Dodecanedioic Acid Market | Acumen Research and Consulting

Dodecanedioic Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

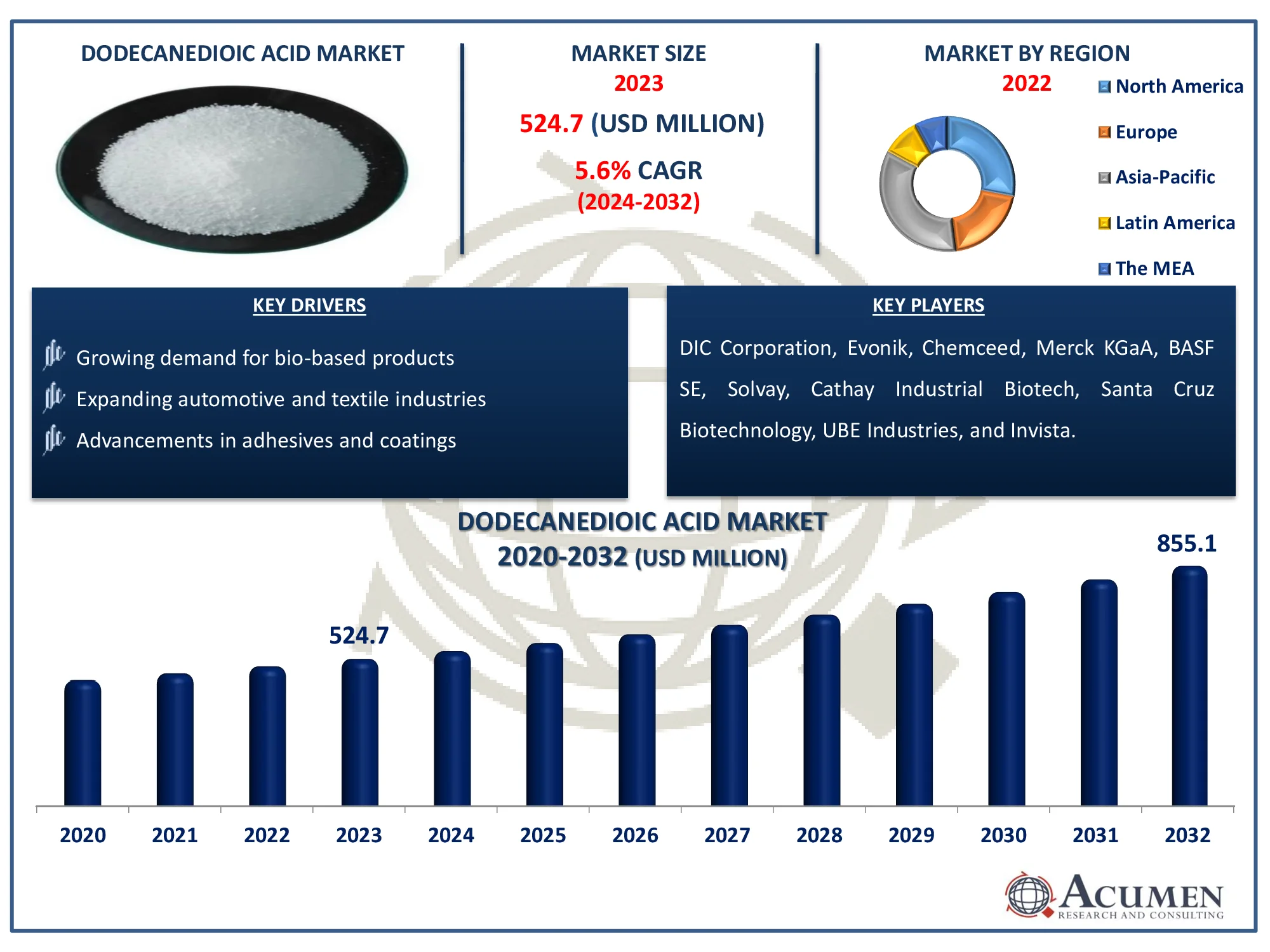

The Global Dodecanedioic Acid Market Size accounted for USD 524.7 Million in 2023 and is estimated to achieve a market size of USD 855.1 Million by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Dodecanedioic Acid Market (By Production Method: Chemical Synthesis, Bio-Based; By Application: Powder coatings, Lubricants, Adhesives, Resins, Others; By End-Use Industry: Automotive, Paints and Coatings, Adhesives and Sealants, Engineering Plastics, and Others and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Dodecanedioic Acid Market Highlights

