Fatty Amines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Fatty Amines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

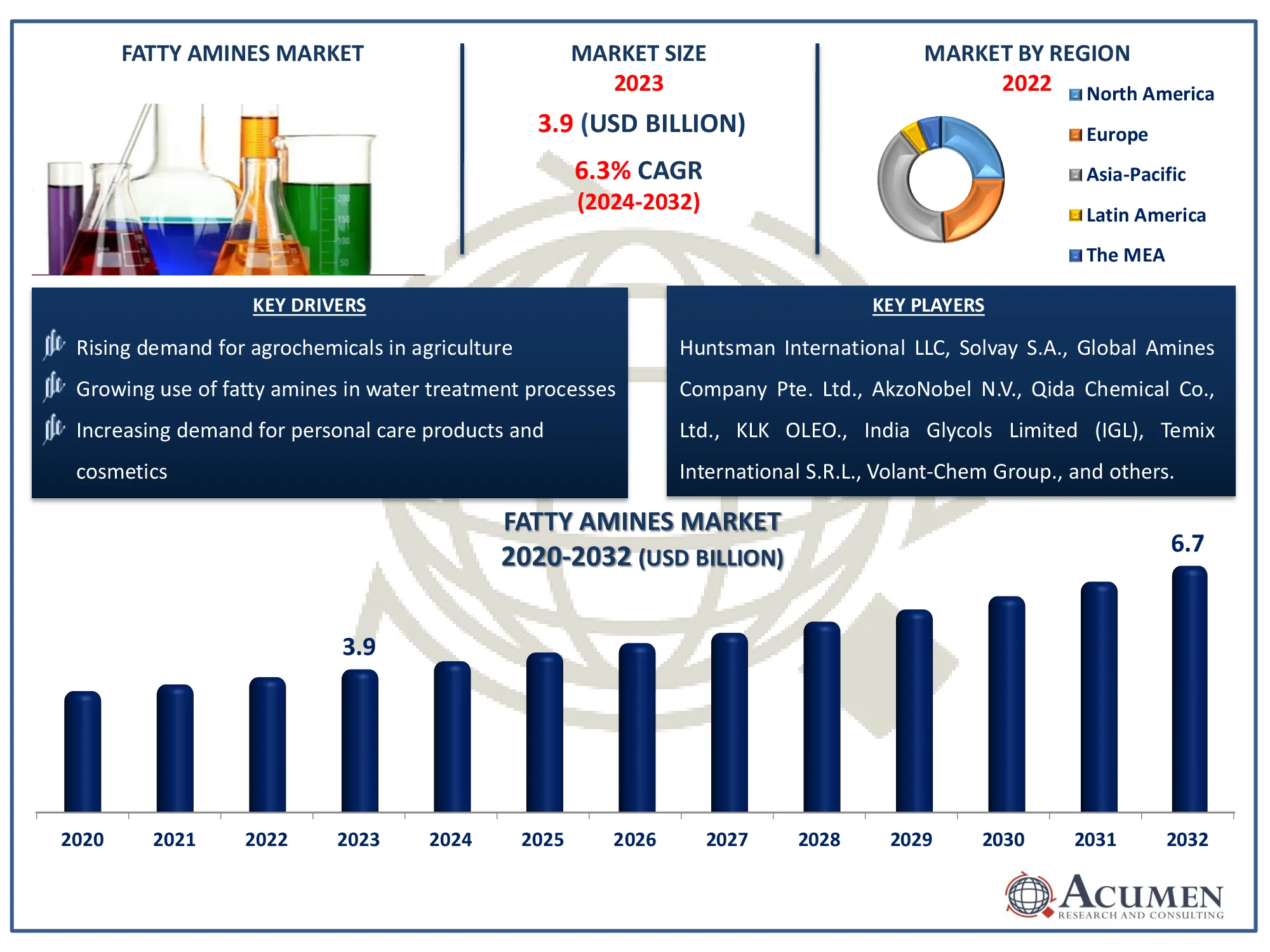

The Global Fatty Amines Market Size accounted for USD 3.9 Billion in 2023 and is estimated to achieve a market size of USD 6.7 Billion by 2032 growing at a CAGR of 6.3% from 2024 to 2032.

