Digital Twin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Digital Twin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

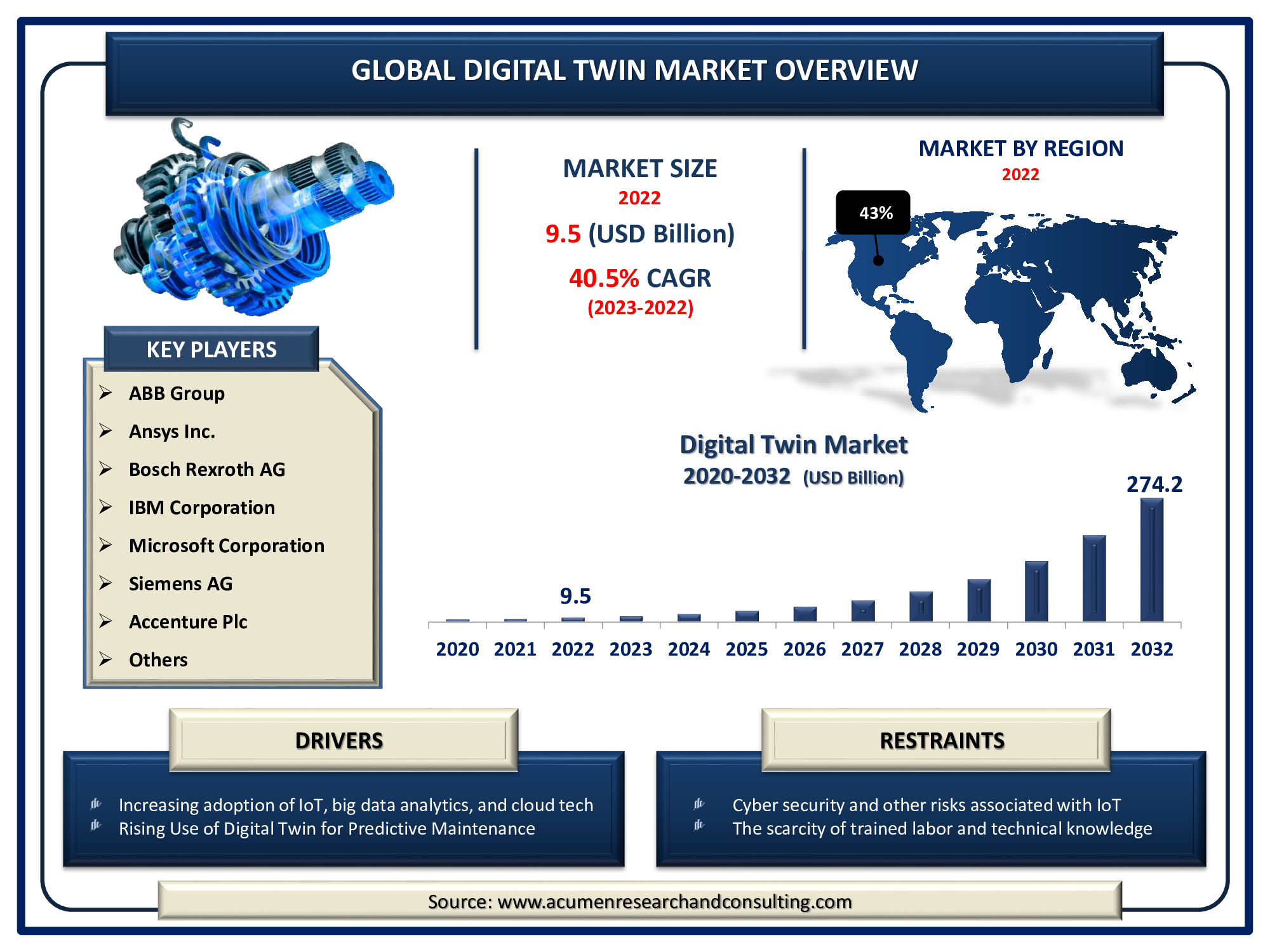

The global Digital Twin Market gathered USD 9.5 Billion in 2022 and is expected to reach USD 274.2 Billion by 2032, growing at a CAGR of 40.5% from 2022 to 2032.

