Electrochemical Gas Analyzer Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Electrochemical Gas Analyzer Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

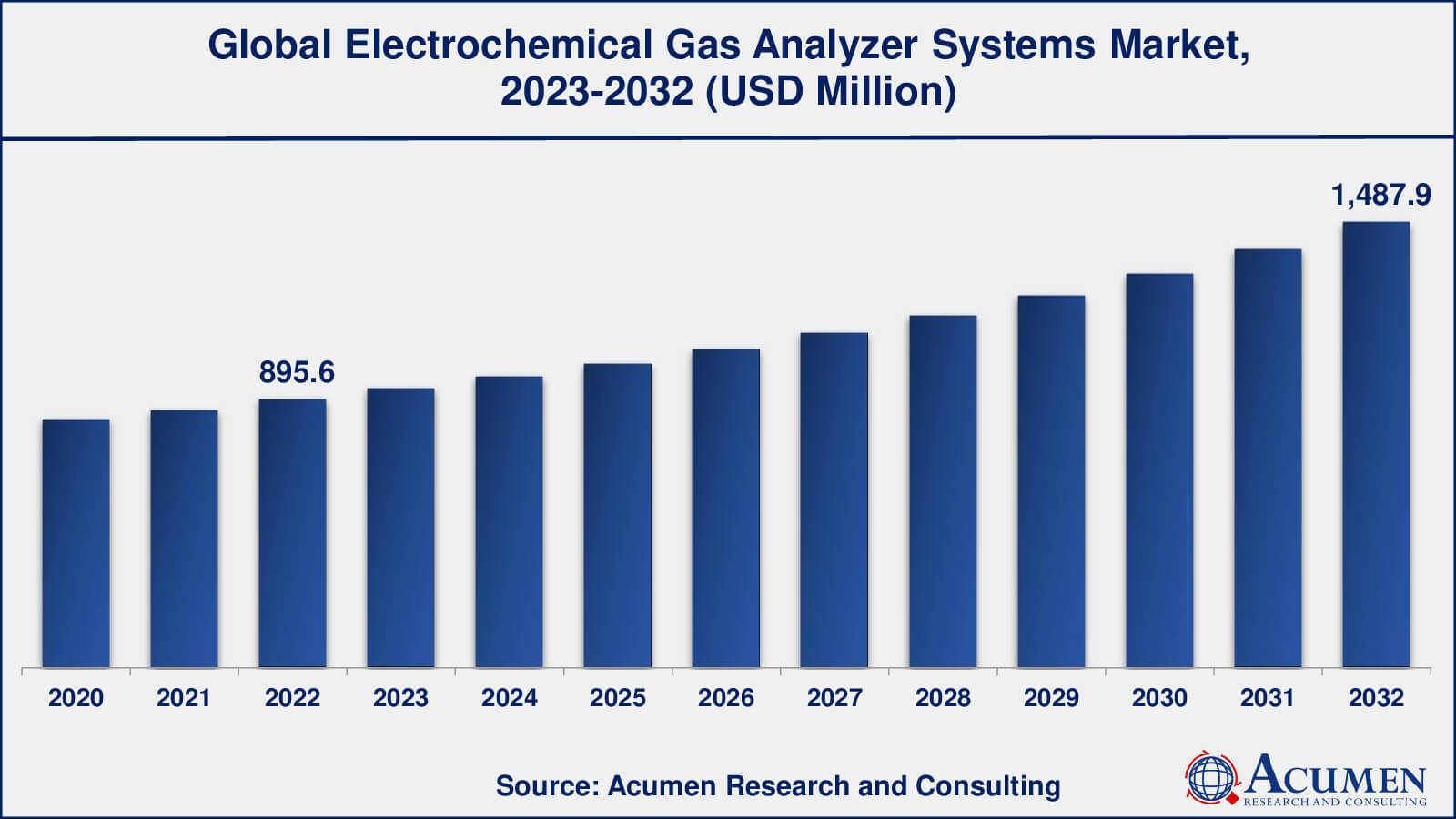

The global Electrochemical Gas Analyzer Systems Market size was valued at USD 895.6 Million in 2022 and is projected to attain USD 1,487.9 Million by 2032 mounting at a CAGR of 5.3% from 2023 to 2032.

