End-of-Line Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

End-of-Line Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

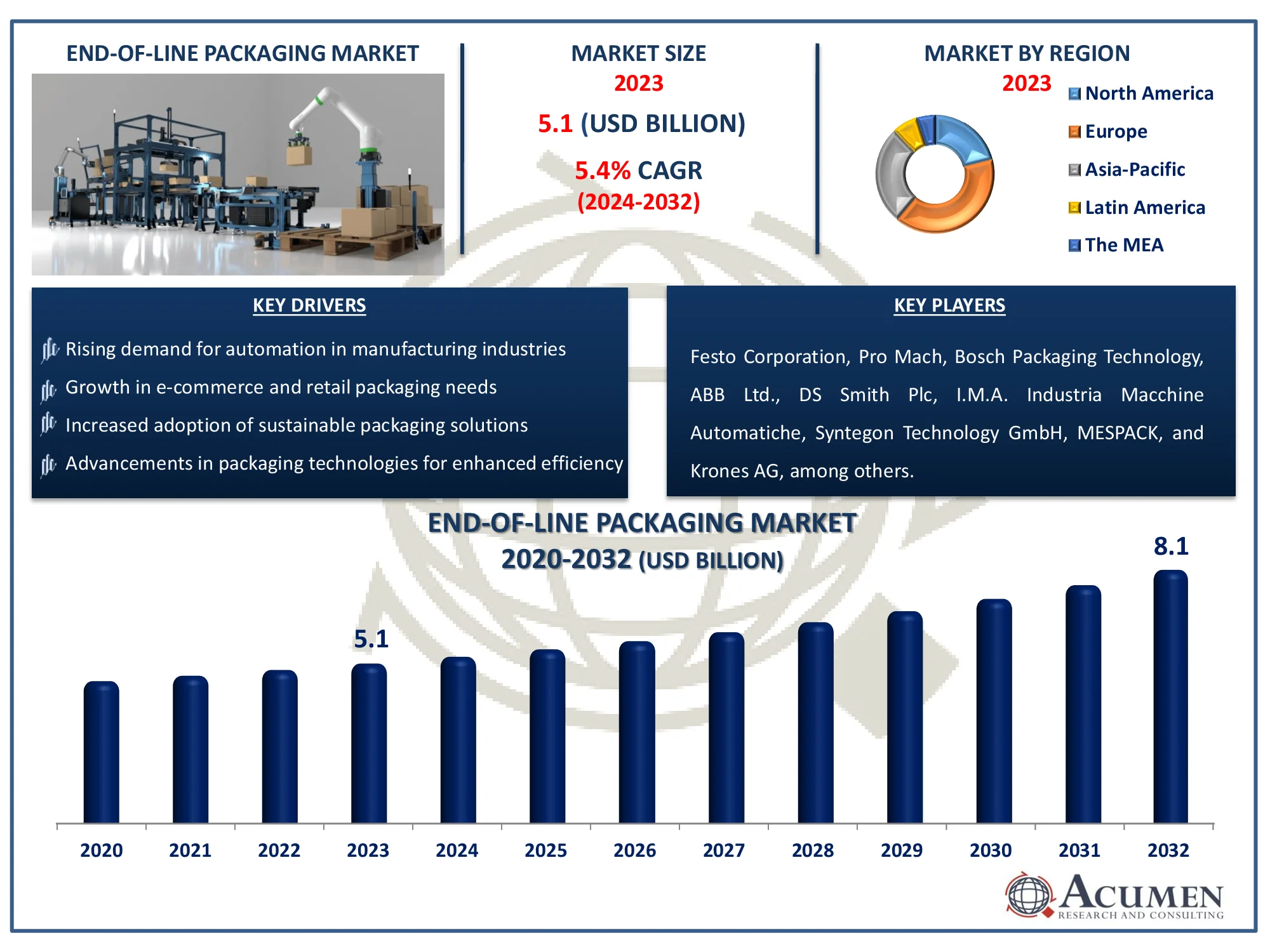

The Global End-of-Line Packaging Market Size accounted for USD 5.1 Billion in 2023 and is estimated to achieve a market size of USD 8.1 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032.

