Feminine Hygiene Products Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Feminine Hygiene Products Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

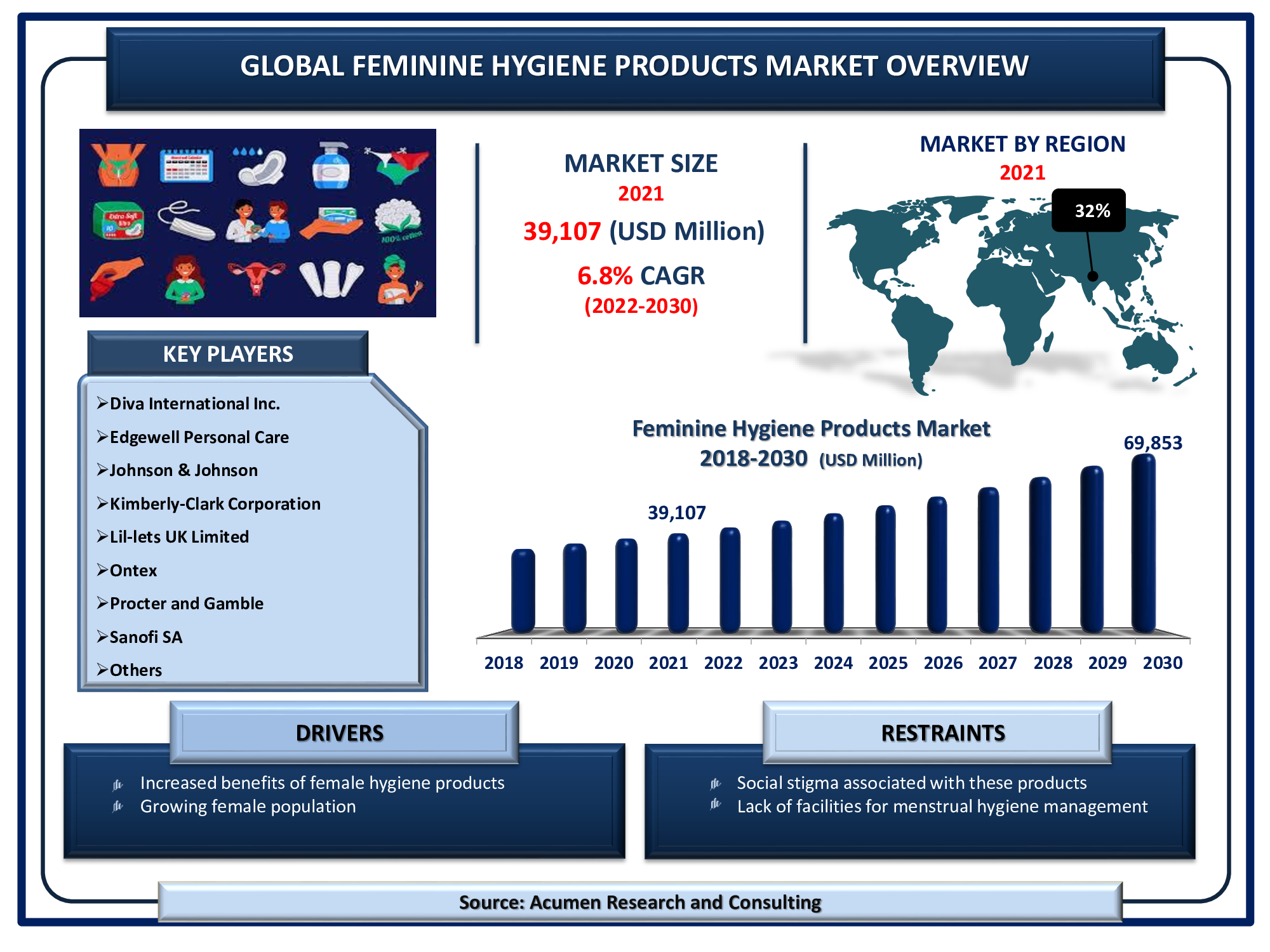

The Global Feminine Hygiene Products Market Size is valued at USD 39,107 Million in 2021 and is projected to reach a market size of USD 69,853 Million by 2030; growing at a CAGR of 6.8%.