- The global dodecanedioic acid market is expected to reach USD 855.1 million by 2032, growing at a CAGR of 5.6% from 2024 to 2032

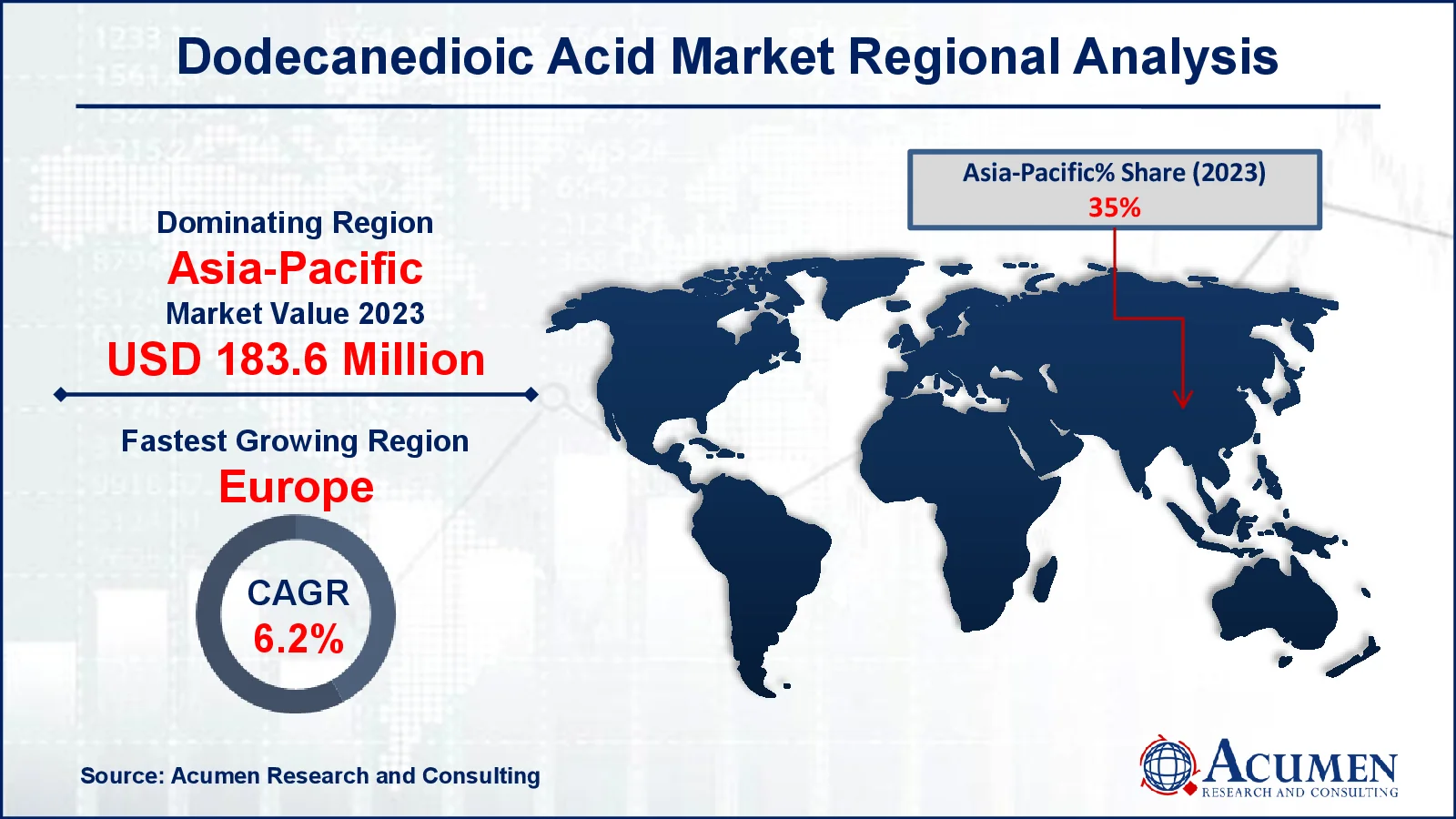

- In 2023, the Asia-Pacific dodecanedioic acid market was valued at approximately USD 183.6 million

- The European region is projected to grow at a CAGR of over 6.2% from 2024 to 2032

- In 2023, resin applications accounted for 60% of the market share

- The surge in consumer electronics manufacturing is boosting the demand for DDDA as a key component in various polymer formulations is the dodecanedioic acid market trend that fuels the industry demand

