Automotive Paints and Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Paints and Coatings Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

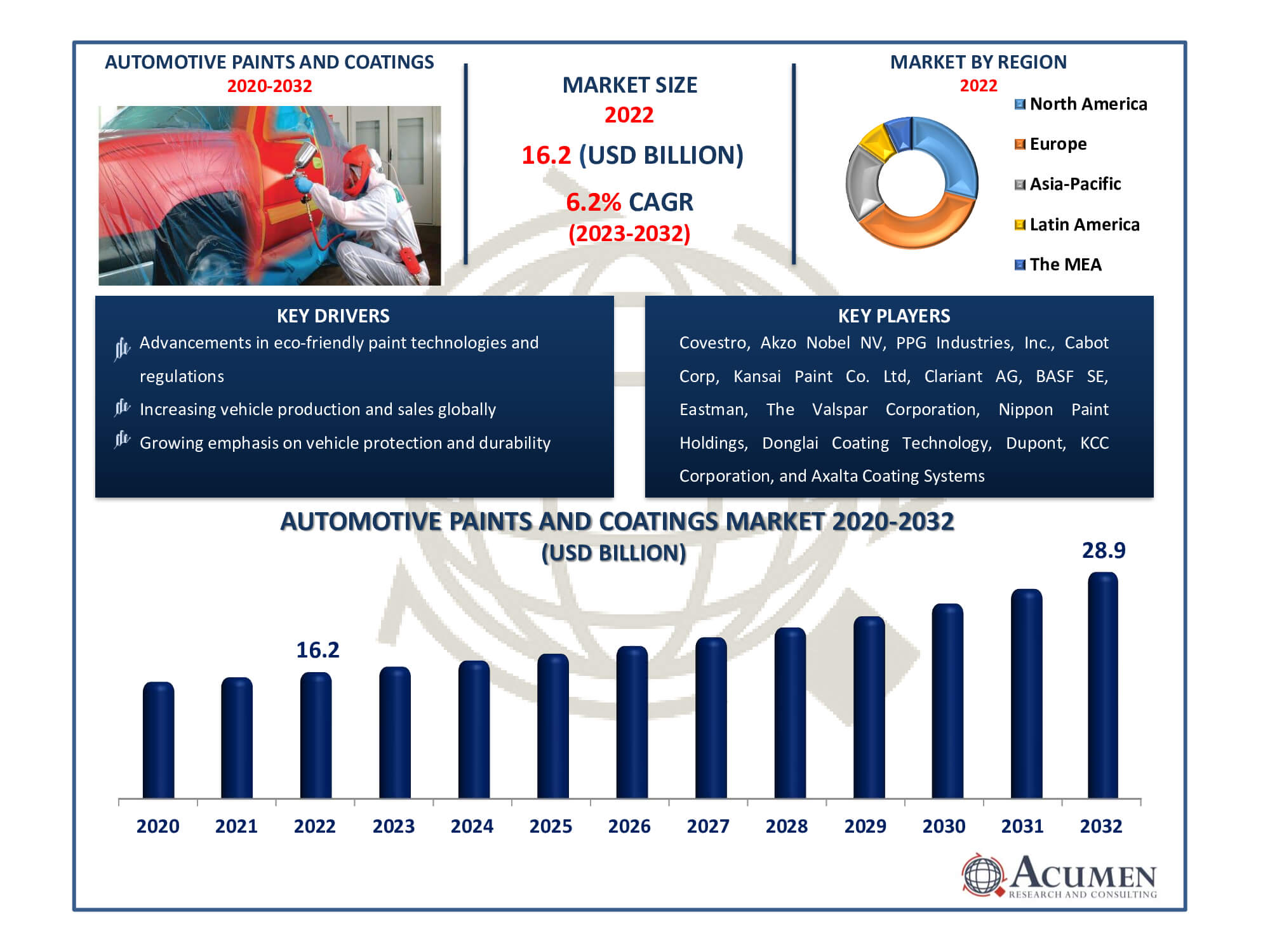

Request Sample Report

The Automotive Paints and Coatings Market Size accounted for USD 16.2 Billion in 2022 and is estimated to achieve a market size of USD 28.9 Billion by 2032 growing at a CAGR of 6.2% from 2023 to 2032.