Electrochemical Gas Analyzer Systems Market Highlights

- Global electrochemical gas analyzer systems market revenue is poised to garner USD 1,487.9 million by 2032 with a CAGR of 5.3% from 2023 to 2032

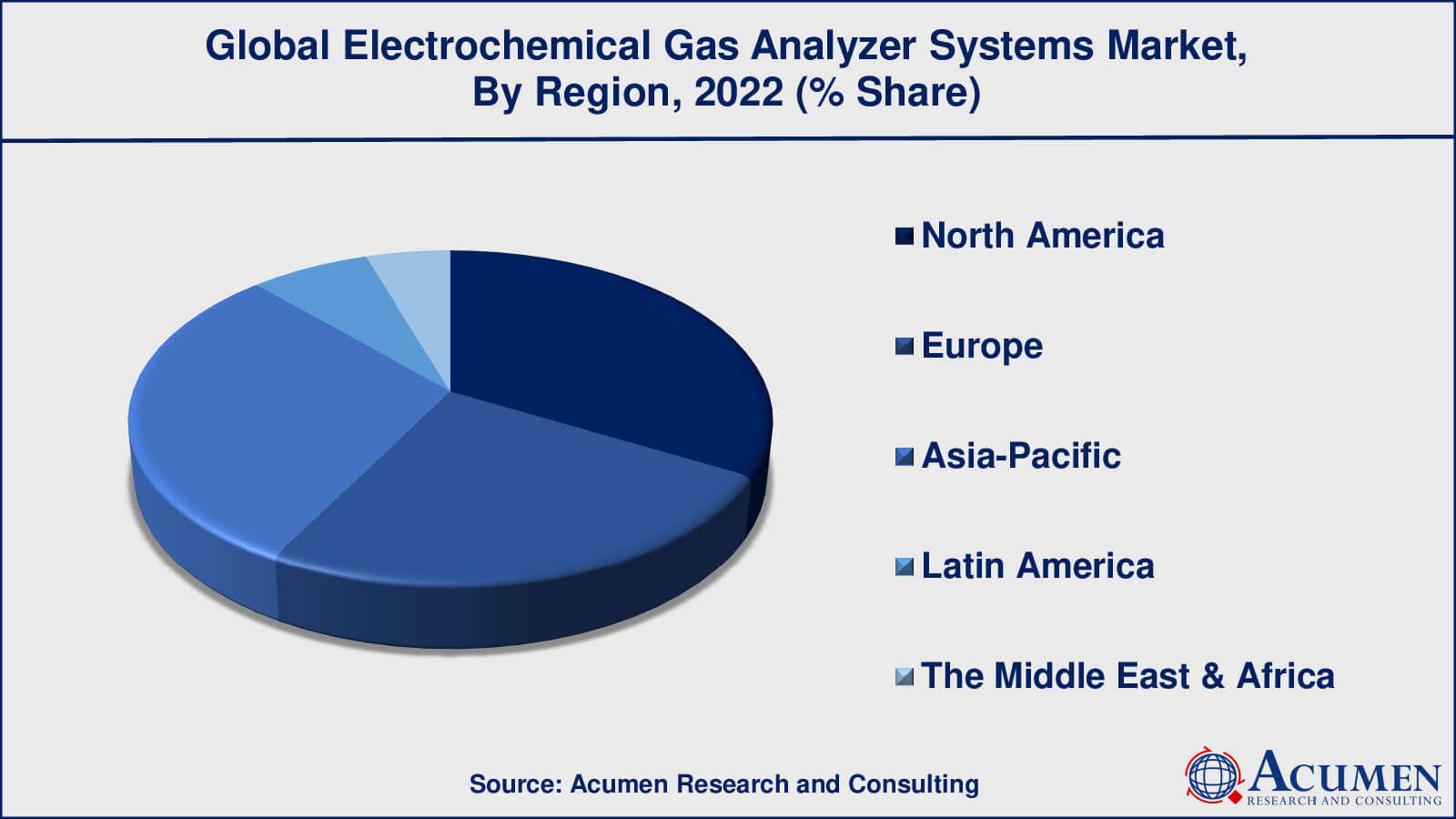

- North America electrochemical gas analyzer systems market value occupied around USD 295 million in 2022

- Asia-Pacific electrochemical gas analyzer systems market growth will record a CAGR of more than 6% from 2023 to 2032

- Among gas type, the multi-gas analyzers sub-segment occupied over US$ 490 million revenue in 2022

