Distributed Energy Generation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Distributed Energy Generation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

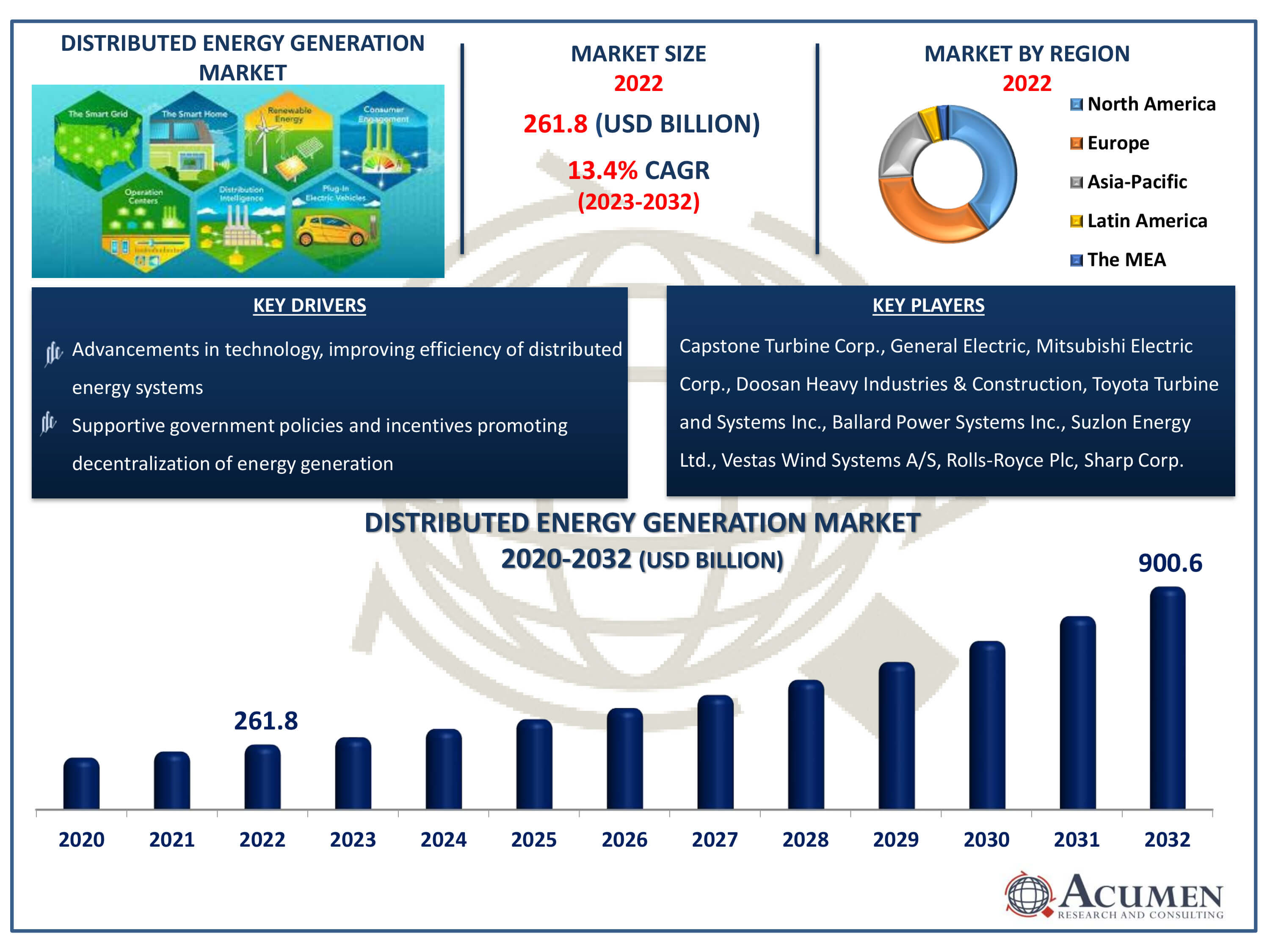

The Global Distributed Energy Generation Market Size accounted for USD 261.8 Billion in 2022 and is estimated to achieve a market size of USD 900.6 Billion by 2032 growing at a CAGR of 13.4% from 2023 to 2032.

