Diabetes Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Diabetes Management Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

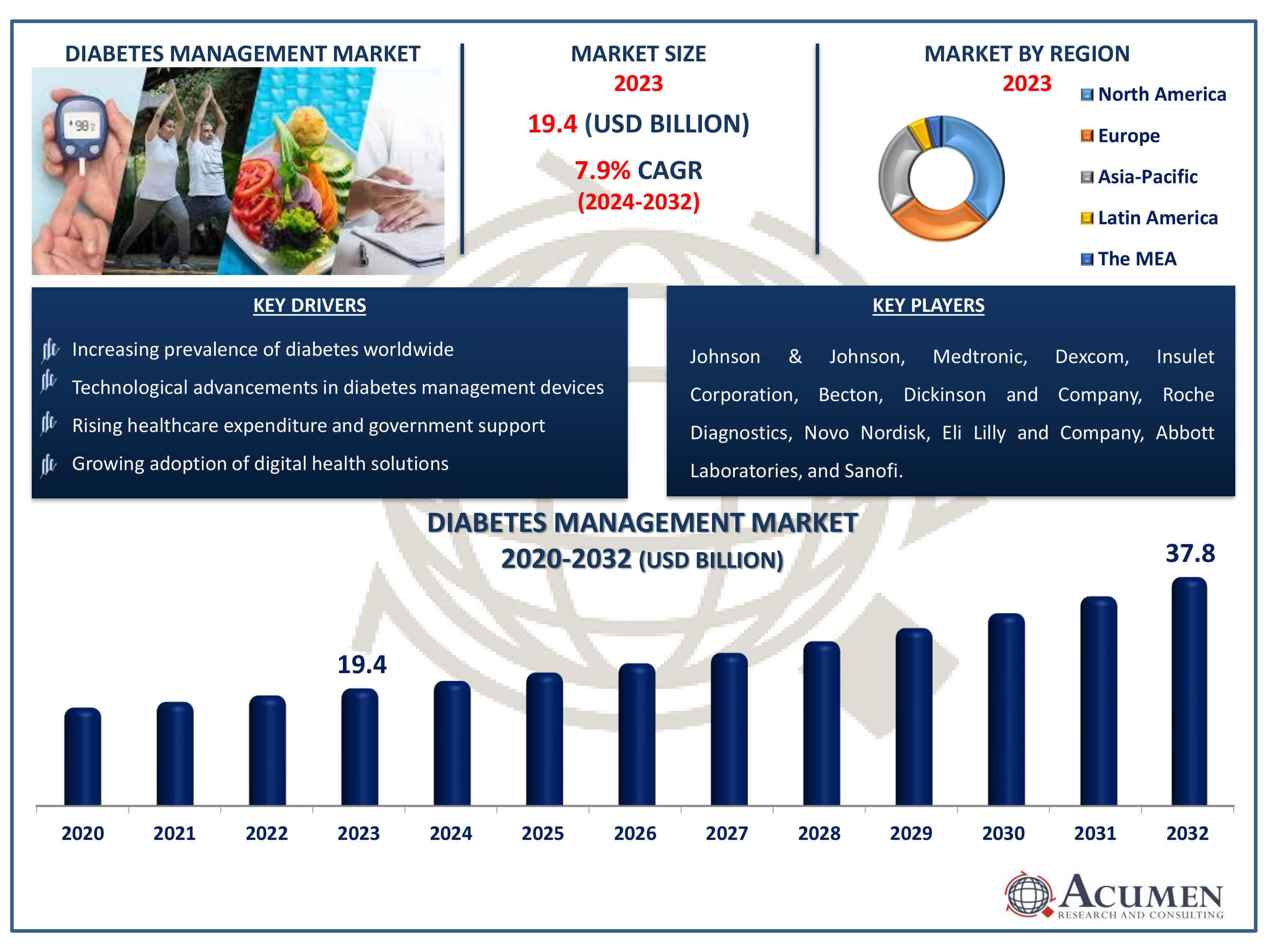

The Diabetes Management Market Size accounted for USD 19.4 Billion in 2023 and is estimated to achieve a market size of USD 37.8 Billion by 2032 growing at a CAGR of 7.9% from 2024 to 2032.