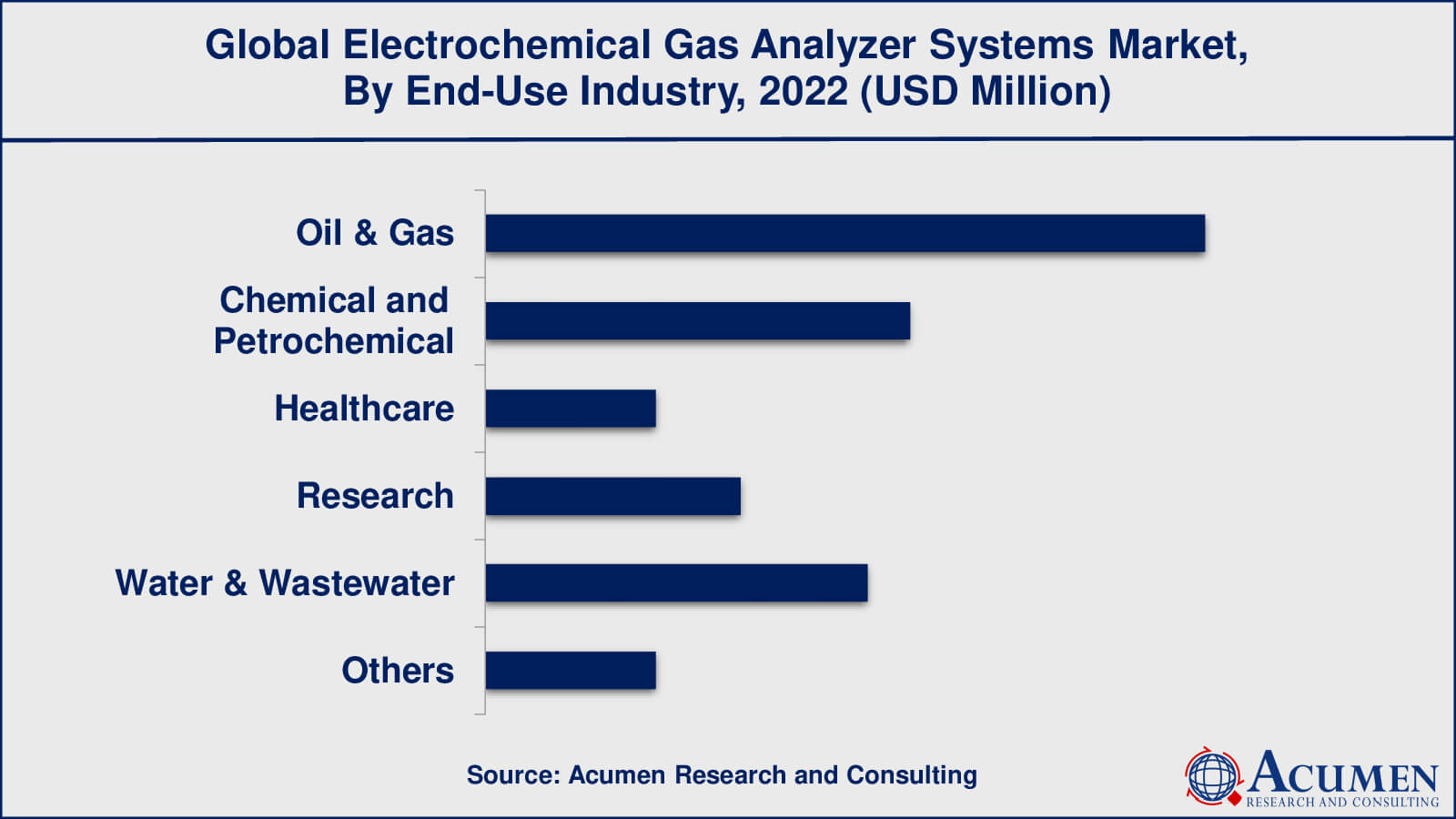

- Based on end-user industry, the oil & gas sub-segment gathered around 34% share in 2022

- Increasing focus on indoor air quality in commercial and residential settings is a popular electrochemical gas analyzer systems market trend that drives the industry demand

Electrochemical gas analyzer systems are used to measure the concentrations of gases. Electrochemical gas sensors using specialized materials on electrodes are used. When a gas interacts with these electrodes, a chemical reaction occurs, resulting in the generation of an electric current. This current is turned into a quantifiable signal that indicates gas concentration. This information is shown on a screen or transmitted via communication interfaces. Electrochemical sensors are selective; they react to certain gases, and they are utilized in a variety of sectors for safety, environmental monitoring, and process control. For accuracy and dependability, calibration and maintenance must be performed on a regular basis.

Global Electrochemical Gas Analyzer Systems Market Dynamics

Market Drivers

- Growing emphasis on occupational safety and health regulations

- Increasing concerns about air pollution and emissions

- Expanding industrial sectors such as oil and gas, chemicals, and manufacturing

- Rising awareness of environmental conservation and sustainability

Market Restraints

- High upfront costs associated with purchasing and installing gas analyzer systems

- Potential cross-sensitivity of electrochemical sensors to interfering gases.

- Regular calibration and maintenance requirements can be time-consuming and costly

