Cosmetic Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cosmetic Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

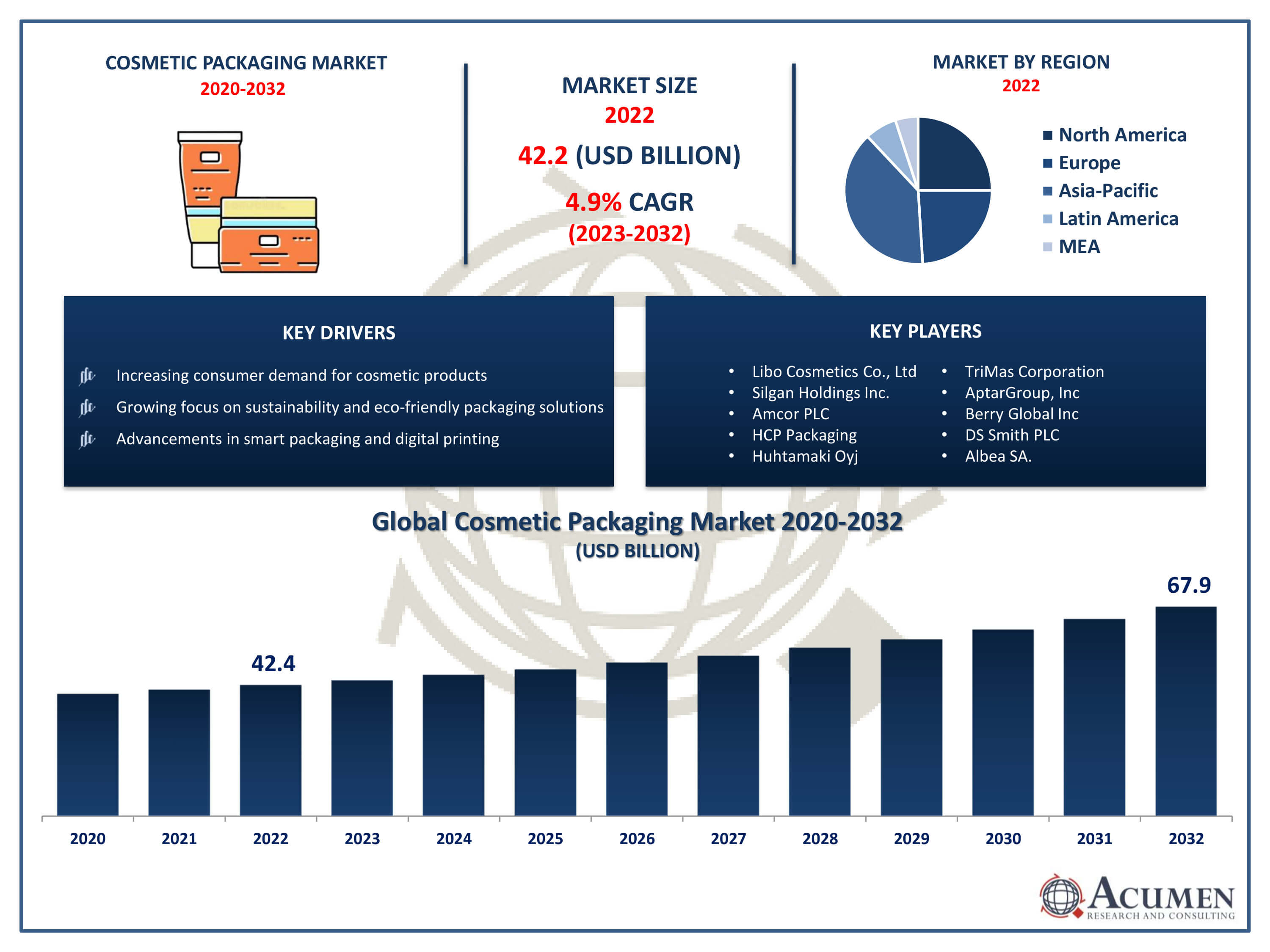

The Cosmetic Packaging Market Size accounted for USD 42.4 Billion in 2022 and is projected to achieve a market size of USD 67.9 Billion by 2032 growing at a CAGR of 4.9% from 2023 to 2032.

Cosmetic Packaging Market Highlights

- Global cosmetic packaging market revenue is expected to increase by USD 67.9 Billion by 2032, with a 4.9% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 42% of cosmetic packaging market share in 2022

- North America cosmetic packaging market growth will record a CAGR of more than 5.3% from 2023 to 2032

- By material type, the plastic segment captured more than 65% of revenue share in 2022.

