Equestrian Equipment Market | Acumen Research and Consulting

Equestrian Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

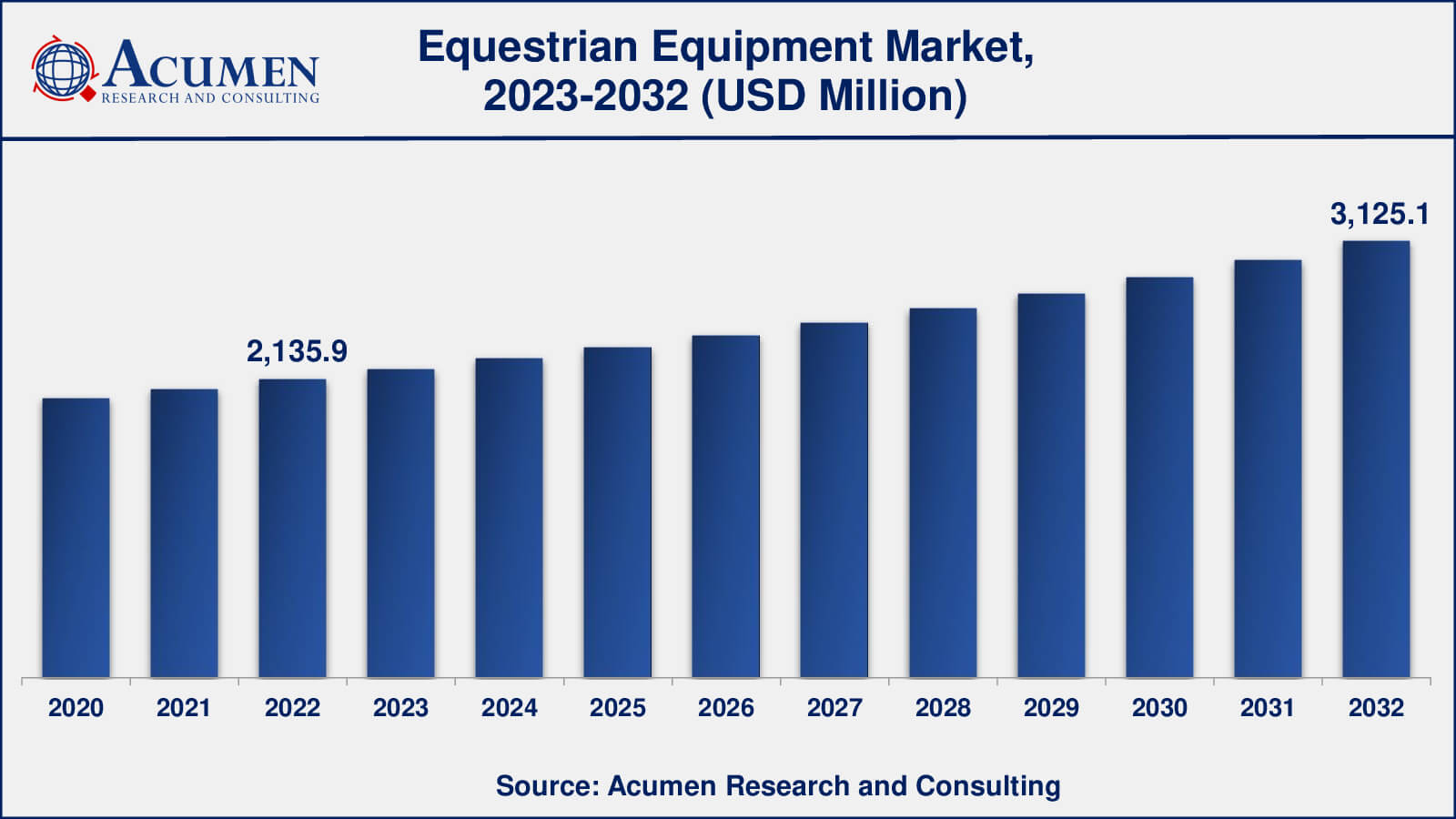

The global Equestrian Equipment Market size was valued at USD 2,135.9 Million in 2022 and is projected to attain USD 3,125.1 Million by 2032 mounting at a CAGR of 3.9% from 2023 to 2032.

