Cosmetic Tubes Market | Acumen Research and Consulting

Cosmetic Tubes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

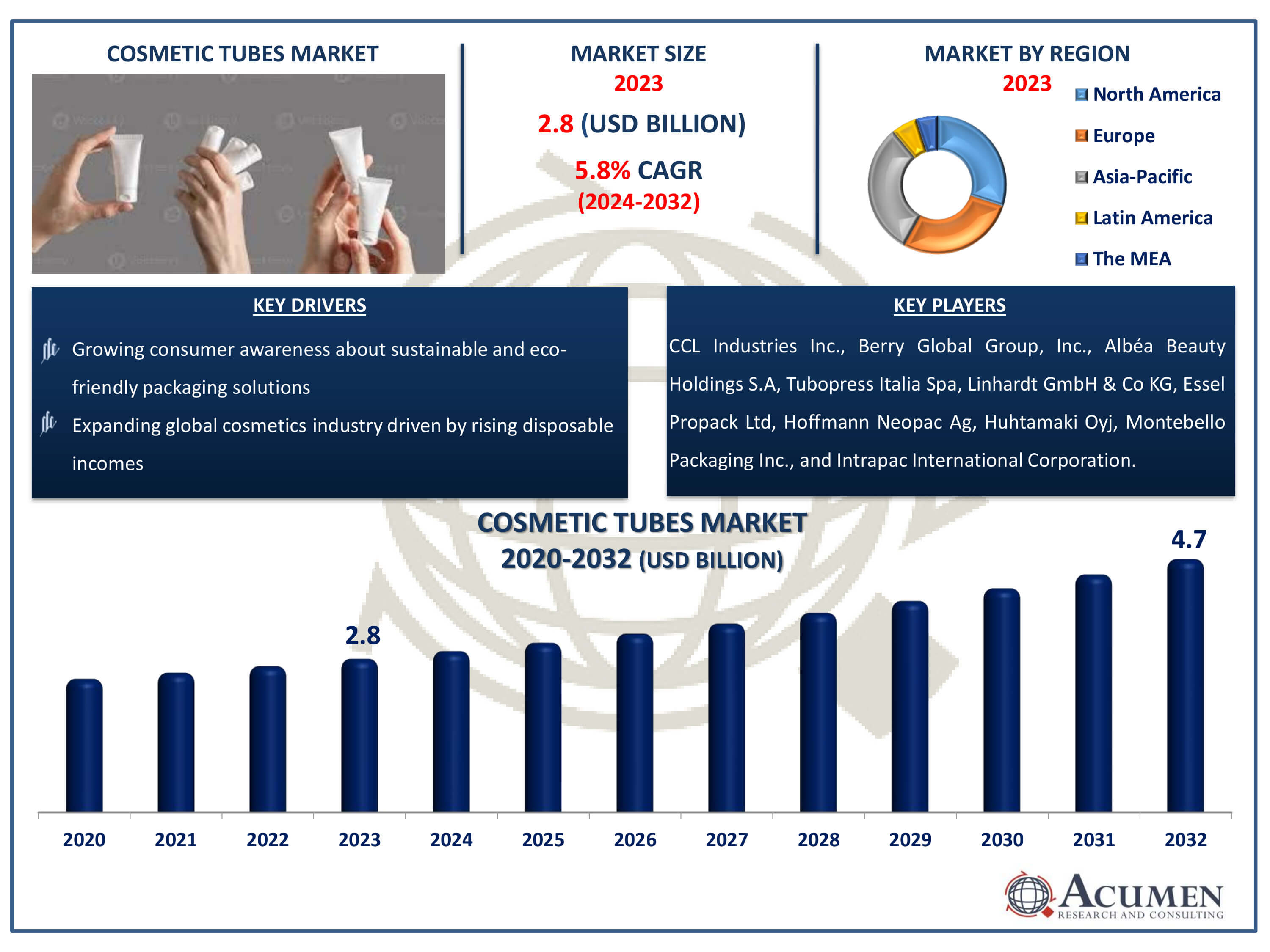

The Cosmetic Tubes Market Size accounted for USD 2.8 Billion in 2023 and is estimated to achieve a market size of USD 4.7 Billion by 2032 growing at a CAGR of 5.8% from 2024 to 2032.

