Diabetes Treatment and Monitoring Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

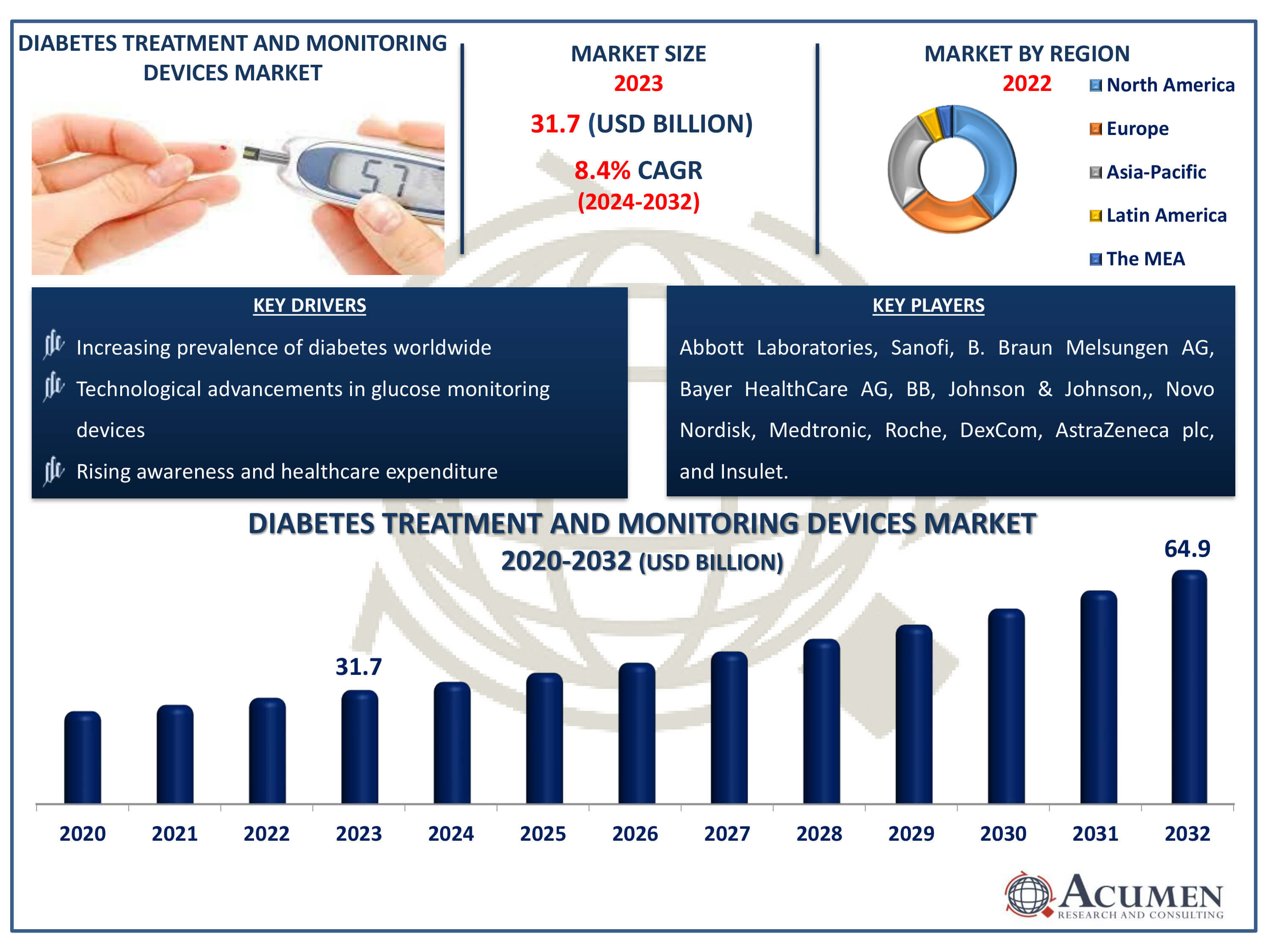

The Diabetes Treatment and Monitoring Devices Market Size accounted for USD 31.7 Billion in 2023 and is estimated to achieve a market size of USD 64.9 Billion by 2032 growing at a CAGR of 8.4% from 2024 to 2032.

Diabetes Treatment and Monitoring Devices Market Highlights

- The global market revenue for diabetes treatment and monitoring devices is projected to reach USD 64.9 billion by 2032, growing at a compound annual growth rate (CAGR) of 8.4% from 2024 to 2032.

