Bioinformatics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Bioinformatics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

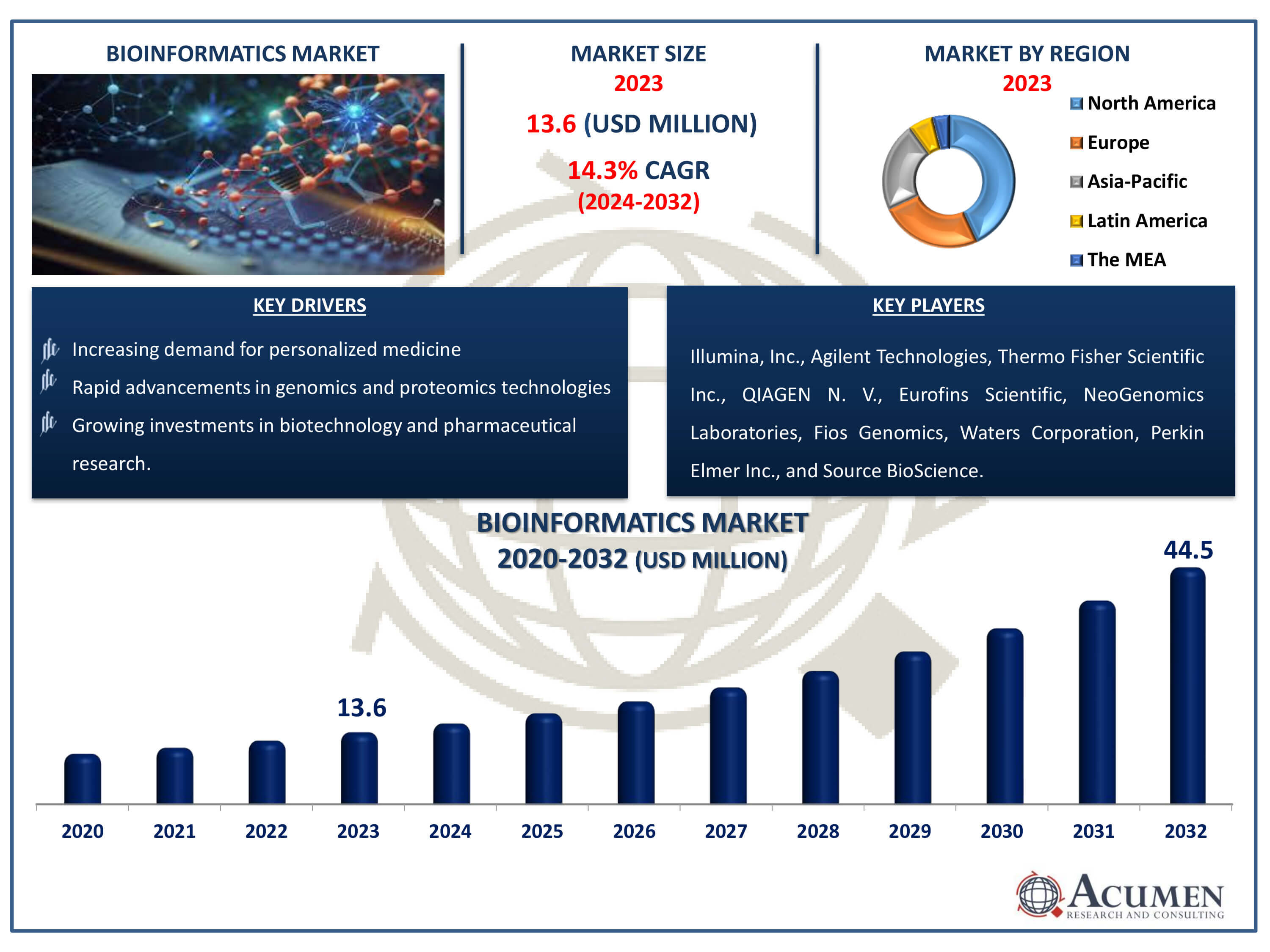

The Bioinformatics Market Size accounted for USD 13.6 Billion in 2023 and is estimated to achieve a market size of USD 44.5 Billion by 2032 growing at a CAGR of 14.3% from 2024 to 2032.