Feminine hygiene products have grown over the years. The increasing awareness regarding women’s hygiene is the primary factor boosting the feminine hygiene products market revenue. According to our feminine hygiene products industry analysis, the growing number of women moving towards cities coupled with the rising number of working women is supporting the market growth. Furthermore, improving policies for women's health is anticipated to boost the industry demand throughout the forecast timeframe from 2022 to 2030.

Global Feminine Hygiene Products Market DRO’s:

Market Drivers:

- Increased benefits of female hygiene products

- Growing female population

- Rising urbanization

- Surging hygiene product innovation

Market Restraints:

- The social stigma associated with these products

- Lack of facilities for menstrual hygiene management

Market Opportunities:

- Rising number of the female working population

- Extensive demand from online platforms

- Growing adoption of environmentally friendly feminine products

Report Coverage

| Market | Feminine Hygiene Products Market |

| Market Size 2021 | USD 39,107 Million |

| Market Forecast 2030 | USD 69,853 Million |

| CAGR During 2022 - 2030 | 6.8% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Nature, By Product Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Diva International Inc., Edgewell Personal Care, Johnson & Johnson, Kimberly-Clark Corporation, Lil-lets UK Limited, Ontex, Procter and Gamble, Sanofi SA, Svenska Cellulose Aktiebolaget SCA, and Unicharm Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The increased value of female hygiene products contributes to the industry's growth in the coming years. The right hygiene products can protect women's clothing and surfaces while also providing them with comfort and confidence. Furthermore, using hygiene products can reduce the risk of infection in women. According to one study, poor feminine hygiene can cause a variety of problems, including urinary tract infections, fungal infections, and even reproductive issues. These medical issues can have an impact on a woman's emotional and mental well-being as well as her physical health. As a result, feminine hygiene products have been outgrown for a couple of years.

The growing female population is another factor boosting the feminine hygiene products market value. According to the United Nations World Population Prospects report, the gender ratio of women is improving day by day, and there are currently more than 3.9 billion (49.5 percent) women in the world. This demonstrates that the global demand for hygiene products is rapidly increasing. On the other hand, the growing female youth population is among the most frequent users of hygiene products, which has fueled the demand at a significant rate.

Rising female literacy rates that result in high product awareness will support the market share for feminine hygiene products. In order to improve the management of women's health, international governmental organizations like UNESCO and UNICEF have been working to increase the literacy rates of young women in low- and middle-income countries. In addition, menstrual health and hygiene are also seen by UNICEF as a fundamental right of women and girls, and as such, it has been identified as a key goal in the organization's Sustainable Development Goals (SDGs) for 2030.

However, the social stigma associated with these products has stifled market growth, particularly in emerging markets. According to WASH United gGmbH, 500 million women and girls do not have the resources they need to manage their periods safely, hygienically, and without embarrassment at any given time. Furthermore, a lack of facilities for women's hygiene management is a factor impeding the market growth. Absenteeism is exacerbated by a lack of infrastructure and stigma; in one Kenyan study, 95 percent of menstruating girls missed 1-3 school days, 70% stated a negative impact on their grades, and more than 50% stated falling behind in class due to menstruation. To combat these occurrences, many public and private organizations, as well as female activists, have led grass-roots initiatives and campaigns, including on social media, to confront stigma, taboos, gender inequality, and period poverty.

Feminine Hygiene Products Market Segmentation

The worldwide feminine hygiene products market is split based on nature, product type, distribution channel, and geography.