End-of-Line Packaging Market Highlights

- Global end-of-line packaging market revenue is poised to garner USD 8.1 billion by 2032 with a CAGR of 5.4% from 2024 to 2032

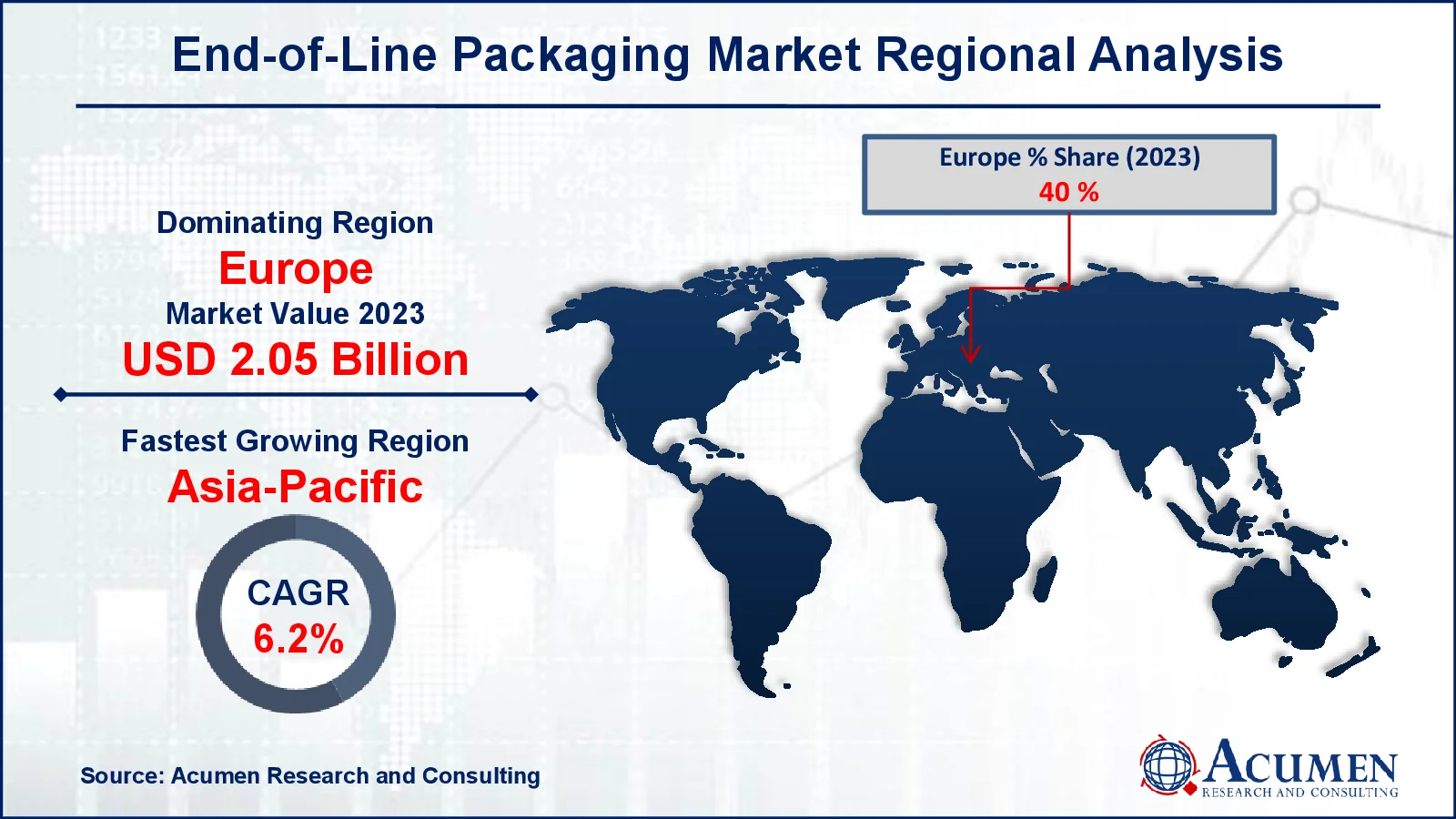

- Europe end-of-line packaging market value occupied around USD 2.05 billion in 2023

- Asia-Pacific end-of-line packaging market growth will record a CAGR of more than 6.2% from 2024 to 2032

- Among function, the palletizing sub-segment generated notable revenue in 2023

- Based on technology, the automatic sub-segment generated around 60% end-of-line packaging market share in 2023

- Increasing demand for customizable and flexible packaging solutions is a popular end-of-line packaging market trend that fuels the industry demand

An end-of-line solution for an industrial unit helps automate the whole process of production and packaging. Process automation in machinery helps to increase production for all industries and helps the demand to increase. Several companies competing in the global market want to upgrade their enterprises to increase productivity over the long run by transforming their manufacturing services. Industries like India, China, Malaysia and Korea implement automated manufacturing procedures in developing countries to address challenges such as labor shortages and cost optimization. End-of-line packaging eliminates training workers ' requirements. It allows companies to employ other valuable tasks in the work they can do.