Cosmetic Tubes Market Highlights

- Global cosmetic tubes market revenue is poised to garner USD 4.7 billion by 2032 with a CAGR of 5.8% from 2024 to 2032

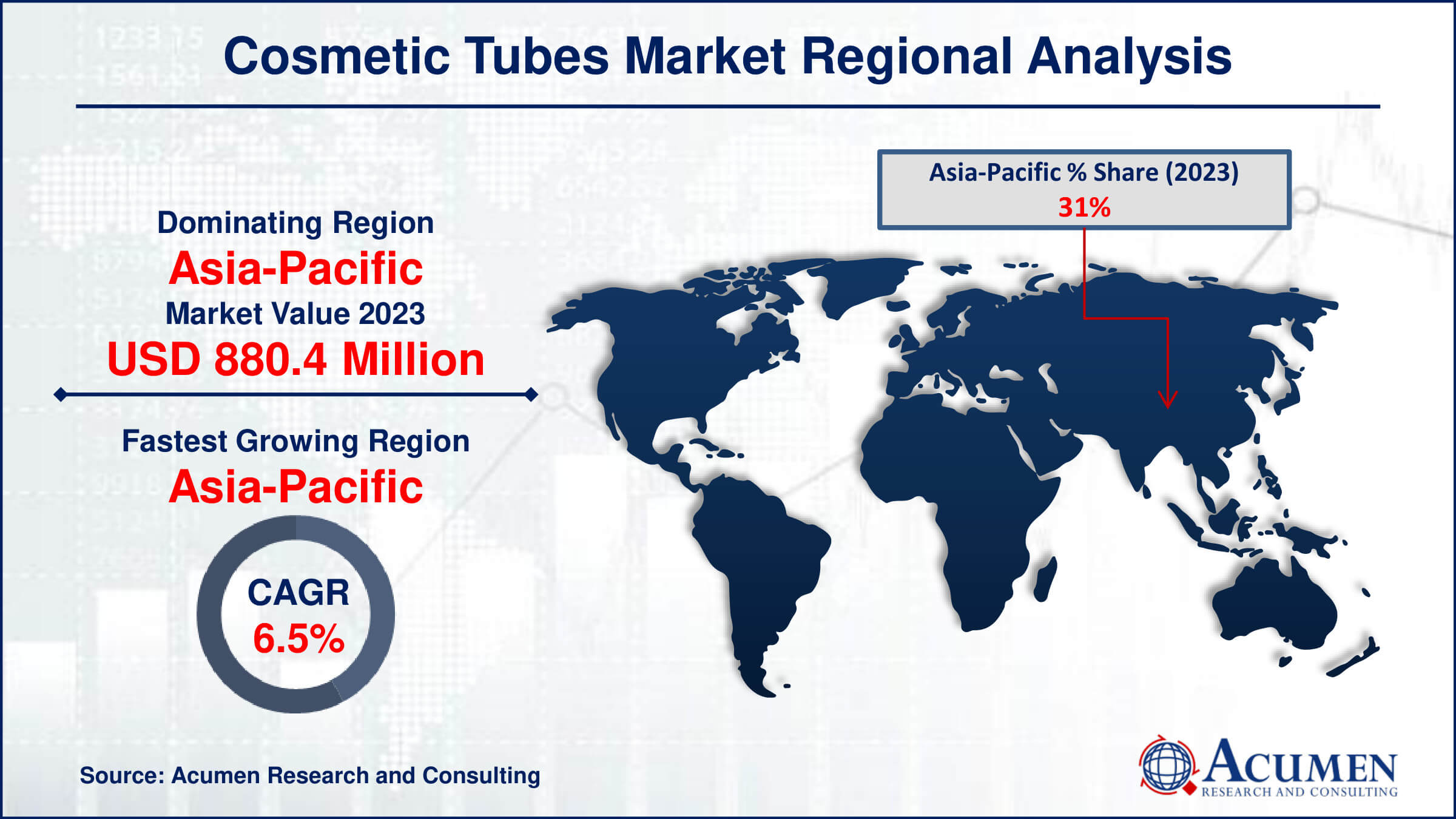

- Asia-Pacific cosmetic tubes market value occupied around USD 880.4 million in 2023

- Asia-Pacific cosmetic tubes market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among material, the plastics sub-segment generated significant revenue in 2023

- Based on capacity, the below 50 ml sub-segment generated around 48% market share in 2023

- Collaborations and partnerships with cosmetic brands to create exclusive packaging designs is a popular cosmetic tubes market trend that fuels the industry demand

Cosmetic tubes are widely utilized as a creative and practical packaging solution for cosmetic products. These tubes are specifically designed to contain, store, and dispense beauty items directly to consumers. As primary packaging, cosmetic tubes come into direct contact with the product, ensuring its safety and maintaining its quality. They are typically accompanied by secondary packaging, such as an outer box, which provides additional protection and serves as a medium for branding and marketing. The secondary packaging often includes printed labels that offer product information and promotional content, aiding in the introduction and support of new products to the market. This comprehensive packaging system not only enhances the preservation and storage of cosmetic products but also leverages the outer packaging for effective consumer communication and brand promotion.

