Food Binders Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Food Binders Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

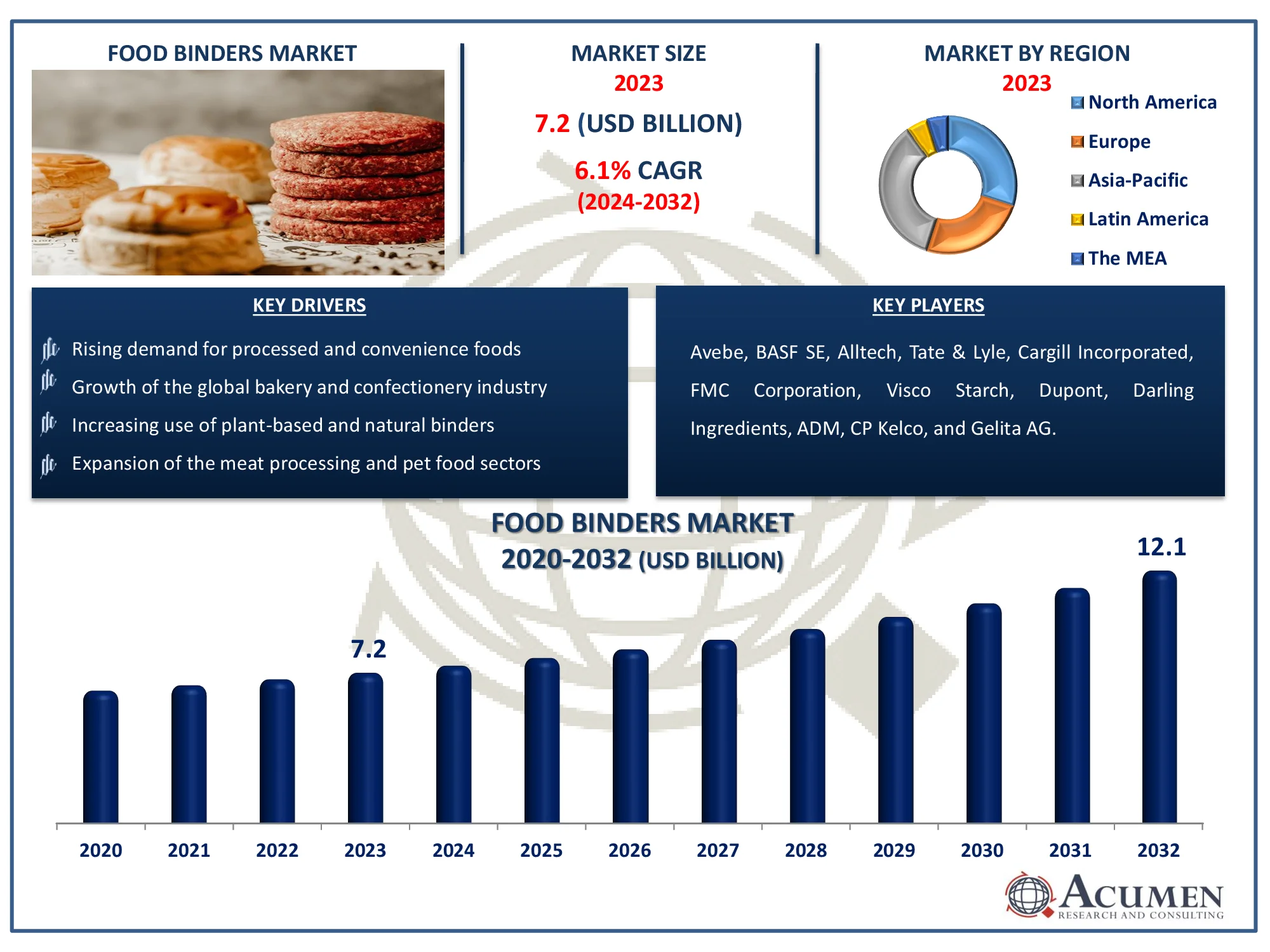

The Global Food Binders Market Size accounted for USD 7.2 Billion in 2023 and is estimated to achieve a market size of USD 12.1 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

