Cyclic Olefin Copolymers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Cyclic Olefin Copolymers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

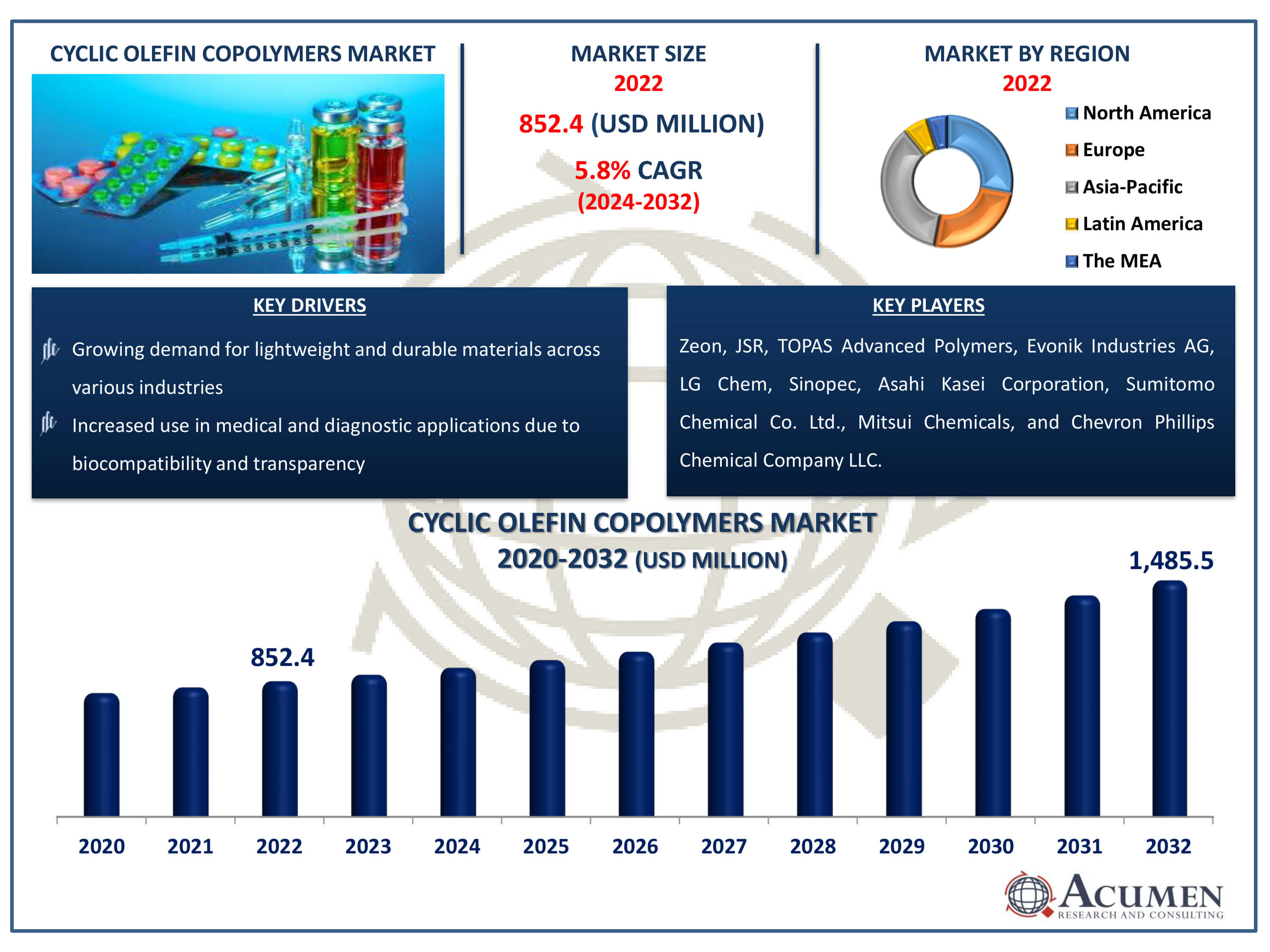

The Cyclic Olefin Copolymers Market Size accounted for USD 852.4 Million in 2022 and is estimated to achieve a market size of USD 1,485.5 Million by 2032 growing at a CAGR of 5.8% from 2024 to 2032.