Fatty Amines Market (By Product: Tertiary Fatty Amines, Secondary Fatty Amines, Primary Fatty Amines, Gesture Recognition, and IR Detection; By Function: Emulsifiers, Floatation Agents; By Application: Agrochemicals, Personal Care, Anti-caking, Water Treatment, and Others and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Fatty Amines Market Highlights

- The global fatty amines market is expected to reach USD 6.7 billion by 2032, growing at a CAGR of 6.3% from 2024 to 2032

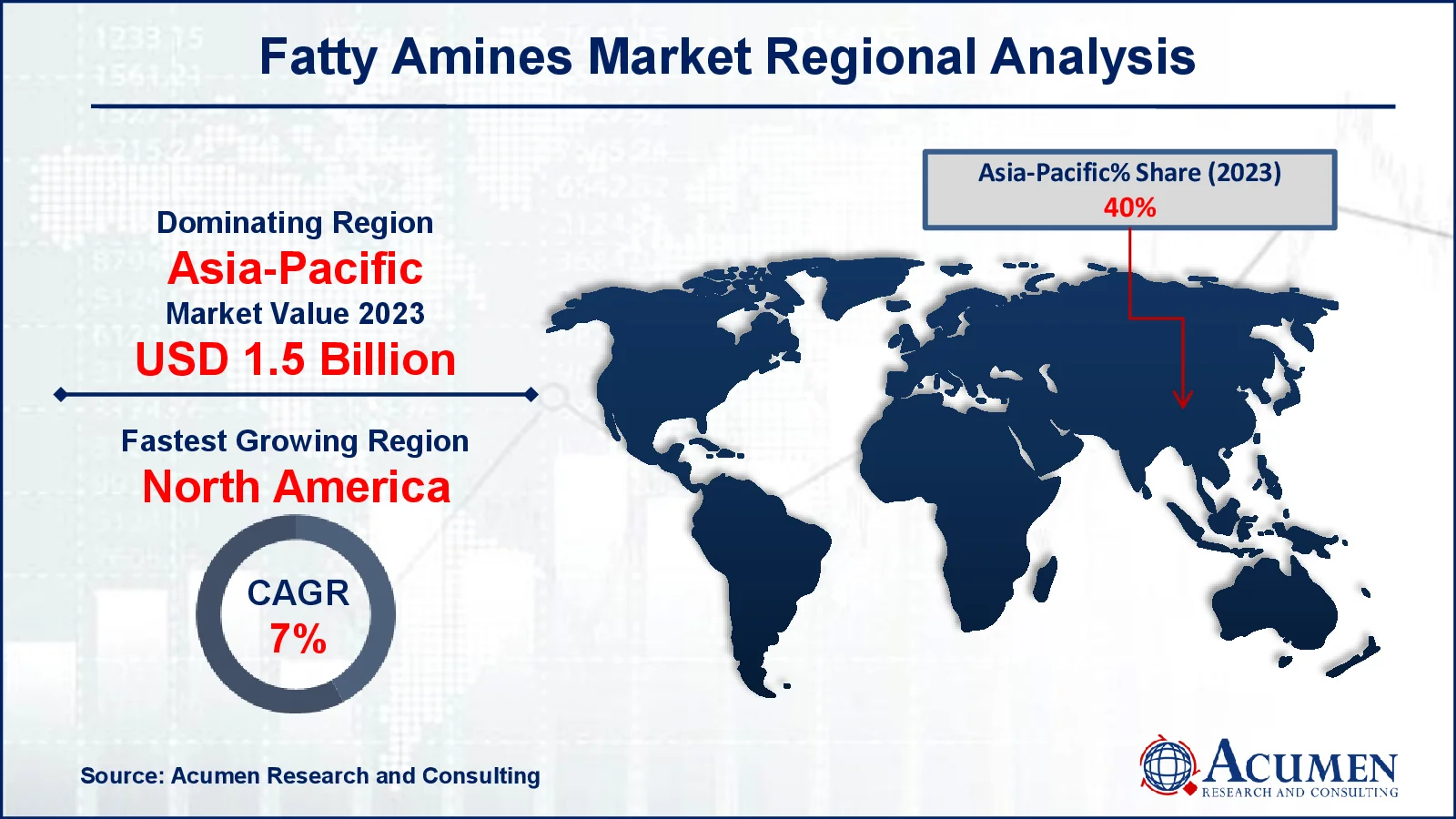

- The Asia-Pacific fatty amines market was valued at approximately USD 1.5 billion in 2023