Food Binders Market Highlights

- Global food binders market revenue is poised to garner USD 12.1 billion by 2032 with a CAGR of 6.1% from 2024 to 2032

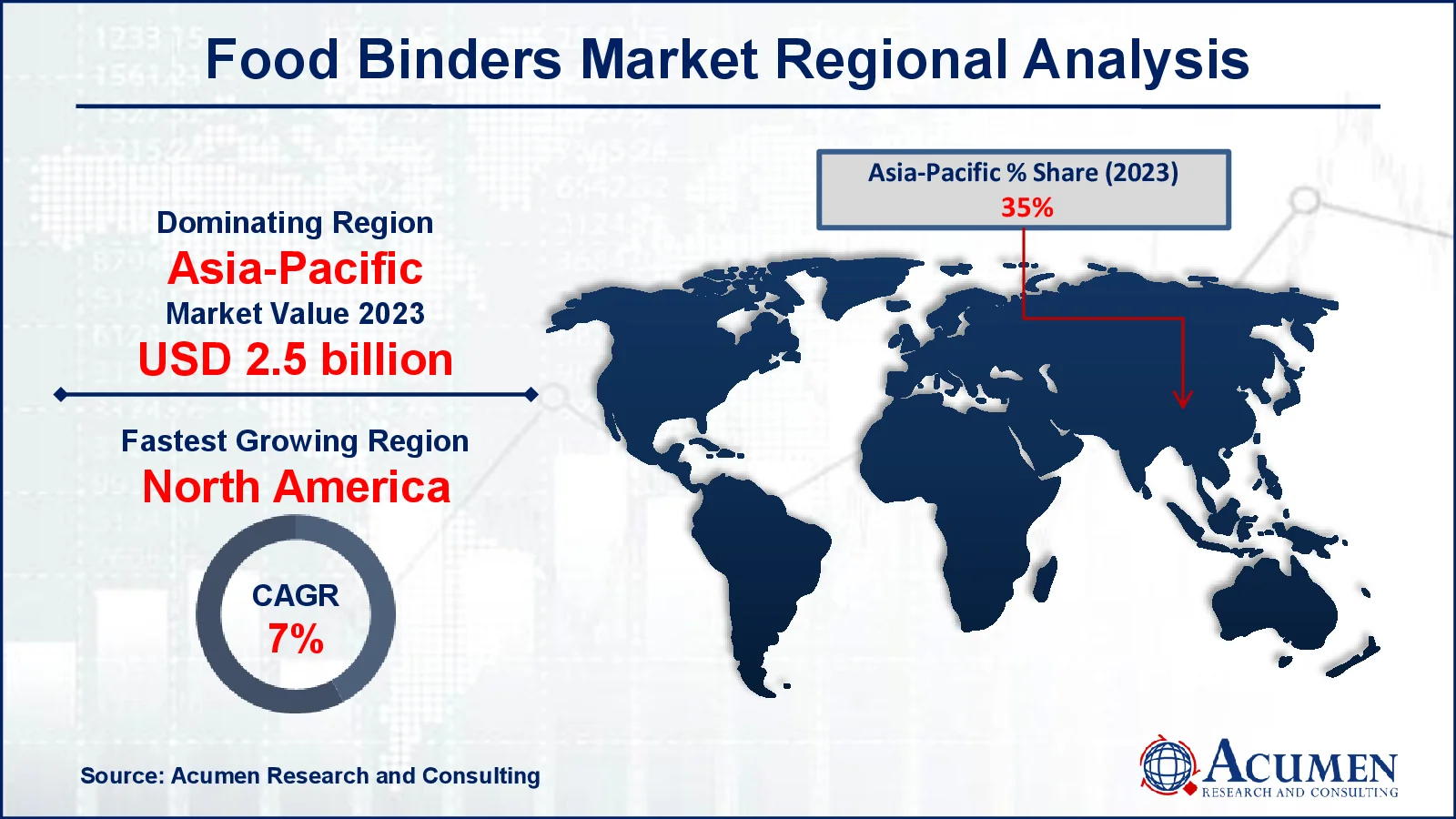

- Asia-Pacific food binders market value occupied around USD 2.5 billion in 2023

- North America food binders market growth will record a CAGR of more than 7% from 2024 to 2032

