Dermal Fillers Market Size (By Type, By Product, By Application, By End-User, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Dermal Fillers Market Size (By Type, By Product, By Application, By End-User, and By Geography) - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

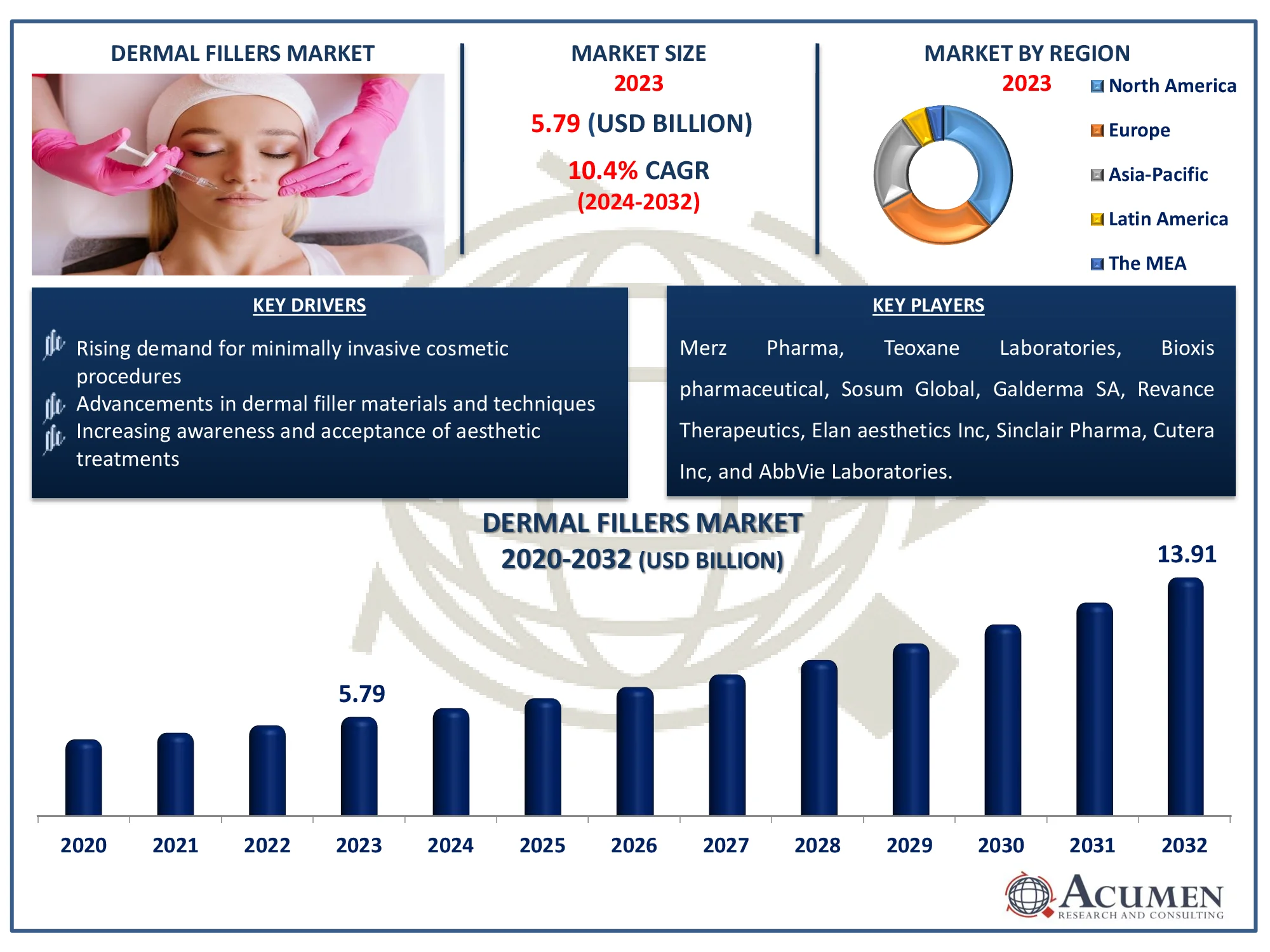

Request Sample Report

The Global Dermal Fillers Market Size accounted for USD 5.79 Billion in 2023 and is estimated to achieve a market size of USD 13.91 Billion by 2032 growing at a CAGR of 10.4% from 2024 to 2032.