- North America is projected to grow at a CAGR of over 7% from 2024 to 2032

- Primary fatty amines held 49% of the market share in 2023

- The agrochemicals application segment captured 23% of the market share in 2023

- Expanding applications of fatty amines in the oilfield chemicals sector is the fatty amines market trend that fuels the industry demand

Fatty amines are nitrogen-based derivatives of basic materials such as petrochemicaux, fats, and oils generated from fatty acids or olefines. Fatty amines are either a mixture of carbon chains or a single chain with 8-22 carbons. Fatty amines are employed in a wide range of applications, including water treatment, agrochemicals, petroleum-field chemicals, additives to asphalts, cacking controls, and so on. They are classed as primary, secondary, or tertiary amines based on their chemical structure and are widely used as emulsifiers, surfactants, and corrosion inhibitors. Because of their amphiphilic nature, they are useful in a range of industries, including agriculture (as pesticide adjuvants), water treatment (as flocculants), and personal care (hair conditioners and skin care products). The versatility of fatty amines stems from their ability to modify surfaces and improve chemical processes, making them valuable in a wide range of applications.

Global Fatty Amines Market Dynamics

Market Drivers

- Rising demand for agrochemicals in agriculture

- Growing use of fatty amines in water treatment processes

- Increasing demand for personal care products and cosmetics

Market Restraints

- Volatile raw material prices affecting production costs

- Environmental concerns related to the use of certain fatty amines

- Strict government regulations on chemical manufacturing

Market Opportunities

- Expanding industrial applications in emerging markets

- Development of bio-based fatty amines for sustainable use

- Increasing demand for eco-friendly surfactants in household products

Fatty Amines Market Report Coverage

| Market | Fatty Amines Market |

| Fatty Amines Market Size 2022 |

USD 3.9 Billion |

| Fatty Amines Market Forecast 2032 | USD 6.7 Billion |

| Fatty Amines Market CAGR During 2023 - 2032 | 6.3% |

| Fatty Amines Market Analysis Period | 2020 - 2032 |

| Fatty Amines Market Base Year |

2022 |

| Fatty Amines Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Function, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Huntsman International LLC, Solvay S.A., Global Amines Company Pte. Ltd., AkzoNobel N.V., Qida Chemical Co., Ltd., KLK OLEO., India Glycols Limited (IGL), Temix International S.R.L., Volant-Chem Group., and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Fatty Amines Market Insights

Derivatives and cosmetics are used to manufacture, emulsify, score, and weather a wide range of products, including personalisation, home care, and lubricants. Increased demand for liquid detergent and fabric softeners is expected to boost industrial investment in developed economies. Furthermore, the variables that are likely to offer up growth opportunities during the projection period include raw material costs and availability, as well as reduced toxicity and manufacturing costs.

Because of their high quality, primary fatty amines are expected to be the fastest increasing raw material for secondary and tertiary amines in the future years. Tertiary amines are also employed to boost the need for tertiary fatty amines for ore flotation, fuel modifications, chemical intermediates, and corrosion inhibitors.

Furthermore, tertiary fatty amines were the largest applications sector due to the product's strong demand rise in advanced and developing economies. Furthermore, due to the increased demand for tertiary goods utilized in a variety of end-use products, the US market is likely to continue to expand.

In the paint and coating industries, fatty amines are commonly employed as a multinational efficiency and an epoxy curing agent. Increased construction expenditures in Asia Pacific and Middle Eastern emerging economies are expected to have a beneficial impact on product supply over the previous year, owing to population expansion and strong economic development. Emerging economies have had strong economic growth, providing governments with a large source of funds to spend in public infrastructure such as hospitals, offices, and housing firms. In the coming years, private sector building enterprises in India, China, and the UAE are expected to significantly subsidize building expenditure.

The successful cosmetic sector's demand will play a significant influence in the overall expansion of the international fatty amine market, and enterprises in this sector will always focus on identifying new applications for their products. The growing demand to enhance agricultural product output to fulfill the needs of the world's growing population also contributes to the growth of the global fatty amine sector, as fatty amines are employed in a variety of agrochemical processes.