Cyclic Olefin Copolymers Market Highlights

- Global cyclic olefin copolymers market revenue is poised to garner USD 1,485.5 million by 2032 with a CAGR of 5.8% from 2024 to 2032

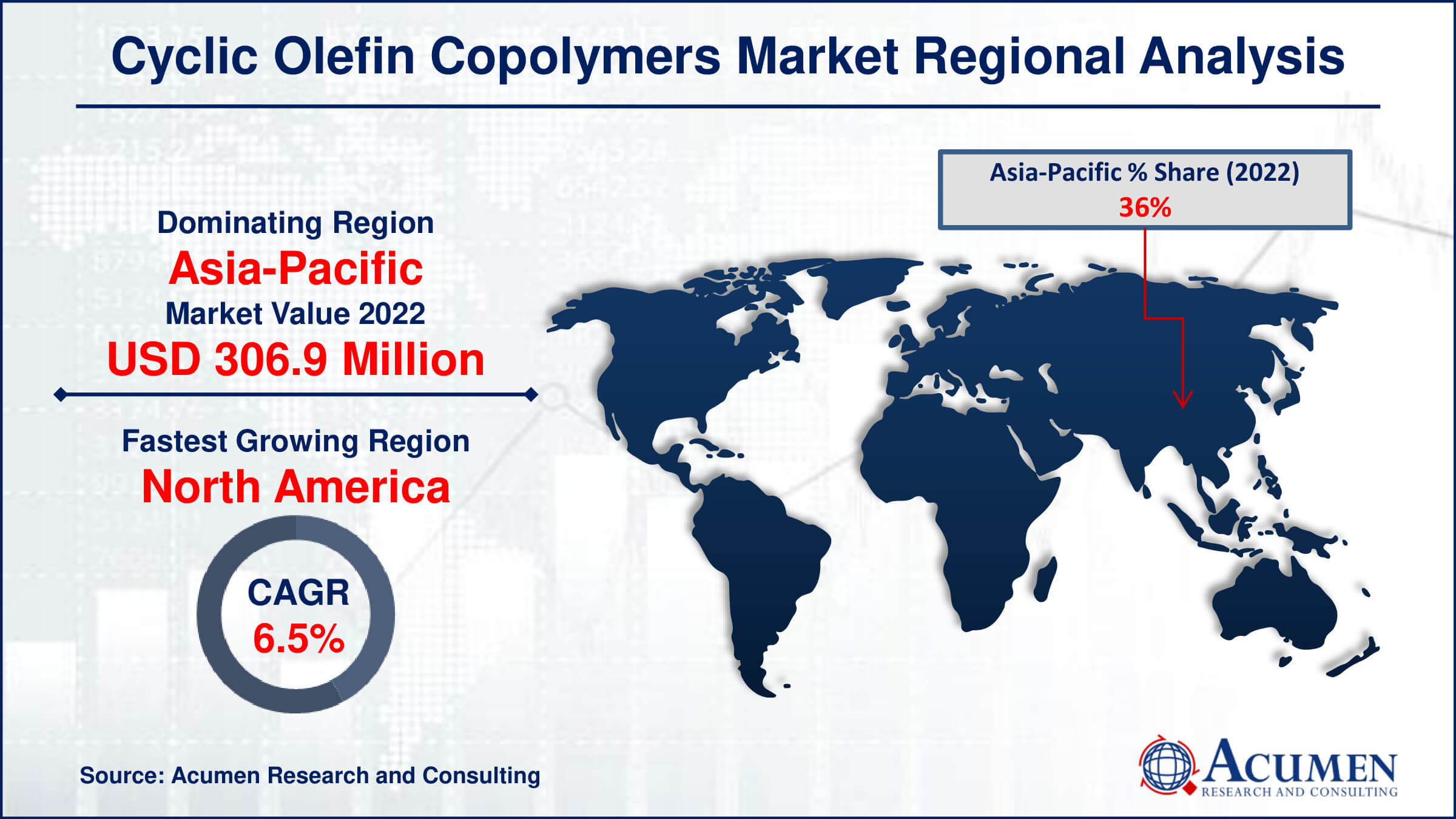

- Asia-Pacific cyclic olefin copolymers market value occupied around USD 306.9 million in 2022

- North America cyclic olefin copolymers market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among grade, the resin sub-segment generated more than USD 596.7 million revenue in 2022

- Based on application, the packaging sub-segment generated around 45% market share in 2022

- Increased demand in emerging markets due to rising industrialization and modernization is a popular cyclic olefin copolymers market trend that fuels the industry demand

Cyclic olefin copolymers (COCs) are high-purity polymers renowned for their break resistance, lightweight characteristics, and chemical stability. They are also quite translucent and have great barrier qualities. These characteristics make COCs a useful material in a variety of applications. COCs are commonly utilized in medical equipment and diagnostic instruments because they are biocompatible and clear, providing for accurate and trustworthy findings. Their transparency and durability make them excellent for use in electronics components such as screens and lenses. Furthermore, COCs' unique mix of properties such as transparency, lightweight nature, and rupture resistance allows them to be used as a glass substitute in situations where glass is too heavy or prone to breaking. This makes COCs the perfect material for creative product design in a variety of sectors.

Global Cyclic Olefin Copolymers Market Dynamics

Market Drivers

- Growing demand for lightweight and durable materials across various industries

- Increased use in medical and diagnostic applications due to biocompatibility and transparency

- Rising adoption in the electronics industry for displays and optical components

