ENT Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

ENT Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

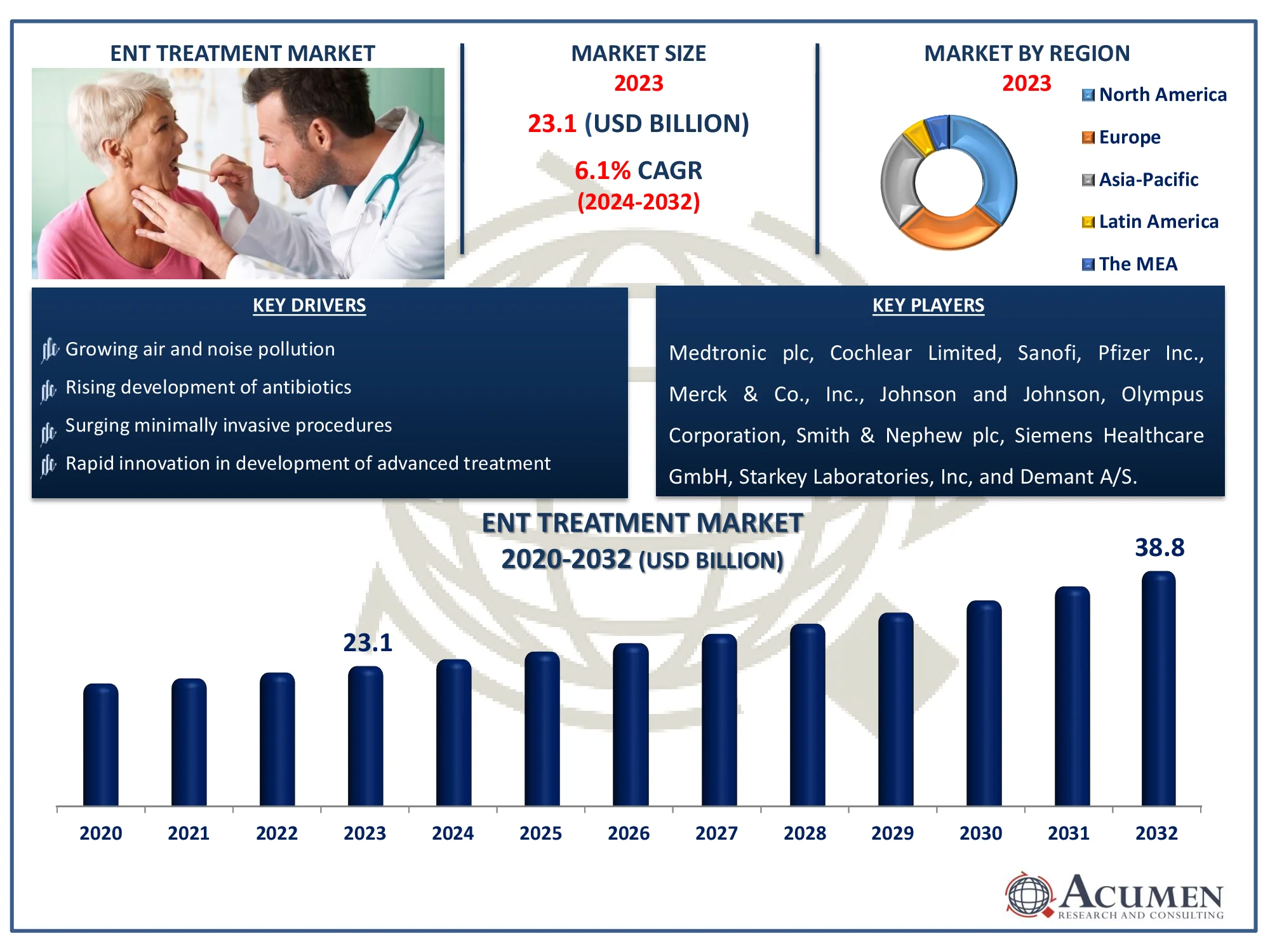

The Global ENT Treatment Market Size accounted for USD 23.1 Billion in 2023 and is estimated to achieve a market size of USD 38.8 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

ENT Treatment Market Highlights

- Global ENT treatment market revenue is poised to garner USD 38.8 billion by 2032 with a CAGR of 6.1% from 2024 to 2032