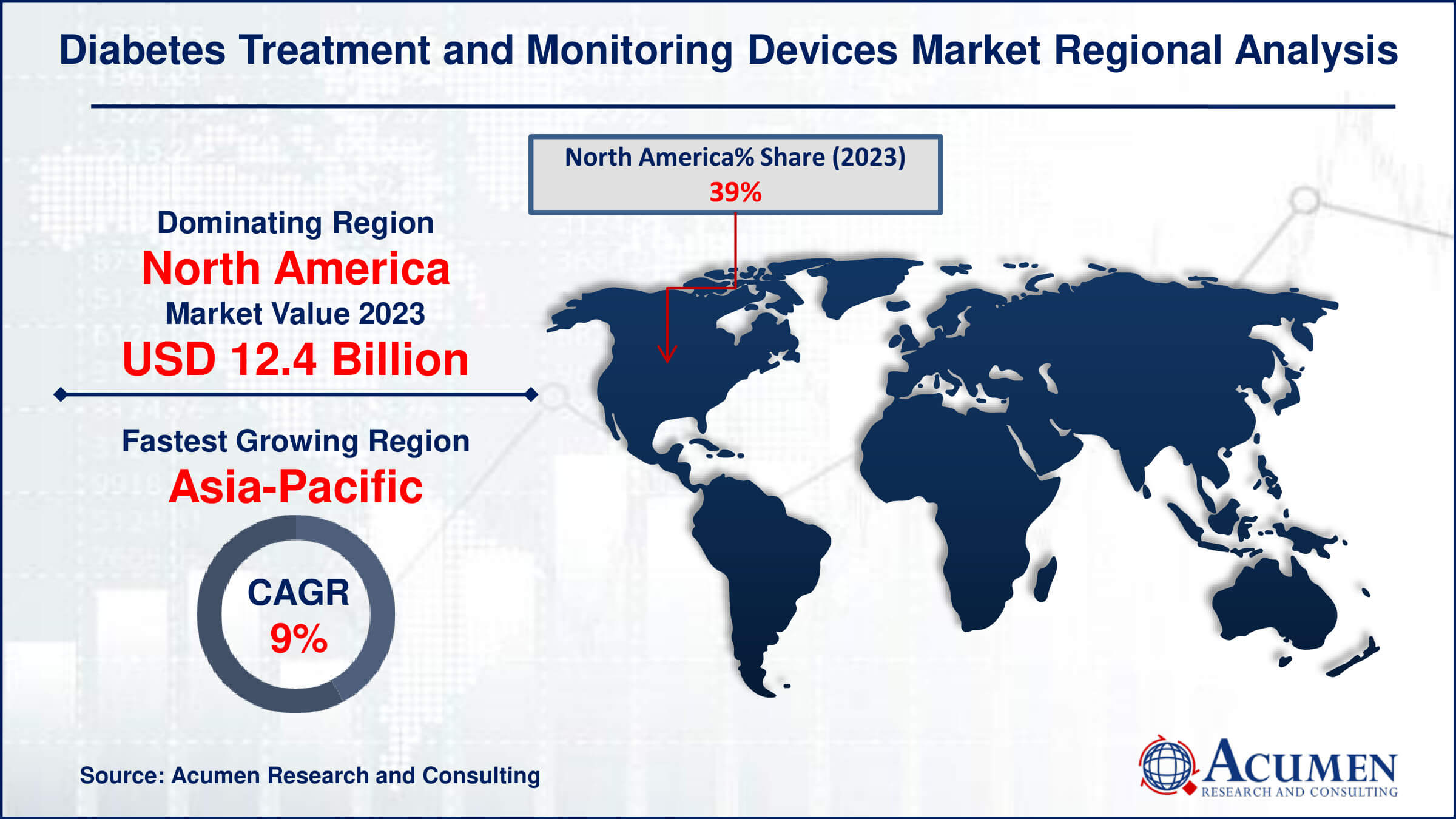

- In 2023, the North American diabetes treatment and monitoring devices market was valued at approximately USD 12.4 billion

- The Asia-Pacific diabetes treatment and monitoring devices market is expected to achieve a CAGR of over 9% from 2024 to 2032

- Among product types, treatment devices accounted for 54% of the diabetes treatment & monitoring devices market share in 2023

- Hospital pharmacies, as a distribution channel, held a diabetes care devices market share of 51% in 2023

- Increasing integration of CGM with insulin pumps and smart phones for real-time monitoring and management is the diabetes care devices market trend that fuels the industry demand

Diabetes treatment and monitoring devices are tools designed to manage and monitor blood glucose levels in individuals with diabetes. These devices include blood glucose meters, continuous glucose monitors (CGMs), insulin pumps, and smart insulin pens. Blood glucose meters provide quick readings by analyzing a drop of blood from a finger prick, while CGMs offer continuous, real-time monitoring of glucose levels through a sensor placed under the skin. Insulin pumps deliver precise amounts of insulin throughout the day, mimicking the body’s natural insulin release. Smart insulin pens track and record insulin doses, helping patients manage their treatment regimens. These devices improve diabetes management by providing accurate data, which aids in timely treatment adjustments. Their use can reduce the risk of diabetes-related complications and enhance the quality of life for patients.