Equestrian Equipment Market Highlights

- Global equestrian equipment market revenue is poised to garner USD 3,125.1 million by 2032 with a CAGR of 3.9% from 2023 to 2032

- Europe equestrian equipment market value occupied around USD 704.8 million in 2022

- North America equestrian equipment market growth will record a CAGR of more than 4% from 2023 to 2032

- Among product type, the rider equipment sub-segment occupied over US$ 1,537.8 million revenue in 2022

- Based on sales channel, the independent sports outlet sub-segment gathered around 40% share in 2022

- Product innovation for specialized disciplines within equestrian sports is a popular equestrian equipment market trend that drives the industry demand

Equestrian equipment refers to the different tools and gear used in horseback riding and associated sports. It includes a wide range of goods meant to protect the rider's and horse's safety, comfort, and control. These items are crucial for cyclists of all ability levels, from novice to advanced. At its core, equestrian equipment consists of the saddle and bridle, which are essential components for horseback riding. The saddle offers a sturdy base for the rider and aids in weight distribution. Bridles are the headpiece and reins that are used to direct and control the horse. Both of these things are available in a variety of forms and materials to accommodate different riding disciplines and rider preferences.

Riders frequently utilize stirrups, which give support for the rider's feet, and girths or cinches to secure the saddle in place, in addition to the saddle and bridle. Riding helmets are essential for safety, as they protect the rider's head in the event of a fall or accident. Riding boots, breeches, and gloves are also worn by riders to improve their comfort and control on the saddle. Equestrian equipment for horses includes goods such as horse blankets, leg wraps, and protective boots to make the animal comfortable and avoid injury. Grooming items like brushes, combs, and footpicks are also used to keep the horse clean and healthy.

Equestrian equipment includes not just riding clothing but also equipment utilized in a variety of equestrian sports and activities such as show jumping, dressage, rodeo, and racing. Each of these fields may necessitate the use of specialized equipment customized to their individual needs.

Global Equestrian Equipment Market Dynamics

Market Drivers

- Growing popularity of equestrian sports and leisure riding

- Increasing disposable income and willingness to invest in premium equipment

- Technological advancements in materials and design for enhanced performance

- Rising awareness of safety measures, driving demand for protective gear

Market Restraints

- High cost associated with quality equestrian equipment

- Economic downturns affecting consumer spending on non-essential items

- Limited access to equestrian facilities and space in urban areas

Market Opportunities

- Emerging markets with growing interest in equestrian sports and culture

- E-commerce and online retail channels for expanding market reach

- Sustainable and eco-friendly product trends gaining traction

- Collaborations with professional riders and endorsements to boost brand image

Equestrian Equipment Market Report Coverage

| Market | Equestrian Equipment Market |

| Equestrian Equipment Market Size 2022 | USD 2,135.9 Million |

| Equestrian Equipment Market Forecast 2032 | USD 3,125.1 Million |

| Equestrian Equipment Market CAGR During 2023 - 2032 | 3.9% |

| Equestrian Equipment Market Analysis Period | 2020 - 2032 |

| Equestrian Equipment Market Base Year |

2022 |

| Equestrian Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Buyer Type, By Sales Channel, By Sports Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ariat International, Dublin Clothing, Equine Couture, Horseware Ireland, WeatherBeeta, Troxel Helmets, Kerrits Equestrian Apparel, Devoucoux, Charles Owen, Horse Health, Weaver Leather, and Hermès. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Equestrian Equipment Market Insights

Several dynamic aspects impact the growth and development of the equestrian equipment industry. The growing popularity of equestrian activities and leisure riding is one of the primary causes. Equestrian activities have grown in popularity as both competitive sports and recreational pleasures. Because of this increased interest, there is a greater need for high-quality equipment, such as riding clothes, saddles, and protective gear.

