Embedded Computing Market | Acumen Research and Consulting

Embedded Computing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

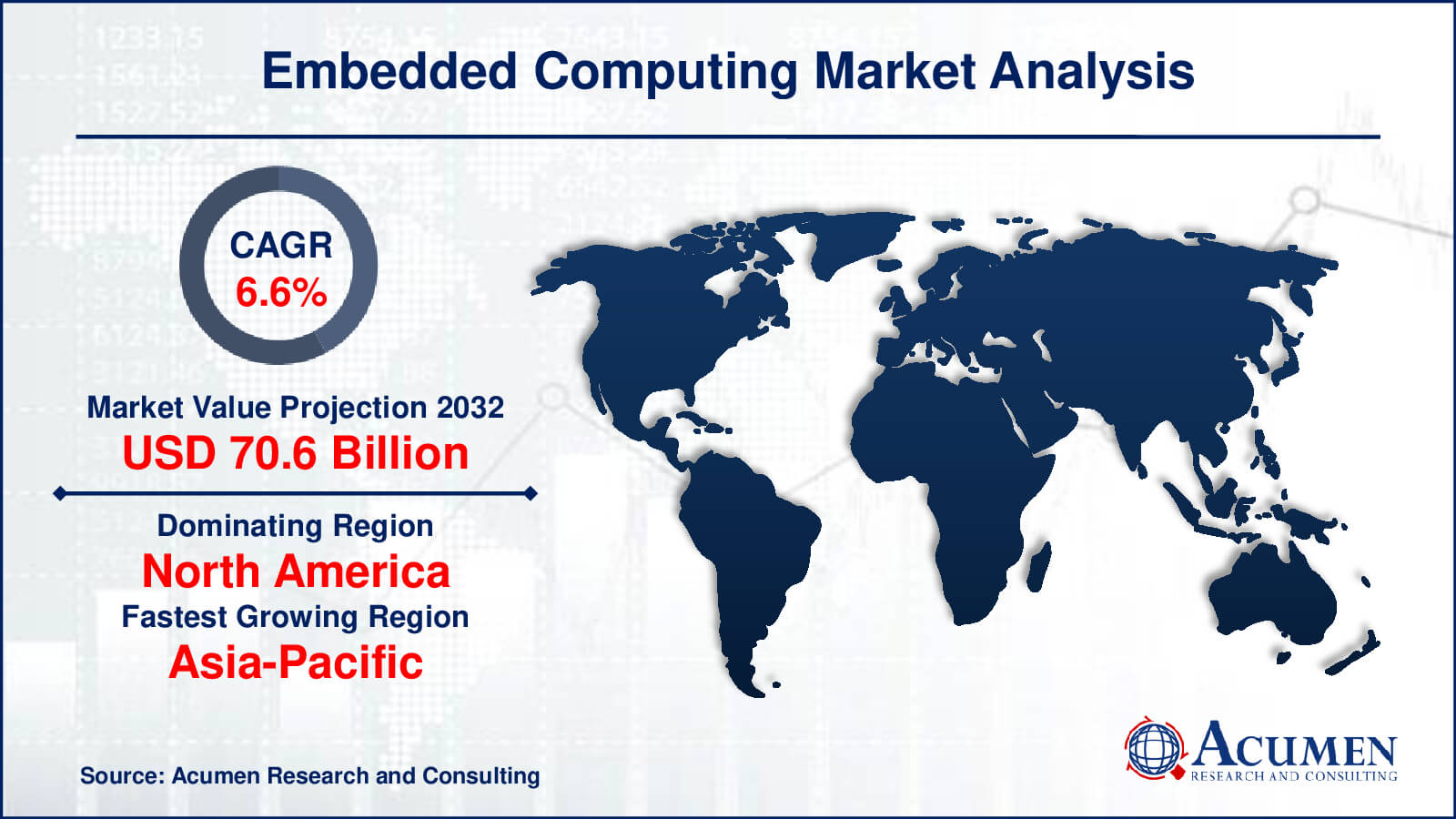

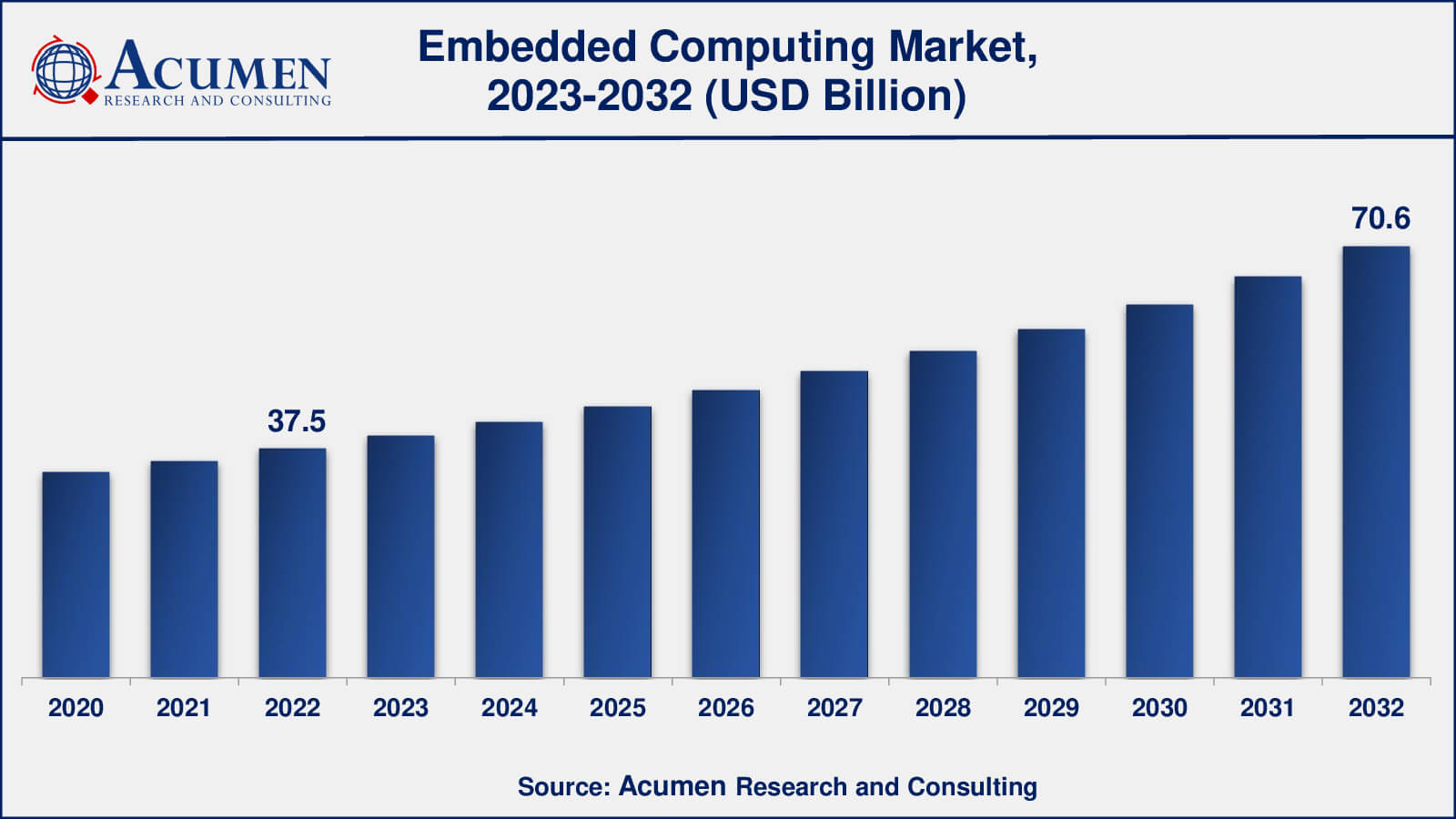

The Global Embedded Computing Market Size accounted for USD 37.5 Billion in 2022 and is estimated to achieve a market size of USD 70.6 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