Automotive Paints and Coatings Market Solvent Highlights

- Global automotive paints and coatings market revenue is poised to garner USD 28.9 billion by 2032 with a CAGR of 6.2% from 2023 to 2032

- Europe automotive paints and coatings market value occupied around USD 5.8 billion in 2022

- Asia-Pacific automotive paints and coatings market growth will record a CAGR of more than 7% from 2023 to 2032

- Among coating, the electrocoat sub-segment generated over US$ 5.7 billion revenue in 2022

- Based on technology, the waterborne sub-segment generated around 48% share in 2022

- Focus on research & development for sustainable, high-performance coatings is a popular automotive paints and coatings market trend that fuels the industry demand

The automotive paints and coatings market revolves around the colourful, protective layers that keep cars gleaming and long-lasting. These unique paints aren't just for show; they also protect vehicles from scratches, rust, and harsh weather. Consider an automobile that lacks brilliant colours and protective coatings; it would not last long on the road! Companies manufacture these coatings using environmentally friendly innovative technology. As more individuals buy cars around the world, the need for these paints grows. And it's not only for new automobiles; when older vehicles require a new look or repairs, these paints and coatings come in handy. So it's not just about making automobiles seem nice; it's also about keeping them safe and stylish for all of us on the road.

Global Automotive Paints and Coatings Market Dynamics

Market Drivers

- Increasing vehicle production and sales globally

- Advancements in eco-friendly paint technologies and regulations

- Rising demand for vehicle customization and aesthetics

- Growing emphasis on vehicle protection and durability

Market Restraints

- Escalating raw material costs impacting profit margins

- Stringent environmental regulations affecting product development

- Challenges related to volatile market dynamics and supply chain disruptions

Market Opportunities

- Expansion in emerging markets with rising automotive demands

- Development of innovative smart coatings and technologies

- Shift towards electric and autonomous vehicles necessitating specialized coatings

Automotive Paints and Coatings Market Report Coverage

| Market | Automotive Paints and Coatings Market |

| Automotive Paints and Coatings Market Size 2022 | USD 16.2 Billion |

| Automotive Paints and Coatings Market Forecast 2032 | USD 28.9 Billion |

| Automotive Paints and Coatings Market CAGR During 2023 - 2032 | 6.2% |

| Automotive Paints and Coatings Market Analysis Period | 2020 - 2032 |

| Automotive Paints and Coatings Market Base Year |

2022 |

| Automotive Paints and Coatings Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Vehicle, By Coating, By Technology, By Texture, By Raw Material, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Covestro, Akzo Nobel NV, PPG Industries, Inc., Cabot Corp, Kansai Paint Co. Ltd, Clariant AG, BASF SE, Eastman, The Valspar Corporation, Nippon Paint Holdings Co. Ltd, Donglai Coating Technology, Dupont, KCC Corporation, and Axalta Coating Systems. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Paints and Coatings Market Insights

The growth of the automotive layers and reinforcing industry is closely linked to the increasing demand for metallic coatings and shifting consumer preferences regarding car color and weight, driven by technological advancements. However, the market faces inconveniences such as volatility in raw material pricing and heightened government regulations on environmental issues and energy costs, acting as barriers to market growth.

The rise in market share of waterborne automotive paints and coatings can be attributed to stringent rules and regulations aiming to reduce VOCs in automotive coatings and paints. Moreover, the segment expands due to the presence of minimal toxic substances, offering lower inflammability compared to solvent-based paints. Additionally, higher polish levels and longer-lasting finishes contribute to sustained segment growth in automotive paints and coatings market forecast from 2023 to 2032.