Dodecanedioic acid is a dicarboxylic acid. DDDA is a mildly odorous white solid. His boiling point is 2500C, but his formation point is 1280C. DDDA has a wide range of uses, including surfactants, corrosion inhibitors, paints, and various medical applications. It is utilized in a variety of applications, including adhesives, condensers, and plasticizers. It can be utilized as a heat transfer component in fluid and corrosion resistant coatings. DDDA is also utilized in powder coatings to stabilize and cure. Despite its numerous applications, DDDA is mostly employed in polyesters, specifically polyamides, and epoxy resins. A chemical process from butadiene produces DDDA. DDDA inhalation poses no health risk because to the lower vapor pressure. None of this applies to DDDA, which is genotoxic or mutagenic.

Global Dodecanedioic Acid Market Dynamics

Market Drivers

- Growing demand for bio-based products

- Expanding automotive and textile industries

- Advancements in adhesives and coatings

Market Restraints

- Volatile raw material prices

- Limited awareness of bio-based alternatives

- Competition from alternative chemicals

Market Opportunities

- Emerging markets in Asia-Pacific

- Innovations in sustainable production

- Increasing applications in electronics

Dodecanedioic Acid Market Report Coverage

| Market | Dodecanedioic Acid Market |

| Dodecanedioic Acid Market Size 2022 |

USD 524.7 Million |

| Dodecanedioic Acid Market Forecast 2032 | USD 855.1 Million |

| Dodecanedioic Acid Market CAGR During 2023 - 2032 | 5.6% |

| Dodecanedioic Acid Market Analysis Period | 2020 - 2032 |

| Dodecanedioic Acid Market Base Year |

2022 |

| Dodecanedioic Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Production Method, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Cathay Industrial Biotech, Chemceed, DIC Corporation, Evonik, Invista, Merck KGaA, Solvay, Santa Cruz Biotechnology, and UBE Industries. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Dodecanedioic Acid Market Insights

Polyamides have mostly fueled the dodecanedioic acid (DDDA) market. Dodecanedioic acid is mostly utilized in polyamide 6, 12 manufacturing processes. Polyamide 6, 12 is mostly utilized in nylon product manufacture. DDDA is also utilized in polyester coatings, synthetic diester lubricants, and textiles.

Dodecanedioic acid is utilized in a variety of applications, including flame retardants, fertilizers, aromas, fragrances, purifying agents, and tea. The dodecanedioic acid industry has the best opportunity to invest in biodegradable DDDA. Products will soon focus on bio-based DDCA. However, in the next years, environmental concerns may significantly limit the market for dodecanedioic acid.

Dodecanedioic acid (DDDA) is widely used in the production of paints, plastics, corrosion inhibitors, coatings, adhesives, lubricants, and surfactants. Furthermore, the presence of strong industrial bases propels the market in emerging economies. The need for adhesives, lubricants, and nylons is expected to surge in emerging markets. The growing demand for lacquers particularly powder lacquers, should result in increased DDDA requests. Increased building operations around the world have a simultaneous impact on product demand.

Emerging markets such as China and India are seeing a growth in demand for nylon due to advantages such as flexibility, thermal stability, and increased scratch resistance in the automobile industry. This has resulted in increased use of the product in the automobile industry. Dodecanedioic acid consumption is expected to rise in recent years due to increased demand for lubricants and adhesives. Increasing support for product innovation from nylon producers in research and development should benefit the market throughout the forecast period. Nylon is also in great demand because to the need for screws, gears, and textiles. Because of rising expenditure dynamics, the thriving automobile industry will have a beneficial impact on global corporate income. Paints and coatings are primarily used to protect automotive parts from corrosion while also improving their cosmetic look.

Another key driver fueling the DDDA (dodecanedioic acid) market throughout the forecast period is the rapidly expanding global automobile sector as a result of improved client lifestyles and expenditure dynamics. Paints and coatings are essential for car body components, such as the motor and body panels. Powder coating is used on certain automotive components to improve their appearance and corrosion resistance.

Continued infrastructure investment is likely to expand the size of the global DDDA market over time. The growing need for paint and coating applications will improve significantly. With acetone, benzene, and water, it provides the necessary solubility qualities, making it suitable for lacquers. DDDA is restricted globally by strict VOC emission environmental standards, which may hamper the overall development of the dodecanedioic acid market in the future. Furthermore, the product is looking into the rigid risks posed by adipic acid and sebacic acid, both of which can be employed in nylon production. On the other hand, the presence of biologic-based DDDA market share would provide respondents in the global dodecanedioic acid industry with several new opportunities for growth.