Global Diabetes Treatment and Monitoring Devices Market Dynamics

Market Drivers

- Increasing prevalence of diabetes worldwide

- Technological advancements in glucose monitoring devices

- Rising awareness and healthcare expenditure

Market Restraints

- High cost associated with diabetes treatment devices

- Stringent regulatory requirements for product approval

- Limited access to healthcare facilities in developing regions

Market Opportunities

- Growing adoption of wearable insulin pumps and continuous glucose monitors

- Expansion of telemedicine and remote monitoring solutions

- Development of AI-based diabetic management systems

Diabetes Treatment and Monitoring Devices Market Report Coverage

| Market | Diabetes Treatment and Monitoring Devices Market |

| Diabetes Treatment and Monitoring Devices Market Size 2022 | USD 31.7 Billion |

| Diabetes Treatment and Monitoring Devices Market Forecast 2032 | USD 64.9 Billion |

| Diabetes Treatment and Monitoring Devices Market CAGR During 2023 - 2032 | 8.4% |

| Diabetes Treatment and Monitoring Devices Market Analysis Period | 2020 - 2032 |

| Diabetes Treatment and Monitoring Devices Market Base Year |

2022 |

| Diabetes Treatment and Monitoring Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Distribution Channel, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Laboratories, Sanofi, B. Braun Melsungen AG, Bayer HealthCare AG, Johnson & Johnson, Becton, Dickinson and Company, Novo Nordisk, Medtronic, Roche, DexCom, AstraZeneca plc, and Insulet. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Diabetes Treatment and Monitoring Devices Market Insights

The increasing global prevalence of diabetes is a key driver propelling the demand for diabetes treatment devices market. For instance, as of June 22, 2023, over 500 million individuals globally are currently living with diabetes, impacting people of all ages and genders across every nation. This number is expected to surpass 1.3 billion over the next three decades, with every country witnessing a rise, according to an Institute for Health Metrics and Evaluation. As more people are diagnosed with diabetes, there is a growing need for devices such as glucose meters, insulin pumps, and continuous glucose monitoring systems. These technologies enable patients to monitor their blood glucose levels more effectively, manage their condition, and improve their quality of life. Consequently, the diabetes monitoring devices market continues to expand, driven by advancements in technology and rising healthcare awareness worldwide. For instance, according to Press Information Bureau (PIB), India's 75/25 initiative aims to screen and provide standard healthcare for 75 million people with hypertension and diabetes by 2025. It's the largest effort globally to improve non-communicable disease (NCD) management at the primary healthcare level.

The high costs associated with diabetes treatment devices present a significant barrier in the glucose monitoring devices market. For instance, the American Diabetes Association (ADA) released its report on the Economic Costs of Diabetes in the U.S. for 2022, revealing a 7% rise in direct medical costs associated with diabetes from 2017 to 2022. These expenses encompass initial purchase costs, ongoing maintenance, and consumables such as test strips and sensors. For patients, affordability can limit access to advanced technologies and continuous monitoring systems, impacting their ability to effectively manage their condition. Healthcare providers and policymakers face challenges in balancing technological advancements with cost-effectiveness to ensure broader access and better outcomes for diabetic patients.

The development of AI-based diabetic management systems represents a significant opportunity for the blood glucose monitoring devices market. These systems leverage advanced algorithms to analyze patient data in real-time, offering personalized insights and enhancing treatment efficacy. By integrating machine learning and predictive analytics, they enable early detection of trends and complications, leading to proactive healthcare interventions. For instance, according to National Institute of Health, recent advancements in digital health technologies, particularly artificial intelligence (AI), offer a significant opportunity to improve efficiency in diabetes care, potentially reducing the rising costs associated with diabetes-related healthcare. This innovation not only improves patient outcomes but also drives demand for next-generation monitoring devices that support seamless data integration and remote patient management.

Diabetes Treatment and Monitoring Devices Market Segmentation

The worldwide market for diabetes treatment and monitoring devices is split based on product type, distribution channel, end use, and geography.

Diabetes Treatment and Monitoring Devices Product Type

- Treatment Devices

- Insulin Delivery Devices

- Insulin Pens

- Insulin Pumps

- Insulin Syringes

- Artificial Pancreas Devices Systems

- Insulin Delivery Devices

- Monitoring Devices

- Continuous Glucose Monitoring (CGM) Systems

- Self-Monitoring of Blood Glucose (SMBG) Systems

- Blood Glucose Meters

- Testing Strips

- Lancets

According to the diabetes treatment and monitoring devices industry analysis, treatment devices, a leader in diabetes treatment and monitoring devices, has revolutionized healthcare with its innovative products. Specializing in advanced glucometers, insulin pumps, and continuous glucose monitoring systems, treatment devices offers comprehensive solutions for managing diabetes effectively. Their commitment to technological advancement and user-friendly designs has garnered widespread approval among healthcare professionals and patients alike. With a strong emphasis on accuracy, reliability, and patient comfort, Treatment Devices continues to set industry standards, making significant strides in improving diabetes management worldwide.