The rise in vehicle production and growing consumer preference for dual-color options are driving market shares in automotive layers and coatings. Industry players invest in technology and finishing offering customers customizable vehicle options. Additionally, improved scratch resistance, corrosion resistance, and enhanced finishing are gaining traction in the market. Customers expect new color combinations and solutions focusing on sustainability, durability, and aesthetics in automobiles. To reduce toxic substances in paints, manufacturers collaborate with automotive OEMs, aiming to eliminate toxic gas emissions during painting. This shift promotes worker safety by developing waterborne products with reduced volatile organic compounds (VOCs), reducing hazardous material usage and waste disposal issues, thereby expanding the automotive lacquers and coatings market.

Technological advancements in paint technology play a crucial role in expanding the automotive painted and layered market size. The proliferation of low-temperature systems enables the production of superior paints at around 100 degrees, compared to traditional systems at approximately 150 degrees. This technology maintains color consistency across different car body parts, allowing automakers to enhance their coatings. For instance, in 2018, Ferrari introduced low-baked paints, enabling the production of over 61 different colors in its base coat. The increasing demand for metallic texture paints due to their unique gloss finish supports the segment's growth during the study period. The enhanced aesthetics, superior design, and ability to easily conceal scratches offer a positive outlook for the expansion of the automotive lacquer and coating market.

Automotive Paints and Coatings Market Segmentation

The worldwide market for automotive paints and coatings is split based on vehicle, coating, technology, texture, raw material, distribution channel, and geography.

Automotive Paints and Coatings Market by Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Passenger Cars

According to the automotive paints and coatings industry analysis, the global market share for light commercial vehicle (LCV) paints and lacquers is expected to grow fastest due to the increasing worldwide sales of LCVs. For instance, the production of LCVs witnessed a noticeable rise, as reported by the International Organization of Motor Vehicle Manufacturers (OICA). Responding to this surge in demand, coating companies are expanding their global footprint by establishing new facilities across various regions to cater to the growing need for LCV paints. As an example, BASF inaugurated new installations, like ColorECo in China, aimed at manufacturing specialized LCV paint solutions.

Automotive Paints and Coatings Market by Coatings

- Primer

- Electrocoat

- Basecoat

- Clearcoat

Electrocoat has the largest market share in car coatings due to its unique application technique. This technology, noted for its high efficiency and environmental friendliness, entails immersing automobile bodywork in an electrically charged paint bath. This method offers uniform covering, high corrosion resistance, and less waste. Electrocoat's ability to thoroughly coat complex shapes, provide outstanding protection, and meet severe environmental laws makes it the preferred choice, fueling its domination in the automotive coatings market.

Automotive Paints and Coatings Market by Technology

- Waterborne

- Powder

- Solvent borne

- UV Cured

Waterborne technology is the industry leader in automotive paints and coatings due to its eco-friendliness and compliance with severe standards. Water is used as a solvent in this method, which greatly reduces VOC emissions as compared to solvent-borne coatings. It meets industry needs for sustainability and quality by providing superior performance, durability, and a shorter drying time. Waterborne coatings are the dominant choice in the automobile business because to the demand for environmental responsibility and greater performance.

Automotive Paints and Coatings Market by Texture

- Matte

- Solid

- Metallic

On the basis of automotive paints and coatings industry analysis the metallic textures are the most popular in the market due to their distinct visual appeal and rising consumer desire. These coatings provide a glossy, shimmering effect that improves the appearance of cars. The metallic coating adds depth and sophistication while concealing minor blemishes better than other materials. Furthermore, the trend towards sleek, modern designs in vehicle designing propels metallic textures to supremacy, making them the preferred choice among consumers and manufacturers alike.

