Fluticasone Propionate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Fluticasone Propionate Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Fluticasone Propionate Market Size accounted for USD 4.13 Billion in 2023 and is estimated to achieve a market size of USD 6.97 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

Fluticasone Propionate Market Highlights

- The global fluticasone propionate market is projected to reach USD 6.97 Billion by 2032, with a CAGR of 6.1% from 2024 to 2032

- According to American Thoracic Society, chronic obstructive pulmonary disease (COPD) is the fourth leading cause of death worldwide, and its incidence

- continues to rise. Lung cancer remains the most deadly form of cancer globally, claiming over 1.4 billion lives each year

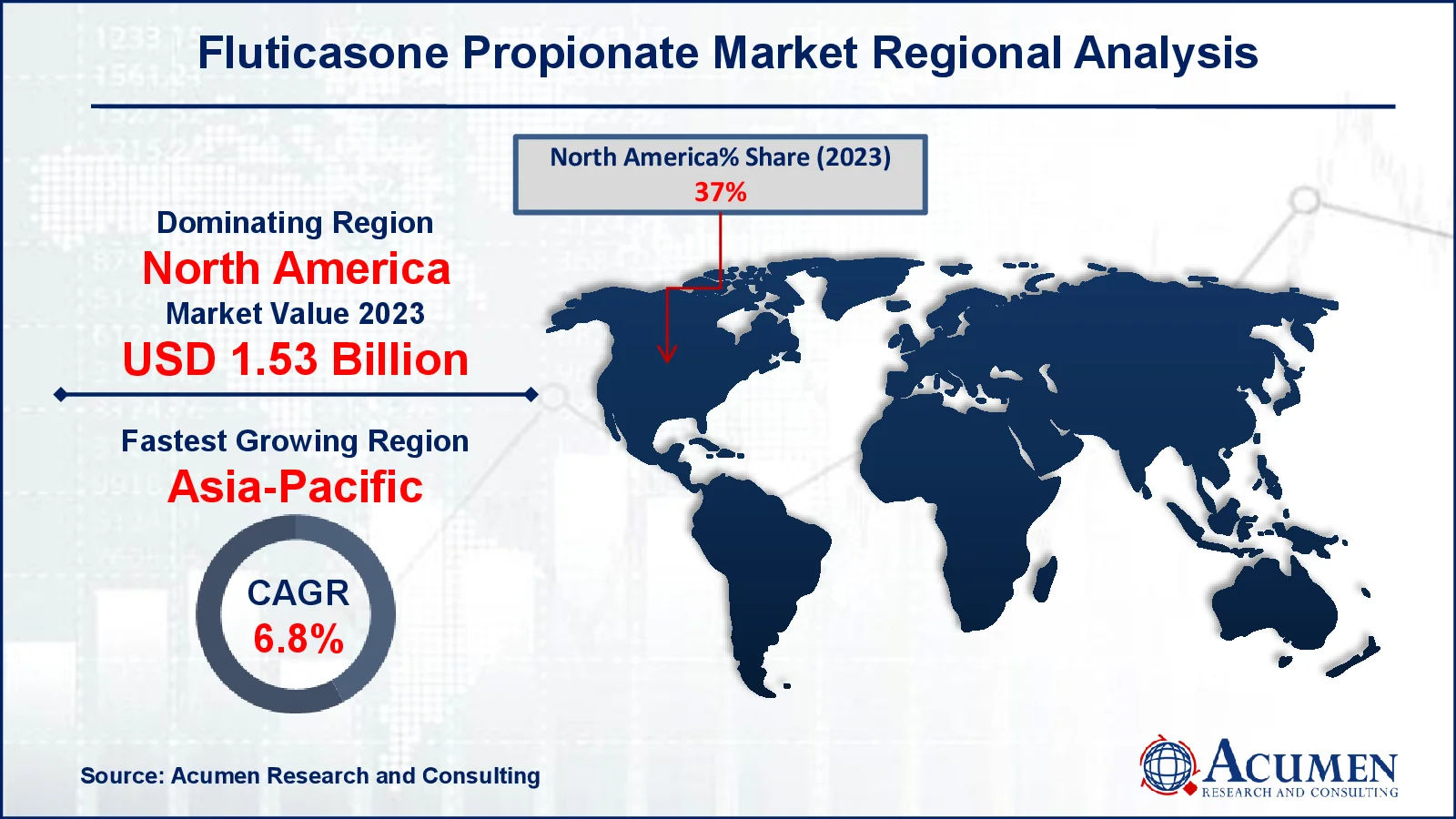

- In 2023, the North American fluticasone propionate market held a value of approximately USD 1.53 billion