Bioinformatics Market Highlights

- Global bioinformatics market revenue is poised to garner USD 44.5 billion by 2032 with a CAGR of 14.3% from 2024 to 2032

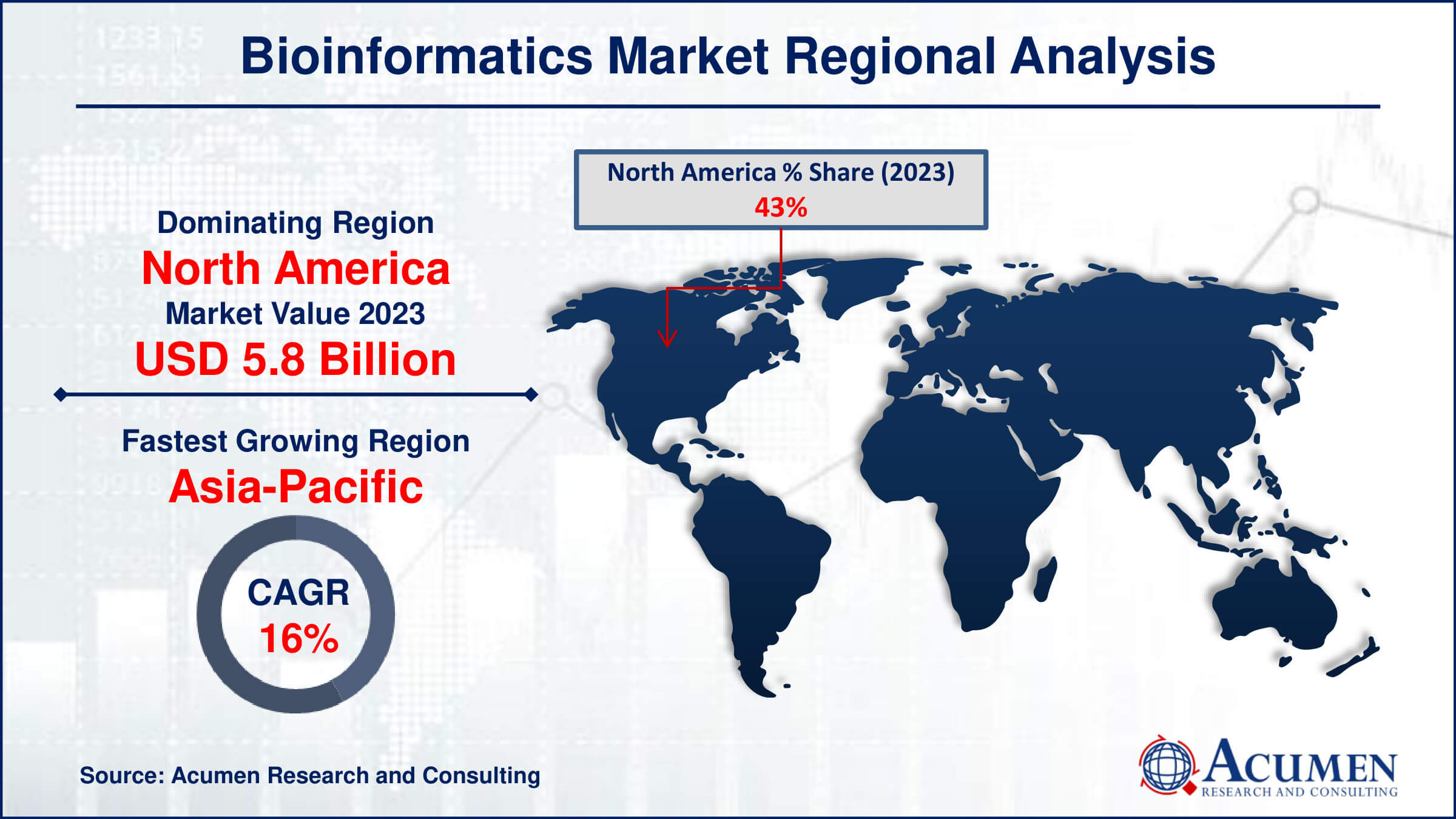

- North America bioinformatics market value occupied around USD 5.8 billion in 2023

- Asia-Pacific bioinformatics market growth will record a CAGR of more than 16% from 2024 to 2032

- Among technology & services, the biocontent management generator sub-segment generated more than USD 5.3 billion revenue in 2023

- Based on application, the genomics sub-segment generated significant market share in 2023

- Rising adoption of cloud-based bioinformatics solutions is a popular bioinformatics market trend that fuels the industry demand

The bioinformatics industry is poised for rapid growth due to several key factors. The rising demand for protein sequencing and nucleic acid research, combined with increased efforts from government and private organizations, is fueling the expansion of genomics and proteomics. Additionally, the surge in research on molecular genetics and drug development is further propelling the market. Significant investments in the biological sciences and information technology sectors are also contributing to the global bioinformatics market's growth. Consequently, the market size is expected to expand swiftly over the bioinformatics industry forecast period.