Automotive Paints and Coatings Market by Raw Material

- Epoxy

- Acrylic

- Polyurethane

- Other Resins

Polyurethane plays a crucial role in the automotive lacquer market. Its widespread use in paints stems from the benefits of higher solvent resistance and superior mechanical and weather damage resilience. Industry leaders focus on introducing polyurethane coatings to enhance their market presence. For instance, PPG Industries Inc. introduced cutting-edge coatings with isocyanate-free technology for polyurethane.

Automotive Paints and Coatings Market by Distribution Channel

- OEM

- Aftermarket

OEMs are expected to maintain dominance in the automotive paints & coatings industry over the foreseeable future. This leading position results from the increasing global demand for vehicles. Collaborating with automotive manufacturers, industry participants are actively engaged in efforts to minimize energy consumption and CO2 emissions during paint application processes. For instance, strategic partnerships like the one formed between Audi, BASF, and Covestro aim to develop bio-based hardeners for vehicles like the Audi Q2. These paints not only deliver superior glossy finishes but also contribute significantly to reducing CO2 emissions.

Automotive Paints and Coatings Market by Region

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Paints and Coatings Market Regional Analysis

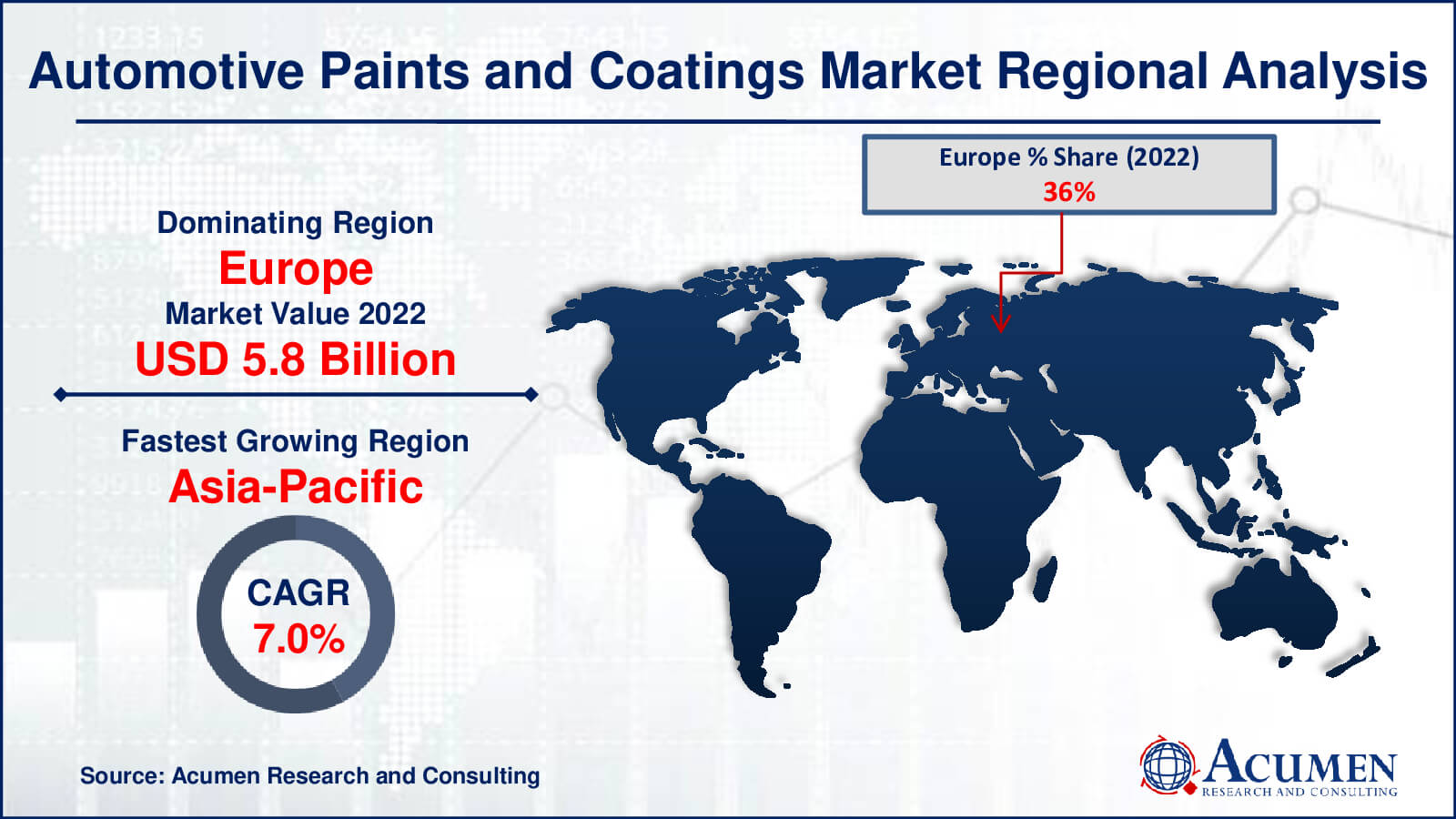

Europe is the largest region in the automotive paints and coatings market, owing to its powerful automobile manufacturing industry and stringent environmental laws. Germany, France, and Italy are home to large vehicle manufacturing, which increases demand for coatings. Europe's emphasis on innovation and sustainability pushes the usage of innovative, eco-friendly coatings that comply with stringent environmental regulations.

The Asia-Pacific car paints and coatings market has experienced substantial growth within the forecasted timeframe. This surge can be attributed to improved economic conditions, increased disposable income, and a rising demand for personal mobility solutions. The region witnesses a growing presence of automakers establishing production plants, elevating vehicle production rates and consequently, bolstering the regional market share.

