Flexible Plastic Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

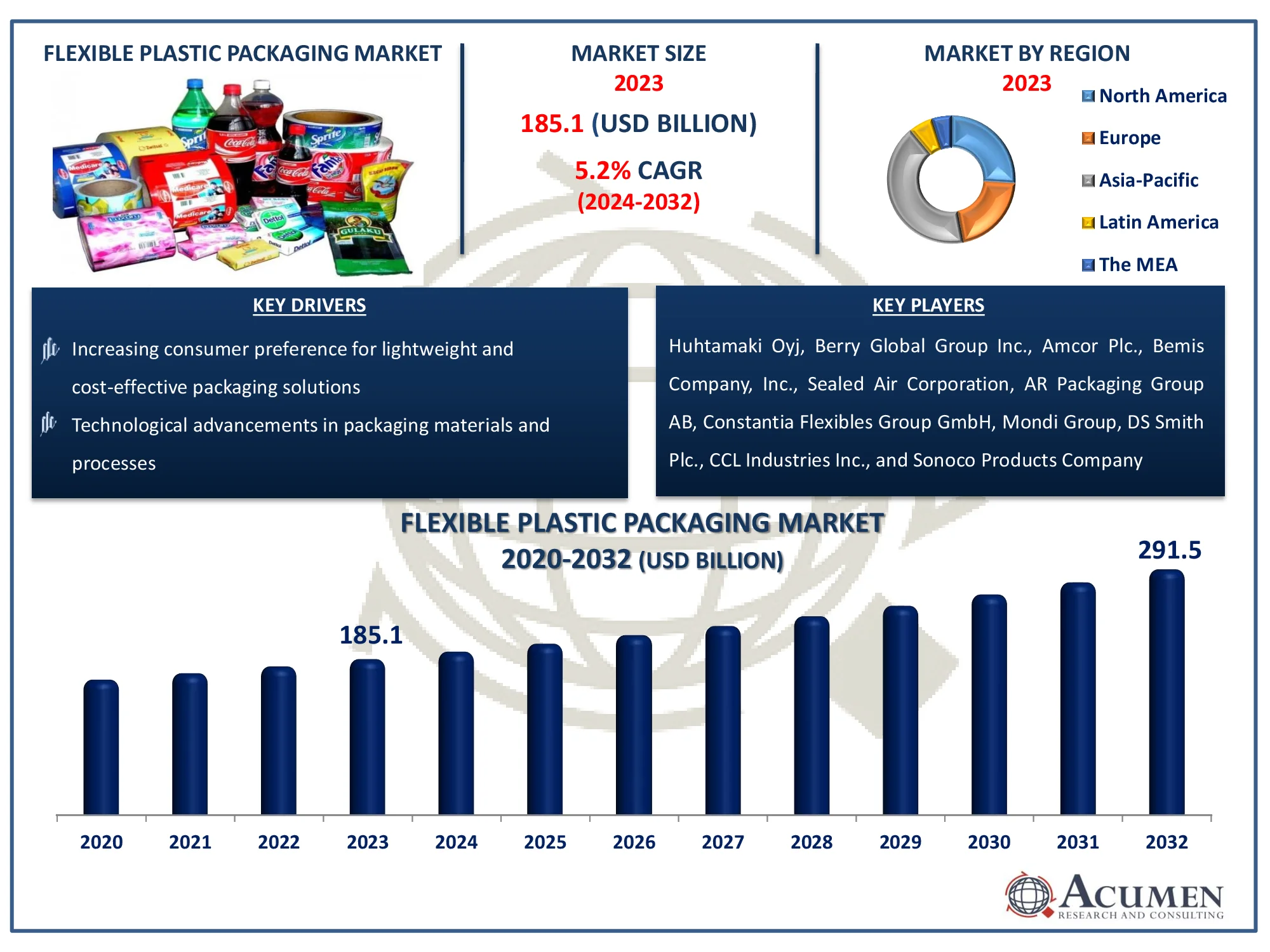

The Flexible Plastic Packaging Market Size accounted for USD 185.1 Billion in 2023 and is estimated to achieve a market size of USD 291.5 Billion by 2032 growing at a CAGR of 5.2% from 2024 to 2032.

