fastest-growing market for frozen bakery products market, owing to increased urbanization, and changing lifestyles that favor easy and ready-to-eat foods. Demand is driven by the increasing popularity of Western-style bakery items, as well as the expansion of the retail and restaurant sectors. For instance, in November 2023, Délifrance expanded its activities in India. Bahri Hospitality will be the master franchise owner for the India business, with plans to open 30 outlets across three layouts by 2028.These elements all contribute to the rapid expansion of the frozen bakery sector in this region.

Frozen Bakery Market Players

Some of the top frozen bakery companies offered in our report include Monbake, Grupo Bimbo, Custom Foods Inc., Cole’s Quality Foods, Inc., Conagra Brands, Inc., Vandemoortele NV, Kellogg Company, Flowers Foods., Panamar Bakery Group, Bridgford Foods Corporation, Associated British Foods plc, and Europastry.

Frequently Asked Questions

How big is the frozen bakery market?

The frozen bakery market size was valued at USD 24.2 billion in 2023.

What is the CAGR of the global frozen bakery market from 2024 to 2032?

The CAGR of frozen bakery is 4.8% during the analysis period of 2024 to 2032.

Which are the key players in the frozen bakery market?

The key players operating in the global market are including Monbake, Grupo Bimbo, Custom Foods Inc., Cole’s Quality Foods, Inc., Conagra Brands, Inc., Vandemoortele NV, Kellogg Company, Flowers Foods., Panamar Bakery Group, Bridgford Foods Corporation, Associated British Foods plc, and Europastry.

Which region dominated the global frozen bakery market share?

North America held the dominating position in frozen bakery industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of frozen bakery during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global frozen bakery industry?

The current trends and dynamics in the frozen bakery industry include growing demand for convenience foods, increased shelf life and reduced food waste, and rising adoption of frozen bakery products in quick-service restaurants.

Which form of consumption held the maximum share in 2023?

The ready-to-bake product held the maximum share of the frozen bakery industry.