Dermal Fillers Market Highlights

- Global dermal fillers market revenue is poised to garner USD 13.91 Billion by 2032 with a CAGR of 10.4% from 2024 to 2032

- North America dermal fillers market value occupied around USD 2.2 Billion in 2023

- Asia-Pacific dermal fillers market growth will record a CAGR of more than 11.2% from 2024 to 2032

- Among product, the hyaluronic acid sub-segment generated 77% of the market share in 2023

- Based on application, the wrinkle correction sub-segment generated 46% market share in 2023

- Rising demand for lip augmentation is the dermal fillers market trend that fuels the industry demand

Dermal fillers are injectable compounds that help to restore volume, smooth wrinkles, and improve facial features. They are usually constructed of biocompatible materials like hyaluronic acid, calcium hydroxylapatite, or poly-L-lactic acid, which ensures safety and efficacy. These fillers operate by plumping up the desired area beneath the skin, producing instant and natural-looking results. Their principal applications include minimizing facial lines and wrinkles, plumping lips, and replenishing lost volume in places such as cheeks and under-eye hollows. Furthermore, dermal fillers are increasingly being used for non-surgical nose reshaping, chin augmentation, and even hand rejuvenation. Because of the increased need for minimally invasive cosmetic solutions, dermal fillers have become a popular choice for anti-aging treatments and aesthetic enhancements.

Global Dermal Fillers Market Dynamics

Market Drivers

- Rising demand for minimally invasive cosmetic procedures

- Advancements in dermal filler materials and techniques

- Increasing awareness and acceptance of aesthetic treatments

Market Restraints

- High cost of dermal filler treatments

- Potential side effects and complications associated with fillers

- Stringent regulatory requirements for product approvals

Market Opportunities

- Growing male demographic seeking aesthetic procedures

- Emergence of new applications, such as acne scar treatment

- Expansion into emerging markets with increasing disposable incomes

Dermal Fillers Market Report Coverage

|

Market |

Dermal Fillers Market |

|

Dermal Fillers Market Size 2023 |

USD 5.79 Billion |

|

Dermal Fillers Market Forecast 2032 |

USD 13.91 Billion |

|

Dermal Fillers Market CAGR During 2024 - 2032 |

10.4% |

|

Dermal Fillers Market Analysis Period |

2020 - 2032 |

|

Dermal Fillers Market Base Year |

2023 |

|

Dermal Fillers Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Product, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Merz Pharma, Teoxane Laboratories, Bioxis pharmaceutical, Sosum Global, Galderma SA, Revance Therapeutics, Elan aesthetics Inc, Sinclair Pharma, Cutera Inc, and AbbVie Laboratories. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Dermal Fillers Market Insights

Non-surgical cosmetic treatments are becoming increasingly popular because to their quicker recovery times and lower risk as compared to standard surgical methods. For example, the American Society of Plastic Surgeons reports that Americans appeared to prioritize cosmetic operations in their self-care routines in 2023. The American Society of Plastic Surgeons (ASPS) has released its 2023 ASPS Procedural Statistics, which indicate a 5% increase in plastic operations and a 7% increase in minimally invasive treatments over the previous year. Of the almost 25.4 million cosmetic minimally invasive procedures carried out in 2023. Dermal fillers offer quick results with minimal discomfort, attracting a wide range of customers. This trend is especially prevalent among younger people searching for mild, natural-appearing modifications.

Ongoing research and innovation have resulted in the creation of safer and more effective dermal filler formulas. Newer materials, such as hyaluronic acid-based fillers, provide improved biocompatibility and longer-lasting results. For example, in May 2023, Galderma introduced RESTYLANE EYELIGHT in Canada. A dermal filler containing hyaluronic acid that can be injected and used to decrease under-eye grooves produced by a lack of volume in the area. Such launches contributed to the rising demand for these procedures. Furthermore, new injection procedures reduce discomfort and downtime, hence increasing market acceptance.

The comparatively high cost of dermal fillers can deter many potential clients, inhibiting market expansion. These operations are frequently considered luxury items and are not covered by insurance. As a result, price sensitivity, particularly in developing countries, can limit market penetration.

Emerging economies in Asia-Pacific and Latin America are experiencing rising disposable incomes and an expanding middle-class population. This group is increasing their spending on cosmetics and personal care goods, as well as aesthetic procedures. For example, India's personal care and cosmetics sector has grown consistently, with more shelf space available in boutiques and retail stores around the country. As more people incorporate the beauty industry's potential into their daily routines for skincare and haircare rather than visiting doctors or taking medications, the beauty sector is no longer just about beauty and make-up; it is also threatening the treatment solution industry, according to the India Brand Equity Foundation. Companies expanding into these locations might tap into a big, underserved client base, driving substantial market growth.