Diabetes Management Market Highlights

- Global diabetes management market revenue is poised to garner USD 37.8 billion by 2032 with a CAGR of 7.9% from 2024 to 2032

- North America diabetes management market value occupied around USD 7.2 billion in 2023

- Asia-Pacific diabetes management market growth will record a CAGR of more than 9% from 2024 to 2032

- Among device type, the monitoring devices sub-segment generated notable revenue in 2023

- Based on application, the diabetes & blood glucose tracking apps sub-segment generated around significant market share in 2023

- Increasing focus on preventive healthcare and lifestyle interventions is a popular diabetes management market trend that fuels the industry demand

Diabetes is a metabolic disease in which the blood sugar levels of the body is increased for extended period. During last few years, there is significant increase in the prevalence of the diabetes which has led to increase in the demand for the various types of technology for diabetes. This technology includes glucose test strips, digital health/digital therapeutics, insulin pumps, continuous glucose monitoring (CGM), insulin pens, side effect management and diagnosis. Digitalization and development in the technology has led to the introduction of the advanced devices. A number of companies are involved in the development of the advanced devices which are used in the management of the diabetes.

Global Diabetes Management Market Dynamics

Market Drivers

- Increasing prevalence of diabetes worldwide

- Technological advancements in diabetes management devices

- Rising healthcare expenditure and government support

- Growing adoption of digital health solutions

Market Restraints

- Lack of awareness about diabetes management

- Limited access to skilled healthcare professionals

- High cost associated with advanced diabetes treatments

Market Opportunities

- Expansion in emerging markets with high diabetes burden

- Development of personalized medicine and therapies

- Integration of artificial intelligence in diabetes management

Diabetes Management Market Report Coverage

| Market | Diabetes Management Market |

| Diabetes Management Market Size 2022 | USD 19.4 Billion |

| Diabetes Management Market Forecast 2032 | USD 37.8 Billion |

| Diabetes Management Market CAGR During 2023 - 2032 | 7.9% |

| Diabetes Management Market Analysis Period | 2020 - 2032 |

| Diabetes Management Market Base Year |

2022 |

| Diabetes Management Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Device Type, By Therapeutics, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Johnson & Johnson, Dexcom, Insulet Corporation, Becton, Dickinson and Company, Medtronic, Roche Diagnostics, Novo Nordisk, Eli Lilly and Company, Abbott Laboratories, and Sanofi. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Diabetes Management Market Insights

During last decade there is a significant increase in the prevalence of the diabetes. As per the WHO, diabetes affects around 422 million people worldwide, and it causes 1.5 million deaths each year. Increasing prevalence of the diabetes is the major driving factor for the growth of the market. Obese and smokers are more prone to diabetes. Increasing patient suffering from obesity and changing lifestyle of the people has catalyzed the growth of the technology for diabetes management market. Moreover, increased the demand for the better treatment option, increasing per capita income, increasing government support, increasing healthcare expenditure, and development in the technology have boosted the growth of the market during the diabetes management industry forecast period 2024-2032. However, lack of awakes among the people and limited availability of the skilled professionals are responsible for affecting the growth of the market negatively. In near future the market is expecting a healthy opportunity owing to the continuous increasing demand for the better technology.

Diabetes Management Market Segmentation

The worldwide market for diabetes management is split based on device type, therapeutics, application, end user, and geography.

Diabetes Management Device Types

- Monitoring Devices

- Blood Glucose Meters

- Lancets

- Blood Sampling Devices

- Diagnostic Devices

- Hemoglobin A1c

- Hemoglobin A1c Kits

- Hemoglobin A1c Meters

- Insulin Delivery Devices

- Insulin Pumps

- Insulin Pens

- Disposable Insulin Pens

- Insulin Syringes

- Reusable Insulin Pens

- Other Devices

- Artificial Pancreas

- Commercial Software

- Software Programs for Diabetes Monitoring

- Web Software

According to diabetes management industry analysis, the monitoring devices sector is the largest. Continuous glucose monitors (CGMs) and standard blood glucose meters are important tools for managing diabetes on a daily basis. The extensive use of these devices is motivated by their vital function in assisting patients in maintaining ideal blood sugar levels, hence avoiding problems. The rising prevalence of diabetes, combined with technical improvements such as real-time glucose monitoring, user-friendly interfaces, and integration with digital health platforms, has spurred demand. Furthermore, increased patient awareness of the significance of regular glucose monitoring, as well as the convenience provided by wearable devices, contribute to the monitoring devices segment's dominance in the market.