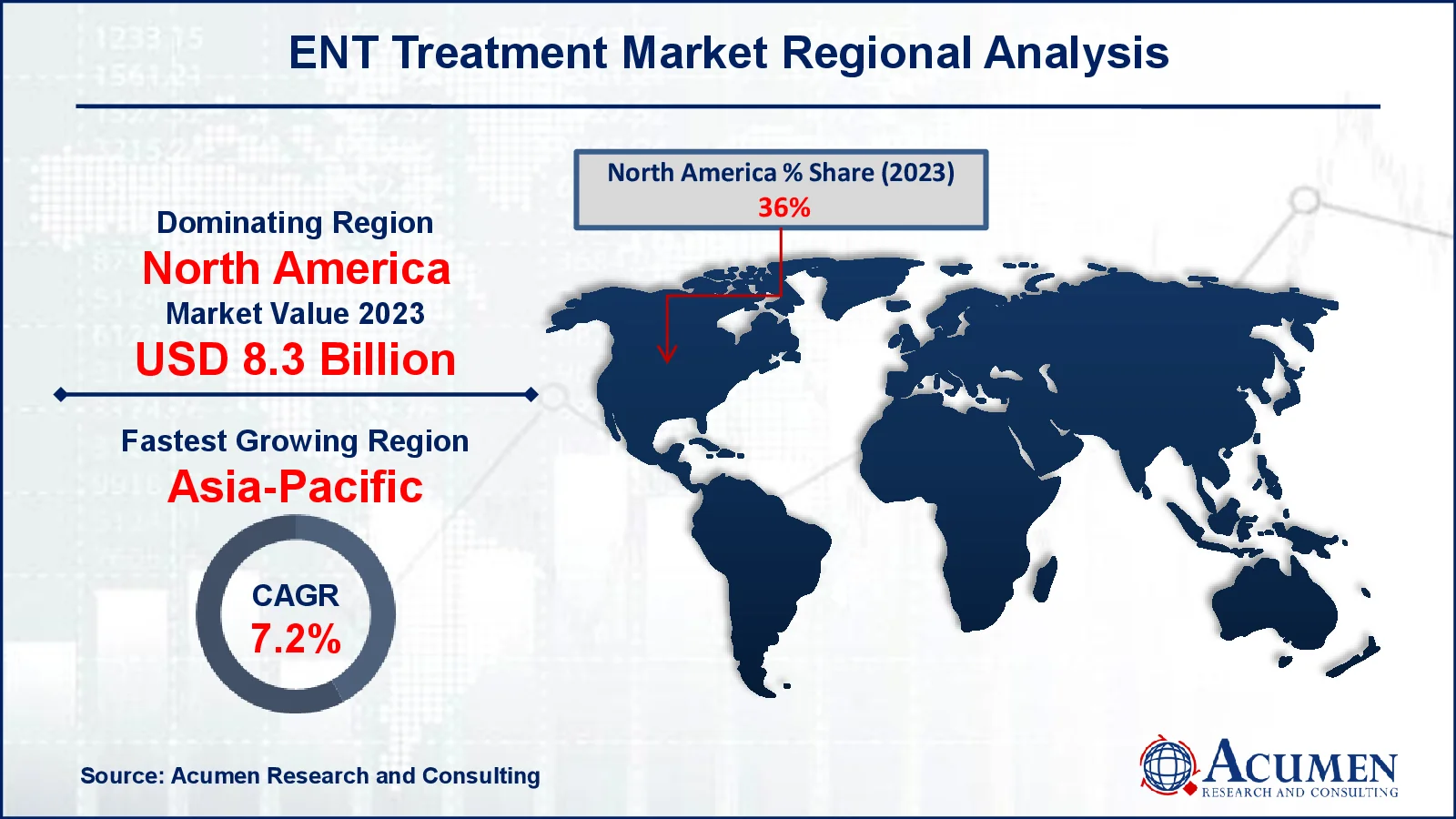

- North America ENT treatment market value occupied around USD 8.3 billion in 2023

- According to the CDC statistics, around 30% of all hearing loss cases in Europe are due to noise pollution

- Asia-Pacific ENT treatment market growth will record a CAGR of more than 7.2% from 2024 to 2032

- Among device, the hearing aid devices sub-segment gathered 31% market share in 2023

- Based on organ type, the nose sub-segment generated around 54% ENT treatment market share in 2023

- Rising prevalence of anti-bacterial resistance is a popular ENT treatment market trend that fuels the industry demand

Increasing air and noise pollution is one of the significant factors that drive the ear, nose, and throat (ENT) market growth. The ENT disorder treatment is very common in the world today and it can cause severe healthcare issues for all age groups. The rising elderly population is another factor that is supporting the global ear, nose, and throat market. Furthermore, growing R&D to discover new treatment methods for these patients is a very popular ENT treatment market trend that will fuel the demand in the coming years.

