Medical Aesthetic Devices Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Medical Aesthetic Devices Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

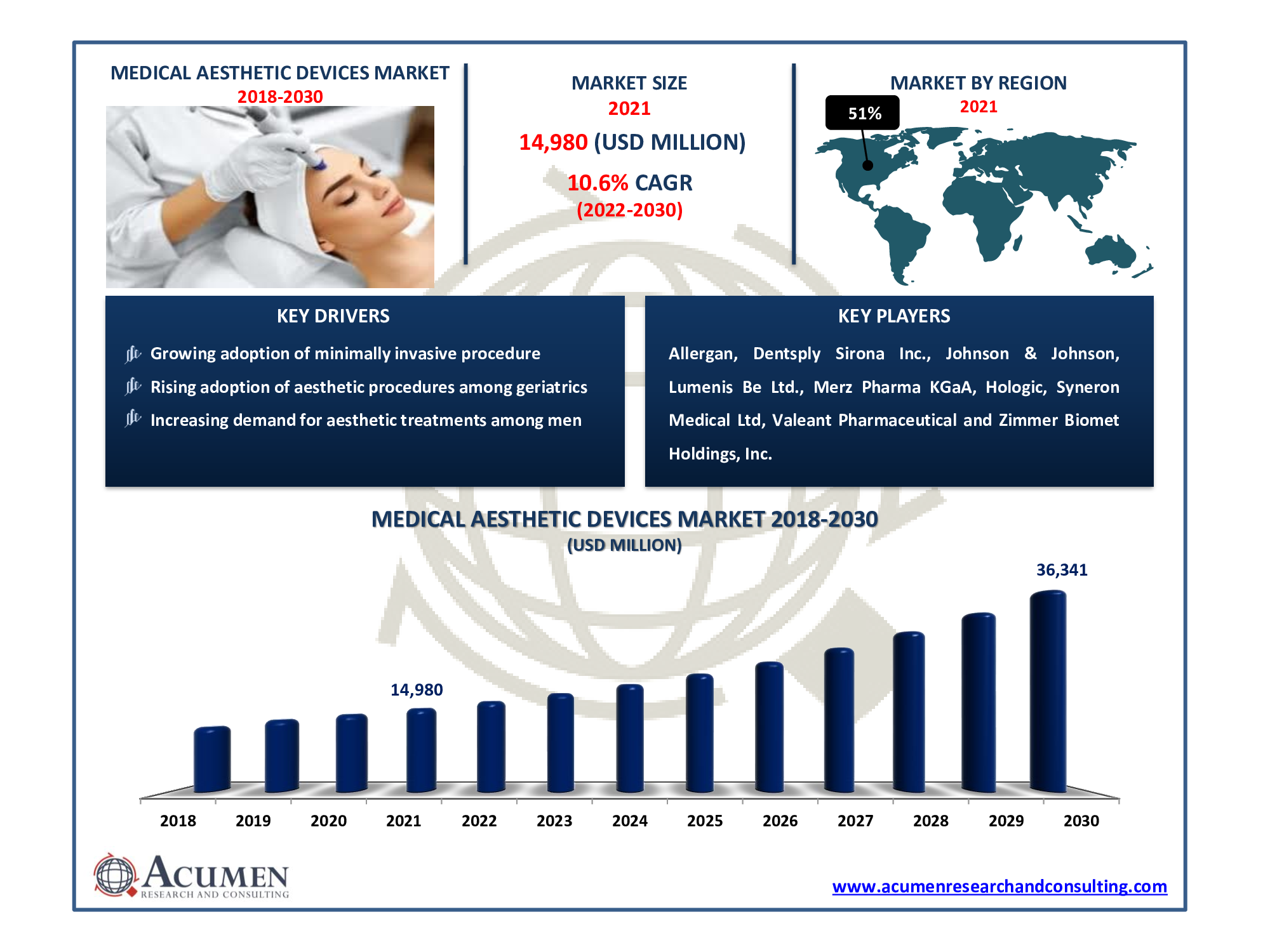

The Global Medical Aesthetic Devices Market size accounted for USD 14,980 Million in 2021 and is estimated to reach USD 36,341 Million by 2030.

