Cyclic Olefin Polymer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cyclic Olefin Polymer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Cyclic Olefin Polymer Market Size accounted for USD 917 Million in 2022 and is projected to achieve a market size of USD 1,521 Million by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Cyclic Olefin Polymer Market Highlights

- Global Cyclic Olefin Polymer Market revenue is expected to increase by USD 1,521 Million by 2032, with a 5.4% CAGR from 2023 to 2032

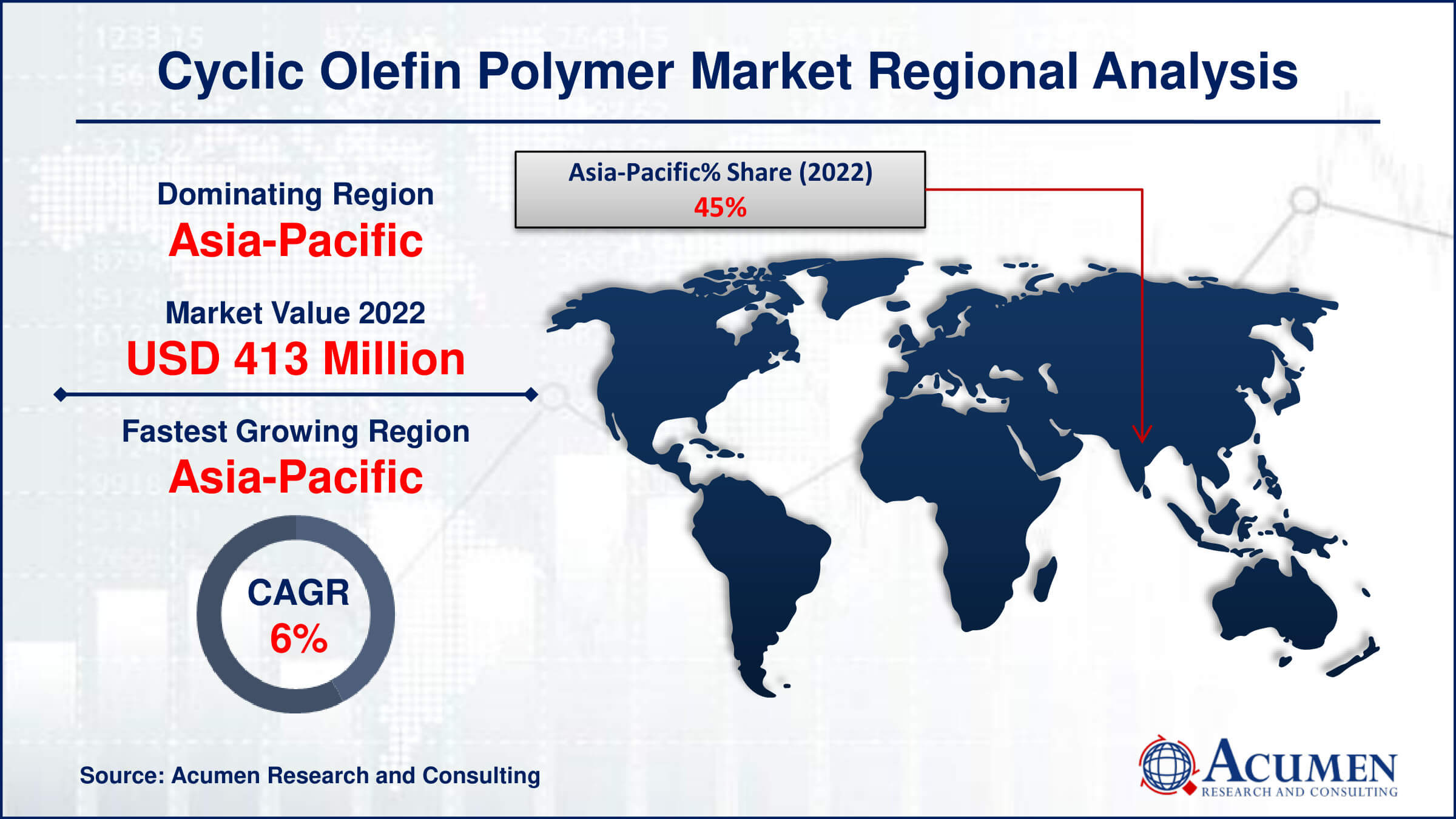

- Asia-Pacific region led with more than 45% of Cyclic Olefin Polymer Market share in 2022

- Europe Cyclic Olefin Polymer Market growth will record a CAGR of more than 5.1% from 2023 to 2032

- By type, the copolymers segment captured more than 66% of revenue share in 2022.