- Among source, the plant sub-segment generated more than USD 3.7 billion revenue in 2023

- Based on application, the bakery & confectionery sub-segment generated around 34% food binders market share in 2023

- Rising demand for functional foods in emerging markets is a popular food binders market trend that fuels the industry demand

Food binders are food additives which are added to foodstuffs to improve texture through thickening or binding together of the ingredients. Food binders sometimes call themselves food fillers because of their property, without adding any nutritional value, to increase the quantity and mass of a food product. The traditional use of food binders is long overdue. Many found starches act as a food binder naturally. Starches, pectin and agaragar, particularly in desserts and sauces, are common in culinary practices as food binders. Because of the economic viability and superior outcomes, most food binders used naturally derive. In fast foods, meat products and substitutes for meat, dairy products, etc. gums are most commonly used in commercial foods and are relatively low - cost, delivering a product which has superior organoleptic parameters.

Global Food Binders Market Dynamics

Market Drivers

- Rising demand for processed and convenience foods

- Growth of the global bakery and confectionery industry

- Increasing use of plant-based and natural binders

- Expansion of the meat processing and pet food sectors

Market Restraints

- Fluctuating raw material prices affecting production costs

- Health Concerns Over Synthetic Food Binders

- Strict regulatory approvals for food additive usage

Market Opportunities

- Growing consumer preference for clean-label and organic food products

- Expansion of food binders in gluten-free and vegan food formulations

- Innovation in sustainable and eco-friendly binder alternatives

Food Binders Market Report Coverage

| Market | Food Binders Market |

| Food Binders Market Size 2022 |

USD 7.2 Billion |

| Food Binders Market Forecast 2032 | USD 12.1 Billion |

| Food Binders Market CAGR During 2023 - 2032 | 6.1% |

| Food Binders Market Analysis Period | 2020 - 2032 |

| Food Binders Market Base Year |

2022 |

| Food Binders Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Avebe, BASF SE, Alltech, Tate & Lyle, Cargill Incorporated, FMC Corporation, Visco Starch, Dupont, Darling Ingredients, ADM, CP Kelco, and Gelita AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Food Binders Market Insights

In developing countries, the global fast-food industry is fast moving. The growing fast-food chains and a connection to Western culture have led to a prosperous fast-food culture. In the fast-food culture, food binders play an important role in many ways. Most quick food items use food binding devices. For two main reasons, the food binders are used. Firstly, the improved texture and juiciness of fast foods are key features of why people like them. Secondly, the volume should be increased. Secondly, the volume should be increased. Not all food binders increase the volume of foodstuffs, but some of which are mainly used in fast food products, such as carrageenan and cellulose, tend to absorb water and to increase its volume. The addition of only 0.1% carrageenan as a nutrient binder can increase product volume by up to 8%. In addition, food production cannot meet the growing demand for foodstuffs, and so the addition of binders as fillers in the fast-food industry has become standard.

By 2032, the food binding sector is expected to exceed its peak due to the use of animal products. Because of its affinity for liquid content, the product promotes water retention and prevents fat bonding. Because of their high protein content, rising demand for meat products will drive expansion in the industry's binding agent market. In the expected timeline, food binders are expected to increase the market dimension from the processed food application up to 5 percent. Potato starch is widely added to a variety of processed foods, including packaged desserts, rice fromage, hot dogs, chips and instant soups, due to its neutral taste, volume improvement and strong binding properties. Growing demand for packaged food products will boost the demand for the potato hive because of the hectic working schedule and the changing lifestyle, thereby increasing industry growth.

