Drug Discovery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Drug Discovery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

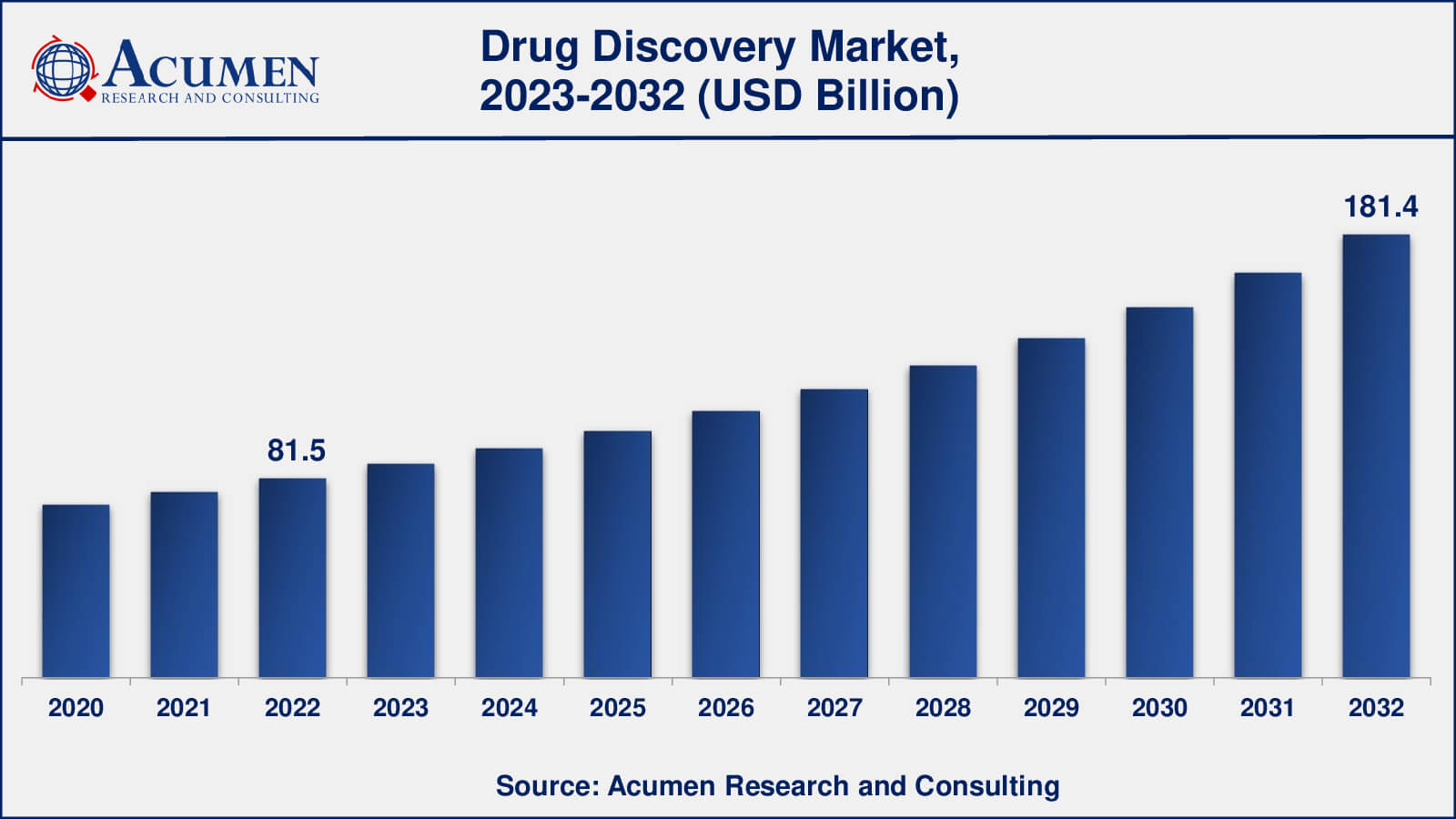

The global Drug Discovery Market size was valued at USD 81.5 Billion in 2022 and is projected to attain USD 181.4 Billion by 2032 mounting at a CAGR of 8.5% from 2023 to 2032.