- By cosmetic type, the skin care segment is projected to expand at the fastest CAGR over the projected period

- Increasing consumer demand for personalized and premium packaging experiences, drives the cosmetic packaging market value

Cosmetic packaging refers to the materials and designs used to contain and present cosmetic products such as skincare items, makeup, perfumes, and haircare products. It plays a crucial role in attracting consumers, protecting the product, and conveying brand identity. Cosmetic packaging encompasses a wide range of materials including glass, plastic, metal, and paperboard, as well as various techniques such as labeling, printing, and embossing to enhance aesthetics and functionality.

In recent years, the cosmetic packaging market has experienced significant growth, driven by factors such as increasing consumer demand for personal care products, rising disposable incomes, and changing lifestyles. Additionally, the emergence of new beauty trends and the growing emphasis on sustainability have led to innovations in packaging materials and designs. Manufacturers are increasingly focusing on eco-friendly and recyclable packaging solutions to meet consumer preferences and regulatory requirements, further propelling market expansion. Moreover, the rise of e-commerce has opened up new avenues for cosmetic packaging, as brands seek to create packaging that is both visually appealing and practical for online retail.

Global Cosmetic Packaging Market Trends

Market Drivers

- Increasing consumer demand for personalized and premium packaging experiences

- Growing focus on sustainability and eco-friendly packaging solutions

- Advancements in packaging technology, such as smart packaging and digital printing

- Expansion of the beauty industry into emerging markets

- Rise of e-commerce and the need for practical yet visually appealing packaging designs

Market Restraints

- Stringent regulations and standards regarding packaging materials and waste management

- Fluctuating raw material prices affecting production costs

Market Opportunities

- Innovation in sustainable packaging materials and designs

- Leveraging augmented reality and interactive packaging for enhanced consumer engagement

Cosmetic Packaging Market Report Coverage

| Market | Cosmetic Packaging Market |

| Cosmetic Packaging Market Size 2022 | USD 42.4 Billion |

| Cosmetic Packaging Market Forecast 2032 |

USD 67.9 Billion |

| Cosmetic Packaging Market CAGR During 2023 - 2032 | 4.9% |

| Cosmetic Packaging Market Analysis Period | 2020 - 2032 |

| Cosmetic Packaging Market Base Year |

2022 |

| Cosmetic Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material Type, By Product Type, By Cosmetic Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Libo Cosmetics Co., Ltd, Silgan Holdings Inc., Amcor PLC, World Wide Packaging LLC, Sonoco, HCP Packaging, Huhtamaki Oyj, TriMas Corporation, AptarGroup, Inc, Berry Global Inc, DS Smith PLC, and Albea SA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cosmetic packaging encompasses a wide array of materials, including plastics, glass, metals, and paperboard, as well as an assortment of techniques such as labeling, printing, embossing, and specialized closures, all aimed at ensuring product attractiveness, functionality, and protection. The applications of cosmetic packaging are diverse and multifaceted, reflecting the vast range of products within the beauty industry. Firstly, cosmetic packaging serves as a means of product preservation, shielding delicate formulations from external factors such as light, air, and moisture, which can compromise their efficacy and shelf life. Additionally, cosmetic packaging acts as a vehicle for branding and marketing, with designs, colors, and typography conveying the brand's identity, values, and product positioning. Moreover, cosmetic packaging plays a vital role in facilitating product usage and convenience, with features such as pumps, sprays, and applicators designed to ensure ease of application and dosage control for consumers.

The cosmetic packaging market has witnessed steady growth in recent years, driven by various factors including increasing consumer spending on beauty products, rising demand for innovative and sustainable packaging solutions, and the expansion of e-commerce channels. With consumers becoming more conscious of the aesthetics and functionality of cosmetic packaging, manufacturers are focusing on delivering visually appealing designs while also prioritizing sustainability. This has led to a surge in the adoption of eco-friendly materials and packaging formats that minimize environmental impact, such as recyclable plastics, biodegradable materials, and refillable containers. Furthermore, the proliferation of digital technologies has opened up new opportunities for cosmetic packaging innovation. Brands are leveraging augmented reality (AR) and virtual reality (VR) technologies to create immersive packaging experiences, allowing consumers to interact with products virtually before making a purchase.

Cosmetic Packaging Market Segmentation

The global cosmetic packaging market segmentation is based on material type, product type, cosmetic type, and geography.

Cosmetic Packaging Market By Material Type

- Plastic

- Metal

- Glass

- Paper

According to the cosmetic packaging industry analysis, the plastic segment accounted for the largest market share in 2022. Plastic packaging offers a wide range of options in terms of shapes, sizes, and designs, making it highly attractive for cosmetic brands seeking to differentiate their products on the shelves. Additionally, advancements in plastic manufacturing technologies have enabled the development of innovative packaging solutions such as airless pumps, squeezable tubes, and lightweight bottles, which enhance user convenience and product efficacy. Moreover, the plastic segment has benefited from the expansion of e-commerce channels in the beauty industry. Plastic packaging is well-suited for online retail due to its lightweight nature, durability during shipping, and ability to protect products from damage. As consumers increasingly turn to online platforms for their beauty purchases, cosmetic brands are investing in plastic packaging solutions that are not only visually appealing but also practical for digital sales channels.