Flexible Plastic Packaging Market Highlights

- Global flexible plastic packaging market revenue is poised to garner USD 291.5 billion by 2032 with a CAGR of 5.2% from 2024 to 2032

- Asia-Pacific flexible plastic packaging market value occupied around USD 77.7 billion in 2023

- Asia-Pacific flexible plastic packaging market growth will record a CAGR of more than 6% from 2024 to 2032

- Among material, the polyethylene sub-segment generated noteworthy revenue in 2023

- Based on application, the pharmaceutical & healthcare sub-segment generated significant flexible plastic packaging market share in 2023

- Increasing demand for sustainable and eco-friendly packaging solutions is a popular flexible plastic packaging market trend that fuels the industry demand

Flexible plastic packaging refers to packaging materials made from plastic films and sheets that can bend, stretch, or conform to various shapes. Unlike rigid packaging, which maintains a fixed shape, flexible packaging adapts to the product’s form and can be easily sealed and reshaped. This category includes materials such as plastic bags, pouches, wraps, and liners, often used for food, beverages, personal care products, and household items. Advantages of flexible plastic packaging include its lightweight nature, which reduces shipping costs, and its ability to provide a barrier against moisture, light, and oxygen, extending product shelf life. It also offers convenience features like resealability and easy storage. Sustainable practices are increasingly emphasized in the industry, with a focus on recyclable and biodegradable materials to address environmental concerns.

Global Flexible Plastic Packaging Market Dynamics

Market Drivers

- Rising demand for convenience foods and beverages

- Increasing consumer preference for lightweight and cost-effective packaging solutions

- Growth in e-commerce and online retailing

- Technological advancements in packaging materials and processes

Market Restraints

- Environmental concerns over plastic waste and recyclability

- Stringent regulations and policies regarding plastic usage

- Volatility in raw material prices

Market Opportunities

- Development of biodegradable and recyclable packaging solutions

- Expansion into emerging markets with growing consumer bases

- Innovations in smart packaging technologies

Flexible Plastic Packaging Market Report Coverage

| Market | Flexible Plastic Packaging Market |

| Flexible Plastic Packaging Market Size 2022 |

USD 185.1 Billion |

| Flexible Plastic Packaging Market Forecast 2032 | USD 291.5 Billion |

| Flexible Plastic Packaging Market CAGR During 2023 - 2032 | 5.2% |

| Flexible Plastic Packaging Market Analysis Period | 2020 - 2032 |

| Flexible Plastic Packaging Market Base Year |

2022 |

| Flexible Plastic Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Material, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Huhtamaki Oyj, Berry Global Group Inc., Amcor Plc., Bemis Company, Inc., Sealed Air Corporation, AR Packaging Group AB, Constantia Flexibles Group GmbH, Mondi Group, DS Smith Plc., CCL Industries Inc., and Sonoco Products Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Flexible Plastic Packaging Market Insights

Increasing Consumer Preference for Lightweight and Cost-Effective Packaging Solutions Drives the Flexible Plastic Packaging Market Growth

The flexible plastic packaging market benefits significantly from the growing consumer preference for lightweight and cost-effective packaging solutions. Flexible plastics, such as films and pouches, are inherently lighter than rigid alternatives, which reduces transportation costs and lowers the overall environmental impact associated with shipping. Additionally, flexible packaging often requires less material to achieve the same protective qualities, leading to cost savings for manufacturers and retailers. This efficiency in material usage not only appeals to cost-conscious businesses but also aligns with consumer desires for affordable products. The flexibility in design and functionality allows for innovative packaging solutions that enhance product appeal and convenience, further driving demand in various sectors, including food and beverages, personal care, and pharmaceuticals.

Environmental Concerns Over Plastic Waste and Recyclability is a Major Concern Restricting the Industry Growth

A significant restraint on the flexible plastic packaging market is the growing environmental concern regarding plastic waste and recyclability. Flexible plastic materials, while versatile and efficient, contribute to environmental challenges due to their durability and difficulty in recycling. Many flexible packaging solutions are not readily recyclable through conventional methods, leading to increased landfill waste and potential ecological harm. The persistence of plastic in the environment raises public awareness and regulatory pressure, prompting calls for more sustainable practices. This scrutiny can affect market dynamics as companies are pressured to seek alternatives or invest in more complex recycling technologies to mitigate environmental impacts.

Development of Biodegradable and Recyclable Packaging Solutions Creates Surplus Opportunity for the Market

An emerging opportunity in the flexible plastic packaging market is the development of biodegradable and recyclable packaging solutions. As environmental regulations tighten and consumer awareness grows, there is a rising demand for packaging that minimizes ecological footprints. Companies have the opportunity to innovate by creating flexible packaging materials that decompose naturally or can be easily recycled. Advances in bioplastics and sustainable material technologies offer potential pathways to address environmental concerns while meeting consumer expectations for eco-friendly products. This shift not only enhances corporate responsibility but also provides a competitive edge in a market increasingly driven by sustainability.

Flexible Plastic Packaging Market Segmentation

The worldwide market for flexible plastic packaging is split based on product, material application, and geography.

Flexible Plastic Packaging Products

- Pouches

- Rollstock

- Films & Wraps

- Bags

- Others

According to flexible plastic packaging industry analysis, the pouches segment is the dominant category. Pouches are preferred due to their versatility, convenience, and effectiveness in preserving product freshness. They are widely used for packaging food, beverages, personal care products, and pharmaceuticals because they offer excellent barrier properties, ease of use, and a variety of design options. Their lightweight nature and space efficiency contribute to reduced shipping costs and improved shelf appeal. Additionally, advancements in pouch technology, including resealable and stand-up options, have enhanced their functionality and consumer appeal, solidifying their position as a leading choice in the flexible packaging industry.