Global ENT Treatment Market Dynamics

Market Drivers

- Growing air and noise pollution

- Rising development of antibiotics

- Surging minimally invasive procedures

- Rapid innovation in development of advanced treatment

Market Restraints

- High cost of medical devices and drugs for tonsillitis and sinusitis

- Lack of awareness in emerging economies

Market Opportunities

- Increasing penetration of robotics in ENT treatment procedures

- Surplus investments in healthcare infrastructure

ENT Treatment Market Report Coverage

|

Market |

Ear, Nose, And Throat Treatment Market |

|

ENT Treatment Market Size 2023 |

USD 23.1 Billion |

|

ENT Treatment Market Forecast 2032 |

USD 38.8 Billion |

|

ENT Treatment Market CAGR During 2024 - 2032 |

6.1% |

|

ENT Treatment Market Analysis Period |

2020 - 2032 |

|

ENT Treatment Market Base Year |

2023 |

|

ENT Treatment Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Device, By Drug Type, By Organ Type, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Medtronic plc, Cochlear Limited, Sanofi, Pfizer Inc., Merck & Co., Inc., Johnson and Johnson, Olympus Corporation, Smith & Nephew plc, Siemens Healthcare GmbH, Starkey Laboratories, Inc, and Demant A/S. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

ENT Treatment Market Insights

An increase in the number of patients suffering from ENT problems across the globe, rapid advancements in the development of advanced treatment, and a rise in awareness among consumers related to the availability of minimally invasive surgical procedures are major factors expected to drive the growth of global ear, nose, and throat treatment market. According to the World Health Organization (WHO), nearly 2.5 billion people across the globe, or one in every four, will have some degree of hearing loss by 2050. Centers for Disease Control and Prevention states that: out of every 1,000 children, about 2 to 3 are born with hearing loss in both ears in the US.

In addition, approximately 15% of American adults (37.5 million) aged 18 and over report some trouble hearing. Tonsillitis, sinus infections, and ear infections are some of the major ENT problems witnessed by doctors every year. According to Getting It Right First Time (GIRFT), UK statistics, 330,000 patients were admitted to hospitals with ENT disorders. Also, tonsillectomy accounts for 17% of the total elective workload, with 2.8 million outpatient visits. Consumer spending on healthcare is increasing and with the availability of advanced healthcare infrastructure their approach towards the availability of better care to patients is increasing.

The rise in the geriatric population in developing countries and the increase in problems associated with hearing among them is expected to increase demand for minimally invasive devices and treatment procedures. In addition, increasing penetration of robotics in treatment procedures in order to deliver high precision in the diagnosis of diseases are some factors expected to boost the ear, nose, and throat (ENT) treatment market growth.

The government is spending high on the development of present infrastructure with a focus to deliver enhanced care to the patients and aiding enterprises in R&D activities. For instance, NHS spends approximately US$ 37.5 million on ENT products and technologies among which cochlear implants, bone-anchored hearing aids (BAHAs), processors, and accessories account for 80% of these expenditures. The government is providing better reimbursement policies to consumers in order to facilitate healthcare treatment. For example:

- The UK provides complete free healthcare in some parts of the country. If the person/patient is S2 approved then the UK government will be solely in charge of the patient's care. The 100% cost of patient treatment would be covered by the government.

- European Health Insurance Card (EHIC), is a healthcare service for (European Economic Area) EEA countries where it covers all the costs of patients in any unplanned medical situation with state-funded treatment. EHIC will reimburse the cost of treatment.

ENT Treatment Market Segmentation

The worldwide market for ENT treatment is split based on device, drug type, organ type, end-user, and geography.

Ear, Nose, and Throat (ENT) Treatment Market By Device

- Hearing Aid Devices

- Nasal Splints

- Voice Prosthesis

- Endoscopes

- Hearing Implants

- Others

According to ENT treatment industry analysis, hearing aid devices are predicted to account for the majority of the market due to the increasing prevalence of hearing loss around the world. An aging population, increased noise pollution, and genetic susceptibility all contribute to the rising need for these gadgets. AI-powered hearing aids, Bluetooth connectivity, and rechargeable batteries are examples of technology innovations that are improving the user experience and increasing adoption. In addition, favorable government initiatives and insurance coverage for hearing aids in many countries fuel market growth. The rising juvenile and geriatric patient population, combined with a shift toward smaller and invisible hearing aids, is propelling market expansion, with hearing aid devices accounting for the majority of revenue in the ear, nose, and throat (ENT) treatment market.