Furthermore, the market benefits from the increased disposable income of horseback riders and other similar activities. Equestrian aficionados are frequently eager to invest in high-quality equipment that improves performance, comfort, and longevity. This desire to spend money on high-quality equipment helps to the market's growth.

Technological improvements significantly impact the dynamics of the equestrian equipment industry. Manufacturers are constantly innovating in terms of materials and design in order to improve the performance and safety of their goods. This involves the creation of lightweight and long-lasting materials for saddles, helmets, and riding clothing. Technological advancements attract riders looking for better gear and contribute to the market's overall growth.

Safety concerns have grown in the equestrian community, driving up demand for protective gear such as helmets, vests, and riding boots. The importance of safety equipment has expanded in recent years, particularly among newcomers and parents of young riders. As a result, producers are encouraged to offer a diverse range of safety-related items, which benefits market dynamics.

Equestrian tourism and leisure activities also give market expansion potential. People looking for equestrian activities during their holidays or weekends add to the demand for rental equipment and riding attire. This tendency has resulted in the rise of equestrian facilities and services, which has fueled the market's growth.

Despite these drivers, the equestrian equipment market is constrained by a number of factors. Some potential purchasers may be put off by the expensive expense of excellent equestrian equipment, particularly those on a restricted budget. Economic downturns and uncertainty can also have an influence on consumer expenditure on non-essential products such as equestrian equipment.

Furthermore, access to equestrian facilities and space may be limited in metropolitan locations, which may stifle market expansion. Concerns about animal welfare and ethical difficulties in horse-related sectors can also impact public image and market dynamics.

Finally, the equestrian equipment market is impacted by a number of factors, including expanding equestrian activity popularity, rising disposable income, technical improvements, safety awareness, and prospects in equestrian tourism. However, it also faces costs, economic concerns, urban constraints, and ethical considerations, all of which impact its dynamics.

Equestrian Equipment Market Segmentation

The worldwide market for equestrian equipment is split based on product type, buyer type, sales channel, sports type, and geography.

Equestrian Equipment Product Types

- Equine Equipment

- Rider Equipment

According to the Equestrian Equipment industry analysis, rider equipment accounted for maximum market share in 2022. Rider equipment, which includes goods such as riding attire, helmets, boots, and protective gear, appears to be at the forefront of the equestrian equipment market for numerous convincing reasons, according to the equestrian equipment industry report. The increased emphasis on rider safety is one key aspect. Equestrian fans are growing more aware of the hazards connected with horseback riding, fueling demand for high-quality protective equipment such as helmets and vests.

Another driving element for rider equipment success is the marriage of fashion and utility. Equestrian clothing has developed to suit not just functional needs but also personal stylistic preferences. Riders frequently seek apparel and accessories that not only improve their performance but also create a fashion statement, which contributes to the steady demand for rider equipment.

Equestrian Equipment Buyer Types

- Individual

- Institutional

- Others

Individual buyers, including horse owners, riders, and enthusiasts, often play a significant role in the equestrian equipment market. They purchase equipment for personal use, such as riding apparel, helmets, saddles, and grooming supplies. The dominance of individual buyers can be attributed to the widespread participation in equestrian activities, ranging from leisure riding to competitive sports, which drives the demand for a wide range of equestrian gear tailored to individual preferences and needs.

Institutional buyers in the equestrian equipment market primarily include riding schools, equestrian clubs, and professional training facilities. These entities procure equipment for the use of their members, students, or clients. Institutional buyers often require bulk orders of saddles, bridles, riding helmets, and other gear to outfit their operations. Their dominance in the market can stem from the collective demand generated by numerous individuals enrolled in riding programs or memberships.

The others category typically encompasses a range of entities not falling strictly into the individual or institutional buyer categories. This can include businesses involved in horse-related industries such as horse racing tracks, rodeo arenas, and horse breeding farms. Additionally, it may encompass government agencies, veterinary clinics, and suppliers of equestrian event equipment.