Drug Discovery Market Highlights

- Global drug discovery market revenue is poised to garner USD 181.4 billion by 2032 with a CAGR of 8.5% from 2023 to 2032

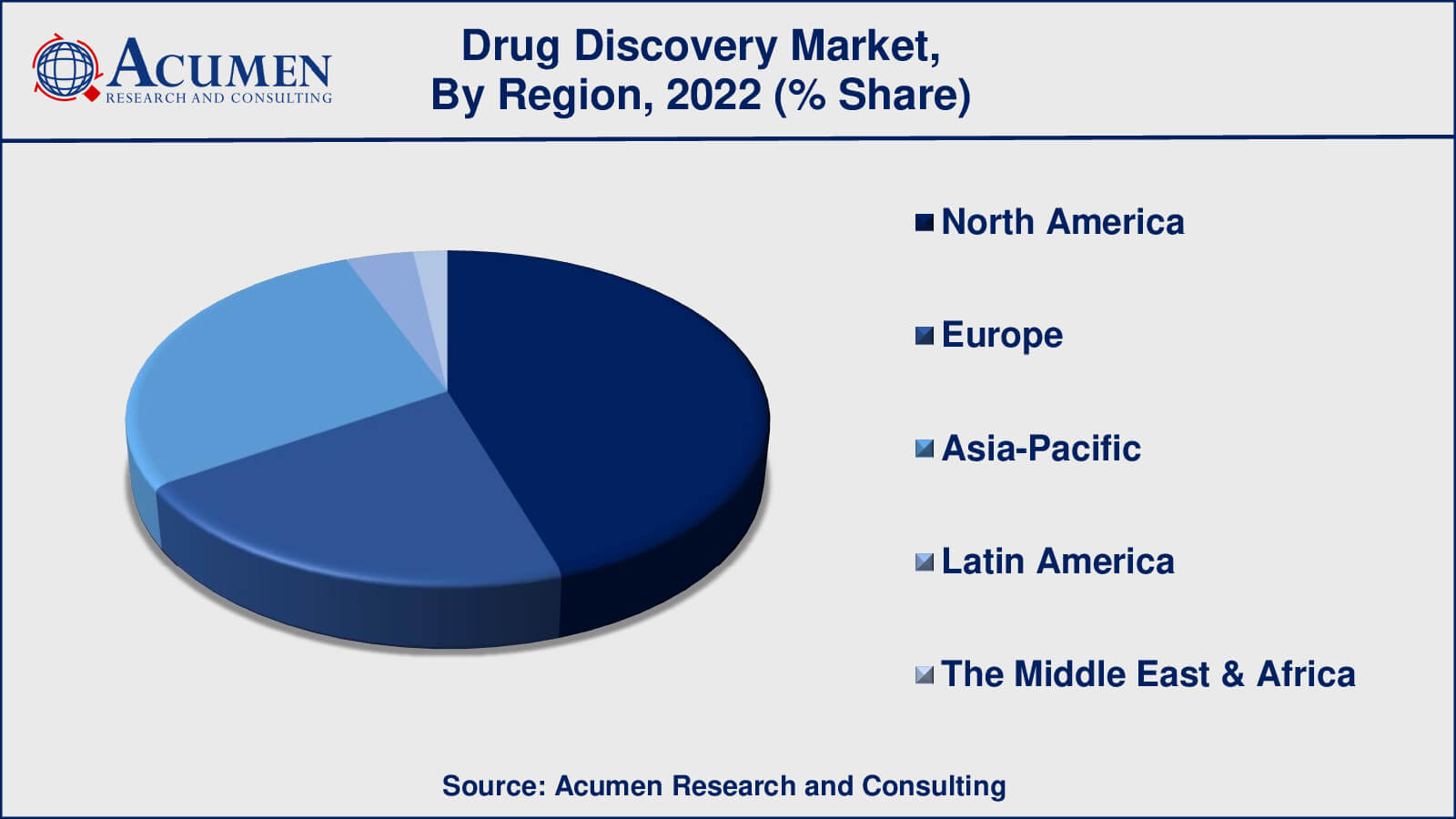

- North America drug discovery market value occupied around USD 36.7 billion in 2022

- Asia-Pacific drug discovery market growth will record a CAGR of more than 10% from 2023 to 2032