- By process type, the injection molding segment generated over 69% of revenue share in 2022

- Growing demand for high-performance materials in pharmaceutical and healthcare applications, drives the Cyclic Olefin Polymer Market value

.jpg)

Cyclic olefin polymers (COP) are a class of high-performance engineering thermoplastics that have gained significant attention in various industries. COPs are characterized by their unique cyclic structure, which imparts them with exceptional optical clarity, high chemical resistance, low water absorption, and good mechanical properties. These polymers find applications in a wide range of industries, including pharmaceuticals, diagnostics, packaging, optics, and electronics. Due to their transparency and purity, COPs are often used in the manufacturing of medical devices, such as syringes, diagnostic consumables, and packaging for pharmaceutical products.

The market for cyclic olefin polymers has been witnessing substantial growth in recent years, driven by the increasing demand for high-performance materials in critical applications. The pharmaceutical and healthcare industries, in particular, have been major contributors to the growth of the COP market. The need for advanced materials that meet stringent regulatory requirements and provide superior performance in drug delivery and diagnostics has fueled the adoption of cyclic olefin polymers. Additionally, the expanding electronics and optical industries, where transparency and high precision are crucial, have further contributed to the market's growth. As industries continue to emphasize the development of innovative and high-quality products, the cyclic olefin polymer market is expected to experience sustained growth in the coming years.

Global Cyclic Olefin Polymer Market Trends

Market Drivers

- Growing demand for high-performance materials in pharmaceutical and healthcare applications

- Increasing adoption in electronics and optical industries for transparency and precision

- Emphasis on advanced packaging solutions, driving demand for cyclic olefin polymers

- Ongoing research and development activities to enhance COP properties

- Rising need for lightweight and durable materials in various industrial applications

Market Restraints

- High production costs associated with cyclic olefin polymers

- Limited availability of raw materials for COP production

Market Opportunities

- Exploration of novel applications and industries for cyclic olefin polymers

- Expansion into emerging markets with increasing industrial activities

Cyclic Olefin Polymer Market Report Coverage

| Market | Cyclic Olefin Polymer Market |

| Cyclic Olefin Polymer Market Size 2022 | USD 917 Million |

| Cyclic Olefin Polymer Market Forecast 2032 | USD 1,521 Million |

| Cyclic Olefin Polymer Market CAGR During 2023 - 2032 | 5.4% |

| Cyclic Olefin Polymer Market Analysis Period | 2020 - 2032 |

| Cyclic Olefin Polymer Market Base Year |

2022 |

| Cyclic Olefin Polymer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Process Type, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | JSR Corporation, Zeon Corporation, Celanese Corporation, Mitsui Chemicals, Cyclo Olefin Copolymer (COC) Japan, Sumitomo Chemical Co., Ltd., The Dow Chemical Company, TOPAS Advanced Polymers, Boehringer Ingelheim, SCHOTT AG, Polyplastics Co., Ltd., and INEOS Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cyclic olefin polymers are characterized by high transparency, low water absorption, excellent chemical resistance, and good mechanical properties. They are also amorphous in nature, making them ideal for applications where optical clarity is crucial. Cyclic olefin polymers find widespread applications in various industries. In the pharmaceutical and healthcare sector, they are commonly used in the manufacturing of medical devices such as syringes, vials, and diagnostic consumables due to their purity and biocompatibility. Additionally, their optical clarity makes them suitable for optical and electronic applications, including the production of lenses, light guides, and high-precision components. The versatility of cyclic olefin polymers extends to packaging, where their barrier properties and resistance to chemicals make them suitable for demanding packaging applications, especially in the food and pharmaceutical industries.

The cyclic olefin polymer (COP) market has been experiencing notable growth driven by several key factors. One significant driver is the increasing demand for high-performance materials, especially in the pharmaceutical and healthcare industries. Cyclic olefin polymers are preferred in these sectors due to their exceptional properties, such as optical clarity, chemical resistance, and low water absorption. The use of COPs in medical devices, drug delivery systems, and diagnostic applications has surged, contributing to the overall expansion of the market. Additionally, the electronics and optical industries have also played a pivotal role in driving market growth, as the need for transparent and precision materials continues to rise. While the cyclic olefin polymer market is witnessing substantial growth, certain challenges and opportunities shape its trajectory. The market faces restraints such as high production costs, limited awareness in specific industries, and regulatory complexities.

Cyclic Olefin Polymer Market Segmentation

The global Cyclic Olefin Polymer Market segmentation is based on type, process type, end-use industry, and geography.

Cyclic Olefin Polymer Market By Type

- Copolymers

- Homopolymers

According to the cyclic olefin polymer industry analysis, the copolymers segment accounted for the largest market share in 2022. Copolymers are formed by the polymerization of two or more different monomers, allowing for the combination of desirable characteristics from each. This versatility has made copolymers a preferred choice in various industries. In particular, cyclic olefin copolymers are gaining traction in the packaging sector, where their exceptional transparency, chemical resistance, and low water absorption make them ideal for manufacturing high-performance packaging materials. The demand for copolymers in the pharmaceutical and healthcare industries has been a key contributor to their growth within the cyclic olefin polymer market. These copolymers are utilized in the production of medical devices, drug delivery systems, and diagnostic components, benefiting from their biocompatibility and suitability for sensitive applications.