Fatty Amines Market Segmentation

The worldwide market for fatty amines is split based on product, function, application, and geography.

Fatty Amines Product

- Tertiary Fatty Amines

- Secondary Fatty Amines

- Primary Fatty Amines

According to the fatty amines industry analysis, primary fatty amines dominate market because they are used in a wide range of industries, including water treatment, agrochemicals, and personal care. These amines are extremely versatile, acting as emulsifiers, wetting agents, and corrosion inhibitors, making them indispensable in many compositions. Their high performance in applications such as surfactants and flotation agents boosts demand. Additionally, the growing emphasis on sustainable agriculture and water management has increased the usage of primary fatty amines in important markets.

Fatty Amines Function

- Emulsifiers

- Floatation Agents

- Dispersants

- Chemical Intermediates

- Others

According to the fatty amines industry analysis, emulsifiers shows robust growth since they are widely used in a variety of industries. Emulsifiers are needed for stabilizing oil-water combinations, making them important in personal care, cosmetics, food processing, and medicines. Their ability to create smooth textures and predictable formulations fuels demand, particularly in the thriving personal care and food industries. Furthermore, its adaptability in industrial applications like paints and coatings buildup their market growth.

Fatty Amines Application

- Agrochemicals

- Personal Care

- Anti-caking

- Water Treatment

- Oilfield Chemicals

- Asphalt additives

- Household

- Chemical Synthesis

- Others

According to the fatty amines market forecast, agrochemicals are dominating because they are widely used as emulsifiers, dispersants, and wetting agents in pesticide formulations. Fatty amines boost the efficacy of agrochemicals by increasing their solubility, stability, and adherence to plant surfaces. They are critical in crop protection, helping to boost agricultural productivity. This demand stems from the increased worldwide demand for food and sustainable farming practices.

Fatty Amines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Fatty Amines Market Regional Analysis

For several reasons, Asia-Pacific has been the market leader in nations such as India and China due to its high degree of technology innovation in personal and household care. The Asia-Pacific region has seen an increase in demand for tertiary fatty amines due to their wide range of uses and adaptability, accounting for the majority of the market. Beneficial petrochemical modifications and regulation are expected to stimulate additional product demand during the predicted period. Furthermore, in Japan and developing economies such as China and India, household and personal care consumption has been steadily increasing in recent years and is likely to contribute to the market in the future. For instance, the Indian beauty, personal care, and hygiene market has grown and expanded significantly in recent years. According to India Brand Equity Foundation, India's personal care market is expected to reach $20 billion by 2025.

North America's second largest regional section contains a huge number of detergents and surfactants, which contribute significantly to regional growth. Key players are more likely to adopt innovative items in order to capitalize on previously untapped growth possibilities.

Fatty Amines Market Players

Some of the top fatty amines companies offered in our report include Huntsman International LLC, Solvay S.A., Global Amines Company Pte. Ltd., AkzoNobel N.V., Qida Chemical Co., Ltd., KLK OLEO., India Glycols Limited (IGL), Temix International S.R.L., Volant-Chem Group., and others.

Frequently Asked Questions

How big is the fatty amines market?

The fatty amines market size was valued at USD 3.9 billion in 2023.

What is the CAGR of the global fatty amines market from 2024 to 2032?

The CAGR of fatty amines is 6.3% during the analysis period of 2024 to 2032.

Which are the key players in the fatty amines market?

The key players operating in the global market are including Huntsman International LLC, Solvay S.A., Global Amines Company Pte. Ltd., AkzoNobel N.V., Qida Chemical Co., Ltd., KLK OLEO., India Glycols Limited (IGL), Temix International S.R.L., Volant-Chem Group., and others.

Which region dominated the global fatty amines market share?

Asia-Pacific held the dominating position in fatty amines industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of fatty amines during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global fatty amines industry?

The current trends and dynamics in the fatty amines industry include rising demand for agrochemicals in agriculture, growing use of fatty amines in water treatment processes, and increasing demand for personal care products and cosmetics.

Which product held the maximum share in 2023?

The primary fatty amines product held the maximum share of the fatty amines industry.