- Expansion of the packaging industry, seeking high barrier properties and transparency

Market Restraints

- High production costs compared to traditional polymers

- Limited availability of raw materials for COC production

- Competition from other alternative materials with similar properties

Market Opportunities

- Development of new applications in the automotive sector, leveraging lightweight properties

- Potential for growth in the renewable energy industry for advanced materials

- Innovation in advanced packaging solutions for the food and pharmaceutical industries

Cyclic Olefin Copolymers Market Report Coverage

| Market | Cyclic Olefin Copolymers Market |

| Cyclic Olefin Copolymers Market Size 2022 | USD 852.4 Million |

| Cyclic Olefin Copolymers Market Forecast 2032 |

USD 1,485.5 Million |

| Cyclic Olefin Copolymers Market CAGR During 2024 - 2032 | 5.8% |

| Cyclic Olefin Copolymers Market Analysis Period | 2020 - 2032 |

| Cyclic Olefin Copolymers Market Base Year |

2022 |

| Cyclic Olefin Copolymers Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Grade, By Processing Technique, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Zeon, JSR, TOPAS Advanced Polymers, Evonik Industries AG, LG Chem, Sinopec, Asahi Kasei Corporation, Sumitomo Chemical Co. Ltd., Mitsui Chemicals, and Chevron Phillips Chemical Company LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cyclic Olefin Copolymers Market Insights

The healthcare industry is characterized by a labyrinth of legislation and regulations covering various products, from drugs and medical devices to the smallest ingredients used in packaging such products. Cyclic olefin copolymers (COCs) have become the most popular plastics for healthcare and packaging applications, offering producers and vendors new opportunities. The growing demand for COCs in various end-use sectors such as packaging, diagnostics, optics, and electronics is expected to drive the development of this market in the cyclic olefin copolymers industry forecast period.