- Limited sensor lifespan and sensitivity degradation over time

Market Opportunities

- Technological advancements in sensor design and materials

- Integration of gas analyzer systems with the Internet of Things (IoT) technology

- Emerging applications in sectors such as healthcare, agriculture, and consumer electronics

Electrochemical Gas Analyzer Systems Market Report Coverage

| Market | Electrochemical Gas Analyzer Systems Market |

| Electrochemical Gas Analyzer Systems Market Size 2022 | USD 895.6 Million |

| Electrochemical Gas Analyzer Systems Market Forecast 2032 | USD 1,487.9 Million |

| Electrochemical Gas Analyzer Systems Market CAGR During 2023 - 2032 | 5.3% |

| Electrochemical Gas Analyzer Systems Market Analysis Period | 2020 - 2032 |

| Electrochemical Gas Analyzer Systems Market Base Year | 2022 |

| Electrochemical Gas Analyzer Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Gas Type, By Application, By End-User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB Ltd., AMETEK, Inc., Drägerwerk AG & Co. KGaA, Emerson Electric Co., General Electric Company, Honeywell International Inc., MSA Safety Incorporated, RKI Instruments, Inc., Siemens AG, SICK AG, Thermo Fisher Scientific Inc., and Yokogawa Electric Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Electrochemical Gas Analyzer Systems Market Insights

The electrochemical gas analyzer systems market is impacted by a dynamic interplay of many elements that determine its growth and trends. These market dynamics include drivers, constraints, opportunities, and challenges that affect the industry's trajectory.

