Ethylene Glycol Market Size (By Derivative Type, By Application, By End Use, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Ethylene Glycol Market Size (By Derivative Type, By Application, By End Use, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Ethylene Glycol Market Size accounted for USD 41.2 Billion in 2023 and is estimated to achieve a market size of USD 65.2 Billion by 2032 growing at a CAGR of 5.3% from 2024 to 2032.

Ethylene Glycol Market Highlights

- Global ethylene glycol market revenue is poised to garner USD 65.2 billion by 2032 with a CAGR of 5.3% from 2024 to 2032

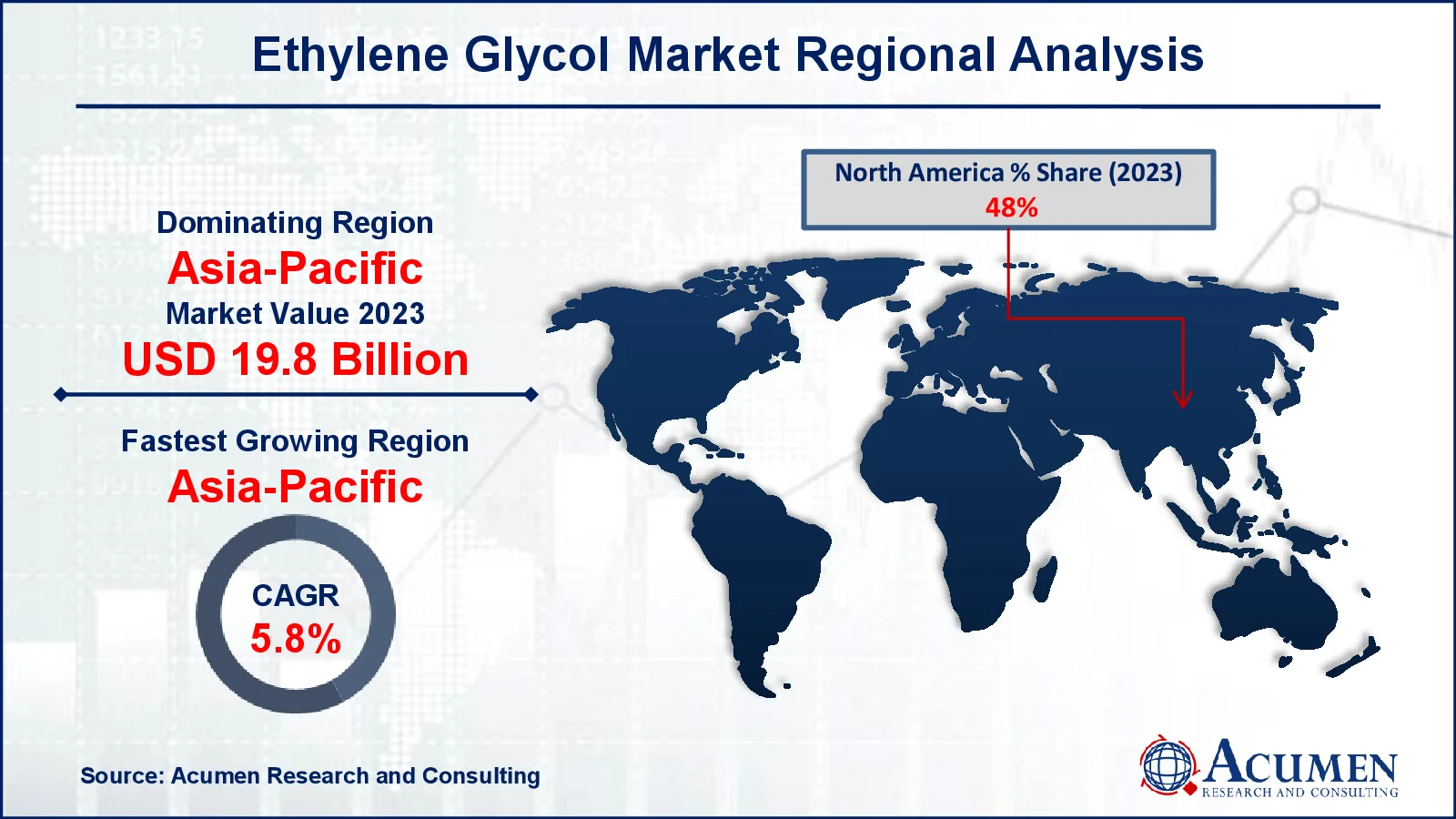

- Asia-Pacific ethylene glycol market value occupied around USD 19.8 billion in 2023

- Asia-Pacific ethylene glycol market growth will record a CAGR of more than 5.8% from 2024 to 2032

- Among application, the PET sub-segment generated more than USD 18.5 billion revenue in 2023

- Based on end use, the packaging sub-segment generated around 36% ethylene glycol market share in 2023

- Innovation in recycling technologies is a popular ethylene glycol market trend that fuels the industry demand

Ethylene glycol is an odorless, colorless, and viscous liquid that may combine with water to form a homogeneous mixture that is not separated or affected by chemical interaction. It is also poisonous in nature and has minimal volatility. Ethylene glycol is often used as an automotive freezer, and it works well as a coolant in radiators. As antifreeze, it can also be utilized as a component in paint solvents, hydraulic fluids, and printing inks. Ethylene glycol is also employed as a reagent in the production of alkyd resins, synthetic waxes, polyesters, and explosives.