Global End-of-Line Packaging Market Dynamics

Market Drivers

- Rising demand for automation in manufacturing industries

- Growth in e-commerce and retail packaging needs

- Increased adoption of sustainable packaging solutions

- Advancements in packaging technologies for enhanced efficiency

Market Restraints

- High initial investment in automated packaging systems

- Limited availability of skilled labor for system operation

- Stringent government regulations on packaging materials

Market Opportunities

- Integration of AI and IoT in packaging systems

- Expanding packaging needs in emerging economies

- Growing focus on eco-friendly and recyclable packaging

End-of-Line Packaging Market Report Coverage

| Market | End-of-Line Packaging Market |

| End-of-Line Packaging Market Size 2022 |

USD 5.1 Billion |

| End-of-Line Packaging Market Forecast 2032 | USD 8.1 Billion |

| End-of-Line Packaging Market CAGR During 2023 - 2032 | 5.4% |

| End-of-Line Packaging Market Analysis Period | 2020 - 2032 |

| End-of-Line Packaging Market Base Year |

2022 |

| End-of-Line Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Function, By Order Type, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Festo Corporation, Pro Mach, Bosch Packaging Technology, ABB Ltd., DS Smith Plc, I.M.A. Industria Macchine Automatiche, Syntegon Technology GmbH, MESPACK, Krones AG, Schneider Packaging Equipment Company, Combi Packaging Systems LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

End-of-Line Packaging Market Insights

The robot hands are rapidly introduced into packaging processes in order to enhance the efficiency of production. End-of-line robotic systems enhance the overall efficiency of production. End-of-line robotic systems also reduce physical tasks such as packaging, palletizing and picking. A robotic arm enables increased efficiency in production leading to high returns on investment and low operating costs. Robotic arms are particularly used in end-of-line packaging for lightweight packaging because it reduces the risk of damage. Key manufacturers in various industries are affected in the implementation of such systems through the inclusion of robotic arm automation in end-of-line packaging.

A complete automation line is formed by automated end of line packaging machines together with control systems to produce products at a rate that allows these to be maintained on the market. The operators require semi-automatic end-of-line packaging machines to carry out several functions. Half-automatic end-of-line machinery are used to lower production rates. Semi-automatic mode is available with palletizers, case erectors, case packers and stretch wrappers.

The customized order category is predicted to increase significantly and profitably depending on the type of order received. End-of-line industries are increasingly choosing custom packaging solutions. As a result, the share of the custom order category is predicted to grow by 2032. As businesses shift to standardized solutions to improve end-of-line packing efficiency, demand for the received order type segment is likely to rise over the end-of-line packaging market forecast period.

End-of-Line Packaging Market Segmentation

The worldwide market for end-of-line packaging is split based on technology, function, order type, end use, and geography.

End-of-Line Packaging Market By Technology

- Semi-Automatic

- Automatic

According to end-of-line packaging industry analysis, the automatic technology sector has the highest market share due to its capacity to expedite packaging processes, eliminate human error, and boost production efficiency. Automatic packaging systems are frequently used in industries like as food and beverage, medicines, and consumer goods, where great speed and precision are required. These systems provide more consistency and can handle a wide range of packing types and sizes without requiring user intervention, making them a cost-effective long-term solution. Furthermore, the increased demand for automation to meet rising production volumes, particularly in the e-commerce and retail industries, contributes to autonomous technology's market domination.

End-of-Line Packaging Market By Function

- Stretch Wrapping

- Palletizing

- Labelling

- Integrated

- Carton Erecting Sealing

- Packing

- Others

Palletization is the expected to largest segment of the end-of-line packaging market. This capability is crucial for properly stacking and sorting products on pallets for storage or transit, making it indispensable in industries with high volume manufacturing such as food, drinks, and logistics. Palletizing solutions, both robotic and traditional, help to minimize space, prevent product damage, and increase overall operational speed. As organizations focus more on automating labor-intensive processes, the demand for innovative palletizing solutions has grown. Palletizing's capacity to manage a wide range of product sizes and weights while maintaining accuracy and stability in packaging makes it critical for enhancing supply chain efficiency, resulting in its market domination.