Ear, Nose, and Throat (ENT) Treatment Market By Drug Type

- Antibiotics

- Steroids

- Antihistamines

- Anti-Inflammatory Drugs

- Others

Antibiotics have developed as a major drug type of ENT treatment market, owing to their efficiency in treating bacterial infections of the ear, nose, and throat. Antibiotic therapy is frequently required for conditions such as sinusitis, otitis media, and tonsillitis in order to prevent complications and expedite recovery. With the rising prevalence of respiratory infections and antibiotic-resistant bacteria, researchers are concentrating on developing broad-spectrum and tailored medicines. Furthermore, increased awareness of appropriate antibiotic use and prescription laws is influencing market patterns. Pediatric and geriatric populations are also driving demand, as they are more vulnerable to ENT-related bacterial infections, making antibiotics a critical and commonly used medication category in this market.

Ear, Nose, and Throat (ENT) Treatment Market By Organ Type

- Ears

- Nose

- Throat

In the ear, nose, and throat treatment market forecast period, the nose organ accumulated a significant market share in 2023. Additionally, the ear segment is expected to attain a substantial growth rate in the coming years. This is attributed to raise in number of ear infection cases across the globe. Increasing R&D activities by major players and introduction of innovative devices is expected to support the segment growth.

Ear, Nose, and Throat (ENT) Treatment Market By End-User

- Ambulatory Surgical Centers

- Hospitals

- Home Care Settings

- Clinics

- Others

Among end-users, the hospital's segment accounted for the highest ear, nose, and throat treatment market share in 2023, due to increasing government spending on the development of hospital infrastructure and focus to deliver enhanced care to the patients. On the other hand, the home care settings are on a boom due to the advent of COVID-19 pandemic and the rising disposable income coupled with the highly aware population regarding the treatment if ear, nose, and throat (ENT).

ENT Treatment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

ENT Treatment Market Regional Analysis

North America accounted for revenue of US$ 8.3 billion in 2023 and is expected to continue its dominance over the market due to the rising number of patients suffering from various ear and nose infections. The availability of favorable reimbursement policies by the government and the presence of advanced healthcare infrastructure are expected to impact the growth of ear, nose, and throat disorder treatment market. Consumer preference for home care is increasing; with the availability of developed infrastructure adoption of advanced devices is easy to provide patients better care.

The presence of a large number of players operating in the country and the introduction of new solutions is expected to boost the ear, nose, and throat (ENT) treatment market growth. The government is providing favorable policies for product approvals. The Food and Drug Administration (FDA), approved "Dupixent (dupilumab)" to treat adults with nasal polyps and chronic rhinosinusitis. This is the first treatment approved by the FDA for inadequately controlled chronic rhinosinusitis with nasal polyps.

ENT Treatment Market Players

Some of the top ENT treatment companies offered in our report include Medtronic plc, Cochlear Limited, Sanofi, Pfizer Inc., Merck & Co., Inc., Johnson and Johnson, Olympus Corporation, Smith & Nephew plc, Siemens Healthcare GmbH, Starkey Laboratories, Inc, and Demant A/S.

Frequently Asked Questions

How big is the ENT treatment market?

The ENT treatment market size was valued at USD 23.1 Billion in 2023.

What is the CAGR of the global ENT treatment market from 2024 to 2032?

The CAGR of ENT treatment is 6.1% during the analysis period of 2024 to 2032.

Which are the key players in the ENT treatment market?

The key players operating in the global market are including Medtronic plc, Cochlear Limited, Sanofi, Pfizer Inc., Merck & Co., Inc., Johnson and Johnson, Olympus Corporation, Smith & Nephew plc, Siemens Healthcare GmbH, Starkey Laboratories, Inc, and Demant A/S.

Which region dominated the global ENT treatment market share?

North America held the dominating position in ENT treatment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ENT treatment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global ENT treatment industry?

The current trends and dynamics in the ENT treatment industry include surging minimally invasive procedures, and rapid innovation in development of advanced treatment.

Which end-user held the maximum share in 2023?

The hospitals end-user held the maximum share of the ENT treatment industry.