Flexible Plastic Packaging Materials

- Polyethylene

- Polypropylene

- Polyamine

- Polyvinyl chloride

- Polystyrene

- Others

In the flexible plastic packaging market, polyethylene holds a leading position due to its remarkable properties and versatility. This material is favored for its strength, flexibility, and resistance to moisture, making it ideal for a wide range of applications. Polyethylene's ability to form durable, yet lightweight packaging solutions has made it a go-to choice for products across various sectors, including food and beverages, personal care, and household goods. Its cost-effectiveness and ease of processing further enhance its appeal. Additionally, advancements in polyethylene formulations, such as improved barrier properties and recyclability, have solidified its dominance in the market, catering to both functional needs and growing environmental concerns.

Flexible Plastic Packaging Applications

- Food & Beverage

- Pharmaceutical & Healthcare

- Personal Care & Cosmetics

- Others

In the flexible plastic packaging market, the pharmaceutical & healthcare segment is anticipated to capture the largest share. This sector increasingly relies on flexible packaging due to its ability to provide superior protection against contamination and environmental factors. The need for precise dosing, tamper-evidence, and sterile packaging solutions drives the demand for flexible materials in this industry. Flexible packaging options, such as pouches and blister packs, offer benefits like enhanced product safety, extended shelf life, and user convenience. Moreover, the growing emphasis on patient compliance and the rise in healthcare product consumption further contribute to the segment's expansion. As innovations continue to emerge in pharmaceutical packaging, the demand for flexible solutions in healthcare is set to increase significantly.

Flexible Plastic Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Flexible Plastic Packaging Market Regional Analysis

Asia-Pacific is poised to be a highly attractive region for flexible plastic packaging manufacturers, particularly due to its burgeoning economies such as China, Japan, and India. These rapidly growing markets offer several advantages that make them appealing for production and investment. The region’s abundance of raw materials, combined with their low cost, provides manufacturers with an opportunity to establish production facilities close to these resources, thereby reducing logistics and material costs. This strategic positioning not only lowers operational expenses but also enhances supply chain efficiency. Secondly, the region benefits from comparatively lower labor costs, which significantly reduces production expenses and increases profitability for manufacturers. This economic advantage allows companies to invest in advanced technologies and expand their operations.

Moreover, Asia-Pacific is recognized as the largest market for beverages globally. This prominence in the beverage sector creates substantial demand for flexible packaging solutions tailored to the industry’s needs. With a diverse range of packaging requirements from convenience pouches to protective wraps manufacturers are presented with numerous opportunities to cater to the growing beverage market. Additionally, the expanding middle class and increasing consumer spending power in these nations drive demand for packaged goods, further boosting the need during flexible plastic packaging market forecast period. The rise in urbanization and changing lifestyles contribute to the higher consumption of packaged foods and beverages, further solidifying Asia Pacific as a key growth region for flexible plastic packaging producers.

Flexible Plastic Packaging Market Players

Some of the top flexible plastic packaging companies offered in our report includes Huhtamaki Oyj, Berry Global Group Inc., Amcor Plc., Bemis Company, Inc., Sealed Air Corporation, AR Packaging Group AB, Constantia Flexibles Group GmbH, Mondi Group, DS Smith Plc., CCL Industries Inc., and Sonoco Products Company.

Frequently Asked Questions

How big is the flexible plastic packaging market?

The flexible plastic packaging market size was valued at USD 185.1 billion in 2023.

What is the CAGR of the global flexible plastic packaging market from 2024 to 2032?

The CAGR of flexible plastic packaging is 5.2% during the analysis period of 2024 to 2032.

Which are the key players in the flexible plastic packaging market?

The key players operating in the global market are including Huhtamaki Oyj, Berry Global Group Inc., Amcor Plc., Bemis Company, Inc., Sealed Air Corporation, AR Packaging Group AB, Constantia Flexibles Group GmbH, Mondi Group, DS Smith Plc., CCL Industries Inc., and Sonoco Products Company.

Which region dominated the global flexible plastic packaging market share?

Asia-Pacific held the dominating position in flexible plastic packaging industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of flexible plastic packaging during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global flexible plastic packaging industry?

The current trends and dynamics in the flexible plastic packaging industry include rising demand for convenience foods and beverages, increasing consumer preference for lightweight and cost-effective packaging solutions, growth in e-commerce and online retailing, and technological advancements in packaging materials and processes.

Which product held the maximum share in 2023?

The pouches product held the significant share of the flexible plastic packaging industry.