Bioinformatics involves conceptualizing biology at the molecular level and applying information technology to organize and interpret data related to these molecules on a large scale. This field encompasses the collection, analysis, integration, and storage of molecular and biological data, which is subsequently utilized in applications such as drug discovery and development. The bioinformatics market is primarily categorized into technology and services. The technology segment is further divided into knowledge management tools and bioinformatics platforms, with the latter also segmented into content/knowledge management tools. Among these, the bioinformatics platform segment is anticipated to generate the highest revenue, followed by the services segment.

Global Bioinformatics Market Dynamics

Market Drivers

- Growing demands for nucleic acid and protein sequencing

- Increasing demand for personalized medicine

- Rapid advancements in genomics and proteomics technologies

- Growing investments in biotechnology and pharmaceutical research

- Rising prevalence of chronic diseases and genetic disorders

Market Restraints

- Higher operational costs

- Lack of interoperability and multiplatform functionality

- Absence of skilled bioinformatics specialists

Market Opportunities

- Integration of artificial intelligence and machine learning in healthcare

- Acceptance of blockchain technology and cloud computing

- Increasing investments in bioinformatics solutions by leading IT enterprises

Bioinformatics industry Report Coverage

| Market | Bioinformatics Market |

| Bioinformatics Market Size 2022 | USD 13.6 Billion |

| Bioinformatics Market Forecast 2032 | USD 44.5 Billion |

| Bioinformatics Market CAGR During 2023 - 2032 | 14.3% |

| Bioinformatics Market Analysis Period | 2020 - 2032 |

| Bioinformatics Market Base Year |

2022 |

| Bioinformatics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology & Services, By Sector, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Illumina, Inc., Agilent Technologies, Thermo Fisher Scientific Inc., QIAGEN N. V., Eurofins Scientific, NeoGenomics Laboratories, Fios Genomics, Waters Corporation, Perkin Elmer Inc., and Source BioScience. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Bioinformatics Market Insights

The burgeoning global bioinformatics market encompasses a multidisciplinary approach, amalgamating information technology, molecular biology, statistics, and algorithms to analyze data gleaned from diverse experiments. The market delineates key sectors such as agriculture, medical bioinformatics, animal research, academia, and others. Applications span metabolomics, proteomics, chemo-informatics, genomics, transcriptomics, and molecular phylogenetics. Driving the escalating demand for bioinformatics are its pivotal roles in drug discovery, development, and personalized medicine, alongside its indispensable support in clinical diagnostics. Nevertheless, the market encounters an array of trends and challenges, including governmental regulations, industry flux, interoperability hurdles, evolving focus areas, integration complexities, intensifying competition, and data management intricacies. Notably, there's a discernible pivot towards proteomics from genomics, propelled by researchers' burgeoning interest in this domain. This shift is propelled by the identification of numerous therapeutic targets and disease biomarkers, amplifying the appeal of proteomics tools, particularly amid heightened demand from pharmaceutical entities.

Another key growth driver for the bioinformatics industry is its critical role in transforming drug discovery and development. Bioinformatics tools and techniques make it easier to analyze large amounts of biological data, which speeds up the identification of prospective drug targets and optimizes the design of innovative treatments. Bioinformatics, which combines information technology, molecular biology, statistics, and algorithms, allows researchers to thoroughly comprehend biological systems, anticipate medication interactions, and prioritize substances for further investigation. This speeds up the medication development process, lowers costs, and increases the likelihood of good outcomes. As pharmaceutical businesses rely more on bioinformatics to streamline their research efforts and bring breakthrough therapies to market, demand for bioinformatics solutions rises, propelling market growth and expansion.

Bioinformatics Market Segmentation

The worldwide market for bioinformatics is split based on technology & services, sector application, and geography.