Embedded Computing Market Highlights

- Global embedded computing market revenue is poised to garner USD 70.6 billion by 2032 with a CAGR of 6.6% from 2023 to 2032

- North America embedded computing market value occupied around USD 25.5 billion in 2022

- Asia-Pacific embedded computing market growth will record a CAGR of more than 7% from 2023 to 2032

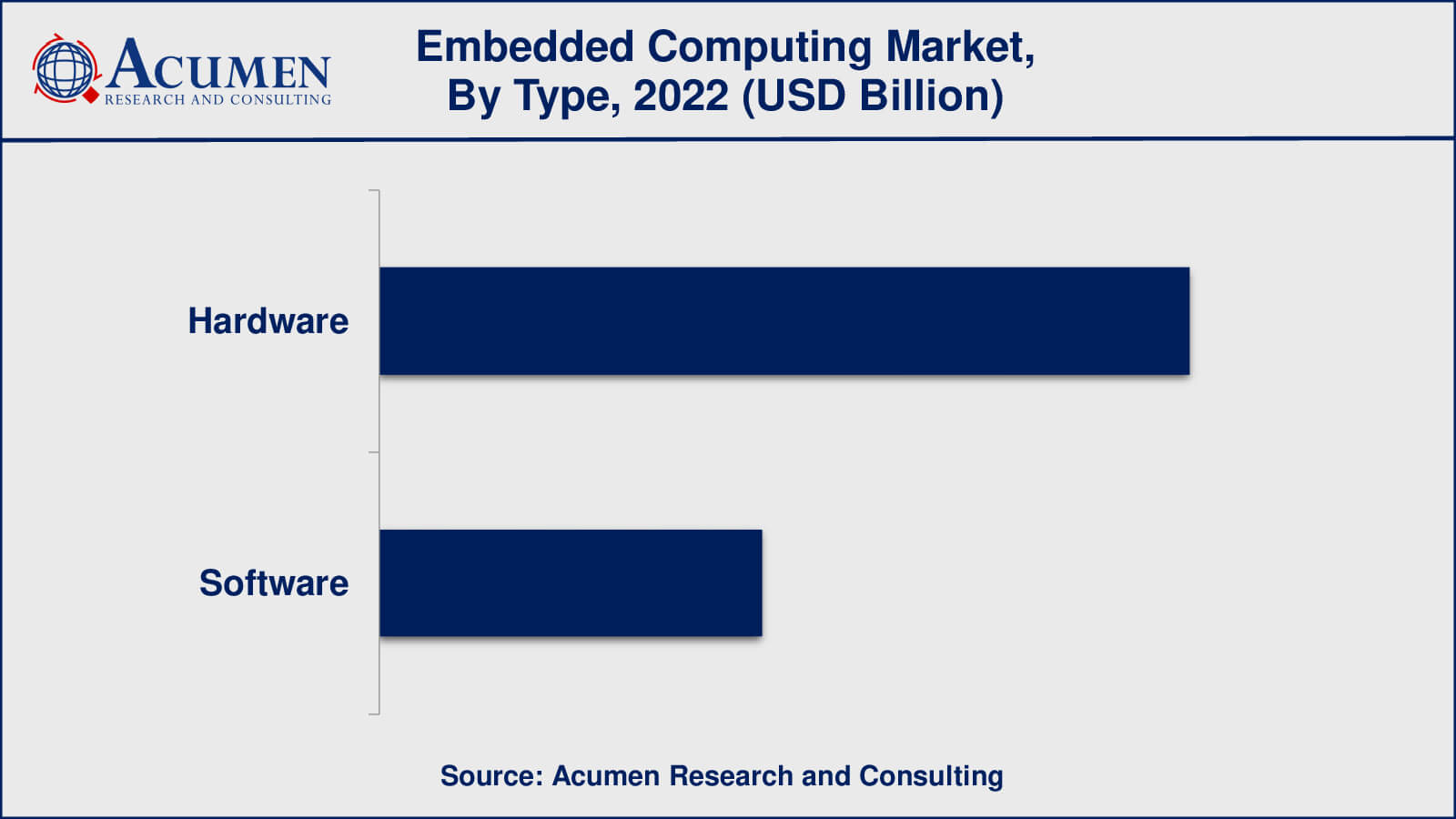

- Among type, the hardware sub-segment generated over US$ 29.2 billion revenue in 2022

