Exosomes Market

Published :

Report ID:

Pages :

Format :

Exosomes Market

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

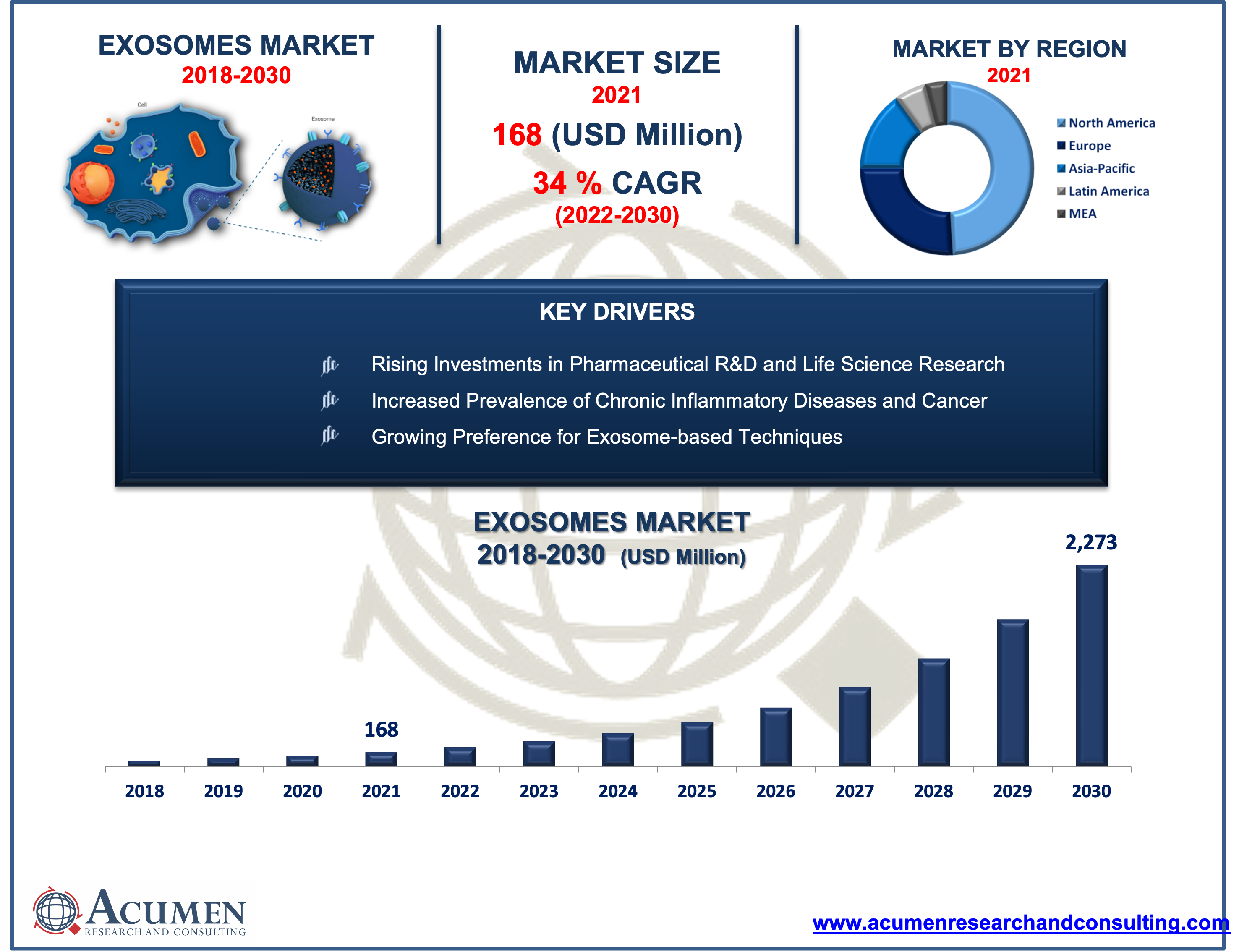

The Global Exosomes Market accounted for US$ 168 Mn in 2021 and is expected to reach US$ 2,273 Mn by 2030 with a considerable CAGR of 34% during the forecast timeframe of 2022 to 2030.