Dodecanedioic Acid Market Segmentation

The worldwide market for dodecanedioic acid is split based on production method, application, end-use industry, and geography.

Dodecanedioic Acid Production Method

- Chemical Synthesis

- Bio-Based

According to the dodecanedioic acid industry analysis, chemical synthesis expected to see notable growth in industry due to its established manufacturing processes and ability to produce consistent quality on a large scale. The classical approach, which commonly involves the oxidation of cyclododecane, provides fine control over the purity and yield of the end product, making it preferable in industries that require high-performance materials. However, bio-based production methods are gaining favor as consumers and businesses prioritize sustainability.

Dodecanedioic Acid Application

- Powder Coatings

- Lubricants

- Adhesives

- Resins

- Others

The resins sector held the biggest market share in the global dodecanedioic acid market, and it is likely to continue to lead the market at a considerable CAGR throughout the forecast period. Nylon demand from a variety of end-use sectors, particularly the automotive industry, is predicted to increase during this phase of implementation. However, the key application location for bio-DDDA in the forecast age is expected to remain resin production. Industrialization and urbanization in Asia Pacific developing countries are predicted to drive up demand for resins and powder coatings. As the world's economies improve, so do the applications for dodecanedioic acid, which include powder coatings, corrosion inhibitors, lacquers, adhesives, surfactants, and lubricants.

Dodecanedioic Acid End-Use Industry

- Automotive

- Paints and Coatings

- Adhesives and Sealants

- Engineering Plastics

- Others

According to the dodecanedioic acid market forecast, the automotive industry shows robust growth in dodecanedioic acid (DDDA) market because it is increasingly used in the production of high-performance polymers and coatings, which are critical for improving vehicle durability and appearance. DDDA plays an important role in the production of polyamides, particularly Nylon 12, which is used in automobile parts due to its superior thermal stability and chemical resistance. The automobile industry's emphasis on lightweight materials and sustainability increases demand for DDDA, which adds to fuel efficiency and reduces emissions.

Dodecanedioic Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Dodecanedioic Acid Market Regional Analysis

For several reasons, Asia-Pacific accounts are expected to grow at the fastest CAGR over the forecast period because to rising national consumption in markets such as China, Malaysia, and Japan. Furthermore, the good influence on the market is anticipated by enacting rules that encourage investment.

Europe is expected to grow significantly throughout the projected period as powder coating production expands in countries such as Germany. In addition, businesses see product trends as a significant market opportunity. Growing demand for bio-adhesives is expected to make bio-decanedioic acid a viable business in the future. DGDA manufacturers have been offered the potential to reduce costs and enhance their penetration of highly restricted markets such as North America and Europe through renewable feedstock. Because of its heating capability, nylon is becoming more popular in the HPP manufacturing business.

North America also has a considerable dodecanedioic acid (DDDA) market share, as Mexico emerges as an automotive production center. Furthermore, rising global demand for consumer luxury automobiles is expected to enhance DDDA demand in the region. This industry has an immense demand for polyamides. In North America, the United States and Canada are the largest buyers. In the future, the rest of the international market for dodecanedioic acid is expected to rise steadily. Demand for DDDA is likely to rise in the next years as nylon products from various end-user apps in the Middle East, North Africa, and Latin America become more popular.

Dodecanedioic Acid Market Players

Some of the top dodecanedioic acid companies offered in our report include BASF SE, Cathay Industrial Biotech, Chemceed, DIC Corporation, Evonik, Invista, Merck KGaA, Solvay, Santa Cruz Biotechnology, and UBE Industries.

Frequently Asked Questions

How big is the dodecanedioic acid market?

The dodecanedioic acid market size was valued at USD 524.7 million in 2023.

What is the CAGR of the global dodecanedioic acid market from 2024 to 2032?

The CAGR of dodecanedioic acid is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the dodecanedioic acid market?

The key players operating in the global market are including DIC Corporation, Evonik, Chemceed, Merck KGaA, BASF SE, Solvay, Cathay Industrial Biotech, Santa Cruz Biotechnology, UBE Industries, and Invista.

Which region dominated the global dodecanedioic acid market share?

Asia-Pacific held the dominating position in dodecanedioic acid industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of dodecanedioic acid during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global dodecanedioic acid industry?

The current trends and dynamics in the dodecanedioic acid industry include growing demand for bio-based products, expanding automotive and textile industries, and advancements in adhesives and coatings.

Which application held the maximum share in 2023?

The resins application method held the maximum share of the dodecanedioic acid industry.