Food Processing Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Food Processing Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

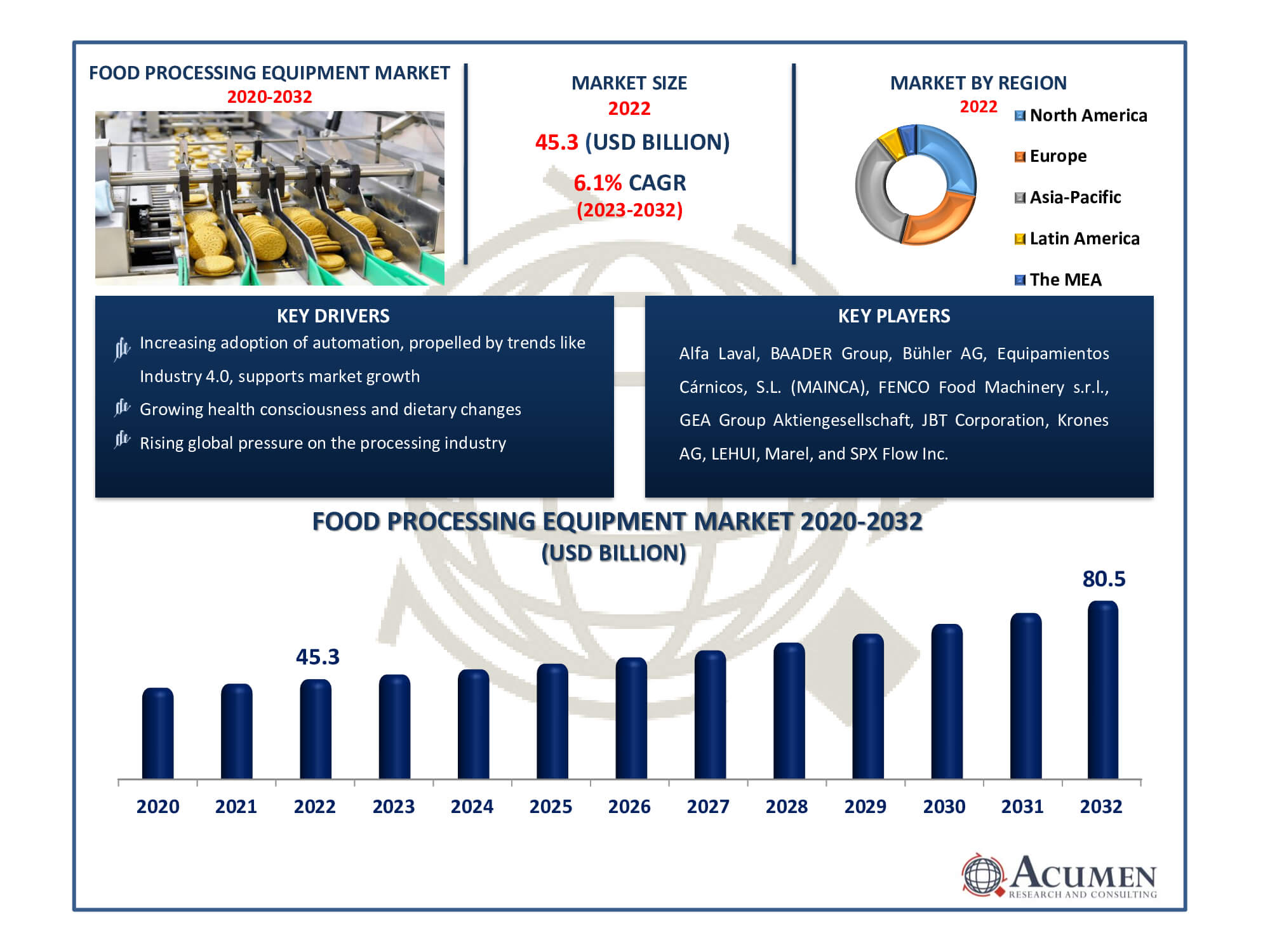

The Global Food Processing Equipment Market Size accounted for USD 45.3 Billion in 2022 and is estimated to achieve a market size of USD 80.5 Billion by 2032 growing at a CAGR of 6.1% from 2023 to 2032.