According to our medical aesthetic devices industry analysis, the primary factor driving the market growth is the rising awareness about their appearance. On the other hand, the recent medical aesthetic devices market trend that is fueling demand over the years is the development of new aesthetic products. As a result, the medical aesthetic devices market forecast a CAGR of 10.6% from 2022 to 2030.

Aesthetic (cosmetic) devices are commonly used to enhance one's appearance. They may be subject to FDA regulation depending on their intended use and whether they affect the structure or function of the body. These devices are commonly used for toning, sculpting, and rejuvenating damaged skin, among many other things. Certain medical aesthetic devices have become available to the public in recent years, though they are less commonly accessible at drugstores.

Medical Aesthetic Devices Market Dynamics

Market Growth Drivers:

- Growing adoption of minimally invasive and non-invasive aesthetic procedures

- Rising adoption of aesthetic procedures among millennials

- Increasing demand for aesthetic treatments among men

Market Restraints:

- High cost of aesthetic skin resurfacing and tightening procedures

- Stringent regulations for the usage of these devices

Market Opportunities:

- Growing adoption of home-use aesthetic devices

- Increasing disposable incomes and the expanding middle-class population

Report Coverage

| Market | Medical Aesthetic Devices Market |

| Market Size 2021 | USD 14,980 Million |

| Market Forecast 2030 | USD 36,341 Million |

| CAGR During 2022 - 2030 | 10.6% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Device Type, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Johnson & Johnson, Allergan plc, Syneron Medical Ltd, Lumenis Be Ltd., Dentsply Sirona Inc., Merz Pharma GmbH & Co. KGaA, Valeant Pharmaceutical International, Inc, Hologic, Inc., Sientra Inc, and Zimmer Biomet Holdings, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

The surging adoption of minimally invasive and non-invasive aesthetic procedures is one of the leading factors fueling the medical aesthetic devices market growth. Medical aesthetics is still a developing medical trend. This trend is primarily driven by patients' increasing emphasis on minimizing the effects of natural aging. To that end, in today's medical landscape, an increasing number of patients are opting for less invasive cosmetic procedures with less downtime and lower risk factors. Essentially, patients, today prefer needle-based cosmetic procedures over scalpel-based surgical procedures.

Increasing adoption of aesthetic procedures among millennials is expected to boost the demand throughout the forecast timeframe from 2022 to 2030. According to a 2019 survey conducted by the American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS), millennials are more likely to seek out skin resurfacing cosmetic procedures such as chemical peels and lasers. This was demonstrated by a 39% rise in the number of cosmetic procedures conducted between 2018 and 2019. Similarly, the surging demand for skin treatments among men is also anticipated to fuel the medical aesthetic devices market growth in the coming future.

However, the high cost of these devices would hamper the market from growing. In addition, strict guidelines for the development and application of these devices are creating a roadblock to market growth. Furthermore, the growing adoption of home-use aesthetic devices is anticipated to create numerous growth opportunities for the market in the coming years.

Medical Aesthetic Devices Market Segmentation

The global medical aesthetic devices market segmentation is based on device type, application, end-user, and region.