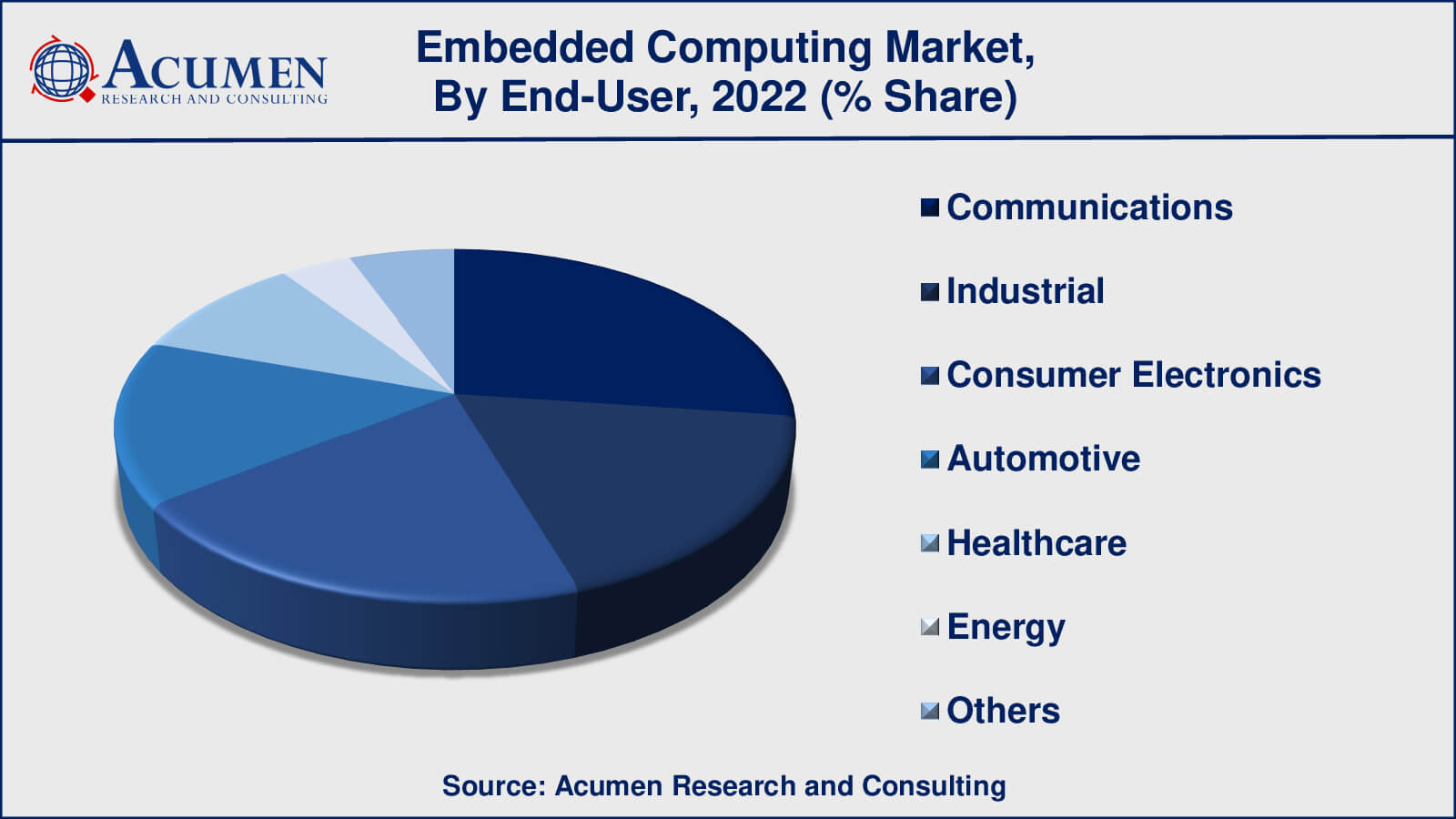

- Based on end-user, the communications sub-segment generated around 27% share in 2022