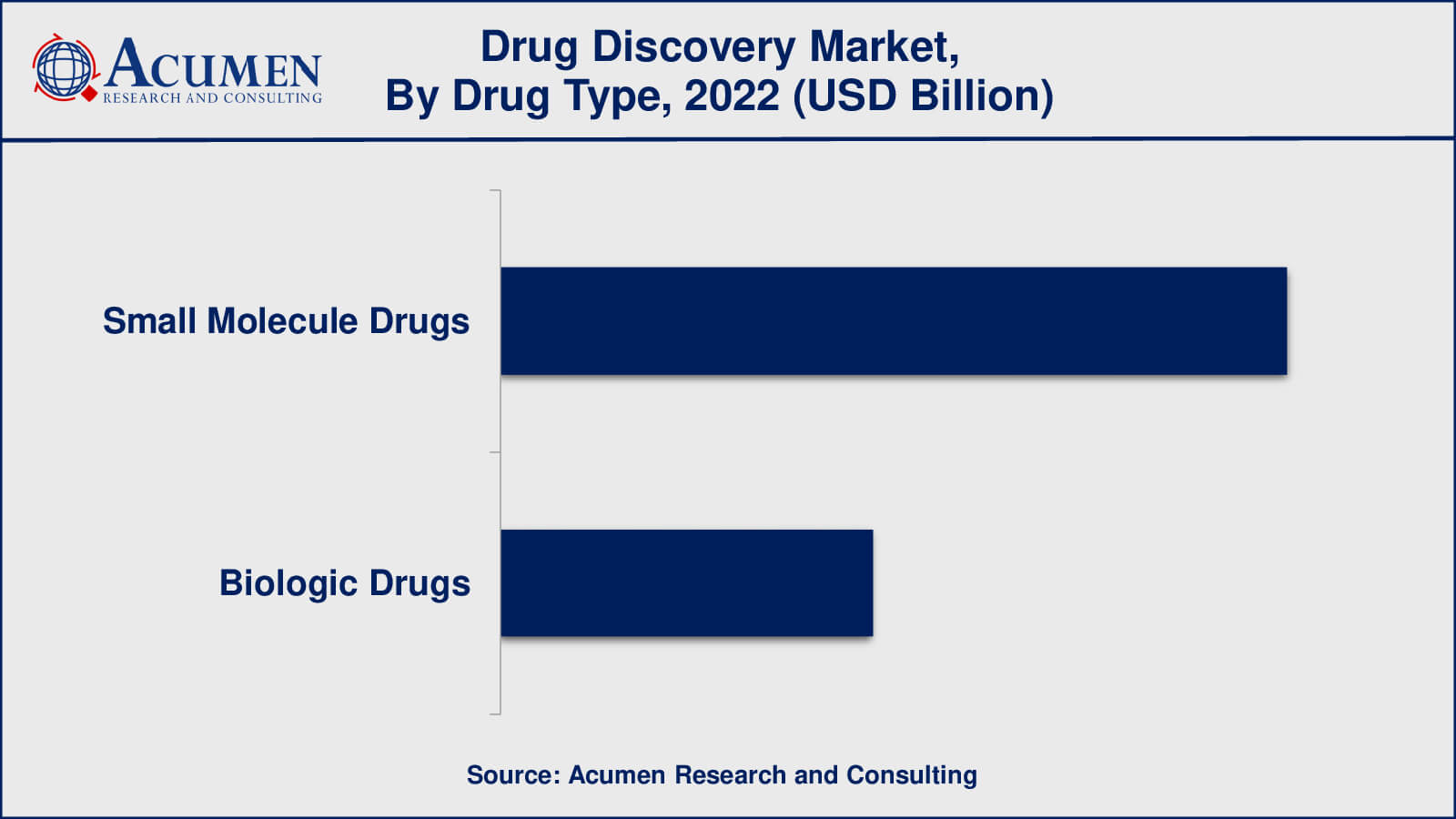

- Among drug type, the small molecule drugs sub-segment occupied over US$ 55.4 billion in revenue in 2022

- Based on end-user, the pharmaceutical companies sub-segment gathered around 45% share in 2022

- Focus on addressing diseases prevalent in developing regions is a popular drug discovery market trend that drives the industry demand

Drug discovery is a complicated and detailed process that aims to uncover novel compounds or molecules with the potential to become useful drugs for treating a variety of medical ailments. This method combines scientific investigation, experimentation, and testing to identify chemicals that can interact with specific biological targets in the body to provide therapeutic effects. It usually starts with the discovery of a biological target, such as a protein or enzyme implicated in a disease process. The researchers then go on a journey of investigating and screening enormous libraries of chemical compounds in order to locate those that may interact with the target in a desired way.

Once a promising molecule is found, it is further optimized to improve its potency, selectivity, and safety. This entails recurrent rounds of chemical alteration and testing to fine-tune the characteristics of the substance. To evaluate their potential in living beings, these optimized molecules are submitted to rigorous preclinical trials, including testing for safety, effectiveness, and pharmacokinetics. If a chemical passes these tests, it can move on to clinical trials, where its safety and efficacy are assessed on human participants.

Clinical trials are divided into phases, each of which is aimed to collect more detailed information regarding the compound's advantages and hazards. If the clinical trial findings are good, regulatory authorities will analyze the data before approving the new medicine for marketing and usage by patients. Drug development is a time-consuming and resource-intensive process that can take years and requires collaboration from several scientific fields such as chemistry, biology, pharmacology, and clinical medicine. The ultimate objective of drug discovery is to provide patients with new and effective therapies that meet unmet medical needs while also enhancing overall health outcomes.

Global Drug Discovery Market Dynamics

Market Drivers