The demand for cyclic olefin copolymers was high across a variety of end-use sectors, including packaging, healthcare, electronics, and optics. The packaging sector alone consumed almost 20 kilotons of cyclic olefin copolymers. The packaging sector is likely to remain the most profitable end-use market for industry players in the cyclic olefin copolymers market forecast period, accounting for over one-third of the global cyclic olefin copolymers market. The increasing demand for cyclic olefin copolymer resins stems primarily from the need to replace costly PAN-based polymers, which are widely used in medical packaging but are being surpassed by more effective resins with high chemical resistance and optical transparency. The use of barrier materials such as ethylene vinyl alcohol (EVOH) has reduced sales of PAN-based products in food packaging, a trend that is spreading into the pharmaceutical sector with the increasing adoption of cyclic olefin copolymers. Original equipment manufacturers in the healthcare industry are transitioning from PAN-based polymers to cyclic olefin copolymers, despite the regulatory challenges associated with altering medical packaging products. In the coming years, the demand for packaging materials with superior chemical properties is expected to increase as the adoption of cyclic olefin copolymers continues to accelerate in these sectors.

Reseach And Development In The Cyclic Olefin Copolymers Market

While cyclic olefin copolymer producers and distributors cater to vibrant demand from end-use sectors such as electronics and healthcare, they are developing their future business strategies based on these end users' dynamic needs. Leading companies are enhancing their research and development facilities to innovate and improve the performance of cyclic olefin copolymers to meet end-user requirements. In particular, in developed regions such as North America and Europe, leading vendors of cyclic olefin copolymers are focusing on expanding the size of their distribution networks. As market leaders continue to grow their patented manufacturing techniques, they are likely to strengthen their positions and expand their product ranges. Manufacturers are also focusing on the packaging sector as their target market. However, the development of cyclic olefin copolymers faces challenges from cost-effective plastic alternatives, which continue to pose limitations. While cyclic olefin copolymers offer a commercial alternative to PAN-based polymers in packaging, cheaper and more commonly available plastics such as acrylics and polycarbonates often substitute cyclic olefin copolymers. Although major companies like PolyPlastics Inc., SABIC, and Johnson & Johnson are driving the adoption of cyclic olefin copolymers, the use of cost-effective plastics is likely to remain high among small and medium-sized end-users in the market due to their superior chemical properties.

Cyclic Olefin Copolymers Market Segmentation

The worldwide market for cyclic olefin copolymers is split based on grade, processing technique, application, end user, and geography.

Cyclic Olefin Copolymers Grades

- Resin

- Film

According to cyclic olefin copolymers industry analysis, the resin sector dominates the market due to its flexibility and wide variety of applications. COC resin is noted for its superior transparency, purity, and barrier qualities, making it a perfect choice for a variety of applications. Because of its biocompatibility and chemical resistance, COC resin is utilized in the manufacturing of medical devices and diagnostic equipment. Its optical clarity makes it ideal for use in optical components in electronics and automobiles. COC resin's low moisture absorption and excellent gas barrier qualities make it an ideal material for food and pharmaceutical packaging, assuring product freshness and shelf life. Its lightweight and long-lasting properties also help the packaging sector run more efficiently.

Cyclic Olefin Copolymers Processing Techniques

- Injection Molding

- Cast and Blown Film Extrusion

- Blow Molding

Injection molding is predicted to be the largest sector in the cyclic olefin copolymers (COC) market due to its adaptability and extensive applicability across numerous industries. Injection molding is a prominent manufacturing technology that enables the creation of complicated and intricate forms with great precision and efficiency. In the medical business, injection molding using COC is used to make medical devices and components such syringes, vials, and diagnostic instruments. Its ability to create high-quality, clear components with outstanding chemical resistance and biocompatibility makes it a popular choice in this industry. In the electronics sector, injection-molded COC parts are also utilized for optical components, lenses, and connections due to their optical clarity and low birefringence. Injection molding is the most popular processing method in the COC industry due to its efficiency and the desirable qualities of COC.