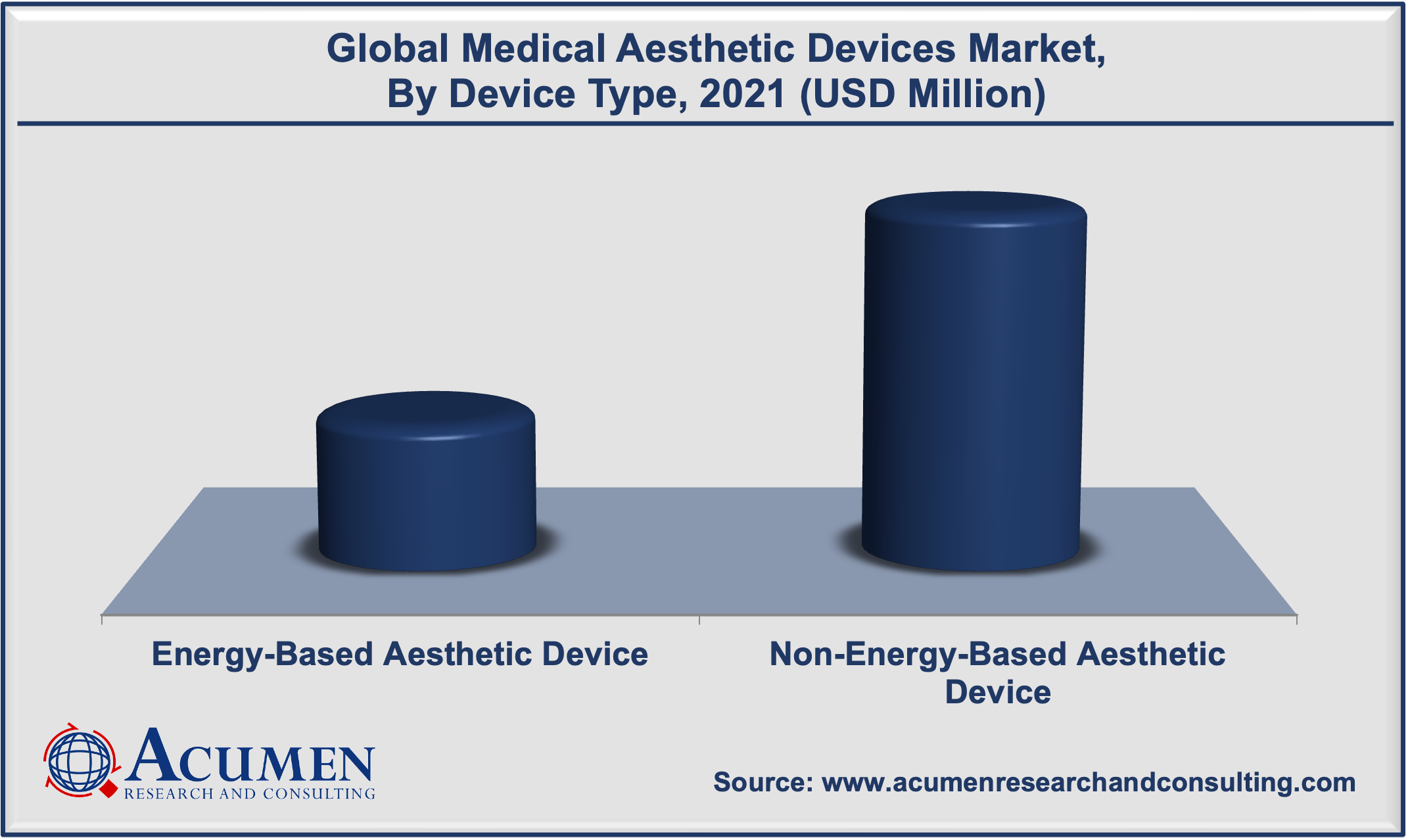

Market by Device Type

Energy-Based Aesthetic Devices

- Laser-Based Aesthetic Devices

- Light-Based Aesthetic Devices

- Radiofrequency (RF)-based Aesthetic Devices

- Ultrasound Aesthetic Devices

Non-Energy-Based Aesthetic Devices

- Dermal Fillers and Aesthetic Threads

- Botulinum Toxin

- Microdermabrasion

- Implants

- Breast Implants

- Facial Implants

- Other Implants

- Other Aesthetic Devices

According to the device type, the botulinum toxin subsegment by the non-energy-based aesthetic device is growing consistently during the forecast timeframe due to an increase in preference for minimally invasive cosmetic procedures and a larger population of beauty-conscious people. The bacterium Clostridium botulinum produces botulinum toxin, a neurotoxic protein. Botulinum toxin injections tend to block nerve signals to the muscle into which they are injected. Meanwhile, implants have also gained significant traction due to the reducing prices of facial implants and rising medical tourism.

