Coronary Stents Market | Acumen Research and Consulting

Coronary Stents Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

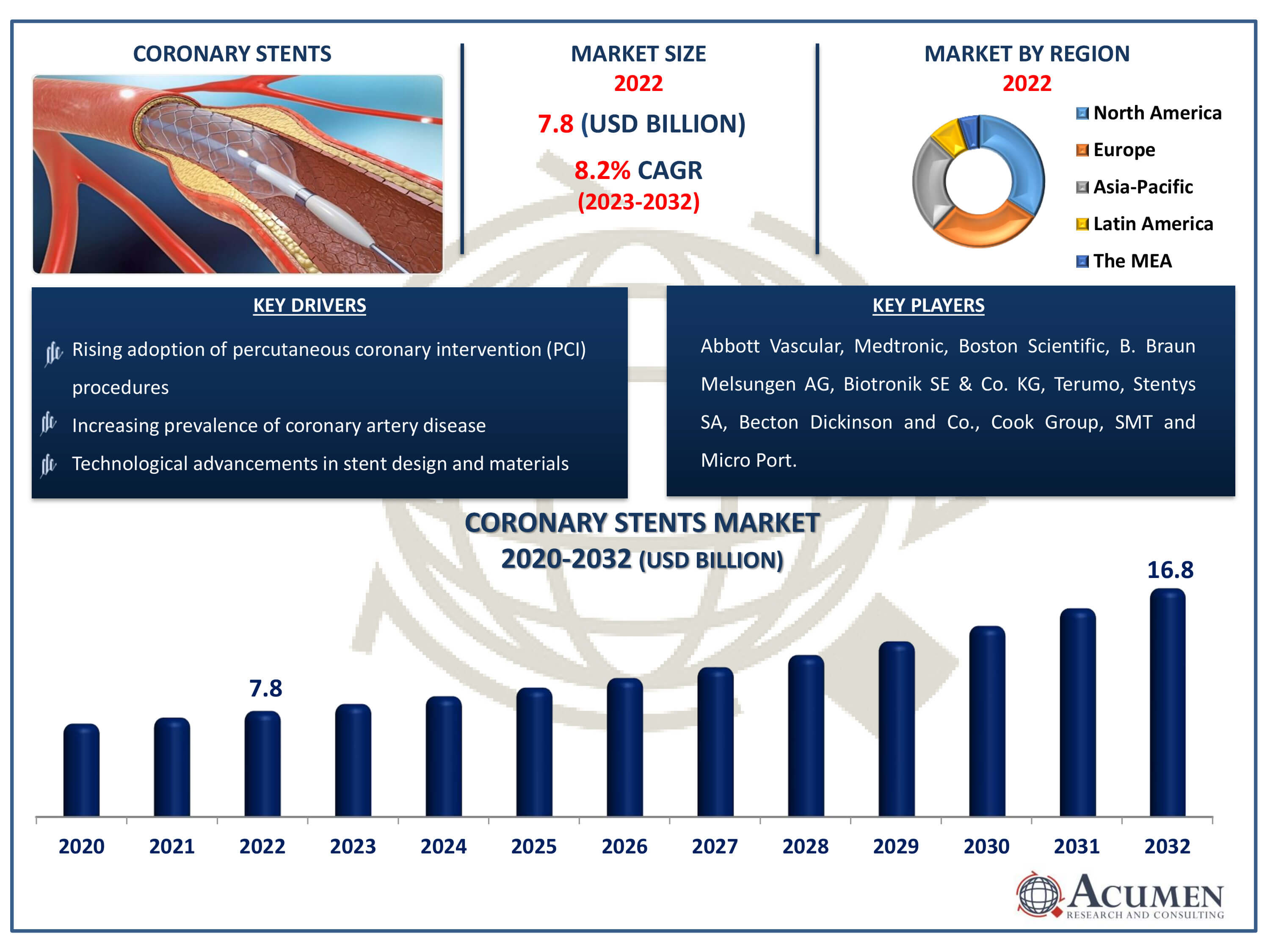

The Coronary Stents Market Size accounted for USD 7.8 Billion in 2022 and is estimated to achieve a market size of USD 16.8 Billion by 2032 growing at a CAGR of 8.2% from 2023 to 2032.