- AI and machine learning integration in embedded systems is a popular market trend that fuels the industry demand

An embedded computing system is a combination of embedded hardware and software designed to perform a specific dedicated function within an electronic device or machine. It can function as an independent system or as part of a larger system. The hardware and software are two distinct components of any embedded computing system, activated by a set of commands known as a program to execute operations as a unified system. The term 'embedded' signifies that they are an integral part of the system.

Embedded computing systems utilize microcontrollers (MCUs), microprocessors (MPUs), or custom-designed chips to operate the system, along with supporting software stored in ROM (Read-Only Memory). They exhibit key characteristics such as high speed, low power consumption, accuracy, adaptability, reliability, reusability, compact size, and others.

Components found in any embedded computing system include interfaces, input/output, displays, memory, and other elements. In general, embedded computing encompasses functions such as storage, timers, power supply, end-user circuitry, and serial communication ports.

Global Embedded Computing Market Dynamics

Market Drivers

- Increasing demand for IoT devices and smart solutions

- Growing adoption of automation and Industry 4.0 technologies

- Rising need for real-time data processing and edge computing capabilities

- Expansion of End-user in automotive, healthcare, and consumer electronics sectors

Market Restraints

- Complexity and high development costs of custom embedded solutions

- Concerns regarding security and data privacy in connected devices

- Challenges in software development and integration for diverse hardware platforms

Market Opportunities

- Expansion of smart cities and infrastructure projects globally

- Growth of 5G networks enabling advanced connectivity for embedded devices

- Aerospace and defense applications for ruggedized systems

Embedded Computing Market Report Coverage

| Market | Embedded Computing Market |

| Embedded Computing Market Size 2022 | USD 37.5 Billion |

| Embedded Computing Market Forecast 2032 | USD 70.6 Billion |

| Embedded Computing Market CAGR During 2023 - 2032 | 6.6% |

| Embedded Computing Market Analysis Period | 2020 - 2032 |

| Embedded Computing Market Base Year | 2022 |

| Embedded Computing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Microsoft Corporation, Intel Corporation, Fujitsu Limited, Microchip Technology Inc., Atmel Corporation, Renesas Electronics Corporation, ARM Holdings Plc, IBM Corporation, Qualcomm Inc., and Texas Instruments Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Embedded Computing Market Insights

Embedded computing systems are used to control, monitor, or perform specific functions in electronic equipment through predefined programs, plans, or rules. They carry out tasks such as reading sensor inputs, processing data, displaying necessary output, generating and transmitting commands, and transforming information. Embedded computing systems find widespread use across various end-user sectors, including home automation, office automation, banking, security, automobiles, defense, personal devices, healthcare, and others.

Embedded computing is applied in sectors such as automobiles, security, aerospace and avionics, telecommunications, consumer electronics, transportation, the smart card industry, and more. The global embedded computing market has been driven by increased consumer electronics usage and the growing adoption of artificial intelligence across various end-user domains worldwide. Other factors influencing the global embedded computing market include technological advancements in healthcare, process automation, and rising demand in areas such as automobiles, defense, smart home appliances, and others. The demand for embedded computing is on the rise globally, driven by potential growth in emerging economies and the proliferation of the Internet of Things (IoT).

However, designing the configuration and features of embedded systems can be challenging and may incur additional costs for additional features. Furthermore, embedded systems' hardware has its limitations, including a limited lifespan and memory capacity.

Embedded Computing Market Segmentation

The worldwide market for embedded computing is split based on type, end-user, and geography.

