Cryogenic Tanks Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cryogenic Tanks Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

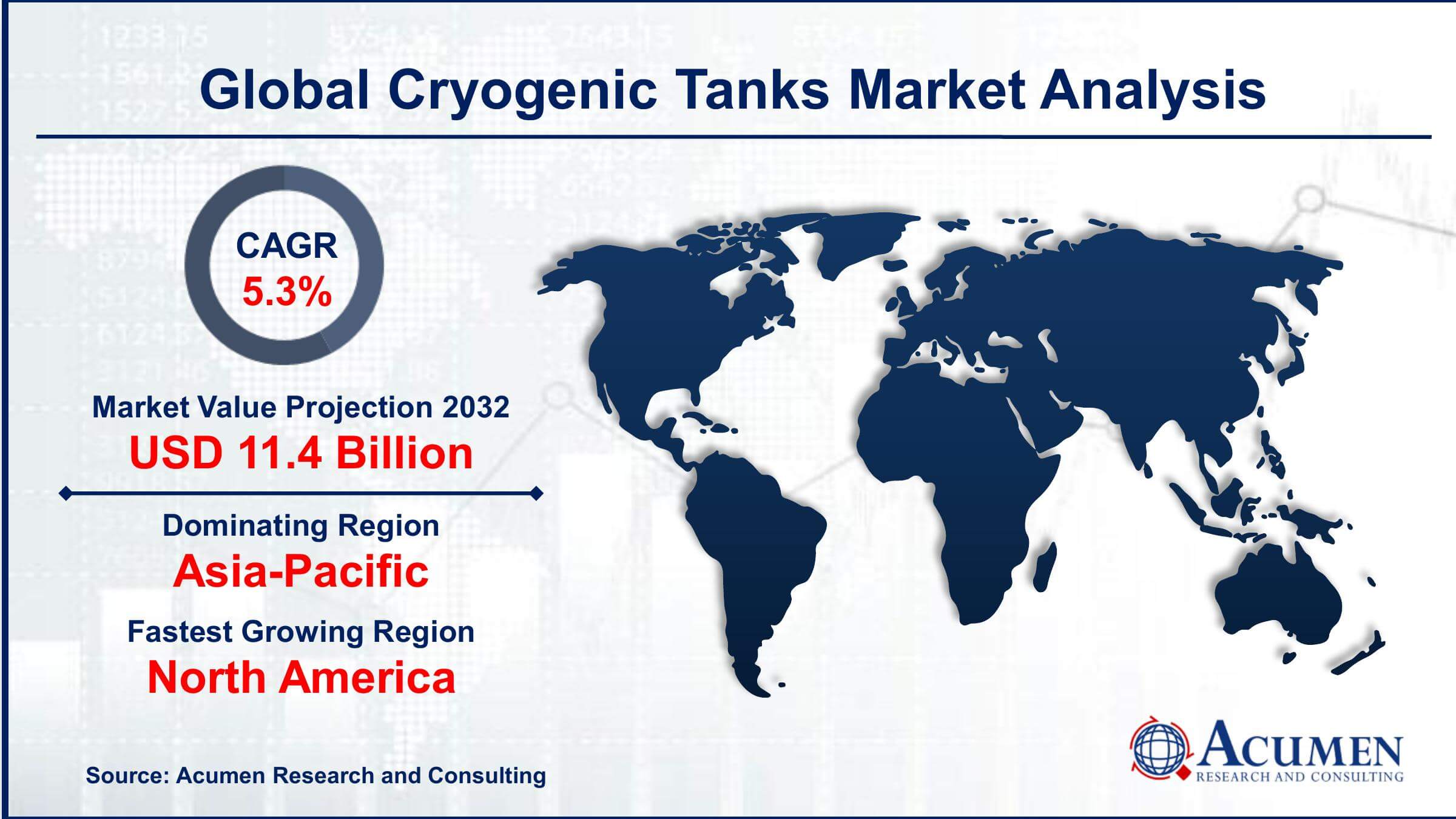

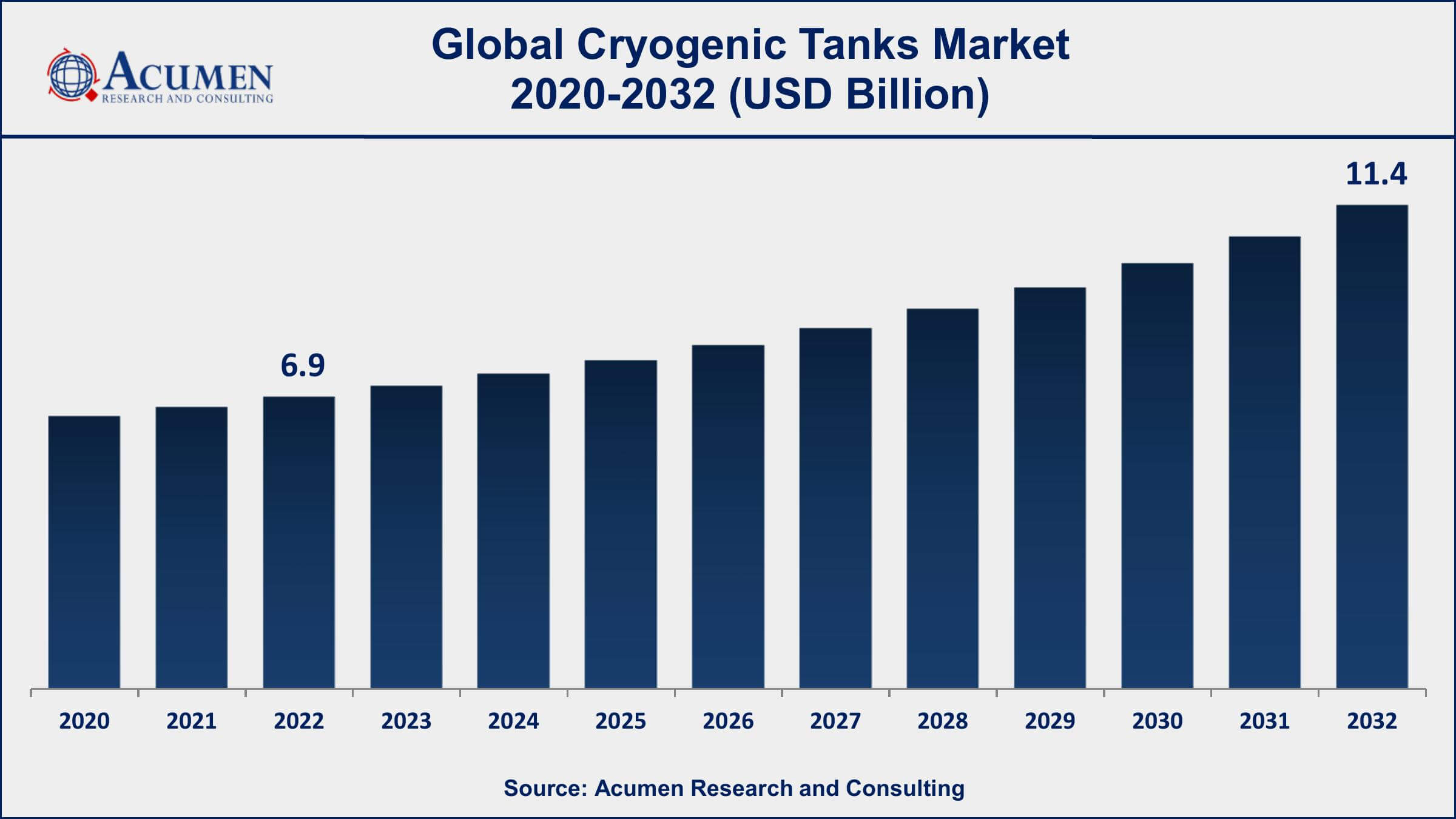

The Global Cryogenic Tanks Market Size accounted for USD 6.9 Billion in 2022 and is projected to achieve a market size of USD 11.4 Billion by 2032 growing at a CAGR of 5.3% from 2023 to 2032.