- Increasing prevalence of chronic and rare diseases

- Technological advancements like AI and automation expediting drug development processes

- Rising investment and funding from both private and public sectors

- Growing emphasis on personalized medicine, tailoring treatments to individual patients

- Collaborative research initiatives promoting cross-disciplinary innovation

Market Restraints

- High costs associated with research, development, and clinical trials

- Stringent regulatory requirements and complex approval processes

- Uncertainties around clinical trial outcomes and potential drug side effects

- Ethical considerations related to testing on animals and human subjects

- Increasing competition and challenges in identifying novel drug targets

Market Opportunities

- Utilization of big data and bioinformatics for enhanced target identification

- Repurposing existing drugs for new therapeutic applications

- Integration of advanced technologies like CRISPR for precise drug targeting

- Exploration of rare diseases and niche markets for unmet medical needs

Drug Discovery Market Report Coverage

| Market | Drug Discovery Market |

| Drug Discovery Market Size 2022 | USD 81.5 Billion |

| Drug Discovery Market Forecast 2032 | USD 181.4 Billion |

| Drug Discovery Market CAGR During 2023 - 2032 | 8.5% |

| Drug Discovery Market Analysis Period | 2020 - 2032 |

| Drug Discovery Market Base Year | 2022 |

| Drug Discovery Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Type, By Technology, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories Inc., Agilent Technologies Inc., AstraZeneca PLC, Bayer AG, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GlaxoSmithKline PLC, Merck & Co. Inc., Pfizer Inc., and Shimadzu Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Drug Discovery Market Insights

The dynamic factors that define the drug discovery market determine its growth and evolution. The rising frequency of chronic and uncommon illnesses is one of the main forces behind the market's rise. As chronic diseases continue to afflict a sizable proportion of the worldwide population, the need for novel and effective therapies grows. This need supports research efforts and encourages pharmaceutical and biotech firms to invest in developing new medications to meet these medical requirements.