Global Ethylene Glycol Market Dynamics

Market Drivers

- Increasing demand from the automotive sector for antifreeze and coolant applications

- Growing consumption of polyethylene terephthalate (PET) in the packaging industry

- Rising adoption of ethylene glycol in textile manufacturing for polyester production

- Expanding construction industry driving the use of ethylene glycol in paints and coatings

Market Restraints

- Volatility in raw material prices impacting production costs

- Environmental concerns related to ethylene glycol toxicity and disposal

- Stringent government regulations limiting the use of non-biodegradable chemicals

Market Opportunities

- Growing demand for bio-based ethylene glycol in sustainable manufacturing processes

- Expansion of the electronics industry creating opportunities for ethylene glycol in heat transfer fluids

- Emerging markets in Asia-Pacific boosting infrastructure and automotive growth

Ethylene Glycol Market Report Coverage

|

Market |

Ethylene Glycol Market |

|

Ethylene Glycol Market Size 2023 |

USD 41.2 Billion |

|

Ethylene Glycol Market Forecast 2032 |

USD 65.2 Billion |

|

Ethylene Glycol Market CAGR During 2024 - 2032 |

5.3% |

|

Ethylene Glycol Market Analysis Period |

2020 - 2032 |

|

Ethylene Glycol Market Base Year |

2023 |

|

Ethylene Glycol Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Derivative Type, By Application, By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Nan Ya Plastics, Mitsubishi Chemical, Nippon Shokubai, LG Chem, LOTTE Chemical, BASF SE, Indian Oil, Eastman Chemical, Ineos Group, Dow Chemical, LyondellBasell, and Formosa Plastics. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ethylene Glycol Market Insights

Polyester fibers are widely used by makers of mono-ethylene glycol, which has led to an increase in demand for ethylene glycol. Consumers mostly use polyester fibers, which account for more than half of the market demand. This is due to the fact that polyester fibers have various advantages over conventional fibers like as cotton, including moisture resistance, stain and oil resistance, and wrinkle resistance.

The growth of the textile sector and the increase in demand for polyester fibers are expected to drive the market for ethylene glycol. For instance according to the India Brand Equity Foundation, the Indian textiles and apparel market is expected to grow at a CAGR of 10%, reaching USD 350 billion by 2030. Meanwhile, exports are expected to increase to USD 100 billion during the same time span. The packaging industry is experiencing rapid growth as global demand for packaged food rises. As a result, rising demand and use of PET in food and beverage packaging is another important reason driving the growth of the ethylene glycol market.

Expanding construction industry driving the use of ethylene glycol in paints and coatings is the another driving factor in the market. For instance according to the Algorithms Software Pvt. Ltd. the worldwide construction business is anticipated to reach $10.5 trillion by 2023. They will rise at a CAGR of 4.2% between 2018 and 2023.

Many firms struggled with supply chain disruptions and global lockdowns as a result of the COVID-19 epidemic. The textile industry have likewise ceased production operations because people were not permitted to leave their homes due to lockdown rules and restrictions. Consequently, fabric production was interrupted during the shutdown. While many businesses and industries struggled during the COVID-19 outbreak, the healthcare and pharmaceutical industries continue to operate in the market.

During this health crisis, ethylene glycol can be used as an effective disinfectant due to its antibacterial qualities. Also, ethylene glycol is used to sterilize surgical tools in hospitals, hence the ethylene glycol market is predicted to rise significantly during the pandemic period.

Ethylene Glycol Market Segmentation

The worldwide market for ethylene glycol is split based on derivative type, application, end use, and geography.

Ethylene Glycols Market By Derivative Type

- Diethylene Glycol (DEG)

- Monoethylene Glycol (MEG)

- Triethylene Glycol (TEG)

According to ethylene glycol industry analysis, the TEG sector dominates the market because of its diverse industrial applications and high performance qualities. TEG is commonly used as a drying agent in the natural gas and oil sectors to remove moisture from gas during processing. Furthermore, its use in the production of solvents, polyester resins, and plasticizers drives rising demand. TEG's superior hygroscopic characteristics and chemical stability make it essential in the air conditioning and dehumidification industries. Rising energy sector activity, particularly in emerging economies, drives up TEG use dramatically. Furthermore, its use in specialist applications such as disinfectants and fogging solutions contributes to its market dominance.