Embedded Computing Types

- Hardware

- Microprocessor Unit (MPU)

- Microcontroller Unit (MCU)

- Digital Signal Processor (DSP)

- Others (ASIC, FPGA, and Embedded Boards)

- Software

Based on types, the market is segmented into hardware and software. According to industry analysis of the embedded computing sector, hardware has held the largest share in the past years within the type segment and is likely to maintain its dominance throughout the forecasted timeframe from 2023 to 2032. The hardware segment includes microprocessor units (MPUs), microcontroller units (MCUs), digital signal processors (DSPs), and other hardware components. The increasing adoption of consumer electronics is expected to drive the growth of this segment in the coming years. Another key factor is the rising standard of living and increasing technology awareness among people, which will further boost the market.

The software segment is projected to exhibit the highest revenue growth rate over the forecast period, indicating promising prospects in the market. Factors contributing to this growth include the increased use of smartphones, rising disposable income, and the growing adoption of the Internet of Things (IoT). These are key drivers for the market's growth in the upcoming years.

Embedded Computing End-Users

- Automotive

- Industrial

- Healthcare

- Energy

- Communications

- Consumer Electronics

- Others

In terms of the end-user segment, the embedded computing market is categorized into automotive, industrial, healthcare, energy, communication, consumer electronics, and others. Among these segments, the communication segment has significantly held the largest market share. The growing use of consumer electronic devices, including mobile devices, laptops, tablets, personal computers, satellites, televisions, and radar, is expected to boost market growth.

Embedded systems can benefit both new and existing products by enhancing the manufacturing process. Factors such as the rapid proliferation of microprocessors, the rise in machine control and monitoring system improvements, and the growing adoption of Industry 4.0 practices are expected to contribute to the future growth of the embedded computing market. Industry 4.0 has a positive impact on business development and supports large-scale business volumes in the industry, thereby driving the adoption of embedded computing. Furthermore, the automotive segment is anticipated to grow at the highest compound annual growth rate (CAGR) during the forecast period.

Embedded Computing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Embedded Computing Market Regional Analysis

In terms of regional segments, Asia-Pacific has consistently held the largest revenue share in the embedded computing market in recent years. This growth can be attributed to numerous investments in Asia-Pacific countries, the rising adoption of the Internet of Things (IoT), and the increasing demand for consumer electronics. The rising demand for connected and smart devices, along with the increasing number of manufacturing companies, will further boost the growth of the embedded computing market in this region.

North America closely follows as the region with the second-largest revenue share in the embedded computing market. The United States, in particular, has shown a significant focus on technologies and associated equipment and controls, leading to an increase in the adoption of embedded computing systems. The growth of the embedded computing market in this region is driven by the increasing automotive and electric manufacturing industries. Notable growth industries in this region include transportation, food processing, and oil and coal.

Embedded Computing Market Players

Some of the top embedded computing companies offered in our report includes Microsoft Corporation, Intel Corporation, Fujitsu Limited, Microchip Technology Inc., Atmel Corporation, Renesas Electronics Corporation, ARM Holdings Plc, IBM Corporation, Qualcomm Inc., and Texas Instruments Inc.

Frequently Asked Questions

What was the market size of the global embedded computing in 2022?

The market size of embedded computing was USD 37.5 Billion in 2022.

What is the CAGR of the global embedded computing market from 2023 to 2032?

The CAGR of embedded computing is 6.6% during the analysis period of 2023 to 2032.

Which are the key players in the embedded computing market?

The key players operating in the global market are including Microsoft Corporation, Intel Corporation, Fujitsu Limited, Microchip Technology Inc., Atmel Corporation, Renesas Electronics Corporation, ARM Holdings Plc, IBM Corporation, Qualcomm Inc., and Texas Instruments Inc.

Which region dominated the global embedded computing market share?

North America held the dominating position in embedded computing industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of embedded computing during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global embedded computing industry?

The current trends and dynamics in the embedded computing industry include Increasing demand for IoT devices and smart solutions, growing adoption of automation and Industry 4.0 technologies, rising need for real-time data processing and edge computing capabilities, and expansion of end-user in automotive, healthcare, and consumer electronics sectors.

Which type held the maximum share in 2022?

The hardware type held the maximum share of the embedded computing industry.