Cosmetic Packaging Market By Product Type

- Plastic Bottles and Containers

- Metal Containers

- Glass Bottles and Containers

- Caps and Closures

- Folding Cartons

- Tubes and Sticks

- Corrugated Boxes

- Others

In terms of product types, the plastic bottles and containers segment is expected to witness significant growth in the coming years. This growth is owing to its widespread use across various cosmetic product categories such as skincare, haircare, and personal care. Plastic bottles and containers offer several advantages, including lightweight construction, durability, and versatility in design. These attributes make them particularly well-suited for packaging a wide range of cosmetic formulations, from lotions and serums to shampoos and body washes. As consumer preferences continue to evolve, cosmetic brands are increasingly turning to plastic bottles and containers to meet the demand for convenient and user-friendly packaging solutions. Additionally, the rise of e-commerce has further fueled the growth of plastic bottles and containers segment. Plastic packaging is highly suitable for online retail due to its robustness during shipping and its ability to protect products from damage.

Cosmetic Packaging Market By Cosmetic Type

- Hair Care

- Skin Care

- Color Cosmetics

- Deodorants

- Men's Grooming

- Other

According to the cosmetic packaging market forecast, the skin care segment is expected to witness significant growth in the coming years. This trend has led to a surge in demand for skincare products ranging from moisturizers and serums to facial masks and sunscreens, thereby driving the need for innovative and attractive packaging solutions. Cosmetic brands are responding to this demand by investing in packaging that not only protects the integrity of skincare formulations but also enhances the overall user experience. Moreover, the skincare segment is witnessing a shift towards premiumization, with consumers willing to spend more on high-quality skincare products that offer visible results. This trend is driving the demand for luxurious and aesthetically pleasing packaging designs that convey a sense of sophistication and exclusivity. Packaging materials such as glass, acrylic, and high-quality plastics are being favored for skincare products to communicate prestige and enhance the perceived value of the product.

Cosmetic Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cosmetic Packaging Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the cosmetic packaging market, primarily due to its vast consumer base, thriving beauty industry, and rapid economic growth. With a burgeoning middle class and increasing disposable incomes, consumers in countries such as China, India, South Korea, and Japan are driving significant demand for cosmetics and personal care products. This robust demand has propelled the growth of the cosmetic packaging market in the region, as manufacturers strive to meet the diverse needs and preferences of Asian consumers. Moreover, Asia-Pacific is home to some of the world's leading cosmetic brands and manufacturers, particularly in countries like South Korea and Japan, known for their innovative skincare and beauty products. These brands often prioritize packaging aesthetics and functionality, driving demand for premium and custom-designed packaging solutions. Additionally, the region's manufacturing prowess and technological advancements have enabled the production of high-quality packaging materials and designs at competitive prices, further fueling market growth. Furthermore, the rise of e-commerce in Asia-Pacific has created new opportunities for cosmetic packaging, with brands investing in visually appealing and practical packaging formats suitable for online retail channels.

Cosmetic Packaging Market Player

Some of the top cosmetic packaging market companies offered in the professional report include Libo Cosmetics Co., Ltd, Silgan Holdings Inc., Amcor PLC, World Wide Packaging LLC, Sonoco, HCP Packaging,Huhtamaki Oyj, TriMas Corporation, AptarGroup, Inc, Berry Global Inc, DS Smith PLC, and Albea SA.

Frequently Asked Questions

How big is the cosmetic packaging market?

The cosmetic packaging market size was USD 42.4 Billion in 2022.

What is the CAGR of the global cosmetic packaging market from 2023 to 2032?

The CAGR of cosmetic packaging is 4.9% during the analysis period of 2023 to 2032.

Which are the key players in the cosmetic packaging market?

The key players operating in the global market are including Libo Cosmetics Co., Ltd, Silgan Holdings Inc., Amcor PLC, World Wide Packaging LLC, Sonoco, HCP Packaging, Huhtamaki Oyj, TriMas Corporation, AptarGroup, Inc, Berry Global Inc, DS Smith PLC, and Albea SA.

Which region dominated the global cosmetic packaging market share?

Asia-Pacific held the dominating position in cosmetic packaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cosmetic packaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cosmetic packaging industry?

The current trends and dynamics in the cosmetic packaging industry include increasing consumer demand for personalized and premium packaging experiences, growing focus on sustainability and eco-friendly packaging solutions, and advancements in packaging technology, such as smart packaging and digital printing.

Which product type held the maximum share in 2022?

The plastic bottles and containers product type held the maximum share of the cosmetic packaging industry.