Digital Twin Market Highlights

- The global digital twin market is poised to achieve a revenue of USD 274.2 billion by 2032, experiencing a CAGR of 40.5% from 2022 to 2032

- In 2022, the North America digital twin market held a value of approximately USD 4 billion

- The Asia-Pacific digital twin market is expected to witness substantial growth, with a projected CAGR of over 41% from 2022 to 2032

- Among component, the system sub-segment accounted for revenue exceeding USD 4.9 billion in 2022

- In terms of end-use, the automotive & transport sub-segment claimed a significant share, surpassing 20% in 2022

- Innovations in the field of virtual reality (VR) is one of the notable digital twin market trends creating surplus opportunities

A digital twin is a computerized virtual representation designed to accurately replicate a physical entity. The digital twin market has significant growth potential, driven by the increasing emphasis on digital twins in industrial sectors to reduce costs and improve supply chain management. Furthermore, the healthcare industry's growing need for related technologies and the greater reliance on predictive analytics are propelling the growth of the digital twin market.

In today's modern business world, digital twins are essential for organizations. By creating a digital replica of physical assets within an industry's service or product, the digital twin aids in data gathering and provides a framework to test functionality in advance, offering solutions for future problems. A digital twin consists of three components: the physical entities in the real world, virtual simulations of those entities, and the information connecting the two worlds. It creates a virtual representation of a system, service, process, product, or other physical entities using augmented and virtual reality, 3D graphics, and predictive analysis. This virtual model serves as a carbon copy of the physical universe and remains up-to-date with real-time updates. Moreover, it can be applied in various contexts, including product inspection during use and throughout the product's life cycle.

.jpg)

Global Digital Twin Market Dynamics

Market Drivers

- Increasing adoption of IoT, big data analytics, and cloud platform

- Rising use of digital twin for predictive maintenance

- Growing adoption of the digital twin in supply chain management (SCM)

- The rapid adoption of industry 4.0 combined with the rising demand for connected devices

Market Restraints

- Cybersecurity and other risks associated with cloud platforms and IoT

- The scarcity of trained labor and technical knowledge

Market Opportunities

- Innovations in the field of virtual reality (VR) and augmented reality (AR)

- Increasing digitalization across all industrial sectors

Digital Twin Market Report Coverage

| Market | Digital Twin Market |

| Digital Twin Market Size 2022 | USD 9.5 Billion |

| Digital Twin Market Forecast 2032 | USD 274.2 Billion |

| Digital Twin Market CAGR During 2023 - 2032 | 40.5% |

| Digital Twin Market Analysis Period | 2020 - 2032 |

| Digital Twin Market Base Year |

2022 |

| Digital Twin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB Group, Ansys Inc., Bosch Rexroth AG, IBM Corporation, Microsoft Corporation, Siemens AG, Accenture Plc, Autodesk Inc., Capgemini SE, Infosys Ltd., Oracle Corporation, and Wipro Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Digital Twin Market Insights

The internet of things (IoT), extended reality (XR), cloud computing, and artificial intelligence are the four main technologies of the digital twin. These technologies are used to create a digital representation, collect and store real-world data, and provide valuable insights based on the collected data. The digital twin market is expected to see significant growth as these technologies become more widely adopted in digital twin systems. Additionally, increased investment by industry participants to expand their product portfolios and global operations contributes to the growth of the digital twin market.

The development of digitalization and automation in manufacturing is driving the global digital twin market. Manufacturing facilities worldwide are adopting digitalization strategies to enhance productivity, accuracy, and operational efficiency. These digitalization technologies, including the digital twin, help manufacturers become more responsive and agile in response to evolving customer preferences and market conditions. According to an InfinityQS survey, more than 52 percent of firms are currently investing in digitalization technology to improve their operational effectiveness. Therefore, the growing adoption of Industry 4.0, digitalization, and automation technologies in the manufacturing industry is likely to boost the application of digital twin technology over the projected timeframe.