Coronary Stents Market Highlights

- Global coronary stents market revenue is poised to garner USD 16.8 billion by 2032 with a CAGR of 8.2% from 2023 to 2032

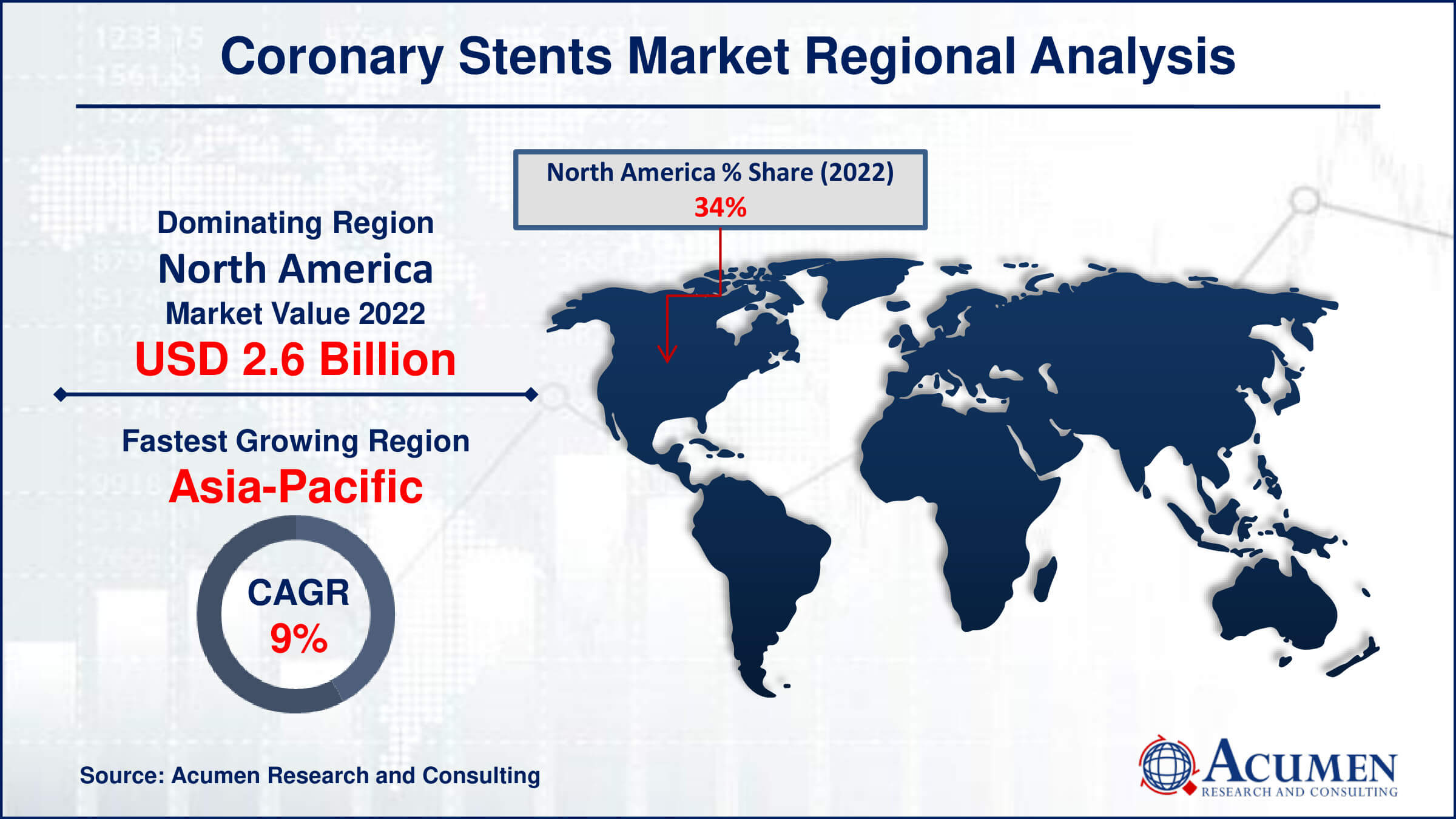

- North America coronary stents market value occupied around USD 2.6 billion in 2022

- Asia-Pacific coronary stents market growth will record a CAGR of more than 9% from 2023 to 2032

- Among type, the drug eluting stent sub-segment generated over US$ 5.2 billion revenue in 2022

- Based on biomaterial, the metallic biomaterials sub-segment generated noteworthy share in 2022

- Increasing focus on personalized medicine and precision therapies is a popular coronary stents market trend that fuels the industry demand

A stent is a small, elastic tube-like mesh made from materials such as cobalt alloy or stainless steel. During stent implantation, a small balloon is used to open the stent inside the artery, providing support to the vessel wall and restoring blood flow. Stenting does not involve major incisions compared to coronary artery bypass surgery, making patients more comfortable with this procedure and driving the market for coronary stents. Coronary stents are used in a procedure called percutaneous coronary intervention (PCI), which accounts for more than 90% of PCI procedures, according to recent studies. Stents are primarily used to reduce angina (chest pain) and have been shown to improve durability and decrease adverse events in acute myocardial infarction. Treatment for coronary heart disease includes balloon angioplasty, pharmaceuticals, and coronary artery bypass grafting (CABG). Coronary stents also pose lower complications and health risks to patients post-surgery and have shown better recovery outcomes compared to coronary bypass surgery.