Diabetes Treatment and Monitoring Devices Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Diabetes Clinics/Centers

The hospital pharmacies segment is the largest distribution channel category in the diabetes care devices market due to their accessibility and specialized medical expertise. Patients often rely on these pharmacies for immediate access to essential medications, testing supplies, and advanced monitoring equipment. The presence of trained healthcare professionals within hospital settings ensures accurate guidance and support, enhancing patient compliance and treatment efficacy. This distribution channel not only facilitates efficient supply chain management but also fosters a seamless integration of diabetes care into broader healthcare services within hospital settings.

Diabetes Treatment and Monitoring Devices End Use

- Hospitals

- Clinics

- Home Healthcare

- Ambulatory Surgical Centers

According to the diabetes treatment and monitoring devices industry forecast, hospitals are expected to dominate as the primary end users. Hospitals typically handle a wide range of diabetes cases, from routine monitoring to acute care, supported by specialized facilities and trained staff. They offer comprehensive treatment options, including advanced diagnostics and intensive management, making them pivotal in managing diabetes effectively. Clinics and ambulatory surgical centers follow, focusing on outpatient care and specialized procedures, while home healthcare plays a growing role with the expansion of self-management technologies for diabetes patients.

Diabetes Treatment and Monitoring Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Diabetes Treatment and Monitoring Devices Market Regional Analysis

For several reasons, North America holds a dominant position in the diabetes treatment devices market due to several factors. The region benefits from advanced healthcare infrastructure, widespread adoption of technologically advanced medical devices, and robust research and development activities. For instance, in June 2022, Abbott introduced a new biowearable that enables continuous monitoring of both blood glucose and ketones with a single sensor, thereby expanding its product portfolio. High prevalence rates of diabetes, coupled with favorable reimbursement policies, further drive market growth. For instance, according to the National Diabetes Statistics Report, in the United States, diabetes affected 38.4 Million people, comprising 11.6% of the population. Additionally, proactive healthcare initiatives and increasing awareness among patients contribute to North America's leadership in this vital sector of medical technology.

The Asia-Pacific region is witnessing rapid growth in the diabetes monitoring devices market, driven by increasing prevalence of diabetes and improving healthcare infrastructure. For instance, according to National Library of Medicine, between 2020 and 2030, the prevalence of diabetes among Chinese adults aged 20-79 years is expected to rise from 8.2% to 9.7%. Concurrently, the total economic burden of diabetes is projected to escalate from $250.2 billion to $460.4 billion, reflecting an annual growth rate of 6.32%. Countries like China and India are major contributors, fueled by greater awareness about diabetes management. Innovations in technology and government initiatives supporting healthcare access further bolster market expansion across the region.

Diabetes Treatment and Monitoring Devices Market Players

Some of the top diabetes treatment and monitoring devices companies offered in our report include Abbott Laboratories, Sanofi, B. Braun Melsungen AG, Bayer HealthCare AG, Johnson & Johnson, Becton, Dickinson and Company, Novo Nordisk, Medtronic, Roche, DexCom, AstraZeneca plc, and Insulet.

Frequently Asked Questions

How big is the diabetes treatment and monitoring devices market?

The diabetes treatment and monitoring devices market size was valued at USD 31.7 Billion in 2023.

What is the CAGR of the global diabetes treatment and monitoring devices market from 2024 to 2032?

The CAGR of diabetes treatment and monitoring devices is 8.4% during the analysis period of 2024 to 2032.

Which are the key players in the diabetes treatment and monitoring devices market?

The key players operating in the global market are including Abbott Laboratories, Sanofi , B. Braun Melsungen AG, Bayer HealthCare AG, Becton, Johnson & Johnson, Dickinson and Company, Novo Nordisk, Medtronic, Roche, DexCom, AstraZeneca plc, and Insulet

Which region dominated the global diabetes treatment and monitoring devices market share?

North America held the dominating position in diabetes treatment and monitoring devices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of diabetes treatment and monitoring devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global diabetes treatment and monitoring devices industry?

The current trends and dynamics in the diabetes treatment and monitoring devices industry include increasing prevalence of diabetes worldwide, technological advancements in glucose monitoring devices, and rising awareness and healthcare expenditure.

Which product type held the maximum share in 2023?

The treatment devices product type held the maximum share of the diabetes treatment and monitoring devices industry.