Market by Application

- Body Contouring and Cellulite Reduction

- Skin Resurfacing and Tightening

- Facial Aesthetic Procedures

- Hair Removal

- Breast Augmentation

- Other Applications

The facial aesthetic procedures application generated a significant medical aesthetic devices market share in 2021. The popularity of facial aesthetics services has skyrocketed. The potential to provide tremendous benefits without surgical procedures has been an ideal match for this demographic. Another segment that achieved notable growth is the hair removal procedure. According to the International Society of Plastic Surgery (ISAPS), the number of hair removal procedures carried out in 2020 was 1.84 Million.

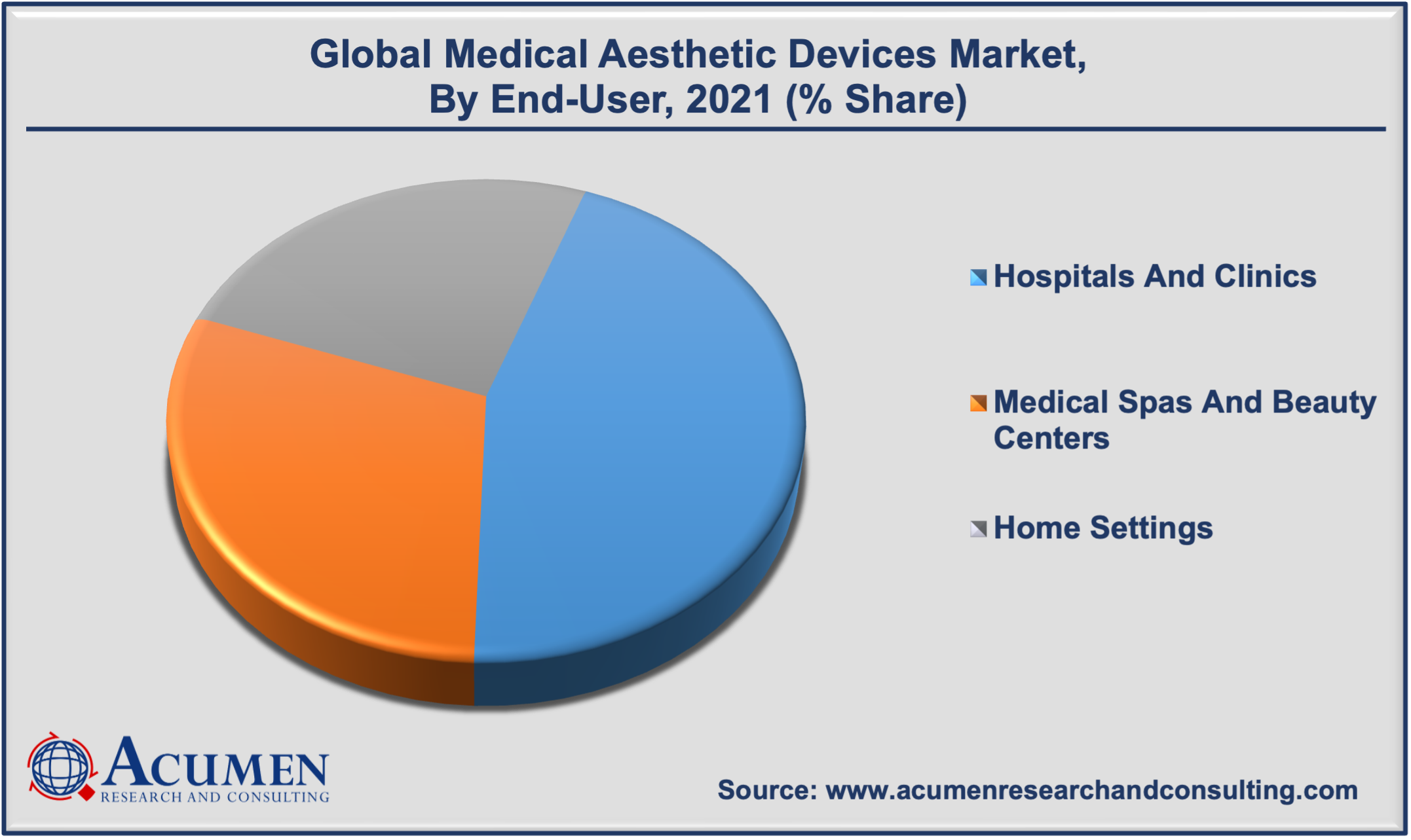

Market by End-User

- Hospitals and Clinics

- Medical Spas and Beauty Centers

- Home Settings

According to our analysis, the hospitals & clinics segment currently dominates the market and is anticipated to remain dominant throughout the projected timeline, as hospitals & clinics offer almost all types of cosmetic procedures for patients. Furthermore, hospitals have high availability of financial and infrastructural resources, such as technologically advanced devices, trained personnel, and skilled professionals to perform aesthetic procedures. This factor has positively impacted the growth of the hospital and clinics segment.

Medical Aesthetic Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America Region Accumulated the Leading Market Share In 2021

North America held the market with the highest share because of factors such as increased demand for aesthetic devices, increased product awareness, continuous technological advancements, and the presence of key players in the region. Meanwhile, the Asia-Pacific region is expected to grow at the fastest rate during the forecast period. Rising consumer awareness and interest in procedures, strong regional economies, assertive marketing by leading US and European companies in Asia, rising medical tourism, and rising aesthetics awareness are among the key factors driving the growth of the Asia-Pacific medical aesthetic devices market.