Exosomes are nano-sized vesicles secreted by specialized cells that contain a variety of biomolecules such as nucleic acids or proteins. Exosomes are a form of extracellular vesicle derived from cells that are generally 30-150 nm in diameter, making them the tiniest type of intracellular vesicle. Exosomes, which are set to release by regenerative cells such as stem cells, are powerful drivers of healing and repair. They are essentially small messengers that transport critical signaling proteins and genetic data from cell to cell. Exosome therapy is responsible for assisting both T-cells and Natural killer cells in the body's immune system, among other things. T-cells are in charge of easing an immune response, whereas NK cells are in charge of amplifying it. This therapy, or a variation of exosome therapies and other interventions, can help with a variety of conditions. It has shown particular potential in the treatment of inflammatory disease, degenerative diseases, autoimmune disorders or fibromyalgia pain, and Lyme disease.

Drivers

· Rising investments in pharmaceutical R&D and life science research

· Increased prevalence of chronic inflammatory diseases

· Growing incidence of cancer

· Growing preference for exosome-based techniques

Restraints

· Absence of standard protocols for the advancement & manufacturing of exosomes

· Lack of awareness and stringent regulation for the approval of the product

Opportunity

· Rising demand for specialized testing services among end-users

· Exosome therapy has proven to be beneficial for COVID 19 disease

Report Coverage

| Market | Exosomes Market |

| Market Size 2021 | US$ 168 Mn |

| Market Forecast 2030 | US$ 2,273 Mn |

| CAGR | 34 % During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2021 - 2028 |

| Segments Covered | By Workflow , By Biomolecule Type, By Application And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Inc., Qiagen, Hitachi Chemical Diagnostics Inc., Fujifilm, Danaher, Illumina, Inc., Lonza, Takara Bio Company, MiltenyiBiotec, Malvern Instruments Ltd., System Biosciences Inc., and MBL International Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Exosomes Market Dynamics

The increase in research & development activities for exosome therapies for the treatment along with the steadily increasing incidence of chronic inflammatory conditions and government funding for the production and development of exosome therapeutic agents is projected to boost the market of the global exosome market. Furthermore, in the event of a pandemic, exosomes can be used as a therapeutic strategy for COVID-19 patients or as an insurer for delivering efficient therapeutic agents. Adipose-derived stem cells (ADSCs) with potent regenerative, immunomodulatory, and exosome therapeutic properties have been proposed as the best treatment option for COVID-19. As a result of the recent COVID-19 pandemic, there seems to be an increase in demand for exosomes, which is driving the market growth. A rise in healthcare spending is expected to create tremendous opportunities for market expansion.

Aside from that, the rising cost of exosome therapeutics, the imposed strict regulations, and the risks associated with their use are some of the constraints that may impede the market growth. Additionally, rising investments, a lack of appropriate procedures for isolating exosomes, and a lack of critical expertise are some of the major challenges that are expected to stymie market growth.