Global Cosmetic Tubes Market Dynamics

Market Drivers

- Increasing demand for convenient and user-friendly packaging

- Growing consumer awareness about sustainable and eco-friendly packaging solutions

- Rising popularity of travel-sized cosmetic products

- Expanding global cosmetics industry driven by rising disposable incomes

Market Restraints

- High production costs associated with advanced packaging materials

- Stringent government regulations regarding cosmetic packaging materials

- Competition from alternative packaging solutions such as glass bottles and jars

Market Opportunities

- Development of innovative and biodegradable packaging materials

- Expansion into emerging markets with rising beauty product consumption

- Leveraging digital printing technology for customized and attractive packaging

Cosmetic Tubes Market Report Coverage

| Market | Cosmetic Tubes Market |

| Cosmetic Tubes Market Size 2022 | USD 2.8 Billion |

| Cosmetic Tubes Market Forecast 2032 |

USD 4.7 Billion |

| Cosmetic Tubes Market CAGR During 2023 - 2032 | 5.8% |

| Cosmetic Tubes Market Analysis Period | 2020 - 2032 |

| Cosmetic Tubes Market Base Year |

2022 |

| Cosmetic Tubes Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Material, By Capacity, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | CCL Industries Inc., Berry Global Group, Inc., Albéa Beauty Holdings S.A, Tubopress Italia Spa, Linhardt GmbH & Co KG, Essel Propack Ltd, Hoffmann Neopac Ag, Huhtamaki Oyj, Montebello Packaging Inc., and Intrapac International Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cosmetic Tubes Market Insights

The cosmetic industry relies heavily on the ability of cosmetic tubes to maintain product integrity by preserving moisture and preventing leakage. These tubes are favored for their cost-effectiveness, safety, and efficient distribution, making them superior to other packaging options for vendors, retailers, and producers. Industry leaders are constantly seeking more efficient and straightforward methods to meet consumer demand, offering personalized solutions through simple and compact packaging like cosmetic tubes. The outstanding barrier capabilities of cosmetic tubes, which prevent contents from contamination, are a primary driving force in their market growth. This is critical to ensuring the quality and safety of cosmetic goods. Furthermore, cosmetic tubes are perfect for visual merchandising on retail assembly lines, which increases product attractiveness and visibility in retailers. However, market expansion is not without hurdles. The necessity for powerful preservatives to assure product safety, as well as the tubes long service life, may limit market expansion.

Despite these challenges, various opportunities exist to fuel the future growth of the cosmetic tube market. One noteworthy trend is the growing demand for sustainable and environmentally friendly packaging. Companies are rapidly creating biodegradable and recyclable materials for cosmetic tubes to suit consumer demand for environmentally friendly products. Another intriguing possibility is the increased demand for travel-sized and sample-sized cosmetic items. As customers seek convenience and portability, demand for compact, portable packaging solutions such as cosmetic tubes is projected to rise. In addition, developments in digital printing technology allow manufacturers to produce unique and visually appealing packaging designs that entice customers. Personalized and one-of-a-kind designs can help brands stand out in a competitive market. In the end, collaborations and partnerships between package producers and cosmetic businesses create potential for inventive and unique packaging designs. These strategic relationships have the potential to result in the creation of one-of-a-kind packaging solutions tailored to individual brand identities and consumer preferences.

Cosmetic Tubes Market Segmentation

The worldwide market for cosmetic tubes is split based on type, material, capacity, application, and geography.

Cosmetic Tube Market By Type

- Squeeze Tubes

- Twist Tubes

- Rigid Tubes

- Others

According to cosmetic tubes industry analysis, squeeze tubes are predicted to be the most popular sector. This supremacy is attributable to a number of key variables. Squeeze tubes are convenient and easy to use, allowing customers to dispense the exact amount of product required with minimal waste. They are extremely versatile, appropriate for a wide range of cosmetic goods including lotions, creams, gels, and pastes. Squeeze tubes also provide excellent contamination prevention and product integrity, which is critical for maintaining the effectiveness and safety of cosmetic compositions. The option to build squeeze tubes in a variety of sizes and with beautiful packaging adds to their appeal, making them a popular choice among both manufacturers and consumers.

Cosmetic Tube Market By Material

- Metal

- Plastics

- Glass

- Laminated

Plastics are expected to be the largest segment in the ever-changing cosmetic tube industry. This estimate is based on their applicability to a variety of cosmetic compositions. Plastics provide a combination of durability, lightweight qualities, and cost-effectiveness, making them a popular choice among producers seeking to balance quality and affordability. Furthermore, plastics allow for sophisticated designs and customization choices, which boosts brand awareness and consumer appeal. Their interoperability with various closing methods emphasizes their usefulness in the cosmetic business. Furthermore, advances in plastic technology have resulted in the creation of environmentally friendly alternatives, which fit with the growing customer preference for sustainable packaging solutions. As a result, plastics are expected to dominate the cosmetic tube industry in the near future.