Food Processing Equipment Market Highlights

- Global food processing equipment market revenue is poised to garner USD 80.5 billion by 2032 with a CAGR of 6.1% from 2023 to 2032

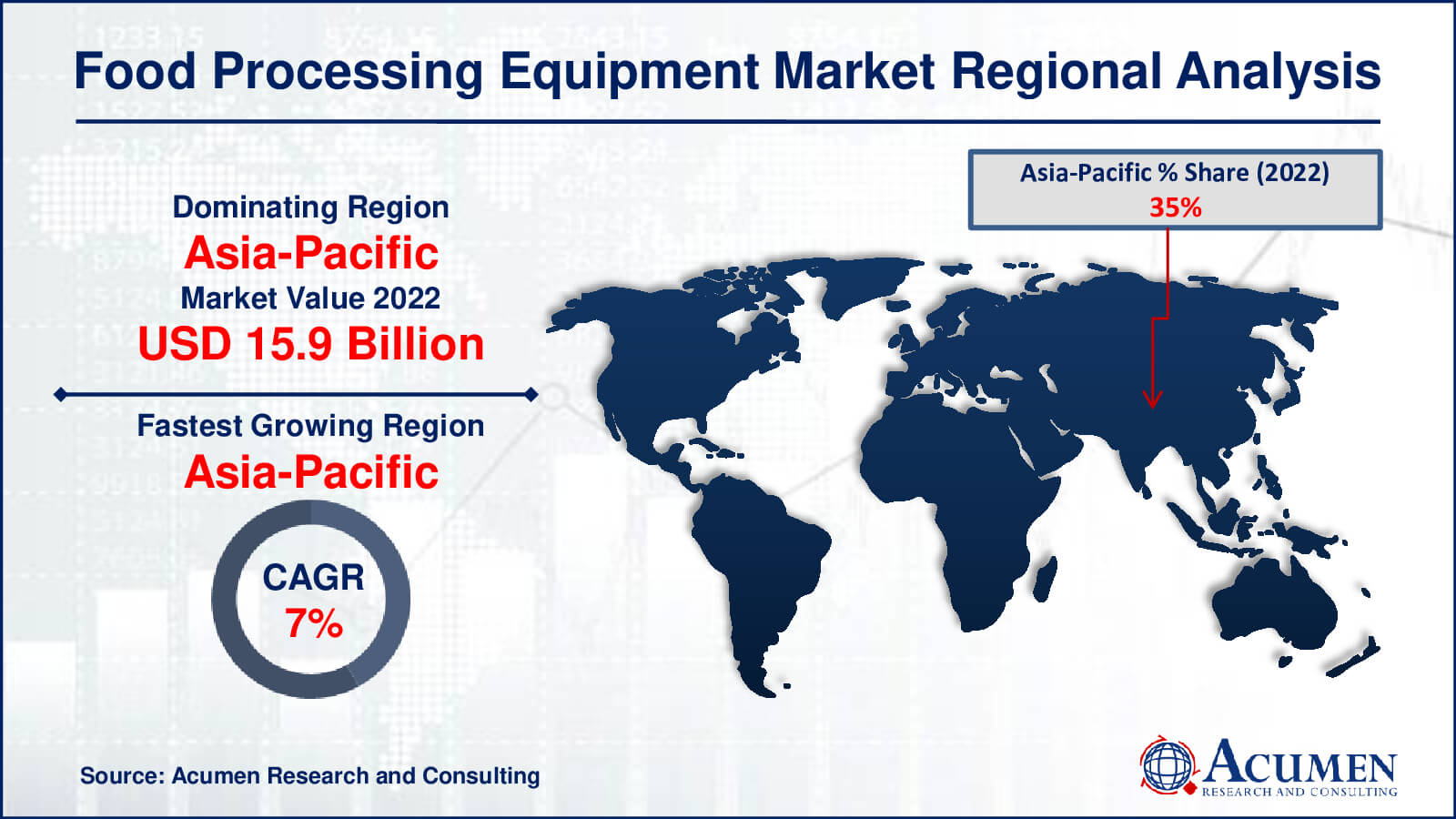

- Asia-Pacific food processing equipment market value occupied around USD 15.9 billion in 2022