Market by Nature

- Disposable

- Reusable

According to our forecast for the feminine hygiene products market, disposable feminine hygiene products held the largest share from 2022 to 2030. The majority of women worldwide prefer disposable hygiene products because they are readily available in retail markets. In addition, disposable female hygiene products provide convenience and a lower upfront cost, which drives industry growth. Reusable feminine hygiene products, on the other hand, are in high demand due to their eco-friendliness, multiple uses, soft fabric, and ability to be customized based on size and flow.

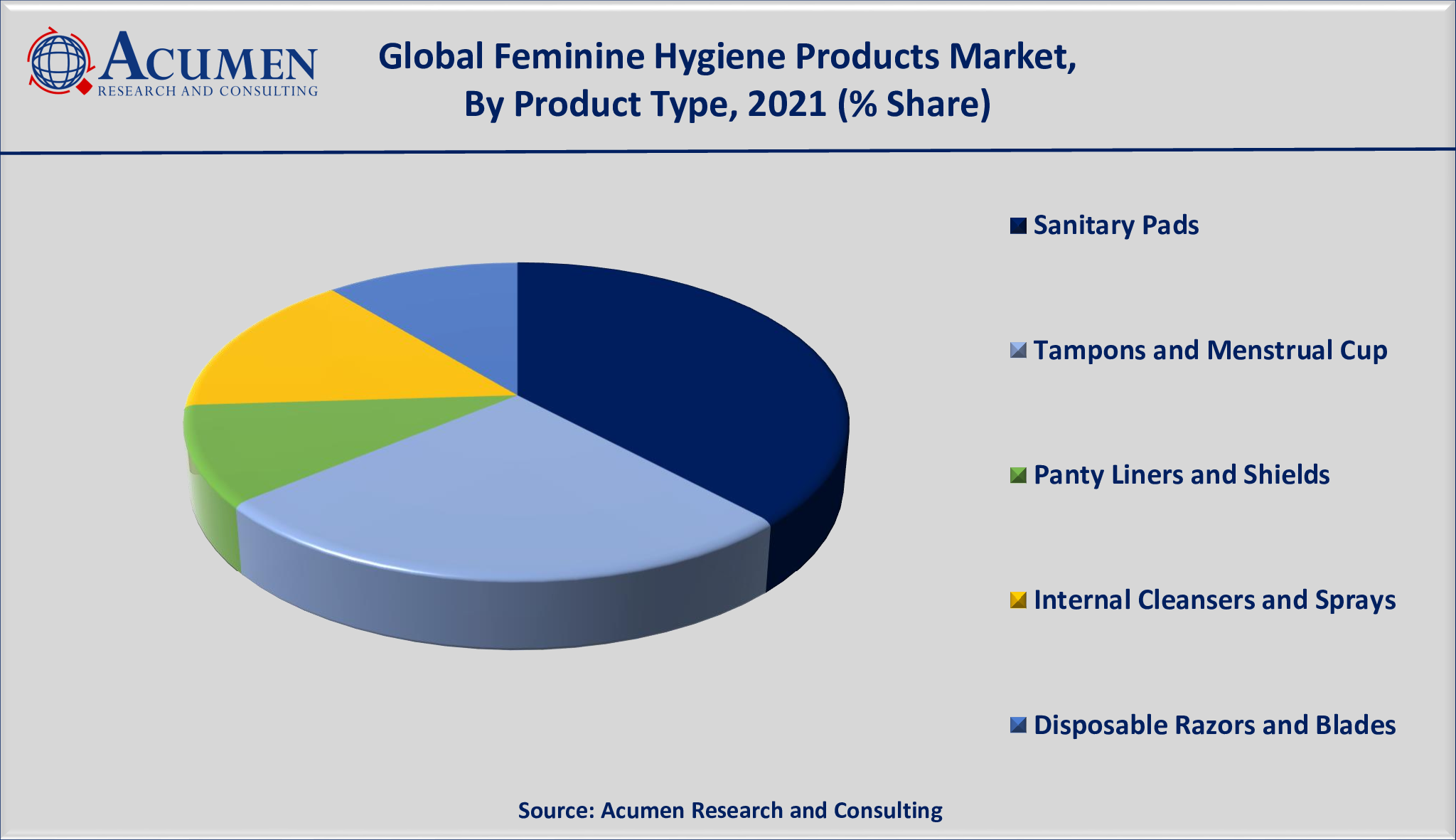

Market by Product Type

- Disposable Razors and Blades

- Internal Cleansers and Sprays

- Panty Liners and Shields

- Sanitary Pads

- Tampons and Menstrual Cups

Based on our feminine hygiene products industry analysis, sanitary pads commanded the maximum market share in 2021 and are projected to do so during the forecasted period 2022 to 2030. The growing number of working women, increasing health concerns and raising awareness about female hygiene. Besides that, aggressive advertisements, increasing government support, and rising literacy levels are other factors boosting the sanitary pads industry. Conversely, the tampons and menstrual cups segment is anticipated to achieve the fastest growth rate (CAGR) in the coming years.

Market by Distribution Channel

- Supermarket/Hypermarket

- Online Store

- Pharmacy

- Others

Among all distribution channels, the supermarket/hypermarket gathered a significant market share throughout the forecasted period. Women’s preference to purchase hygiene items from big retail stores is the primary factor driving the segmental growth. Supermarkets and hypermarkets offer the ability to physically check the product and their specification and since women's hygiene products are intimate items they are very conscious when selecting the suitable product. Thus, this segment dominates the market. However, the online channel is likely to attain the fastest growth due to the increasing options for these products on the online channel and increasing social media advertising which also boosts online sales.

Feminine Hygiene Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The growing population of women’s in Asia-Pacific fuels the regional feminine hygiene products market growth