Technological advancements have a significant impact on the drug discovery environment. Artificial intelligence (AI), high-throughput screening, and computer modeling are examples of innovations that have dramatically expedited the drug development process. These tools enable researchers to analyze large datasets more effectively, anticipate medication interactions, and identify possible candidates with more precision. As a consequence, drug development activities may be simplified, requiring less time and money to bring novel medications to market.

The dynamics of the drug discovery industry are also influenced by financial investment and financing. Robust funding from both the private and governmental sectors promote research programmes, foster collaboration between academia and business, and allow for the pursuit of high-risk, high-reward ventures. These investments help to increase scientific understanding and lead to the development of new therapeutic targets and molecules.

The drug development process, however, is not without its difficulties. The enormous expenses of research, development, and clinical trials are a severe constraint. Furthermore, the tight regulatory standards and complicated approval processes necessitate significant time and money. The uncertainty inherent in clinical trial outcomes, as well as the possibility of severe medication effects, can cause setbacks and delays.

Opportunities in the drug development industry can be found in a variety of places. The increased interest in personalised medicine offers the possibility to individualized therapies based on specific patient profiles, utilizing genomics and precision medicine breakthroughs. Repurposing existing medications for new therapeutic purposes is a low-cost way to innovate. Furthermore, collaboration across diverse sectors of the pharmaceutical and biotechnology industries, as well as multidisciplinary collaborations, can lead to breakthroughs in overcoming technological and financial constraints.

Finally, the demand for innovative therapies, technical developments, and financial expenditures drive the drug discovery market. It operates in a challenging environment that includes high expenses and regulatory barriers. However, chances for overcoming these limitations exist in personalized medicine, medication repurposing, and collaborative initiatives. The interaction of these forces continues to change the landscape of drug discovery, influencing global healthcare outcomes.

Drug Discovery Market Segmentation

The worldwide market for drug discovery is split based on drug type, technology, end-user, and geography.

Drug Discovery Drug Types

- Small Molecule Drugs

- Biologic Drugs

As per the drug discovery industry analysis, small molecule pharmaceuticals have been the leading class in drug discovery. These pharmaceuticals are often low molecular weight molecules that may be synthesised and made into oral medications for patient convenience. Small molecule medications have shown effective in treating a variety of ailments, including infections, cardiovascular disease, and several malignancies. Because of their oral bioavailability, stability, and well-established production techniques, they are frequently favored.

Biologic drugs have gained significance in recent years and have emerged as a major force in drug discovery, notably in immunology, cancer, and rare disorders. Biologics, which include monoclonal antibodies, vaccines, and therapeutic proteins, are big, complicated molecules created by living cells. They provide extremely specialised and focused therapies, generally with less off-target adverse effects. Because biologics are often not suited for oral administration, they are frequently delivered through injection or infusion. Their manufacturing techniques are more sophisticated than those of small molecule medications, including cell cultures and elaborate purification procedures.

Drug Discovery Technologies

- High Throughput Screening

- Spectroscopy

- Combinatorial Chemistry

- Biochips

- Pharmacogenomics and Pharmacogenetics

- Bioinformatics

- Metabolomics

- Nanotechnology

- Other Technologies

According to our drug discovery market study, the high throughput screening (HTS) sector and nanotechnology accounts for a sizable market share in 2022. HTS has been a cornerstone tool in drug development, allowing for the fast screening of a large number of compounds for possible target action. It has considerably expedited the early phases of drug development and the discovery of lead compounds. Nanotechnology has showed promise in medication delivery, allowing for the controlled and targeted release of medicinal substances. Its influence is growing, particularly in terms of boosting therapeutic effectiveness and decreasing adverse effects.