End-of-Line Packaging Market By Order Type

- Standard

- Customized

In the end-of-line packaging market, the customized order type has grown in popularity. Companies are increasingly choosing tailored packaging solutions to fulfill unique operating needs, product specifications, and industry standards. Customized packaging equipment enables firms to adapt to specific manufacturing lines, accommodating a wide range of packaging materials and product kinds. This adaptability is critical, particularly in industries such as pharmaceuticals, food, and electronics, where items frequently have unique handling or packaging arrangements. As customer preferences shift and demand for bespoke packaging rises, manufacturers need solutions that are both efficient and adaptable. The ability to perfectly coordinate packaging methods with specific business objectives makes bespoke solutions a large and rising market area.

End-of-Line Packaging Market By End Use

- Automotive

- Pharmaceutical

- Food and Beverages

- Electronics & Semiconductor

- Others

The food and beverage industry stands out as an important rising segment. With rising demand for packaged goods, ready-to-eat meals, and beverages, businesses are increasing their investments in efficient packaging solutions. This business requires high-speed, precise, and safe packaging, particularly to retain product freshness and comply with demanding hygiene regulations. Furthermore, the growth of e-commerce has increased demand, as food and beverage products require secure and long-lasting packaging for transportation. As consumer preferences evolve toward convenience and sustainability, packaging solutions designed to satisfy these changing needs are driving growing use of end-of-line systems in this industry, making it a prominent area of growth.

End-of-Line Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

End-of-Line Packaging Market Regional Analysis

European consumers prefer a wider range of cost, convenience, and quality options. The automated end-of-line packaging machinery business is mature in industrialized countries such as Italy, Germany, France, and the United Kingdom, and it is expected to grow slowly or modestly during the forecast period. The automated division contains end-of-line packing solutions for food, pharmaceuticals, and electronics, as well as automobile packaging. Automated end-of-line packaging is predicted to have the greatest market share in terms of value.

During the end-of-line packaging market forecast period, the European end-of-line packaging market is estimated at notable of CAGRs. More production, functionality and safer handling are demanded. There is a high demand. End-of-line machinery automation can help to address these rising demands. Automation supporting end users in Europe is incorporated by machine manufacturers by minimizing the operability of end-of-line packaging machines and handling. The transition from semi-automatic end-of-line to fully automated end-of-line solutions leads to higher automation levels such as machine views, security controls and even remote monitoring. The demand for end-of-line packaging machines in Europe will be influenced by these factors.

In Asia the industrialization and urbanization have rapidly upgraded the manufacturing industry. In the emerging markets of Asia such as India, Malaysia and China many manufacturers and brand owners have been attracted. The key sectors of extraction of raw materials, manufacturing and services are growing in companies from countries such as China, India and Japan. Due to increased demand for quality products, the Chinese end-of-line packaging market is expected to grow substantially during the forecast period.

End-of-Line Packaging Market Players

Some of the top end-of-line packaging companies offered in our report include Festo Corporation, Pro Mach, Bosch Packaging Technology, ABB Ltd., DS Smith Plc, I.M.A. Industria Macchine Automatiche, Syntegon Technology GmbH, MESPACK, Krones AG, Schneider Packaging Equipment Company, and Combi Packaging Systems LLC.

Frequently Asked Questions

How big is the end-of-line packaging market?

The end-of-line packaging market size was valued at USD 5.1 billion in 2023.

What is the CAGR of the global end-of-line packaging market from 2024 to 2032?

The CAGR of end-of-line packaging is 5.4% during the analysis period of 2024 to 2032.

Which are the key players in the end-of-line packaging market?

The key players operating in the global market are including Festo Corporation, Pro Mach, Bosch Packaging Technology, ABB Ltd., DS Smith Plc, I.M.A. Industria Macchine Automatiche, Syntegon Technology GmbH, MESPACK, Krones AG, Schneider Packaging Equipment Company, Combi Packaging Systems LLC.

Which region dominated the global end-of-line packaging market share?

Europe held the dominating position in end-of-line packaging industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of end-of-line packaging during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global end-of-line packaging industry?

The current trends and dynamics in the end-of-line packaging industry include rising demand for automation in manufacturing industries, growth in e-commerce and retail packaging needs, increased adoption of sustainable packaging solutions, and advancements in packaging technologies for enhanced efficiency.

Which technology held the maximum share in 2023?

The automatic technology held the maximum share of the end-of-line packaging industry.