Distributed Energy Generation Market Highlights

- Global distributed energy generation market revenue is poised to garner USD 900.6 billion by 2032 with a CAGR of 13.4% from 2023 to 2032

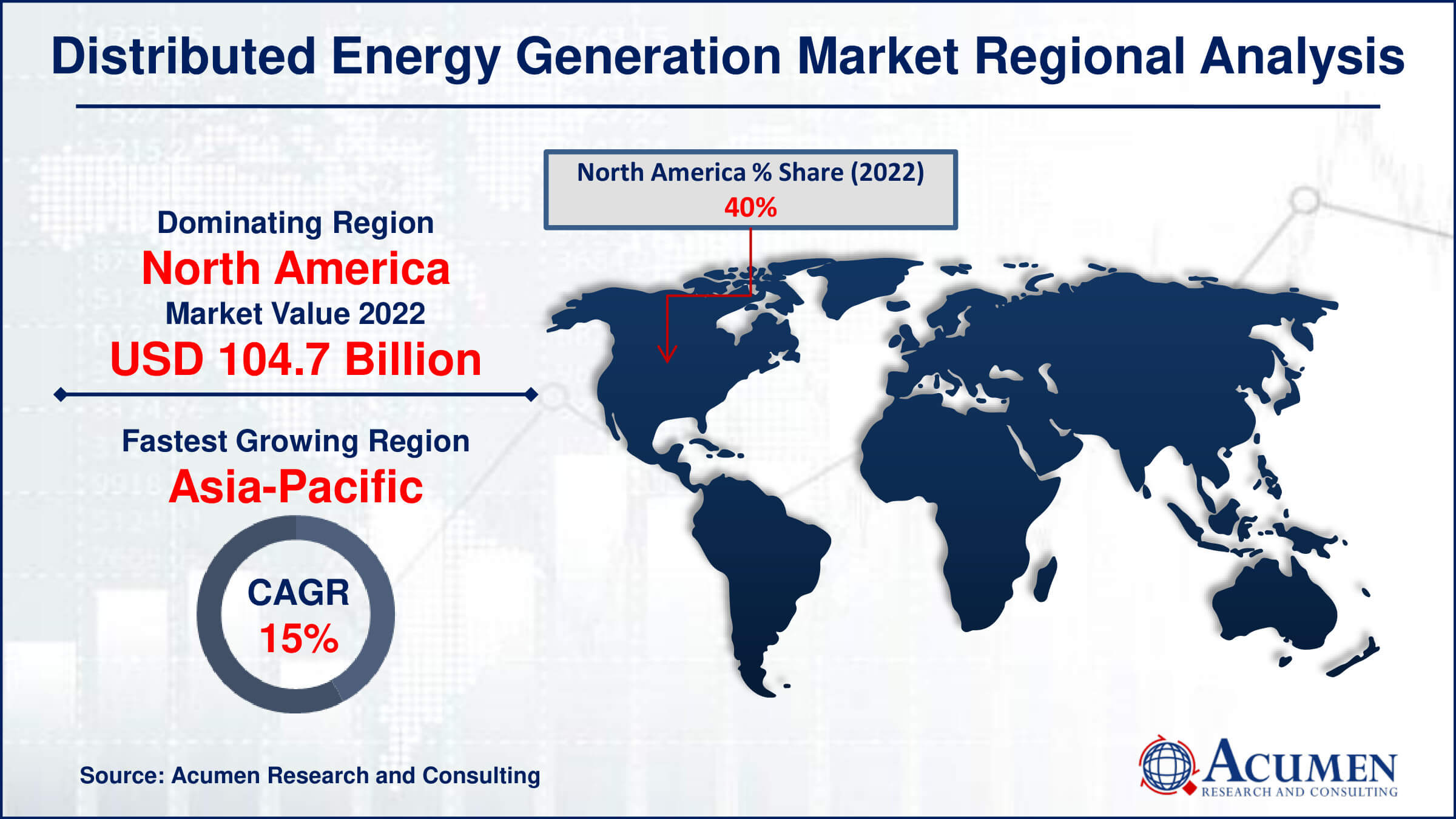

- North America distributed energy generation market value occupied around USD 104.7 billion in 2022

- Asia-Pacific distributed energy generation market growth will record a CAGR of more than 15% from 2023 to 2032

- Among application, the on-grid sub-segment generated more than USD 151.8 billion revenue in 2022

- Based on end user, the commercial sub-segment generated around 41% market share in 2022

- Innovation in business models, such as energy-as-a-service and peer-to-peer energy trading is a popular distributed energy generation market trend that fuels the industry demand