- The Asia-Pacific region is expected to grow at a CAGR of over 6.8% from 2024 to 2032

- Increasing awareness of preventive respiratory care is the fluticasone propionate market trend that fuels the industry demand

Fluticasone propionate is a synthetic corticosteroid that reduces inflammation and suppresses the immune system. It is often used to treat respiratory disorders such as asthma and chronic obstructive pulmonary disease (COPD) with inhalers. It is also used as a nasal spray to treat allergic rhinitis symptoms, such as nasal congestion and sneezing. Topical lotions and ointments containing fluticasone propionate are useful for treating eczema and psoriasis. Its versatility in addressing inflammation makes it a popular medicine for respiratory and skin uses.

Global Fluticasone Propionate Market Dynamics

Market Drivers

- Increasing prevalence of respiratory diseases like asthma and COPD

- Growing awareness about allergic conditions and effective treatments

- Advancements in drug delivery systems, such as inhalers and nasal sprays

Market Restraints

- Side effects associated with long-term corticosteroid use

- Availability of alternative treatments and generic competition

- Strict regulatory requirements for corticosteroid products

Market Opportunities

- Expansion in emerging markets with rising healthcare expenditure

- Development of advanced formulations for better patient compliance

- Increasing demand for over-the-counter allergy relief products

Fluticasone Propionate Market Report Coverage

|

Market |

Fluticasone Propionate Market |

|

Fluticasone Propionate Market Size 2023 |

USD 4.13 Billion |

|

Fluticasone Propionate Market Forecast 2032 |

USD 6.97 Billion |

|

Fluticasone Propionate Market CAGR During 2024 - 2032 |

6.1% |

|

Fluticasone Propionate Market Analysis Period |

2020 - 2032 |

|

Fluticasone Propionate Market Base Year |

2023 |

|

Fluticasone Propionate Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product Type, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Glenmark Pharmaceuticals Ltd., Cipla Limited, Teva Pharmaceutical Industries Ltd., Apotex Inc., Pfizer Inc., Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, GlaxoSmithKline plc, Mylan N.V., and Perrigo Company plc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fluticasone Propionate Market Insights

The increased prevalence of respiratory disorders like asthma and chronic obstructive pulmonary disease (COPD) is driving up demand for fluticasone propionate. According to the Centers for Disease Control and Prevention, asthma prevalence is increasing in the United States, with 14,690,043 females and 10,273,831 males affected by 2021. As pollution levels and lifestyle-related respiratory disorders rise, more patients will require effective anti-inflammatory medicines. According to the National Institute of Environmental Health Sciences, air pollution causes more than 6.5 million fatalities worldwide each year, a figure that has increased over the last two decades. It can damage lung growth and contribute to the development of respiratory disorders such as emphysema, asthma, and chronic obstructive pulmonary disease. As a result, fluticasone propionate inhalers are widely utilized for long-term treatment of various chronic illnesses, which fuels market growth.

Awareness of allergic rhinitis and other respiratory allergies is growing, resulting in a greater demand for nasal sprays containing fluticasone propionate. For example, in May 2023, Bausch Health Companies Inc. reported that Health Canada has approved its RYALTRIS nasal spray to treat nasal allergies in adolescents, children, and adults. This trend drives market expansion as people look for effective and convenient over-the-counter and prescription choices.

Long-term usage of corticosteroids, such as fluticasone propionate, might result in reduced immunological response, hormonal abnormalities, and skin thinning. These safety concerns may cause healthcare practitioners to be cautious regarding long-term prescriptions. Furthermore, patients may seek alternate treatments to avoid these potential side effects.

In February 2022, GLENMARK PHARMACEUTICALS LTD., in conjunction with SaNOtize, launched Nitric Oxide Nasal Spray (FabiSpray) in India to treat adult COVID-19 patients. Such activities by manufacturers are projected to propel market expansion in the future years. This breakthrough could also benefit the fluticasone propionate market, as demand for nasal sprays and respiratory treatments continue to climb.

Fluticasone Propionate Market Segmentation

The worldwide market for fluticasone propionate is split based on product type, application, end-user, and geography.