According to our regional analysis of the feminine hygiene products market, Asia-Pacific is anticipated to hold the largest regional share over the estimated period from 2022 to 2030. The primary factor driving the regional share is the high female population in emerging economies such as China and India. Besides, the rapid urbanization, increasing working women population, rising awareness about personal hygiene, and increased disposable incomes are some of the factors that are boosting the Asia-Pacific feminine hygiene products market revenue.

Furthermore, the North American region will register the fastest growth rate in the coming years. A higher standard of living, higher income levels for women, and better sanitation practices are supporting the North America feminine hygiene products market.

Feminine Hygiene Products Market Players

Some of the top Feminine Hygiene Products companies offered in the professional report include Diva International Inc., Edgewell Personal Care, Johnson & Johnson, Kimberly-Clark Corporation, Lil-lets UK Limited, Ontex, Procter and Gamble, Sanofi SA, Svenska Cellulose Aktiebolaget SCA, and Unicharm Corporation.

Frequently Asked Questions

How much was the estimated value of the global feminine hygiene products market in 2021?

The estimated value of global feminine hygiene products market in 2021 was accounted to be USD 69,853 Million.

What will be the projected CAGR for global feminine hygiene products market during forecast period of 2022 to 2030?

The projected CAGR feminine hygiene products market during the analysis period of 2022 to 2030 is 6.8%.

Which are the prominent competitors operating in the market?

The prominent players of the global feminine hygiene products market are Diva International Inc., Edgewell Personal Care, Johnson & Johnson, Kimberly-Clark Corporation, Lil-lets UK Limited, Ontex, Procter and Gamble, Sanofi SA, Svenska Cellulose Aktiebolaget SCA, and Unicharm Corporation.

Which region held the dominating position in the global feminine hygiene products market?

North America held the dominating feminine hygiene products during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for feminine hygiene products during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global feminine hygiene products market?

Increased benefits of female hygiene products, growing female population, and rising urbanization drives the growth of global feminine hygiene products market.

By nature segment, which sub-segment held the maximum share?

Based on nature, disposable segment held the maximum share feminine hygiene products market in 2021.