Ethylene Glycols Market By Application

- PET

- Polyester Fibers

- Films

- Antifreeze and Coolants

- Others

PET is predicted to lead industry growth in the ethylene glycol market forecast period. In the manufacture of PET films, monoethylene glycol is employed. It is a high-performing, crystal-clear thermoplastic. Polyethylene terephthalate offers reduced moisture absorption, better dimension stability, increased tensile strength, and physical qualities such as good retention throughout a wide temperature range. PET has good electrical qualities, high gloss, outstanding UV resistance, good optical clarity, and a good gas barrier, however its moisture absorption properties are moderate. Because of these quality, lamination, and printing considerations, PET can be a perfect material. PET has a high melting point, making it suitable for high-temperature sterilizing applications.

Ethylene Glycols Market By End Use

- Automotive

- Textile

- Packaging

- Others

The packaging segment has the biggest market share due to the critical function of ethylene glycol in PET manufacture, which is a major material for packaging solutions. The global demand for PET-based bottles and containers has increased as people consume more beverages, packaged foods, and household items. Ethylene glycol, notably monoethylene glycol (MEG), is essential for PET applications that need strength and clarity. Furthermore, the growing emphasis on eco-friendly and recyclable packaging materials has increased reliance on PET, which has led to increased ethylene glycol use. The growing retail, e-commerce, and FMCG industries in developing countries all add to the segment's importance. PET's adaptability in packaging a wide range of items predicts that this application will continue to increase in the future.

Ethylene Glycol Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ethylene Glycol Market Regional Analysis

Asia-Pacific is emerging as the largest and fastest-growing ethylene glycol market, owing to increased industrialization and urbanization in China, India, and Southeast Asian nations. For instance according to the World Bank Group India is rapidly urbanizing, with towns and cities anticipated to house 600 million people, or 40% of the population, by 2036 up from 31% in 2011. Urban areas are predicted to account for roughly 70% of the country's GDP. Effectively managing this urban shift would be critical to India's ambition of becoming a developed nation by 2047, when it celebrates its 100th anniversary of independence. The region's expanding middle-class population boosts demand for consumer products, textiles, and PET-based packaging, which increases the demand for Ethylene Glycol.

Furthermore, Asia-Pacific's thriving construction industry boosts the demand for ethylene glycol-based insulation and coatings. The region's governments are actively spending in infrastructure development, which is driving up demand. The existence of cost-effective industrial hubs, as well as a readily available labor force, places Asia-Pacific as a global leader in production and consumption, making it the fastest growing region in the Ethylene Glycol market.

North America is the second largest region in the ethylene glycol market, due to its strong chemical and automotive industries. The region's high demand for polyester fibers and polyethylene terephthalate (PET) in the textile, packaging, and beverage container industries is a key growth driver. The United States possesses superior infrastructure and technology to support large-scale ethylene glycol production.

Furthermore, the automotive industry's large presence drives up demand for ethylene glycol-based antifreeze and coolant products, securing North America's leadership position. Regulatory frameworks that support sustainable production practices, as well as technology improvements in industrial processes, help to stabilize the region's markets. Expanding construction industry is driving the use of ethylene glycol in paints and coatings, which will drive the market in this region. According to the Associated General Contractors (AGC) of America, Inc., the construction sector is crucial to the US economy, with about 919,000 construction enterprises operating across the country as of the first quarter of 2023.

Ethylene Glycol Market Players

Some of the top ethylene glycol companies offered in our report includes Nan Ya Plastics, Mitsubishi Chemical, Nippon Shokubai, LG Chem, LOTTE Chemical, BASF SE, Indian Oil, Eastman Chemical, Ineos Group, Dow Chemical, LyondellBasell, and Formosa Plastics.

Frequently Asked Questions

How big is the ethylene glycol market?

The ethylene glycol market size was valued at USD 41.2 billion in 2023.

What is the CAGR of the global ethylene glycol market from 2024 to 2032?

The CAGR of ethylene glycol is 5.3% during the analysis period of 2024 to 2032.

Which are the key players in the ethylene glycol market?

The key players operating in the global market are including Nan Ya Plastics, Mitsubishi Chemical, Nippon Shokubai, LG Chem, LOTTE Chemical, BASF SE, Indian Oil, Eastman Chemical, Ineos Group, Dow Chemical, LyondellBasell, and Formosa Plastics.

Which region dominated the global ethylene glycol market share?

Asia-Pacific held the dominating position in ethylene glycol industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ethylene glycol during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global ethylene glycol industry?

The current trends and dynamics in the ethylene glycol industry include increasing global focus on renewable energy sources, advancements in ethylene glycol technology, growing concerns about climate change and carbon emissions, and government incentives and policies promoting clean energy adoption.

Which application held the maximum share in 2023?

The PET application held the maximum share of the ethylene glycol industry.