Global Coronary Stents Market Dynamics

Market Drivers

- Increasing prevalence of coronary artery disease

- Technological advancements in stent design and materials

- Growing preference for minimally invasive procedures

- Rising adoption of percutaneous coronary intervention (PCI) procedures

Market Restraints

- Risk of stent thrombosis and restenosis

- High cost associated with stent placement procedures

- Regulatory challenges and stringent approval processes

Market Opportunities

- Expanding application of drug-eluting stents (DES) in complex lesions

- Emerging markets offering untapped growth opportunities

- Development of bioresorbable stents for enhanced patient outcomes

Coronary Stents Market Report Coverage

| Market | Coronary Stents Market |

| Coronary Stents Market Size 2022 | USD 7.8 Billion |

| Coronary Stents Market Forecast 2032 | USD 16.8 Billion |

| Coronary Stents Market CAGR During 2023 - 2032 | 8.2% |

| Coronary Stents Market Analysis Period | 2020 - 2032 |

| Coronary Stents Market Base Year |

2022 |

| Coronary Stents Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Biomaterial, By Mode of Delivery, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott Vascular, Medtronic, Boston Scientific, B. Braun Melsungen AG, Biotronik SE & Co. KG, Terumo, Stentys SA, Becton Dickinson and Co., Cook Group, SMT, and Micro Port. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Coronary Stents Market Insights

The alarming rise in the prevalence of cardiovascular diseases globally is a key factor driving the growth of the coronary stents market. According to the American Heart Association (AHA), cardiovascular diseases claim more lives each year than cancer and chronic lower respiratory diseases combined. Coronary heart disease ranks as the leading cause of mortality in the U.S., followed by stroke, heart failure, hypertension, and other diseases. Other factors driving the market include developing health infrastructure, lifestyle diseases, an increasing geriatric population, a profound increase in healthcare spending and coverage, the subsequent growth in the number of percutaneous coronary intervention (PCI) procedures, advancements in medical technologies and procedures, a full-fledged demographic shift toward an aging society, and the development of information and communication technologies (ICT). Growing government funding and investment in research and development for efficient and effective stents will boost the demand for coronary stents during the forecast period. Favorable reimbursement policies have been shown to increase the adoption of coronary stents in countries such as the U.S., Canada, India, and the U.K. For instance, the government in India subsidized the prices of drug-eluting and bare metal stents to drive their adoption in the country.

However, there are a few complications post-implementation of stents, such as blood clots and infections at the stent sites. Blood clots and blockages are the most common, which can be prevented by medications such as aspirin and anti-platelets. Thus, there is a constant need for novel and innovative advancements in the market. Some areas of improvement include the accuracy of the stents, enhancement in workflow and procedures, and reduction in errors. The development of biodegradable polymer stents, bioresorbable stents, scaffolds, and the facilitation of minimally invasive procedures are trends that will drive the market for coronary stents during the coronary stents industry forecast period.

Coronary Stents Market Segmentation

The worldwide market for coronary stents is split based on type, biomaterial, mode of delivery, end user, and geography.

Coronary Stent Types

- Bare Metal Stents

- Drug Eluting Stent

- Biodegradable

- Non-Biodegradable

- Bio-Absorbable Stent

According to coronary stents industry analysis, among all types, both bare metal and drug-eluting stents (DES) are extensively adopted by patients and preferred by healthcare practitioners. Currently, drug-eluting stents hold the largest share in the global coronary stents market, as they are considered the gold standard treatment and are expected to continue exhibiting strong growth during the forecast period. Drug-eluting stents hold 80% of the market and are promoted by many healthcare professionals due to their efficacy and benefits over other procedures. Moreover, with technological progress, these stents have improved and shown additional reductions in stent thrombosis. Using DES in stenting offers improved outcomes for patients with coronary artery disease (CAD) treated with percutaneous coronary intervention (PCI). Bio-absorbable stents are projected to grow at an exponential rate during the forecast period. Bio-absorbable or bioresorbable stents were introduced as an alternative due to growing concerns about the presence of stents for a lifetime or until surgically removed. New product approvals and their benefits will surge the demand for these stents in the global coronary stents market.