Equestrian Equipment Sales Channel

- Hypermarket and Supermarket

- Independent Sports Outlet

- Sports Retail Chain

- Others

As per the equestrian equipment market forecast, the indendent sports outlet is expected to dominate the market from 2023 to 2032. These speciality retailers cater to sports and outdoor lovers, including equestrians. Independent sporting goods stores frequently have a large choice of equestrian equipment, such as riding attire, boots, saddles, and other accessories. They usually have skilled employees who can provide consumers personalised guidance depending on their riding discipline and preferences. Independent sporting goods stores play an important role in supporting the equestrian community and may be a substantial sales channel for equestrian equipment.

The sports retail chain is frequently regarded as the second most important sales channel for equestrian equipment. Sports retail chains are well-established and have a strong regional presence. These stores usually sell a wide variety of athletic products, including equestrian equipment and clothes. They frequently have various retail locations, which makes equestrian equipment more accessible to a diverse consumer base. Sports retail chains may profit from economies of scale as well, allowing them to provide competitive prices and a varied product assortment.

Equestrian Equipment Sports Type

- Individual Sports

- Others

As per the equestrian equipment market analysis, individual sports, which refer to various equestrian disciplines and leisure riding pursued by individuals, have historically dominated the equestrian equipment market. Dressage, show jumping, eventing, rodeo, and leisure riding are examples of individual sports.

Individual sports dominate the equestrian equipment market due to the various demands of riders competing in these disciplines. Each profession frequently need specialised equipment and gear customised to its distinct needs. Dressage riders, for example, may require specialised saddles and clothing tailored for exact movements, but rodeo participants may require safety gear such as vests and helmets.

Equestrian Equipment Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Equestrian Equipment Market Regional Analysis

Europe, with countries like the United Kingdom, Germany, and France, boasts a rich equestrian heritage. The European market places a strong emphasis on disciplines like dressage and eventing, driving the demand for specialized equipment such as dressage saddles and competition attire. High-quality leather products, including saddles and bridles, are in high demand in Europe. Additionally, the region has witnessed a growing interest in sustainable and eco-friendly equestrian equipment due to its environmentally conscious consumer base.

In North America, particularly the United States and Canada, there exists a robust equestrian culture with a substantial market for equestrian equipment. Safety is a top priority in this region, leading to a high demand for riding helmets and protective gear. Western-style riding equipment, including saddles and tack, also enjoys popularity. The prevalence of e-commerce and online retail has allowed North American customers to access a wide range of equestrian products conveniently.

Equestrian Equipment Market Players

Some of the top equestrian equipment companies offered in our report include Ariat International, Dublin Clothing, Equine Couture, Horseware Ireland, WeatherBeeta, Troxel Helmets, Kerrits Equestrian Apparel, Devoucoux, Charles Owen, Horse Health, Weaver Leather, and Hermès.

Frequently Asked Questions

What was the size of the global equestrian equipment market in 2022?

The size of equestrian equipment market was USD 2,135.9 million in 2022.

What is the equestrian equipment market CAGR from 2023 to 2032?

The equestrian equipment market CAGR during the analysis period of 2023 to 2032 is 3.9%.

Which are the key players in the equestrian equipment market?

The key players operating in the global equestrian equipment market are Ariat International, Dublin Clothing, Equine Couture, Horseware Ireland, WeatherBeeta, Troxel Helmets, Kerrits Equestrian Apparel, Devoucoux, Charles Owen, Horse Health, Weaver Leather, and Hermès.

Which region dominated the global equestrian equipment market share?

Europe region held the dominating position in equestrian equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of equestrian equipment during the analysis period of 2023 to 2032.

What are the current trends in the global equestrian equipment industry?

The current trends and dynamics in the equestrian equipment industry include growing popularity of equestrian sports and leisure riding, increasing disposable income and willingness to invest in premium equipment, and technological advancements in materials and design for enhanced performance.

Which product type held the maximum share in 2022?

The rider equipment held the maximum share of the equestrian equipment industry.