Cryogenic Tanks Market Highlights

- Global Cryogenic Tanks Market revenue is expected to increase by USD 11.4 Billion by 2032, with a 5.3% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 36% of Cryogenic Tanks Market share in 2022

- North America Cryogenic Tanks Market growth will record a CAGR of around 5.9% from 2023 to 2032

- By application, the storage segment is the largest segment in the market, accounting for over 75% of the market share in 2022

- By cryogenic liquids, the nitrogen segment has recorded more than 37% of the revenue share in 2022

- Growing demand for liquefied natural gas (LNG) for cleaner energy, drives the Cryogenic Tanks Market value

Cryogenic tanks are specialized containers designed to store and transport materials at extremely low temperatures, typically below -150 degrees Celsius (-238 degrees Fahrenheit). These tanks are essential for the storage and transportation of liquefied gases such as oxygen, nitrogen, argon, hydrogen, and LNG (liquefied natural gas). They are engineered to maintain these cryogenic liquids in their liquid state by preventing heat from entering the tank, thus minimizing vaporization and ensuring safe and efficient handling and distribution of these gases.

The cryogenic tanks market has witnessed significant growth over the years, driven by several factors. The increasing demand for industrial gases in various applications, including healthcare, electronics, aerospace, and energy, has been a key driver. Additionally, the growing adoption of LNG as a cleaner fuel source for transportation and energy generation has boosted the demand for cryogenic tanks for LNG storage and distribution. Furthermore, advancements in cryogenic technology, including improved insulation materials and designs, have enhanced the efficiency and safety of cryogenic tank systems. As industries continue to seek more efficient and sustainable solutions for their gas storage and transportation needs, the cryogenic tanks market is expected to experience steady growth in the coming years, with a focus on innovation and expanding applications.

Global Cryogenic Tanks Market Trends

Market Drivers

- Growing demand for liquefied natural gas (LNG) for cleaner energy

- Increasing applications in healthcare, electronics, and aerospace industries

- Advancements in cryogenic technology and materials

- Expanding industrial gas industry

- Rising demand for liquid hydrogen in space exploration

Market Restraints

- Stringent safety and regulatory standards

- High initial investment and operational costs

Market Opportunities

- Research and development for cryogenic hydrogen storage

- Renewable energy storage applications

Cryogenic Tanks Market Report Coverage

| Market | Cryogenic Tanks Market |

| Cryogenic Tanks Market Size 2022 | USD 6.9 Billion |

| Cryogenic Tanks Market Forecast 2032 | USD 11.4 Billion |

| Cryogenic Tanks Market CAGR During 2023 - 2032 | 5.3% |

| Cryogenic Tanks Market Analysis Period | 2020 - 2032 |

| Cryogenic Tanks Market Base Year |

2022 |

| Cryogenic Tanks Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By Cryogenic Liquid, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Wessington Cryogenics, Cryofab Inc., Eden Cryogenic LLC, FIBA Technologies, Inc., INOX India Limited, Air Liquide, Linde Plc, Air Products and Chemicals, Inc., Auguste Cryogenics, Cryogas Equipment Private Limited, Suretanks Group Limited, and Chart Industries. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cryogenic tanks are specialized containers designed to store and transport materials at extremely low temperatures, typically below -150 degrees Celsius (-238 degrees Fahrenheit). They are engineered to keep gases and liquids in their cryogenic state, preventing them from vaporizing into gas form by minimizing heat transfer. Cryogenic tanks are typically constructed with high-quality insulation materials and advanced engineering to maintain the ultra-low temperatures required for the substances they contain.