Bioinformatics Technology & Services

- Bioinformatics Platforms

- Sequence Analysis Platforms

- Sequence Alignment Platforms

- Sequence Manipulation Platforms

- Structural Analysis Platforms

- Others

- Knowledge Management Tools

- Generalized Knowledge Management Tools

- Specialized Knowledge Management Tools

- Bioinformatics Services

- Sequencing Services

- Database Management

- Data Analysis

- Others

- Biocontent Management

- Generalized Biocontent

- Specialized Biocontent

According to bioinformatics industry analysis, bioinformatics services segment gathered notable market share in 2023, fueled by surging investments in research and development and a growing appetite for groundbreaking bioactive molecules. Technological advancements further bolster this segment's prominence, fostering a robust global demand for bioinformatics services. With a focus on offering tailored solutions and expertise to navigate complex biological data, bioinformatics services providers play a pivotal role in accelerating scientific discoveries and facilitating the development of novel therapeutics. As the industry continues to evolve and innovate, the bioinformatics services segment stands at the forefront, catering to the burgeoning needs of researchers, pharmaceutical companies, and other stakeholders in the life sciences domain.

Bioinformatics Sectors

- Agriculture Bioinformatics

- Medical Bioinformatics

- Academics

- Animal Bioinformatics

- Others

As per bioinformatics market forecast, the academics segment is projected to experience notable growth in the market in the forthcoming years. The escalating adoption of innovative technologies is driving the demand for bioinformatics within genomics. Additionally, the sustained expansion of pharmacogenomics, particularly in drug development and sequence screening, coupled with technological advancements tailored to manage vast volumes of genomic data, constitutes a substantial portion of this growth trajectory. As researchers and pharmaceutical entities increasingly leverage genomic insights to unravel complex biological mechanisms and develop personalized treatments, the role of bioinformatics in genomics becomes increasingly indispensable, positioning this segment as a pivotal driver of market expansion in the foreseeable future.

Bioinformatics Applications

- Proteomics

- Metabolomics

- Transcriptomics

- Genomics

- Molecular Phylogenetic

- Chemo-informatics

- Others

According to a bioinformatics industry analysis, the genomics segment is expected to grow significantly in the market over the next few years. The acceptance of new and cutting-edge technologies is increasing the requirement for bioinformatics in genomics. Furthermore, the continued growth of pharmacogenomics in developing drugs and sequence screening, as well as technological developments aimed at handling multiple amounts of genomic data, contribute to a significant portion of this significant chunk.

Bioinformatics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bioinformatics Market Regional Analysis

In terms of bioinformatics market analysis, North America is the largest region in the global industry, because to its strong infrastructure, major investments in R&D, and a multitude of well-established biotech and pharmaceutical businesses. The region's supremacy is reinforced by a large presence of academic institutions, which create relationships between academia and industry, hence promoting innovation and technical developments. In addition, supportive government efforts and funding mechanisms help to fuel North America's thriving bioinformatics ecosystem.

On the other hand, the Asia-Pacific (APAC) region emerges as the fastest-growing and it expected to grow throughout the bioinformatics market forecast period, driven by a number of significant variables. APAC's strong economic expansion, thriving healthcare sector, and growing emphasis on precision medicine and individualized healthcare solutions have all fueled demand for bioinformatics tools and services. Furthermore, the region's vast population and expanding healthcare expenditure make it an ideal environment for the implementation of bioinformatics solutions to solve a wide range of healthcare concerns.

Bioinformatics Market Players

Some of the top bioinformatics companies offered in our report includes Illumina, Inc., Agilent Technologies, Thermo Fisher Scientific Inc., QIAGEN N. V., Eurofins Scientific, NeoGenomics Laboratories, Fios Genomics, Waters Corporation, Perkin Elmer Inc., and Source BioScience.

Frequently Asked Questions

How big is the bioinformatics market?

The bioinformatics market size was valued at USD 13.6 billion in 2023.

What is the CAGR of the global bioinformatics market from 2024 to 2032?

The CAGR of bioinformatics is 14.3% during the analysis period of 2024 to 2032.

Which are the key players in the bioinformatics market?

The key players operating in the global market are including Illumina, Inc., Agilent Technologies, Thermo Fisher Scientific Inc., QIAGEN N. V., Eurofins Scientific, NeoGenomics Laboratories, Fios Genomics, Waters Corporation, Perkin Elmer Inc., and Source BioScience.

Which region dominated the global bioinformatics market share?

North America held the dominating position in bioinformatics industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of bioinformatics during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global bioinformatics industry?

The current trends and dynamics in the bioinformatics industry include growing demands for nucleic acid and protein sequencing, rising bioinformatics applications and various initiatives from private and government organizations, rising R&D spending and increased collaborations between research institutions and companies, cost-cutting for genome sequencing, and The emerging trend in personalized medicine.

Which technology & services held the maximum share in 2023?

The biocontent management technology & services held the maximum share of the bioinformatics industry.