Distributed energy generation refers to the production of electricity from multiple small-scale or localized sources, usually located near the point of consumption. Macro power grids are transformed by distributed generations (DGs), where electricity generation occurs on-site or near-site of the electricity user. DGs resemble energy storage systems with low power generating capacity, aiding in grid failures. Over time, DGs have become part of distributed energy resources (DER), which include storage and even sensitive loads. DGs offer cost-effective alternatives to large grids, reducing transmission losses and utilizing various energy sources. Demand for DGs is primarily influenced by economic, regulatory, and commercial factors. The economic performance and adoption of small-scale electricity generation systems are considered in environmental considerations, promoting greater use of renewable and addressing regulatory concerns over electricity sustainability. Compliance with policies and market factors also play a significant role in shaping demand for DGs.

Global Distributed Energy Generation Market Dynamics

Market Drivers

- Increasing demand for renewable energy sources

- Growing need for energy resilience and reliability

- Advancements in technology, improving efficiency of distributed energy systems

- Supportive government policies and incentives promoting decentralization of energy generation

Market Restraints

- High initial investment costs for implementing distributed energy systems

- Regulatory barriers and permitting challenges

- Limited scalability of some distributed energy technologies

Market Opportunities

- Expansion of distributed energy systems in developing regions

- Integration of energy storage technologies for enhanced grid stability

- Adoption of microgrid solutions for remote and off-grid communities

Distributed Energy Generation Market Report Coverage

| Market | Distributed Energy Generation Market |

| Distributed Energy Generation Market Size 2022 | USD 261.8 Billion |

| Distributed Energy Generation Market Forecast 2032 |

USD 900.6 Billion |

| Distributed Energy Generation Market CAGR During 2023 - 2032 | 13.4% |

| Distributed Energy Generation Market Analysis Period | 2020 - 2032 |

| Distributed Energy Generation Market Base Year |

2022 |

| Distributed Energy Generation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Capstone Turbine Corp., General Electric, Mitsubishi Electric Corp., Doosan Heavy Industries & Construction, Toyota Turbine and Systems Inc., Ballard Power Systems Inc., Suzlon Energy Ltd., Vestas Wind Systems A/S, Rolls-Royce Plc, and Sharp Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Distributed Energy Generation Market Insights

Rising demand for distributed energy generation is a key driver of market growth, spurred by the shift from traditional to unconventional power generation resources. This movement reflects increased worldwide awareness about environmental sustainability and the use of safe, non-hazardous, gas-free green energy sources. Distributed energy systems, such as solar panels, wind turbines, and microgrids, enable decentralised energy generation, reducing reliance on centralised power grids and lowering the danger of widespread outages. Furthermore, user-friendly designs, competitive pricing, and a varied variety of choices in distributed energy producing systems all contribute to increased demand and market development.

Supportive government policies in emerging countries, together with activities aimed at reducing reliance on traditional energy sources and encouraging renewable energy, are likely to drive considerable demand growth. Furthermore, continued technical advancements and significant R&D efforts, aided by increased government funding, create profitable opportunities for market participants globally. These aspects, when combined, point to a bright future for the distributed energy generation industry, fostering innovation and worldwide market growth.

One important opportunity in the distributed energy generation (DEG) industry is the potential to improve energy resilience and reliability. DEG systems provide decentralised energy generation, minimising reliance on central power grids and the possibility of extensive outages, especially in disaster-prone locations. Furthermore, using renewable energy sources into DEG systems improves environmental sustainability and assists in meeting carbon reduction goals. Along with these benefits, DEG offers chances for energy cost savings and efficiency increases, particularly for commercial and industrial users. With supportive government policies, technological advancements, and growing awareness of distributed energy's benefits, the DEG market is poised for significant growth and innovation, providing opportunities for businesses and consumers to transition to a more resilient and sustainable energy future.

Distributed Energy Generation Market Segmentation

The worldwide market for distributed energy generation is split based on technology, application end user, and geography.

Distributed Energy Generation (DEG) Market by Technology

- Combined Heat and Power (CHP)

- Fuel Cells

- Reciprocating Engines

- Gas & Steam Turbines

- Wind Turbines

- Solar PV Cells

According to distributed energy generation industry analysis, fuel cells are emerging as the main technology due to their adaptability and efficiency in generating energy. Fuel cells use electrochemical processes to transform chemical energy directly into electrical energy, providing a clean and stable power source. Their capacity to function constantly with little emissions and noise makes them ideal for a variety of applications, including residential, commercial, and industrial environments. Furthermore, advances in fuel cell technology, such as increased durability and cost-effectiveness, are driving its implementation in distributed energy systems. With a rising emphasis on sustainability and energy independence, fuel cells are positioned to play an important part in satisfying the global need for decentralised power production solutions.