Cryogenic tanks find a wide range of applications across various industries. One of the most prominent uses is in the storage and transportation of liquefied gases such as oxygen, nitrogen, argon, and hydrogen. These tanks play a crucial role in the industrial gas industry, where these gases are essential for various processes, including metal fabrication, healthcare, electronics manufacturing, and aerospace applications. Additionally, cryogenic tanks are vital in the emerging field of liquefied natural gas (LNG), where they are used for the storage and transportation of LNG, a cleaner alternative to traditional fossil fuels. These tanks are also used in research and scientific applications, as well as in space exploration, where they store and transport cryogenic propellants like liquid oxygen and liquid hydrogen for rockets and spacecraft.

The cryogenic tanks market has been experiencing substantial growth in recent years and is expected to continue expanding at a healthy rate in the coming years. Several key factors are contributing to this growth. First and foremost, the increasing demand for liquefied natural gas (LNG) as a cleaner and more efficient fuel source for various applications, including power generation and transportation, has driven the need for cryogenic tanks for LNG storage and transportation. Moreover, the ever-growing industrial gas sector, which includes gases like oxygen, nitrogen, and argon, relies heavily on cryogenic tanks for safe and efficient storage and distribution, further fueling market growth. Advancements in cryogenic technology have played a pivotal role in market expansion.

Cryogenic Tanks Market Segmentation

The global Cryogenic Tanks Market segmentation is based on raw material, cryogenic liquid, application, end-user, and geography.

Cryogenic Tanks Market By Raw Material

- Steel

- Aluminum alloy

- Nickel alloy

- Others

According to the cryogenic tanks industry analysis, the steel segment accounted for the largest market share in 2022. Steel, particularly stainless steel, is widely used in the construction of cryogenic tanks because of its excellent durability, corrosion resistance, and high strength at low temperatures. These qualities are essential for ensuring the safe containment of cryogenic liquids such as liquefied natural gas (LNG), liquid oxygen, and liquid nitrogen. One of the key drivers of growth in the steel segment is the increasing demand for LNG. LNG is becoming an increasingly popular and cleaner fuel source for various applications, including power generation, transportation, and marine fuels. As the LNG market expands, so does the need for robust cryogenic tanks made from steel. Additionally, advancements in steel manufacturing techniques and materials have allowed for the development of more efficient and cost-effective cryogenic tanks, further fueling the growth of this segment.

Cryogenic Tanks Market By Cryogenic Liquid

- Nitrogen

- Argon

- Oxygen

- Natural gas

- Others

In terms of cryogenic liquids, the nitrogen segment is expected to witness significant growth in the coming years. This growth is expected to continue as industries increasingly rely on nitrogen for processes like cryopreservation, inert gas blanketing, and laser cutting. In the healthcare sector, liquid nitrogen is used for preserving biological materials, such as biological samples, vaccines, and tissue samples. With advancements in medical research and healthcare services, the demand for cryogenic tanks for nitrogen storage has surged. Additionally, in the electronics industry, nitrogen is used for semiconductor manufacturing and cooling applications, creating a need for cryogenic storage solutions.

Cryogenic Tanks Market By Application

- Transportation

- Storage

According to the cryogenic tanks market forecast, the transportation segment is expected to witness significant growth in the coming years. This growth is driven by the increasing demand for the safe and efficient transportation of cryogenic liquids, including liquefied natural gas (LNG), liquid nitrogen, liquid oxygen, and liquid hydrogen. Cryogenic tanks are essential for the secure storage and transportation of these substances at extremely low temperatures, making them pivotal in various industries and applications. One of the key drivers of growth in the transportation segment is the expanding use of LNG as a cleaner alternative fuel for heavy-duty vehicles, ships, and locomotives. LNG offers environmental benefits by reducing greenhouse gas emissions and is gaining traction globally. As a result, there is a growing need for cryogenic tanks designed specifically for LNG transportation, such as ISO containers and specialized tanker trucks.