The bioinformatics sub-segment, on the other hand, is likely to increase at the quickest rate throughout the forecast timeframe. With the proliferation of biological data, bioinformatics is becoming increasingly important in data analysis, predictive modelling, and target identification. Its significance is predicted to expand as big data becomes increasingly important in drug discovery.

Drug Discovery End-Users

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Other End-Users

According to the drug discovery market forecast, pharmaceutical companies have historically been the dominant end-users in the drug discovery market. These firms do considerable R&D to find and develop novel medications for a variety of medical ailments. They invest heavily in finding pharmacological targets, doing high-throughput screening, optimising lead compounds, and conducting preclinical and clinical trials.

Contract Research Organisations (CROs) play an important part in the drug discovery process as well. They specialise in providing services to pharmaceutical corporations, biotechnology companies, and academic organisations. CROs specialise in preclinical testing, clinical trials, bioinformatics, and assay development. They assist to the drug development process by offering outsourced services that aid in the streamlining of R&D activities and the reduction of expenses.

Academic and research institutes, government agencies, and nonprofit organisations are among the other end-users. These organisations may conduct drug development for a variety of reasons, including as expanding scientific understanding, solving specific medical needs, or contributing to public health efforts.

Drug Discovery Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Drug Discovery Market Regional Analysis

Historically, North America, particularly the United States, has been a prominent centre for drug development. Advanced research facilities, significant investment in biotechnology and pharmaceutical industries, and a well-established regulatory framework benefit the region. The presence of prestigious academic institutions and research centers aids in the creation of novel pharmaceuticals.

Europe, which includes nations such as the United Kingdom, Germany, and Switzerland, is also a major role in the drug discovery environment. The region has a long history of scientific research and pharmaceutical development. Collaboration among academia, business, and government agencies promotes advances in drug discovery technology and technique.

The Asia-Pacific area, driven by China, Japan, and India, has grown quickly in prominence in the drug discovery business. Factors such as a huge pool of competent researchers, cheaper research expenses, and increased expenditures in biotechnology all contribute to the region's importance. Furthermore, because of the different patient populations, Asia-Pacific is becoming a clinical trial hub.

Drug Discovery Market Players

Some of the top drug discovery companies offered in our report includes Abbott Laboratories Inc., Agilent Technologies Inc., AstraZeneca PLC, Bayer AG, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GlaxoSmithKline PLC, Merck & Co. Inc., Pfizer Inc., and Shimadzu Corp.

Frequently Asked Questions

What was the size of the global drug discovery market in 2022?

The size of drug discovery market was USD 81.5 billion in 2022.

What is the drug discovery market CAGR from 2023 to 2032?

The drug discovery market CAGR during the analysis period of 2023 to 2032 is 8.5%.

Which are the key players in the drug discovery market?

The key players operating in the global drug discovery market are Abbott Laboratories Inc., Agilent Technologies Inc., AstraZeneca PLC, Bayer AG, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GlaxoSmithKline PLC, Merck & Co. Inc., Pfizer Inc., and Shimadzu Corp.

Which region dominated the global drug discovery market share?

North America region held the dominating position in drug discovery industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of drug discovery during the analysis period of 2023 to 2032.

What are the current trends in the global Drug Discovery industry?

The current trends and dynamics in the drug discovery industry include increasing prevalence of chronic and rare diseases, technological advancements like AI and automation expediting drug development processes, and rising investment and funding from both private and public sectors

Which type held the maximum share in 2022?

The small molecule drugs type held the maximum share of the drug discovery industry.?