Exosomes Market Segmentation

Market by Workflow

· Downstream Analysis

o Protein analysis using Blotting & ELISA

o Cell Surface Marker Analysis using Flow Cytometry

o Proteomic analysis using Mass Spectrometry

o RNA analysis with NGS & PCR

o Others

· Isolation Methods

o Ultracentrifugation

o Precipitation

o Immunocapture on Beads

o Filtration

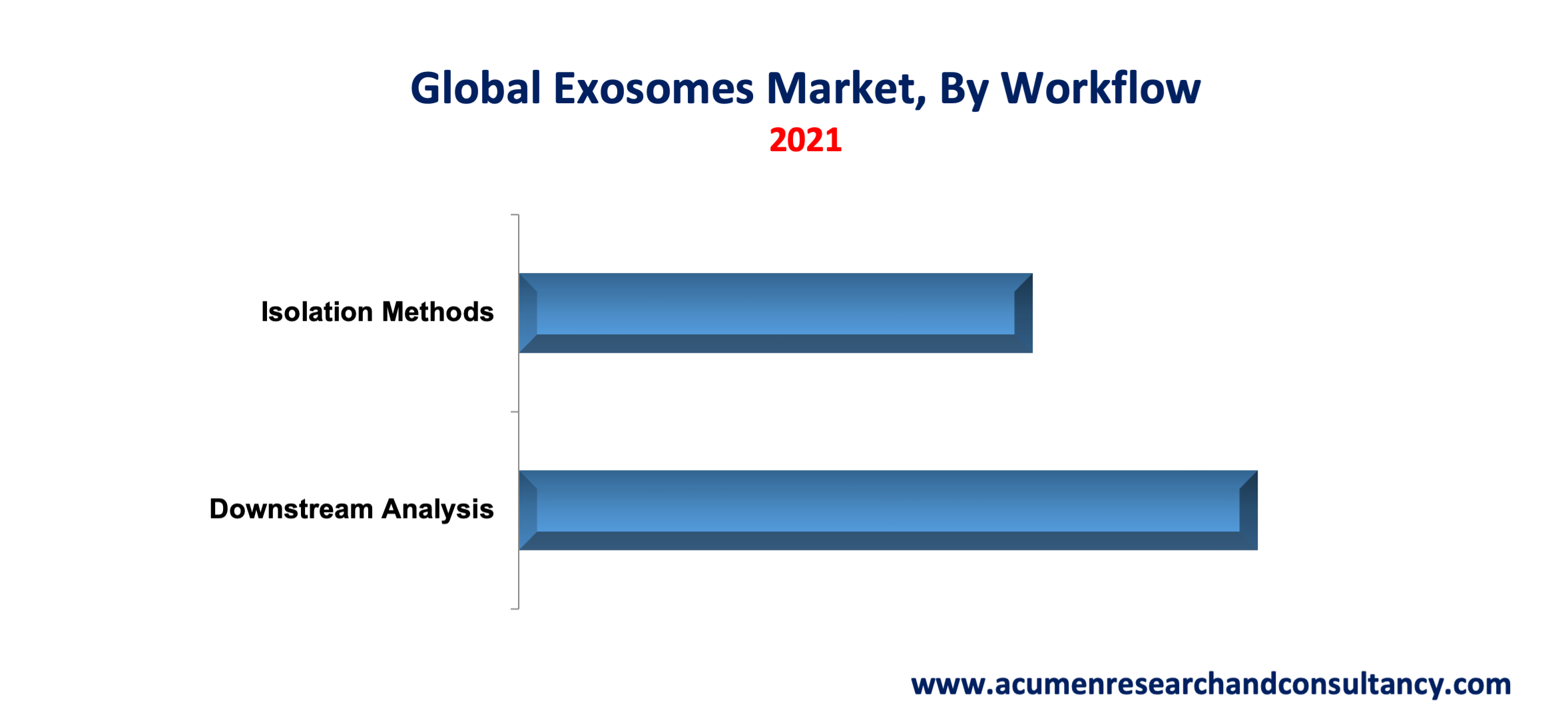

Based on the workflow, the isolation method segment is expected to grow positively in the market over the next few years. With the rapid developments in science and technology, numerous methods for the isolation of exosomes in significant quantity and purity have been developed. Each technique uses a unique feature of exosomes, such as shape, density, size, and surface proteins, to aid in exosome isolation. The benefits of this method include quick and efficient processing as well as a high purity rate in the final exosomal pellet. Ultracentrifugation, precipitation, immunocapture, and filtration are some of the most commonly used isolation techniques today. While ultracentrifugation has dominated the segment in terms of sales, other methods are expected to follow due to fragmented research in isolation protocols.