Fluticasone Propionate Market By Product Type

- Inhalers

- Nasal Spray

- Creams and Ointments

According to the fluticasone propionate industry analysis, inhalers are quickly expanding in the market, owing to their widespread usage in treating respiratory disorders such as asthma and chronic obstructive pulmonary disease (COPD). Inhalers administer medication directly to the lungs, making them more effective in managing respiratory problems. They are particularly popular due to their convenience, portability, and ease of use, making them the best choice for long-term asthma and COPD care. Nasal sprays are commonly used to treat allergic rhinitis and other nasal inflammations. Creams and ointments are used to treat dermatological disorders such as eczema and psoriasis.

Fluticasone Propionate Market By Application

- Asthma

- Allergic Rhinitis

- Dermatitis

- Chronic Obstructive Pulmonary Disease (COPD)

- Others

Asthma is the leading application in the fluticasone propionate market, this is primarily due to the great prevalence of the illness and the efficacy of fluticasone-based inhalers in treating chronic symptoms. The inhalation method enables for focused administration to the lungs, which reduces inflammation and relieves asthma attacks. This focused approach has made fluticasone propionate the favored asthma treatment option among healthcare practitioners. Nasal sprays are used to treat allergic rhinitis, and they have a considerable but specialized market share. Dermatitis is treated with creams and ointments, which account for a lesser portion due to its low prevalence. COPD employs inhalers but has a lesser market than asthma due to the lower illness prevalence.

Fluticasone Propionate Market By End-User

- Hospitals

- Clinics

- Home Care Settings

- Pharmaceutical Companies

According to the fluticasone propionate market forecast, hospitals are dominant because they address acute respiratory diseases and establish treatment regimens for chronic conditions such as asthma and COPD. Clinics monitor patients attentively, providing continuous care and medicines for allergic rhinitis and dermatitis. Home care settings are quickly expanding due to the ease and growing inclination for at-home management of chronic respiratory disorders. Pharmaceutical businesses manufacture and distribute fluticasone propionate medicines. They also boost market expansion by doing research and development on new formulations and drug delivery methods.

Fluticasone Propionate Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Fluticasone Propionate Market Regional Analysis

For several reasons, North America dominates the fluticasone propionate market because of the high frequency of respiratory illnesses such as asthma and COPD. Furthermore, a strong pharmaceutical presence and ongoing product innovation help to drive market leadership in this region. In April 2023, Apotex Inc. announced that it has received a Drug Shortage Assistance Award from the United States Food and Drug Administration (FDA) for its significant efforts to alleviate a varenicline tablet shortage. This trend may also help to grow the fluticasone propionate market in the United States, as the resolution of drug shortages improves healthcare providers' trust in generic pharmaceuticals, thereby increasing demand for alternative respiratory therapies, including fluticasone propionate.

The fluticasone propionate market in Asia-Pacific is rapidly expanding as a result of rising urbanization, pollution levels, and respiratory disease cases. The Union Health Ministry of India held a Joint Monitoring Group (JMG) meeting in January 2025 to monitor respiratory infections in India and China. This improved surveillance and monitoring of respiratory problems may result in increased awareness and early detection, thereby driving demand for respiratory therapies such as fluticasone propionate, which is routinely used to treat chronic respiratory diseases like asthma and COPD.

Fluticasone Propionate Market Players

Some of the top fluticasone propionate companies offered in our report Glenmark Pharmaceuticals Ltd., Cipla Limited, Teva Pharmaceutical Industries Ltd., Apotex Inc., Pfizer Inc., Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, GlaxoSmithKline plc, Mylan N.V., and Perrigo Company plc.

Frequently Asked Questions

How big is the fluticasone propionate market?

The fluticasone propionate market size was valued at USD 4.13 Billion in 2023.

What is the CAGR of the global fluticasone propionate market from 2024 to 2032?

The CAGR of fluticasone propionate is 6.1% during the analysis period of 2024 to 2032.

Which are the key players in the fluticasone propionate market?

The key players operating in the global market are including Glenmark Pharmaceuticals Ltd., Cipla Limited, Teva Pharmaceutical Industries Ltd., Apotex Inc., Pfizer Inc., Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, GlaxoSmithKline plc, Mylan N.V., and Perrigo Company plc.

Which region dominated the global fluticasone propionate market share?

North America held the dominating position in fluticasone propionate industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of fluticasone propionate during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global fluticasone propionate industry?

The current trends and dynamics in the fluticasone propionate industry include increasing prevalence of respiratory diseases like asthma and COPD, growing awareness about allergic conditions and effective treatments, and advancements in drug delivery systems, such as inhalers and nasal sprays.

Which product type held the maximum share in 2023?

The inhalers product type held the maximum share of the fluticasone propionate industry.