Dermal Fillers Market Segmentation

The worldwide market for dermal fillers is split based on type, product, application, end-user, and geography.

Dermal Filler Market By Type

- Biodegradable

- Non-biodegradable

According to the dermal fillers industry analysis, biodegradable dermal fillers are projected to gain popularity in the market because to their safety and transitory nature, which decreases long-term issues. They are made from chemicals such as hyaluronic acid and collagen, which are gradually absorbed by the body, providing a natural appearance with few adverse effects. Their biocompatibility and ease of correction have made them popular for face rejuvenation and volume enhancement. Non-biodegradable fillers, on the other hand, are composed of synthetic materials and produce long-term results. However, their permanence can cause issues over time, making them less desirable as consumers prioritize safety and natural beauty.

Dermal Filler Market By Product

- Polymethyl-Methacrylate Microspheres

- Polylactic Acid (PLLA)

- Hyaluronic Acid

- Calcium Hydroxylapatite

- Others

According to the dermal fillers industry analysis, hyaluronic acid is the market leader due to its natural compatibility with human skin and ability to offer long-term hydration and volume. Its appeal stems from the increased demand for non-surgical cosmetic procedures that require little downtime and produce natural-looking results. Furthermore, advances in filler compositions improve safety and effectiveness, attracting a larger user base. As the aesthetics business grows globally, hyaluronic acid-based fillers are positioned to dominate the market due to their versatility and dependable performance.

Dermal Filler Market By Application

- Wrinkle Correction

- Lip Enhancement

- Scar Treatment

- Facial Contouring

- Others

According to the dermal fillers industry forecast, wrinkle correction is predicted to fuel growth in the business as the population ages and beauty-conscious customers seek non-invasive alternatives to maintain their youthful appearance. Dermal fillers are efficient at smoothing fine lines and deep wrinkles, providing quick and natural-looking results without surgery. Filler technology advancements improve durability and safety, making them a popular option for wrinkle repair. With increased global acceptability of cosmetic operations, demand for wrinkle-targeted fillers is expected to rise, accelerating the industry's growth.

Dermal Filler Market By End-User

- MedSpa

- Cosmetic Surgery Clinics

- Hospitals

According to the dermal fillers market forecast, medspa area of the industry is predicted to expand fast as people seek tailored and premium cosmetic experiences. Medspas provide a combination of professional competence and spa-like relaxation, attracting clients seeking minimally invasive cosmetic enhancements in a soothing setting. The increase in disposable wealth and beauty awareness is driving demand for dermal filler treatments in these high-end venues. As medspas develop globally, they are emerging as important growth drivers in the dermal filler market.