Cyclic Olefin Copolymers Applications

- Electronics

- Packaging

- Medical Devices

- Optical

- Others

The packaging sector is the largest application area in the cyclic olefin copolymer (COC) market, owing to the material's outstanding characteristics, which make it ideal for a wide range of packaging requirements. COC is noted for its high transparency, good barrier qualities, and minimal moisture absorption, making it perfect for food and pharmaceutical packaging applications. COC's moisture resistance and barrier properties in food packaging aid to keep products fresh and increase shelf life. Its clarity improves the visual appeal of packaged items, so enticing customers. In pharmaceutical packaging, COC's chemical resistance and purity make it a good choice for sterile containers and vials, assuring medical product safety and integrity. COC's lightweight nature also helps to provide cost-effective and efficient packaging solutions. Because of its capacity to protect and preserve packed goods while keeping their visual appeal, the packaging industry is the largest and most important market for COC applications.

Cyclic Olefin Copolymers End Users

- Consumer Goods

- Healthcare and Pharmaceutical

- Electronics

- Automotive

- Others

Owing to the material's exceptional properties that satisfy these industries' exacting requirements, the healthcare and pharmaceutical industries are probably going to be the primary end-user markets for cyclic olefin copolymers (COC). COC is valued for its excellent purity, chemical resistance, and optical clarity, making it perfect for medical devices, diagnostic equipment, and pharmaceutical packaging. Its biocompatibility promotes medical safety, and its barrier capabilities keep medicinal items intact. Demand for COC in the healthcare and pharmaceutical industries is expected to stay high as they develop due to advancements and rising global health concerns.

Cyclic Olefin Copolymers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cyclic Olefin Copolymers Market Regional Analysis

In terms of cyclic olefin copolymers market analysis, the global cyclic olefin copolymer market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In terms of manufacturing, Asia-Pacific is a significant player, with ZEON CORPORATION being the world's leading manufacturer of cyclic olefin copolymers and holding a major share in the global market. Japan is a major hub for cyclic olefin copolymer manufacturing and consumption in Asia-Pacific. The high demand for cyclic olefin copolymers in Asia-Pacific is primarily driven by factors such as high population levels. The presence of rapidly growing economies such as India and China is expected to create opportunities for the cyclic olefin copolymer industry in Asia-Pacific in the near future.

Cyclic Olefin Copolymers Market Players

Some of the top cyclic olefin copolymers companies offered in our report includes Zeon, JSR, TOPAS Advanced Polymers, Evonik Industries AG, LG Chem, Sinopec, Asahi Kasei Corporation, Sumitomo Chemical Co. Ltd., Mitsui Chemicals, and Chevron Phillips Chemical Company LLC.

Frequently Asked Questions

How big is the cyclic olefin copolymers market?

The cyclic olefin copolymers market size was valued at USD 852.4 million in 2022.

What is the CAGR of the global cyclic olefin copolymers market from 2024 to 2032?

The CAGR of cyclic olefin copolymers is 5.8% during the analysis period of 2024 to 2032.

Which are the key players in the cyclic olefin copolymers market?

The key players operating in the global market are including Zeon, JSR, TOPAS Advanced Polymers, Evonik Industries AG, LG Chem, Sinopec, Asahi Kasei Corporation, Sumitomo Chemical Co. Ltd., Mitsui Chemicals, and Chevron Phillips Chemical Company LLC.

Which region dominated the global cyclic olefin copolymers market share?

Asia-Pacific held the dominating position in cyclic olefin copolymers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of cyclic olefin copolymers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cyclic olefin copolymers industry?

The current trends and dynamics in the cyclic olefin copolymers industry include growing demand for lightweight and durable materials across various industries, increased use in medical and diagnostic applications due to biocompatibility and transparency, rising adoption in the electronics industry for displays and optical components, and expansion of the packaging industry, seeking high barrier properties and transparency.

Which application held the maximum share in 2022?

The packaging application held the maximum share of the cyclic olefin copolymers industry.