Cosmetic Tube Market By Capacity

- Below 50 ml

- 50 ml - 100 ml

- 100 ml - 150 ml

- 150 ml - 200 ml

- Above 200 ml

The cosmetic tubes market is projected to see the segment of less than 50 ml emerge as the largest. This projection is driven by consumer demand for compact, travel-friendly packaging that is convenient and portable. With the advent of on-the-go lifestyles and more travel, compact-sized cosmetic tubes are becoming increasingly popular among consumers looking for goods that are portable and can be used anytime, anywhere. Furthermore, lower capacity tubes are frequently connected with trial or sample-sized products, allowing customers to test new formulations before making bigger purchases. This trend toward lower capacities is consistent with the demand for products that meet individual needs while reducing waste.

Cosmetic Tube Market By Application

- Hair Care

- Skin Care

- Make-up

- Others

Skin care is likely to be the largest segment and it is expected to grow throughout the cosmetic tubes industry forecast period. This prognosis is supported by an increasing global emphasis on skincare routines and wellness habits. As consumers prioritize skincare as an essential part of their daily routine, there is a growing need for a varied selection of skincare products packaged in convenient and hygienic tubes. Skin care items include moisturizers, serums, facial cleansers, and sunscreen, all of which require effective packaging solutions. Furthermore, the diversity of tubes enables for the simple dispensing and application of a variety of skincare compositions, improving user experience and product effectiveness. This growing demand for skin care products is projected to fuel the segment's dominance in the cosmetic tubes market.

Cosmetic Tubes Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cosmetic Tubes Market Regional Analysis

In terms of cosmetic tubes market analysis, the Asia-Pacific region is anticipated to play a pivotal role in the globally. This prominence is largely due to the substantial customer bases in China and Japan, where demand for cosmetics is robust. Additionally, the region is home to numerous plastic producers, which significantly drives regional demand for cosmetic tubes. In developing countries such as India and China, the improvement in lifestyle and living standards further fuels market growth. Moreover, end-users in key regions of the Middle East and Africa, including South Africa and Saudi Arabia, are shifting from conventional to innovative packaging solutions, which are expected to boost demand in the Cosmetic Tubes Market forecast period. For example, a new aesthetic range of eco-friendly plastic tube packaging is set to be introduced for consumers in the Asia-Pacific region.

Furthermore, technological advancements in packaging and sustainability initiatives are gaining traction in the Asia-Pacific market. The focus on eco-friendly materials and innovative designs aligns with global sustainability trends and consumer preferences. The increasing penetration of e-commerce platforms also plays a crucial role in the market's expansion, as online retailing of cosmetic products grows rapidly in this region. Importantly, the Asia-Pacific region is not only the largest market but also the fastest-growing market for cosmetic tubes. Rapid urbanization, an expanding middle class, and increasing consumer awareness about beauty and skincare, driven by social media and influencer culture, are key factors contributing to this growth. Emerging markets in Southeast Asia, such as Vietnam, Indonesia, and the Philippines, are also experiencing significant growth due to rising economic stability and consumer spending power.

Cosmetic Tubes Market Players

Some of the top cosmetic tubes companies offered in our report includes CCL Industries Inc., Berry Global Group, Inc., Albéa Beauty Holdings S.A, Tubopress Italia Spa, Linhardt GmbH & Co KG, Essel Propack Ltd, Hoffmann Neopac Ag, Huhtamaki Oyj, Montebello Packaging Inc., and Intrapac International Corporation.

Frequently Asked Questions

How big is the cosmetic tubes market?

The cosmetic tubes market size was valued at USD 2.8 billion in 2023.

What is the CAGR of the global cosmetic tubes market from 2024 to 2032?

The CAGR of cosmetic tubes is 5.8% during the analysis period of 2024 to 2032.

Which are the key players in the cosmetic tubes market?

The key players operating in the global market are including CCL Industries Inc., Berry Global Group, Inc., Albéa Beauty Holdings S.A, Tubopress Italia Spa, Linhardt GmbH & Co KG, Essel Propack Ltd, Hoffmann Neopac Ag, Huhtamaki Oyj, Montebello Packaging Inc., and Intrapac International Corporation

Which region dominated the global cosmetic tubes market share?

Asia-Pacific held the dominating position in cosmetic tubes industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cosmetic tubes during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cosmetic tubes industry?

The current trends and dynamics in the cosmetic tubes industry include increasing demand for convenient and user-friendly packaging, growing consumer awareness about sustainable and eco-friendly packaging solutions, rising popularity of travel-sized cosmetic products, and expanding global cosmetics industry driven by rising disposable incomes.

Which application held the maximum share in 2023?

The skin care application the maximum share of the cosmetic tubes industry.