Dermal Fillers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

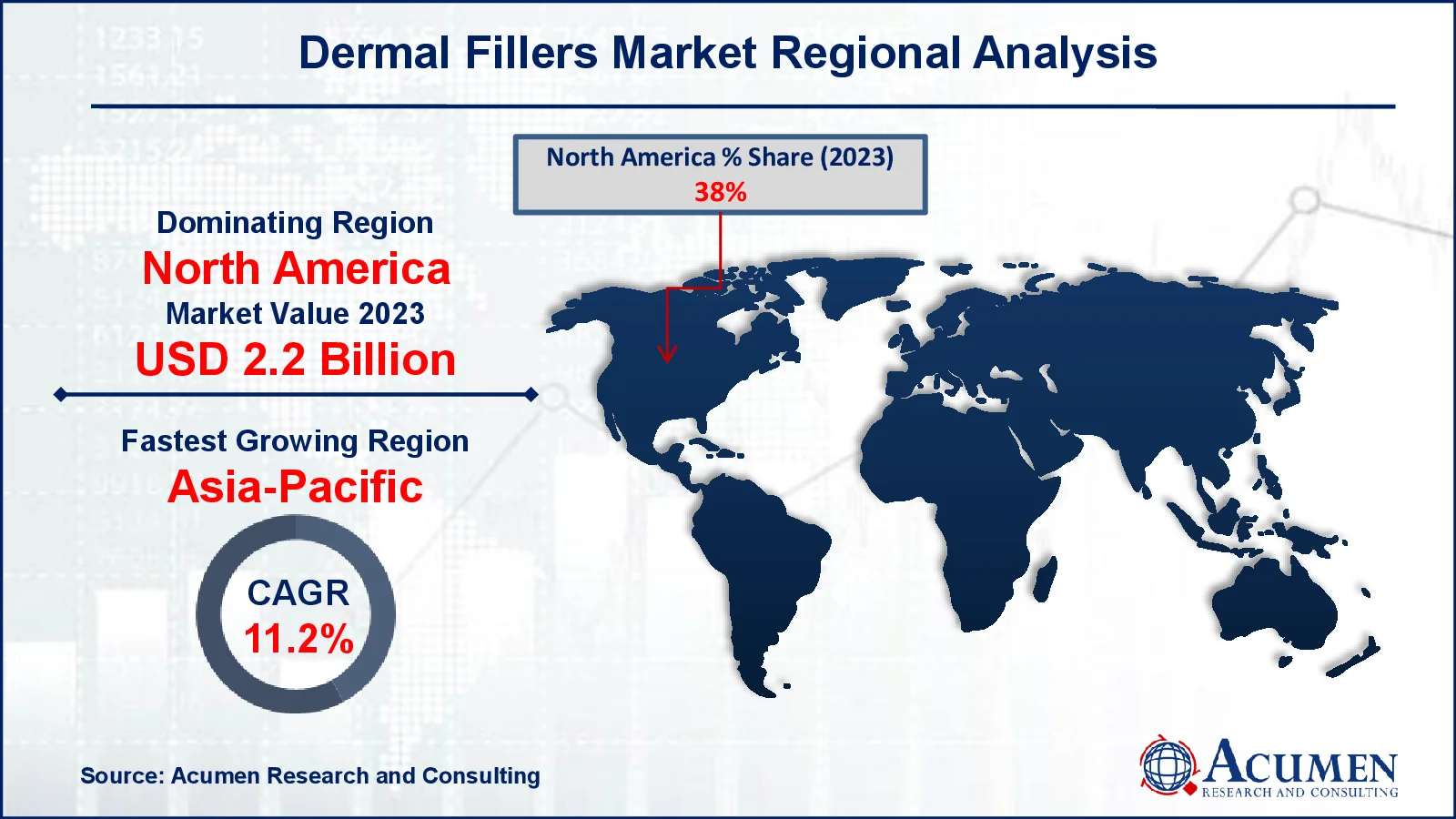

Dermal Fillers Market Regional Analysis

For several reasons, North America has the highest proportion of the dermal filler market. The region benefits from a high concentration of major industry companies, superior healthcare facilities, and favorable regulatory approvals. For example, in October 2023, Prollenium Medical Technologies announced the acquisition of SoftFil medical devices, with the goal of developing powerful tools that give best results for practitioners and patients. Furthermore, high disposable income and an older population seeking anti-aging remedies contribute to long-term market growth. For example, the number of Americans aged 100 and more is expected to more than triple over the next three decades, from an estimated 101,000 in 2024 to around 422,000 in 2054, according to Census Bureau predictions. Increased public awareness and acceptance of cosmetic operations helps to region’s growth in forecast year.

The Asia-Pacific region's dermal fillers market is expanding rapidly due to rising beauty consciousness and the presence of important players. For example, in May 2022, BioPlus signed a joint venture agreement with Chimin Health to expand their development capabilities for hyaluronic acid-based dermal fillers in the Chinese market. Non-invasive cosmetic procedures are becoming increasingly popular, particularly among younger consumers who have been affected by social media and celebrity beauty standards. Furthermore, medical tourism and a thriving aesthetics business in countries such as South Korea and Japan are driving market growth.

Dermal Fillers Market Players

Some of the top dermal fillers companies offered in our report include Merz Pharma, Teoxane Laboratories, Bioxis pharmaceutical, Sosum Global, Galderma SA, Revance Therapeutics, Elan aesthetics Inc, Sinclair Pharma, Cutera Inc, and AbbVie Laboratories.

Frequently Asked Questions

How big is the Dermal Fillers market?

The dermal fillers market size was valued at USD 5.79 Billion in 2023.

What is the CAGR of the global Dermal Fillers market from 2024 to 2032?

The CAGR of dermal fillers is 10.4% during the analysis period of 2024 to 2032.

Which are the key players in the Dermal Fillers market?

The key players operating in the global market are including Merz Pharma, Teoxane Laboratories, Bioxis pharmaceutical, Sosum Global, Galderma SA, Revance Therapeutics, Elan aesthetics Inc, Sinclair Pharma, Cutera Inc, and AbbVie Laboratories.

Which region dominated the global Dermal Fillers market share?

North America held the dominating position in dermal fillers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of dermal fillers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Dermal Fillers industry?

The current trends and dynamics in the dermal fillers industry include rising demand for minimally invasive cosmetic procedures, advancements in dermal filler materials and techniques, and increasing awareness and acceptance of aesthetic treatments.

Which type held the maximum share in 2023?

The hyaluronic acid held the maximum share of the dermal fillers industry.