Distributed Energy Generation (DEG) Market by Application

- On-Grid

- Off-Grid

On-grid applications dominate the distributed energy generation DEG market. On-grid distributed energy generating systems are linked to the primary electrical grid, allowing them to feed surplus power back into it or take power from it as needed. This integration with the grid allows for more effective energy management and a consistent source of electricity, especially in heavily populated regions with well-established grid infrastructure. On-grid solutions can allow for energy trading and income creation via feed-in tariffs or net metering programmes. They also help to grid stability and resilience by promoting the integration of renewable energy sources and lowering reliance on centralised power generation. As a result, the on-grid sector continues to dominate the DEG market, fueling its expansion and broad acceptance.

Distributed Energy Generation (DEG) Market by End User

- Residential

- Commercial

- Industrial

Several significant factors contribute to the commercial segment's rise to the top of the market and it will expect to grow over the distributed energy generation industry forecast period. Commercial enterprises, such as office buildings, retail malls, and hotels, often have high energy requirements to run their activities. Distributed energy generating solutions allow these enterprises to cut electricity costs, improve energy efficiency, and provide a consistent power supply. Furthermore, business enterprises frequently have the financial resources and infrastructure to invest in and deploy distributed energy systems successfully. Furthermore, the growing emphasis on corporate sustainability and environmental responsibility encourages commercial organisations to embrace renewable energy solutions, which increases demand for distributed energy generating technology in the commercial sector.

Distributed Energy Generation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Distributed Energy Generation Market Regional Analysis

North America dominates the distributed energy generating business, thanks to its mature energy infrastructure, technological breakthroughs, and favorable legislative climate that encourages renewable energy adoption. The region faces high energy consumption in the residential, commercial, and industrial sectors, which drives the implementation of distributed energy solutions. Furthermore, the presence of important market competitors, as well as substantial research and development initiatives, help North America maintain its market leadership. Rising concerns about energy security, grid dependability, and environmental sustainability are driving the development of distributed energy generating solutions in the area, cementing its position as the largest market for such technology.

In contrast, the Asia-Pacific region appears as the most rapidly expanding market for distributed energy generation. DEG market expansion is being driven by factors such as rising power consumption, considerable expenditures in energy infrastructure, and favorable energy regulations. Countries with rising buying power, such as China, Korea, and India, are positioned to make major contributions to market expansion. Meanwhile, Europe accounts for a moderate percentage of worldwide sales, but it is predicted to rise significantly during the distributed energy generation market forecast period. Stringent regulations and policy programs, like as feed-in tariffs and net metering, are expected to boost consumer demand in the area, resulting in additional development in the distributed energy generating industry.

Distributed Energy Generation Market Players

Some of the top distributed energy generation companies offered in our report include Capstone Turbine Corp., General Electric, Mitsubishi Electric Corp., Doosan Heavy Industries & Construction, Toyota Turbine and Systems Inc., Ballard Power Systems Inc., Suzlon Energy Ltd., Vestas Wind Systems A/S, Rolls-Royce Plc, and Sharp Corp.

Frequently Asked Questions

How big is the distributed energy generation market?

The distributed energy generation market size was valued at USD 261.8 billion in 2022.

What is the CAGR of the global distributed energy generation market from 2023 to 2032?

The CAGR of distributed energy generation is 13.4% during the analysis period of 2023 to 2032.

Which are the key players in the distributed energy generation market?

The key players operating in the global market are including Capstone Turbine Corp., General Electric, Mitsubishi Electric Corp., Doosan Heavy Industries & Construction, Toyota Turbine and Systems Inc., Ballard Power Systems Inc., Suzlon Energy Ltd., Vestas Wind Systems A/S, Rolls-Royce Plc, and Sharp Corp.

Which region dominated the global distributed energy generation market share?

North America held the dominating position in distributed energy generation industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of distributed energy generation during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global distributed energy generation industry?

The current trends and dynamics in the distributed energy generation industry include increasing demand for renewable energy sources, growing need for energy resilience and reliability, advancements in technology, improving efficiency of distributed energy systems, and supportive government policies and incentives promoting decentralization of energy generation.

Which application held the maximum share in 2022?

The on-grid application held the maximum share of the distributed energy generation industry.