North America ranks second in the world in this business because to its massive vehicle production and consumer demand. The automobile industries in the United States and Canada are well-established, resulting in a consistent demand for coatings. High vehicle ownership rates, ongoing developments in automotive technology, and a culture of vehicle customization all contribute to the market's expansion. Furthermore, North America prioritizes quality and longevity in coatings to resist the continent's different weather conditions. The region's investment in R&D promotes the development of coatings that fulfill both regulatory standards and market preferences. While Europe thrives due to its automotive manufacturing prowess and environmental focus, North America's robust production base and attention on quality help it to rank second in the global automotive paints and coatings market.

Automotive Paints and Coatings Market Players

Some of the top automotive paints and coatings companies offered in our report includes Covestro, Akzo Nobel NV, PPG Industries, Inc., Cabot Corp, Kansai Paint Co. Ltd, Clariant AG, BASF SE, Eastman, The Valspar Corporation, Nippon Paint Holdings Co. Ltd, Donglai Coating Technology, Dupont, KCC Corporation, and Axalta Coating Systems.

Frequently Asked Questions

How big is the automotive paints and coatings market?

The market size of automotive paints and coatings was USD 16.2 billion in 2022.

What is the CAGR of the global automotive paints and coatings market from 2023 to 2032?

The CAGR of automotive paints and coatings is 6.2% during the analysis period of 2023 to 2032.

Which are the key players in the automotive paints and coatings market?

The key players operating in the global market are including Covestro, Akzo Nobel NV, PPG Industries, Inc., Cabot Corp, Kansai Paint Co. Ltd, Clariant AG, BASF SE, Eastman, The Valspar Corporation, Nippon Paint Holdings Co. Ltd, Donglai Coating Technology, Dupont, KCC Corporation, and Axalta Coating Systems.

Which region dominated the global automotive paints and coatings market share?

Europe held the dominating position in automotive paints and coatings industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive paints and coatings during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive paints and coatings industry?

The current trends and dynamics in the automotive paints and coatings industry include increasing vehicle production and sales globally, advancements in eco-friendly paint technologies and regulations, rising demand for vehicle customization and aesthetics, and growing emphasis on vehicle protection and durability.

Which coating held the maximum share in 2022?

The electrocoat coating held the maximum share of the automotive paints and coatings industry.?