Market by Biomolecule Type

· Non-coding RNAs

· Proteins /Peptides

· mRNA

· DNA Fragments

· Lipids

Based on the biomolecule type, non-coding RNAs are expected to have the highest market share in 2021, owing to their widespread use in research. Exosomes' inherent ability to shuttle small bioactive molecules as perfect non-immunogenic carriers of therapeutics to target cells makes them a remarkably promising therapeutic tool for a wide range of diseases, including cancer. However, exosomes can indeed be used as ncRNA carriers to rebuild miRNA expression in specific cells, where they may play a therapeutic role as tumor suppressor factors. Identifying non-coding RNAs in circulation during cancer development and treatment may also provide unique, non-invasive, remote, and nearly constant access to the changing molecular composition of cancer cells, which could have significant clinical implications.

Market by Application

· Cancer

· Cardiovascular Diseases

· Neurodegenerative Diseases

· Infectious Diseases

· Others

Based on the application, the cancer segment will account for the lion's share of the market in 2021, attributed to the increasing role of exosomes in cancer research. Exosomes are naturally produced by the majority of eukaryotic cells to aid in intercellular communication. Exosome components such as DNA, proteins, microRNA, mRNA, circular RNA, long non-coding RNA, and others play important roles in regulating cancer growth, metastatic spread, and angiogenesis during the cancer development phase that could be used as a strong predictive marker and grading basis for cancer patients. However, as research methodologies and techniques have progressed, it has become clear that exosomes represent a novel method of intercellular communication and contribute to a wide range of biological procedures in health and disease, including cancer. As a result, the demand for exosomes is expected to rise in the coming years.

Exosomes Market Regional Overview

North America

· U.S.

· Canada

Europe

· U.K.

· France

· Germany

· Spain

· Rest of Europe

Latin America

· Mexico

· Brazil

· Rest of Latin America

Asia-Pacific

· India

· China

· Japan

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· South Africa

· GCC

· Rest of Middle East & Africa

North America accounted for the lion's share of the global exosome market in 2021, owing to the region's high prevalence of chronic diseases such as cardiovascular disease and cancer, technological developments, and increased acceptance of these technologies. Additionally, due to the presence of health remuneration policies, and FDA-approved wound debridement devices, and rise in the elderly population, North America is expected to dominate the global exosome market. Furthermore, the strategies of key players are expected to boost the market in the United States. A large number of government-funded studies on the role of exosome-containing drugs in various types of cancers, including melanoma, lung cancer, breast cancer, and pancreatic cancer, have been conducted. As a result, exosome technologies are becoming more prevalent in the region.

Competitive Landscape

Some of the prominent players in global exosomesmarket are Thermo Fisher Scientific, Inc., Qiagen, Hitachi Chemical Diagnostics Inc., Fujifilm, Danaher, Illumina, Inc., Lonza, Takara Bio Company, MiltenyiBiotec, Malvern Instruments Ltd., System Biosciences Inc., and MBL International Corporation.

Frequently Asked Questions

How much was the estimated value of the global exosomes market in 2021?

The estimated value of global exosomes market in 2021 was accounted to be US$168Mn.

What will be the projected CAGR for global exosomes market during forecast period of 2022 to 2030?

The projected CAGR of exosomes during the analysis period of 2022 to 2030 is 34%.

Which are the prominent competitors operating in the market?

The prominent players of the global exosomes market involve Thermo Fisher Scientific, Inc., Qiagen, Hitachi Chemical Diagnostics Inc., Fujifilm, Danaher, Illumina, Inc., Lonza, Takara Bio Company, MiltenyiBiotec, Malvern Instruments Ltd., System Biosciences Inc., and MBL International Corporation.

Which region held the dominating position in the global exosomes market?

North America held the dominating share for exosomes during the analysis period of 2022 to 2030

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for exosomes during the analysis period of 2022 to 2030

What are the current trends and dynamics in the global exosomes market?

Rising investments in pharmaceutical R&D and life science research, increased prevalence of chronic inflammatory diseases, and incidence of cancer are the prominent factors that fuel the growth of global exosomes market

By segment workflow, which sub-segment held the maximum share?

Based on workflow, downstream analysis segment held the maximum share for exosomes market in 2021