- Asia-Pacific food processing equipment market growth will record a CAGR of more than 7% from 2023 to 2032

- Among modes of operation, the semi-automatic sub-segment generated over US$ 22.2 billion revenue in 2022

- Based on application, the bakery & confectionery sub-segment generated around 22% share in 2022

- Collaborations with government initiatives in developing regions offer untapped market potential is a popular market trend that fuels the industry demand

The food processing equipment market is a fast-paced business that converts raw components into edible food products. It includes a wide range of machinery and instruments meant to improve and streamline the food manufacturing process. As consumer lifestyles change, so does the demand for convenient, packaged, and processed goods, propelling the market forward. This sector's key companies are always innovating, using sophisticated technology to boost efficiency and fulfill worldwide demand. The market places a premium on automation, sustainability, and adhering to severe food safety regulations. It is critical in adjusting to modern problems, providing the consistent and efficient production of a varied range of food items for a growing global population.

Global Food Processing Equipment Market Dynamics

Market Drivers

- Growing health consciousness and dietary changes

- Government emphasis on research and development

- Increasing adoption of automation, propelled by trends like Industry 4.0

- Rising global pressure on the processing industry, driven by the need for processed and packaged food

Market Restraints

- High initial costs hinder widespread adoption of advanced food processing equipment

- Regulatory complexities and adherence to stringent safety standards pose challenges for the market

- Limited availability of skilled workforce for handling advanced food processing machinery

Market Opportunities

- Emerging trends like the green revolution create opportunities for sustainable food processing equipment

- Integration of smart technologies presents new avenues for innovation in the market

- Increasing demand for organic and natural food products opens niche markets

Food Processing Equipment Market Report Coverage

| Market | Food Processing Equipment Market |

| Food Processing Equipment Market Size 2022 | USD 45.3 Billion |

| Food Processing Equipment Market Forecast 2032 | USD 80.5 Billion |

| Food Processing Equipment Market CAGR During 2023 - 2032 | 6.1% |

| Food Processing Equipment Market Analysis Period | 2020 - 2032 |

| Food Processing Equipment Market Base Year |

2022 |

| Food Processing Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Modes of operation, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alfa Laval, BAADER Group, Bühler AG, Equipamientos Cárnicos, S.L. (MAINCA), FENCO Food Machinery s.r.l., GEA Group Aktiengesellschaft, JBT Corporation, Krones AG, LEHUI, Marel, SPX Flow Inc., Tetra Laval International S.A., The Middleby Corporation, TNA Australia Pty Limited., and Bigtem Makine A.S. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Food Processing Equipment Market Insights

The rapidly expanding food and beverage sector worldwide is expected to drive the food processing equipment market. Factors such as increasing disposable income levels, rapid globalization, and the adoption of automated technologies propel the growth of this market. The processing industry is under increasing pressure due to the growing need for processed and packaged food, driven by the rising global population. This anticipation is expected to boost the food processing equipment market during the forecast period.

The increasing focus on health consciousness and dietary shifts in both developed and emerging regions is projected to bolster the development of the food processing equipment market in the coming years. Additionally, numerous government organizations are encouraging food processing equipment producers to enhance their research and development capabilities, which is expected to drive market growth.

Automatic equipment has witnessed higher demand in recent years compared to semi-automatic machinery. Trends such as the green revolution and Industry 4.0 in the manufacturing sector favor automation in the industry, further supporting the growth of the food processing equipment market. Food standards and safety are paramount for the value chain players, requiring adherence to stringent government guidelines and standards.

Food Processing Equipment Market Segmentation

The worldwide market for food processing equipment is split based on modes of operation, type, application, and geography.

Food Processing Equipment Modes of Operations

- Semi-automatic

- Automatic

- Manual

According to the food processing equipment industry analysis, the semi-automatic sector asserts dominance in the market, aligning perfectly with the industry's demand for a balanced blend of efficiency and human control. This operational approach, combining the advantages of automation and manual intervention, offers heightened flexibility in processing diverse food products. As discerned through comprehensive market analysis, the semi-automatic technique ensures precision in crucial production stages while affording operators a hands-on role when needed. Renowned for its adaptability and efficiency, the prevalence of semi-automatic equipment is anticipated to persist, as indicated by positive market forecasts, securing its market dominance in food processing applications.