Cyclic Olefin Polymer Market By Process Type

- Injection Molding

- Blow Molding

- Extrusion

- Others

In terms of process types, the injection molding segment is expected to witness significant growth in the coming years. Injection molding is a widely used manufacturing technique, especially in industries such as packaging, medical devices, and electronics, and cyclic olefin polymers have proven to be well-suited for this application. The unique properties of COPs, including high flowability, excellent moldability, and low shrinkage, make them ideal for precision molding of intricate and complex shapes. These characteristics contribute to the efficiency of the injection molding process, enabling the production of high-quality and detailed components. The pharmaceutical and healthcare sectors have been major contributors to the growth of the injection molding segment within the cyclic olefin polymer market. The demand for precise and transparent components in medical devices and drug delivery systems has led to an increased adoption of COPs in injection molding applications.

Cyclic Olefin Polymer Market By End-Use Industry

- Packaging

- Pharmaceutical

- Automotive

- Optical

- Food & Beverages

- Chemicals

- Electronics

- Others

According to the cyclic olefin polymer market forecast, the packaging segment is expected to witness significant growth in the coming years. Cyclic olefin polymers offer exceptional transparency, high chemical resistance, low water absorption, and good mechanical properties, making them well-suited for a range of packaging applications. These polymers are increasingly preferred in the packaging of pharmaceuticals, cosmetics, and other high-value products where product visibility, protection, and shelf appeal are crucial. One key driver of the packaging segment's growth is the rising demand for advanced and sustainable packaging solutions. Cyclic olefin polymers, being recyclable and possessing low environmental impact, align with the growing global emphasis on sustainable packaging practices. The pharmaceutical industry, in particular, has embraced COPs for blister packaging and vials due to their inert nature and ability to maintain the integrity of sensitive medications.

Cyclic Olefin Polymer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cyclic Olefin Polymer Market Regional Analysis

The Asia-Pacific region has emerged as the dominating force in the cyclic olefin polymer (COP) market, experiencing robust growth attributed to various factors. A key driver is the rapid industrialization and economic development witnessed across countries in the region. The increasing demand for high-performance materials in sectors such as pharmaceuticals, electronics, and packaging has fueled the adoption of cyclic olefin polymers, which offer unique properties suitable for diverse applications. The growing population and rising disposable incomes in Asia-Pacific have further amplified the demand for advanced and innovative products, contributing to the expansion of the COP market. Moreover, the pharmaceutical and healthcare industries in the Asia-Pacific region have been pivotal in driving the dominance of COPs. The need for transparent and biocompatible materials in the manufacturing of medical devices and drug delivery systems has led to a significant uptake of cyclic olefin polymers. Additionally, the packaging sector in the region has witnessed a surge in demand for high-quality and sustainable packaging solutions, further boosting the application of COPs.

Cyclic Olefin Polymer Market Player

Some of the top cyclic olefin polymer market companies offered in the professional report include JSR Corporation, Zeon Corporation, Celanese Corporation, Mitsui Chemicals, Cyclo Olefin Copolymer (COC) Japan, Sumitomo Chemical Co., Ltd., The Dow Chemical Company, TOPAS Advanced Polymers, Boehringer Ingelheim, SCHOTT AG, Polyplastics Co., Ltd., and INEOS Group.

Frequently Asked Questions

How big is the cyclic olefin polymer market?

The cyclic olefin polymer market size was USD 917 Million in 2022.

What is the CAGR of the global cyclic olefin polymer market from 2023 to 2032?

The CAGR of cyclic olefin polymer is 5.4% during the analysis period of 2023 to 2032.

Which are the key players in the cyclic olefin polymer market?

The key players operating in the global market are including JSR Corporation, Zeon Corporation, Celanese Corporation, Mitsui Chemicals, Cyclo Olefin Copolymer (COC) Japan, Sumitomo Chemical Co., Ltd., The Dow Chemical Company, TOPAS Advanced Polymers, Boehringer Ingelheim, SCHOTT AG, Polyplastics Co., Ltd., and INEOS Group.

Which region dominated the global cyclic olefin polymer market share?

Asia-Pacific held the dominating position in cyclic olefin polymer industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cyclic olefin polymer during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cyclic olefin polymer industry?

The current trends and dynamics in the cyclic olefin polymer industry include growing demand for high-performance materials in pharmaceutical and healthcare applications, and increasing adoption in electronics and optical industries for transparency and precision.

Which process type held the maximum share in 2022?

The injection molding process type held the maximum share of the cyclic olefin polymer industry.