Medical Aesthetic Devices Market Players

Some of the top medical aesthetic devices companies offered in the professional report include Johnson & Johnson, Allergan plc, Syneron Medical Ltd, Lumenis Be Ltd., Dentsply Sirona Inc., Merz Pharma GmbH & Co. KGaA, Valeant Pharmaceutical International, Inc, Hologic, Inc., Sientra Inc, and Zimmer Biomet Holdings, Inc.

Frequently Asked Questions

How much was the estimated market size of global medical aesthetic devices market in 2021?

The global medical aesthetic devices market size was valued at USD 14,980 Million in 2021.

What will be the projected CAGR for global medical aesthetic devices market during forecast period of 2022 to 2030?

The projected CAGR of medical aesthetic devices market during the analysis period of 2022 to 2030 is 10.6%.

Which are the prominent competitors operating in the market?

The prominent players of the global medical aesthetic devices market involve Allergan plc, Dentsply Sirona Inc., Johnson & Johnson, Lumenis Be Ltd., Merz Pharma GmbH & Co. KGaA, Hologic, Inc., Sientra Inc, Syneron Medical Ltd, Valeant Pharmaceutical International, Inc, and Zimmer Biomet Holdings, Inc.

Which region held the dominating position in the global medical aesthetic devices market?

North America held the dominating share for medical aesthetic devices during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for medical aesthetic devices during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global medical aesthetic devices market?

Growing adoption of minimally invasive and non-invasive aesthetic procedures, rising adoption of aesthetic procedures among geriatric individuals, and increasing demand for aesthetic treatments among men drives the growth of global medical aesthetic devices market.

By segment end-user, which sub-segment held the maximum share?

Based on end-user, hospitals and clinics sub-segment held the maximum share for medical aesthetic devices market in 2021.