Digital Twin Market Segmentation

The worldwide market for digital twin is split based on type, end-use, and geography.

Digital Twin Types

- Component

- System

- Process

Based on the type, the system segment is expected to hold the largest market share in 2022. This trend is primarily driven by the extensive use of system digital twins by a wide range of industries, particularly in energy and utilities, automotive, oil and gas, manufacturing, and others. These industries leverage system digital twins to uncover new revenue-generating opportunities by reducing costs and improving customer support. These factors are considered to be the primary drivers influencing the digital twin market size over the projected period.

Furthermore, according to predictions for the digital twin market, the process segment is expected to experience significant growth in the coming years. This growth can be attributed to the deployment of virtual environments for developing workflows in organizations, supply chain operations, smart city initiatives, warehousing procedures, and other applications. Organizations are focusing on improving collaboration across all departments to streamline workflow procedures and reduce operational expenses.

Digital Twin End-Uses

- Manufacturing

- Automotive & Transport

- Agriculture

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Telecommunication

- Energy & Utilities

- Residential & Commercial

- Aerospace

- Others

According to the digital twin industry analysis, the automotive and transportation segment is expected to lead the market in 2022. This can be attributed to the increased use of electric mobility, lean manufacturing, and simulation technology. The use of the digital twin technique in the automotive industry enables designers to record functional and behavioral data from the vehicle, facilitating future advancements in automotive applications and cost optimization. Moreover, future developments in the automotive industry, such as connected and autonomous vehicles, transportation systems, and digitalization, are also expected to drive the adoption of digital technologies.

Digital Twin Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digital Twin Market Regional Analysis

Asia-Pacific's Expanding Automotive Industry Fuels Regional Market Expansion

The Asia-Pacific region is predicted to experience rapid expansion over the projection period. Well-established industrial production and automotive sectors in developing countries such as India, Japan, China, and Korea have contributed to the region's prosperity. Asia-Pacific stands as one of the fastest-growing markets for advanced technologies, focusing on a variety of industries poised for growth in the coming years. This region is also witnessing rapid growth in all sectors of technology. Digital twin solutions are being rapidly deployed across enterprises in this region as technology advances across various industries and company operations. The need to leverage technological services in design and development activities to reduce downtime, along with the growing willingness of consumers to invest in cloud-based solutions to remain competitive in the market, is driving growth in this industry.

Digital Twin Market Players

Some of the top digital twin companies offered in our report includes ABB Group, Ansys Inc., Bosch Rexroth AG, IBM Corporation, Microsoft Corporation, Siemens AG, Accenture Plc, Autodesk Inc., Capgemini SE, Infosys Ltd., Oracle Corporation, and Wipro Ltd.

Frequently Asked Questions

What was the size of the digital twin market?

The size of global digital twin market was USD 9.5 billion in 2022.

What is the CAGR of digital twin market?

The digital twin market CAGR during the analysis period of 2022 to 2032 is 40.5%.

Which are the key players in the digital twin market?

The key players operating in the global digital twin market are ABB Group, Ansys Inc., Bosch Rexroth AG, IBM Corporation, Microsoft Corporation, Siemens AG, Accenture Plc, Autodesk Inc., Capgemini SE, Infosys Ltd., Oracle Corporation, and Wipro Ltd.

Which region dominated the digital twin market?

North America region held the dominating position in digital twin industry during the analysis period of 2022 to 2032.

Which region registered fastest CAGR from 2022 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of digital twin during the analysis period of 2022 to 2032.

What are the current trends in the digital twin industry?

The current trends and dynamics in the digital twin industry include increasing adoption of IoT, big data analytics, and cloud platform, rising use of digital twin for predictive maintenance, and growing adoption of the digital twin in supply chain management (SCM).

Which type held the maximum share in 2022?

The system type held the maximum share of the digital twin industry.?