Food Binders Market Segmentation

The worldwide market for food binders is split based on type, source, application, and geography.

Food Binders Market By Type

- Sugar Type

- Starch Type

- Protein Type

- Gel Type

According to food binders industry analysis, starch is the most common type of food binder. Starches made from corn, wheat, and potatoes are commonly utilized in the food sector due to their flexibility and binding qualities. They serve as thickeners, stabilizers, and emulsifiers in a variety of applications, including sauces, baked goods, and processed meats. Their low cost and ease of availability make them a popular choice among producers, resulting in increased market demand. The flexibility of starches in both traditional and modern food formulations contributes to their dominance in the food binders market.

Food Binders Market By Source

- Plant

- Animal

- Hydrocolloids

Plant-based binders are the largest segment by source, thanks to the increased demand for natural and sustainable components. Consumers are increasingly looking for clean-label products, prompting manufacturers to use plant-based binders like starches, gums, and pectin. These binders are preferred not only for their functioning in food items, but also for their environmentally friendly nature, which is consistent with the current trend toward plant-based diets and ethical consumerism. As plant-based components gain traction around the world, plant-based binders maintain their dominance, particularly in the baking, dairy, and beverage industries.

Food Binders Market By Application

- Bakery & Confectionery

- Beverages

- Dairy & Frozen Desserts

- Sports Nutrition

- Processed Food

- Sauces & Dressings

- Meat Products

The bakery & confectionery segment is predicted to experience the fastest growth in the food binders market forecast period. This can be ascribed to rising disposable incomes and the growing trend of on-the-go munchies. Food binders improve the texture, moisture retention, and shelf life of bakery and confectionery items, making them crucial ingredients in these applications. Furthermore, the growing demand for gluten-free, vegan, and clean-label baked goods has boosted the use of natural binders such as starches and plant-based gums in this industry. Product formulation innovations, as well as the growing popularity of luxury confectionary items, are expected to keep the industry on track for growth in the future years.

Food Binders Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Food Binders Market Regional Analysis

Significant percentage improvements are predicted throughout Asia-Pacific, led by South Korea, India, and Japan. The chemical finds use in kite gum, potato chips, and sweets because of its bonding properties. Growing urbanization, distribution networks, and hypermarkets in the region will boost the garment sector, resulting in market increase for binding agents.

Food binders in Canada, Mexico, and the United States may surpass. Binding agents are used in sports drinks and supplements because of their cohesive characteristics. The region's increased interest in sports as a result of improved awareness of physical fitness will drive demand for additional services. This will increase the industry size of food binders. Brazil's meat consumption is expected to climb significantly. Carrageenan, xanthan, and whey protein concentrates are utilized to bind fat and retain moisture in emulsified meat products. The rising consumption of sausages as food patterns change will drive up demand for products.

Food Binders Market Players

Some of the top food binders companies offered in our report includes Avebe, BASF SE, Alltech, Tate & Lyle, Cargill Incorporated, FMC Corporation, Visco Starch, Dupont, Darling Ingredients, ADM, CP Kelco, and Gelita AG.

Frequently Asked Questions

How big is the food binders market?

The food binders market size was valued at USD 7.2 billion in 2023.

What is the CAGR of the global food binders market from 2024 to 2032?

The CAGR of food binders is 6.1% during the analysis period of 2024 to 2032.

Which are the key players in the food binders market?

The key players operating in the global market are including Avebe, BASF SE, Alltech, Tate & Lyle, Cargill Incorporated, FMC Corporation, Visco Starch, Dupont, Darling Ingredients, ADM, CP Kelco, and Gelita AG.

Which region dominated the global food binders market share?

Asia-Pacific held the dominating position in food binders industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of food binders during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global food binders industry?

The current trends and dynamics in the food binders industry include rising demand for processed and convenience foods, growth of the global bakery and confectionery industry, increasing use of plant-based and natural binders, and expansion of the meat processing and pet food sectors.

Which source held the maximum share in 2023?

The plant source held the maximum share of the food binders industry.