The increased emphasis on workplace safety and regulatory compliance is one of the key forces fueling the electrochemical gas analyzer systems market. Stringent occupational safety laws in areas such as manufacturing, chemicals, and oil and gas have prompted the use of gas analyzer systems to monitor potentially dangerous gases and assure worker safety. Furthermore, increased awareness of environmental problems and air pollution has resulted in an increase in demand for precise and continuous monitoring systems. Industries have invested in these systems in order to comply with pollution standards and protect public health.

The high initial investment costs of electrochemical gas analyzer systems continue to be a significant barrier to their implementation. The purchase, installation, and calibration of these devices may all be quite expensive. Furthermore, the technical intricacies of maintaining and calibrating these systems can be difficult for smaller organizations. Cross-sensitivity concerns, in which sensors respond to interfering gases, can also have an influence on measurement accuracy and impede widespread implementation.

Sensor technology advancements present significant market development potential. Continuous R&D efforts are yielding sensors with better accuracy, sensitivity, and selectivity, solving some of the issues involved with electrochemical gas analysis. The Internet of Things (IoT) integration of gas analyzer systems opens up possibilities for remote monitoring, real-time data analysis, and predictive maintenance. The market's potential applications continue to develop as new industries arise and current ones see the need for gas monitoring.

The requirement for frequent calibration and maintenance is a significant problem in the electrochemical gas analyzer systems industry. Consistent accuracy over time necessitates frequent calibration, which can be time-consuming and costly. Furthermore, sensor longevity and probable sensitivity decline after lengthy usage demand sensor replacement, affecting operational continuity. Furthermore, the industry is being challenged by other gas detection technologies such as infrared and photoionization detectors, each of which has individual strengths and disadvantages.

Electrochemical Gas Analyzer Systems Market Segmentation

The worldwide market for electrochemical gas analyzer systems is split based on gas type, application, end-user industry, and geography.

Electrochemical Gas Analyzer Systems Gas Types

- Single Gas Analyzers

- Multi-Gas Analyzers

Single gas analyzers are used to determine the concentration of a single gas such as oxygen (O2), carbon monoxide (CO), hydrogen sulfide (H2S), etc. They are frequently employed in applications where monitoring a specific gas is crucial, such as safety applications (for example, monitoring carbon monoxide in restricted areas) or specialised processes where just one gas is of importance. Single gas analyzers can provide simplicity and cost-effectiveness for monitoring certain gases, making them appropriate for specialised applications.

As per our electrochemical gas analyzer systems industry analysis, the multi-gas analyzers is gaining significant traction in the coming years. Multi-gas analyzers can measure the concentrations of many gases at the same time. These analyzers are useful in contexts where many gases must be monitored for safety, regulatory compliance, or complicated operations. The simultaneous measurement of many gases is frequently required in industries such as oil and gas, industry, and environmental monitoring. Multi-gas analyzers offer a comprehensive solution for such cases and can improve productivity and convenience by eliminating the need for many separate analyzers.

Electrochemical Gas Analyzer Systems Applications

- Environmental Monitoring

- Industrial Processes

- Safety and Personal Protection

Environmental monitoring is measuring gas concentrations in ambient air in order to assess air quality, identify contaminants, and track emissions. This use is critical for polluted metropolitan areas, industrial zones, and regions. Electrochemical gas analyzer systems are frequently used by governments, regulatory authorities, and organisations concerned about public health and environmental impact to detect gases such as nitrogen dioxide (NO2), sulphur dioxide (SO2), ozone (O3), and particulate matter.

Electrochemical gas analyzer systems are critical in industrial processes for assuring operational safety, process optimisation, and regulatory compliance. These systems are used in industries like as oil and gas, petrochemicals, chemicals, and manufacturing to monitor gases that can effect worker safety, production quality, and environmental impact. In many industries, monitoring gases such as hydrogen sulphide (H2S), carbon monoxide (CO), and flammable gases is critical.

Electrochemical gas analyzer systems are used in safety and personal protection applications to assure the safety of personnel in tight spaces, hazardous environments, and regions prone to gas leaks. Applications in industries such as mining, construction, utilities, and emergency response are examples of this. These devices are used to identify gases that are immediately hazardous to human health, such as poisonous or flammable gases.