Diabetes Management Therapeutics

- Injectables

- Insulin

- Exenatide

- Oral Drugs

- Metformin

- Sulfonylureas

- Alpha Glycosidase Inhibitors

- Dipeptidyl Inhibitors

- Meglitinides

- Thaizolidinediones

- Combination Medications

Oral drugs are the largest sector and it is expected to grow over the diabetes management market forecast period. This domination is fueled by the high frequency of Type 2 diabetes, which accounts for the vast majority of diabetes cases worldwide. Oral antidiabetic medications such metformin, sulfonylureas, DPP-4 inhibitors, and SGLT2 inhibitors are frequently used as the first line of treatment due to their efficacy, convenience of administration, and patient compliance. The growing prevalence of Type 2 diabetes, combined with an aging population and rising obesity rates, has increased demand for these drugs. Furthermore, advances in oral drug formulations and the introduction of new therapeutic classes have improved treatment outcomes and patient adherence, reinforcing the oral pharmaceuticals segment's dominant position in the industry.

Diabetes Management Applications

- Obesity

- Diet Management Apps

- Diabetes & Blood Glucose Tracking Apps

- Others

The diabetes & blood glucose tracking apps sector is predicted to be the most significant in the market. These apps enable patients to monitor and manage their blood sugar levels in real time, giving important information for efficient diabetes treatment. The rising prevalence of diabetes, combined with a growing emphasis on individualized healthcare, has fueled the popularity of these apps. Advances in mobile health technologies, integration with wearable devices, and user-friendly interfaces make these apps extremely accessible and convenient for daily usage. Furthermore, rising awareness of the significance of frequent blood glucose monitoring, as well as increased global smartphone use, contribute to the diabetes & blood glucose tracking apps segment's predicted dominance in the diabetes management industry.

Diabetes Management End-Users

- Specialty Diabetes Clinics

- Home Healthcare

- Others

The home healthcare category is expected to lead the diabetes management industry. This expansion is being driven by an increase in preferences for managing chronic illnesses like diabetes at home, which provides convenience, tailored treatment, and regular health monitoring without the need for frequent clinic visits. Patients benefit from services such as expert nursing care, medication management, and self-management training. Telemedicine and remote monitoring advancements improve accessibility and provide real-time help for diabetes control at home. With a growing aging population and rising diabetes incidence globally, demand for specialized home healthcare services is increasing, highlighting the segment's critical role in influencing the diabetes management market.

Diabetes Management Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Diabetes Management Market Regional Analysis

Regionally, the technology for diabetes management industry is segmented into North America, Europe, Asia-Pacific and Latin America, Middle East & Africa.

In terms of diabetes management market analysis, North America is expected to dominate the technology for industry owing to the presence of huge patient pool, advancement in technology, and high spending on healthcare. According to WHO, 9.2% of the American population were suffering from diabetes. Additionally, presence of a huge number of players and increasing government support will fuel the growth of the market. Europe accounts for the second leading market in the forecast period followed by the Asia Pacific. Presences of huge investment in European region, huge government support, and well developed economies have driven the growth of the European market.

Asia-Pacific technology for expected to be the fastest growth during the diabetes management market forecast period of 2024-2032. The growth is majorly attributed due to presence of huge diabetic and obese patients of the region. According to the International Diabetes Federation (IDF), approximately 60% of total global diabetic population was present in Asia of which over 114 million are in China alone. Moreover, increasing government support and increasing per capita income have fueled the growth of the Asia-Pacific market. LAMEA region is expecting a steady growth during the forecast period.

Diabetes Management Market Players

Some of the top diabetes management companies offered in our report includes Johnson & Johnson, Dexcom, Insulet Corporation, Becton, Dickinson and Company, Medtronic, Roche Diagnostics, Novo Nordisk, Eli Lilly and Company, Abbott Laboratories, and Sanofi.

Frequently Asked Questions

How big is the diabetes management market?

The diabetes management market size was valued at USD 19.4 billion in 2023.

What is the CAGR of the global diabetes management market from 2024 to 2032?

The CAGR of diabetes management is 7.9% during the analysis period of 2024 to 2032.

Which are the key players in the diabetes management market?

The key players operating in the global market are including Johnson & Johnson, Dexcom, Insulet Corporation, Becton, Dickinson and Company, Medtronic, Roche Diagnostics, Novo Nordisk, Eli Lilly and Company, Abbott Laboratories, and Sanofi.

Which region dominated the global diabetes management market share?

North America held the dominating position in diabetes management industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of diabetes management during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global diabetes management industry?

The current trends and dynamics in the diabetes management industry include increasing prevalence of diabetes worldwide, technological advancements in diabetes management devices, rising healthcare expenditure and government support, and growing adoption of digital health solutions.

Which end user held the maximum share in 2023?

The home healthcare end user held the significant share of the diabetes management industry.