Coronary Stent Biomaterials

- Metallic Biomaterials

- Polymers Biomaterials

- Natural Biomaterials

Metallic biomaterials constitute the largest sector in the coronary stent market. Cobalt-chromium and stainless steel are two examples of metallic biomaterials that are frequently used in the production of coronary stents because of their superior mechanical qualities and extensive durability. With their exceptional strength and flexibility, these materials give the blood vessel walls the best support possible while preserving the integrity of the stent. In addition, medical professionals favour metallic stents due to their dependability and effectiveness in treating coronary artery disease, as well as their demonstrated track record of clinical success. Therefore, the market for coronary stents is dominated by the metallic biomaterial category.

Coronary Stent Mode of Deliveries

- Self Expandable Stent

- Balloon Expandable Stent

The balloon-expandable stent category expected to holds the highest share in the coronary stent market. Because of their precise deployment capabilities and adaptability, balloon-expandable stents are commonly used. A balloon catheter is used to deliver these stents to the intended location, where they are expanded and fixed firmly inside the coronary artery. Stents that are balloon-expandable provide consistent and regulated expansion, which promotes ideal vascular scaffolding and reduces the possibility of stent malapposition. Because of their dependability and efficiency in treating coronary artery disease, balloon-expandable stents are the most favoured type of coronary stents among medical professionals.

Coronary Stents End User

- Hospitals

- Ambulatory Surgical Centers

- Other

Hospitals are the biggest end-user group in the coronary stent industry. Hospitals are the main healthcare facilities that are furnished with specialised equipment and highly qualified medical staff to carry out intricate operations, such as the placement of coronary stents. Many patients in need of cardiac procedures are drawn to hospitals due to their extensive array of services and resources. Hospitals further solidify their position as major users of coronary stents by accepting patients from a variety of healthcare settings through their well-established referral networks. In addition, hospitals guarantee the best possible outcomes for their patients by offering post-procedural care and ongoing monitoring. Hospitals make up the largest section of the coronary stents market due to their widespread use in the healthcare system and versatility in treating a variety of medical ailments.

Coronary Stents Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Coronary Stents Market Regional Analysis

The market experienced high demand in the North American region in 2022 and is anticipated to dominate the market during the coronary stents market forecasted period. According to the Stroke Association, approximately 1 million Americans are affected by strokes each year. Solely in the U.S., the financial burden of strokes is valued at $34 billion annually, including expenditures on healthcare services, prescriptions, and reduced productivity. The American Stroke Association (ASA) has made great efforts to transform existing healthcare systems and support patients worldwide by collaborating with other countries, governments, and international cardiac societies. Countries in this region have well-established healthcare systems, well-planned compensation programs, and a rise in population numbers, all of which contribute significantly to the global coronary stent market. The latest developments in bio-absorbable stents and the growing popularity of new trends have been observed in this region.

In terms of coronary stents market analysis, Asia-Pacific is the second largest and fastest growing region compared to others. China, with its large population, leads the Asia-Pacific market for coronary stents. Stroke is one of the leading causes of death in China, claiming 1.6 million lives annually. China experiences similar stroke risk factors as Western nations. Furthermore, China has identified specific geographic areas where the mortality associated with stroke is 50% higher than other regions in the country. Additionally, growing healthcare infrastructure and target populations in countries like India, Japan, and Indonesia will further drive the market. The growing medical tourism industry in the region will also generate demand for coronary stents. In China and India, the coronary stents market is increasing due to economic developments and government initiatives. For example, the comprehensive tax system and Goods and Services Tax (GST) in India prevent the cascading effect of taxes, benefiting both consumers and manufacturers by reducing taxes.

Coronary Stents Market Players

Some of the top coronary stents companies offered in our report includes Abbott Vascular, Medtronic, Boston Scientific, B. Braun Melsungen AG, Biotronik SE & Co. KG, Terumo, Stentys SA, Becton Dickinson and Co., Cook Group, SMT, and Micro Port.

Frequently Asked Questions

How big is the coronary stents market?

The coronary stents market size was valued at USD 7.8 billion in 2022.

What is the CAGR of the global coronary stents market from 2023 to 2032?

The CAGR of coronary stents is 8.2% during the analysis period of 2023 to 2032.

Which are the key players in the coronary stents market?

The key players operating in the global market are including Abbott Vascular, Medtronic, Boston Scientific, B. Braun Melsungen AG, Biotronik SE & Co. KG, Terumo, Stentys SA, Becton Dickinson and Co., Cook Group, SMT and Micro Port.

Which region dominated the global coronary stents market share?

North America held the dominating position in coronary stents industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of coronary stents during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global coronary stents industry?

The current trends and dynamics in the coronary stents industry include increasing prevalence of coronary artery disease, technological advancements in stent design and materials, growing preference for minimally invasive procedures, and rising adoption of percutaneous coronary intervention (PCI) procedures.

Which type held the maximum share in 2022?

The drug eluting stent type held the maximum share of the coronary stents industry.