Electrochemical Gas Analyzer Systems End-User Industries

- Chemical and Petrochemical

- Healthcare

- Oil & Gas

- Research

- Water & Wastewater

- Others

According to the electrochemical gas analyzer systems market forecast, the oil & gas end-user industry is expected to dominate the industry from 2023 to 2032. Historically, the oil and gas sector has made extensive use of electrochemical gas analyzer equipment. These systems are used in this business to monitor poisonous and flammable gases in a variety of operating situations, such as drilling rigs, refineries, and pipelines. Gas analyzers are critical for worker safety, accident prevention, and compliance with environmental requirements.

The chemical and petrochemical industries, like the oil and gas industry, rely heavily on electrochemical gas analyzer systems for process safety, emissions monitoring, and regulatory compliance. Accurate gas monitoring in industrial plants is critical for preventing mishaps and ensuring product quality.

Electrochemical Gas Analyzer Systems Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Electrochemical Gas Analyzer Systems Market Regional Analysis

North America has been an important market for electrochemical gas analyzer systems, including the United States and Canada. Stricter occupational safety and environmental laws have prompted the use of these systems in a variety of sectors. The oil and gas, chemical, and industrial industries have all contributed significantly to demand. The presence of established firms as well as technical improvements contributes to this region's market supremacy.

Europe has exhibited strong demand for electrochemical gas analyzer systems due to stringent environmental regulations and a focus on industrial safety. Countries in the European Union have established rules requiring emissions monitoring and control, which has aided in the adoption of these systems in industries such as energy, chemicals, and manufacturing.

The electrochemical gas analyzer systems market has demonstrated substantial development potential in the Asia-Pacific region. Rapid industrialization, urbanization, and growing environmental consciousness have boosted demand for workplace safety and pollution control. China and India are significant participants, with industries such as manufacturing, chemicals, and energy contributing to market expansion.

Electrochemical Gas Analyzer Systems Market Players

Some of the top electrochemical gas analyzer systems companies offered in our report includes ABB Ltd., AMETEK, Inc., Drägerwerk AG & Co. KGaA, Emerson Electric Co., General Electric Company, Honeywell International Inc., MSA Safety Incorporated, RKI Instruments, Inc., Siemens AG, SICK AG, Thermo Fisher Scientific Inc., and Yokogawa Electric Corporation.

Frequently Asked Questions

What was the size of the global electrochemical gas analyzer systems market in 2022?

The size of electrochemical gas analyzer systems market was USD 895.6 million in 2022.

What is the electrochemical gas analyzer systems market CAGR from 2023 to 2032?

The electrochemical gas analyzer systems market CAGR during the analysis period of 2023 to 2032 is 5.3%.

Which are the key players in the electrochemical gas analyzer systems market?

The key players operating in the global electrochemical gas analyzer systems market are ABB Ltd., AMETEK, Inc., Dr�gerwerk AG & Co. KGaA, Emerson Electric Co., General Electric Company, Honeywell International Inc., MSA Safety Incorporated, RKI Instruments, Inc., Siemens AG, SICK AG, Thermo Fisher Scientific Inc., and Yokogawa Electric Corporation.

Which region dominated the global electrochemical gas analyzer systems market share?

North America region held the dominating position in electrochemical gas analyzer systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of electrochemical gas analyzer systems during the analysis period of 2023 to 2032.

What are the current trends in the global electrochemical gas analyzer systems industry?

The current trends and dynamics in the electrochemical gas analyzer systems industry include growing emphasis on occupational safety and health regulations, increasing concerns about air pollution and emissions, and expanding industrial sectors such as oil and gas, chemicals, and manufacturing.

Which application held the maximum share in 2022?

The multi-gas analyzers held the maximum share of the electrochemical gas analyzer systems industry.?