Food Processing Equipment Types

- Processing

- Pre-processing

As per the food processing equipment market forecast, the processing category unequivocally leads as it encapsulates the fundamental operations crucial for transforming raw materials into consumable products. Serving as the core of food manufacturing, this segment encompasses pivotal phases such as cooking, cutting, and combining. Its prominence is underscored by comprehensive market analysis, emphasizing the critical function it plays in delivering the final food product. This analysis highlights the processing segment's dominance, acknowledging its substantial contribution to the entire food processing chain and recognizing its indispensable role in producing market-ready products.

Food Processing Equipment Applications

- Bakery & Confectionery

- Meat, Poultry, & Seafood

- Beverage

- Dairy

- Fruit, Nut, & Vegetable

- Grains

- Others

Driven by the worldwide affinity for baked goods and confections, the bakery & confectionery segment overwhelmingly dominates the food processing equipment market. This sector experiences rapid expansion owing to the escalating demand for diverse and innovative baked products. The intricate nature of bakery and confectionery processes, involving tasks like mixing, baking, and decorating, demands specialized equipment. As indicated by comprehensive market forecasts, the bakery & confectionery category is poised to maintain its leading market share, propelled by evolving consumer preferences and continuous innovation, solidifying its dominating position in the foreseeable future.

Food Processing Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Food Processing Equipment Market Regional Analysis

In the food processing equipment market, Asia-Pacific is the largest and fastest-growing region. Several significant variables contribute to its supremacy. For starters, the region is seeing a population boom, which is increasing demand for processed food goods. As disposable incomes develop in nations such as China and India, dietary tastes change towards convenience and processed meals, fueling the demand for improved food processing equipment.

Furthermore, Asia-Pacific's growing industrialization and urbanization contribute to the expansion of the food and beverage business. To satisfy expanding production demands, the growing number of food processing plants and facilities necessitates the use of modern and efficient equipment.

The regulatory agencies' emphasis on food safety and quality requirements fuels the region's desire for technologically advanced food processing equipment. To comply with severe requirements, manufacturers are required to invest in novel solutions, pushing market growth.

Despite being the second-largest market, North America maintains a solid position in the food processing equipment market. North America's market is propelled by a well-established food and beverage industry, technological improvements, and a high level of consumer awareness about food safety. Furthermore, the presence of significant market players, as well as ongoing research and development initiatives, add to the region's strong market position.

Food Processing Equipment Market Players

Some of the top food processing equipment companies offered in our report includes Alfa Laval, BAADER Group, Bühler AG, Equipamientos Cárnicos, S.L. (MAINCA), FENCO Food Machinery s.r.l., GEA Group Aktiengesellschaft, JBT Corporation, Krones AG, LEHUI, Marel, SPX Flow Inc., Tetra Laval International S.A., The Middleby Corporation, TNA Australia Pty Limited., Bigtem Makine A.S.

Frequently Asked Questions

How big is the food processing equipment market?

The food processing equipment market size was USD 45.3 billion in 2022.

What is the CAGR of the global food processing equipment market from 2023 to 2032?

The CAGR of food processing equipment is 6.1% during the analysis period of 2023 to 2032.

Which are the key players in the food processing equipment market?

The key players operating in the global market are including Alfa Laval, BAADER Group, B�hler AG, Equipamientos C�rnicos, S.L. (MAINCA), FENCO Food Machinery s.r.l., GEA Group Aktiengesellschaft, JBT Corporation, Krones AG, LEHUI, Marel, SPX Flow Inc., Tetra Laval International S.A., The Middleby Corporation, TNA Australia Pty Limited., and Bigtem Makine A.S.

Which region dominated the global food processing equipment market share?

Asia-Pacific held the dominating position in food processing equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of food processing equipment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global food processing equipment industry?

The current trends and dynamics in the food processing equipment industry include growing health consciousness and dietary changes, government emphasis on research and development drives innovation in the food processing equipment market, increasing adoption of automation, propelled by trends like industry 4.0, supports market growth, and rising global pressure on the processing industry, driven by the need for processed and packaged food, fuels market expansion.

Which modes of operation held the maximum share in 2022?

The semi-automatic modes of operation held the maximum share of the food processing equipment industry.