Cryogenic Tanks Market By End-User

- Manufacturing industries

- Power

- Oil & gas industry

- Metallurgy

- Shipping

- Healthcare

- Others

Based on the end-user, the healthcare segment is expected to continue its growth trajectory in the coming years. Cryogenic tanks provide a reliable and ultra-low-temperature storage solution, ensuring the long-term viability of these sensitive biological substances. This is particularly crucial in healthcare and biomedical research, where maintaining the integrity of biological samples is essential for diagnosis, treatment, and scientific advancement. One significant driver of growth in the healthcare segment is the increasing demand for cryopreservation services, particularly in fields like regenerative medicine and organ transplantation. Cryogenic tanks are utilized for the long-term storage of stem cells, cord blood, and tissues, which can be crucial in regenerative therapies and transplantation procedures. Furthermore, advancements in precision medicine and the development of personalized therapies have fueled the need for extensive biobanking facilities, further boosting the demand for cryogenic storage solutions.

Cryogenic Tanks Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cryogenic Tanks Market Regional Analysis

Geographically, Asia-Pacific has emerged as a dominating region in the cryogenic tanks market for several compelling reasons. Firstly, the region's rapid industrialization and urbanization have led to an increased demand for industrial gases such as oxygen, nitrogen, and argon in various sectors, including manufacturing, healthcare, and electronics. These gases require cryogenic storage and transportation, driving the demand for cryogenic tanks. Additionally, Asia-Pacific's robust healthcare and pharmaceutical industry, along with its growing research and development activities, has created a substantial need for cryogenic storage solutions for biological samples, vaccines, and medical gases, further fueling market growth. Furthermore, the Asia-Pacific region is experiencing a significant surge in LNG demand, driven by the transition to cleaner energy sources and the growth of natural gas as a primary fuel for power generation and transportation. Cryogenic tanks are essential for the storage and transportation of LNG, and this demand has led to substantial investments in LNG infrastructure across the region. Countries like China, India, Japan, and South Korea have been actively expanding their LNG import and distribution networks, driving the demand for cryogenic tanks.

Cryogenic Tanks Market Player

Some of the top cryogenic tanks market companies offered in the professional report include Wessington Cryogenics, Cryofab Inc., Eden Cryogenic LLC, FIBA Technologies, Inc., INOX India Limited, Air Liquide, Linde Plc, Air Products and Chemicals, Inc., Auguste Cryogenics, Cryogas Equipment Private Limited, Suretanks Group Limited, and Chart Industries.

Frequently Asked Questions

What was the market size of the global cryogenic tanks in 2022?

The market size of cryogenic tanks was USD 6.9 Billion in 2022.

What is the CAGR of the global cryogenic tanks market from 2023 to 2032?

The CAGR of cryogenic tanks is 5.3% during the analysis period of 2023 to 2032.

Which are the key players in the cryogenic tanks market?

The key players operating in the global market are including Wessington Cryogenics, Cryofab Inc., Eden Cryogenic LLC, FIBA Technologies, Inc., INOX India Limited, Air Liquide, Linde Plc, Air Products and Chemicals, Inc., Auguste Cryogenics, Cryogas Equipment Private Limited, Suretanks Group Limited, and Chart Industries.

Which region dominated the global cryogenic tanks market share?

Asia-Pacific held the dominating position in cryogenic tanks industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of cryogenic tanks during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cryogenic tanks industry?

The current trends and dynamics in the cryogenic tanks industry include growing demand for liquefied natural gas (LNG) for cleaner energy, and increasing applications in healthcare, electronics, and aerospace industries.

Which cryogenic liquid held the maximum share in 2022?

The nitrogen cryogenic liquid held the maximum share of the cryogenic tanks industry.