Stainless Steel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Stainless Steel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

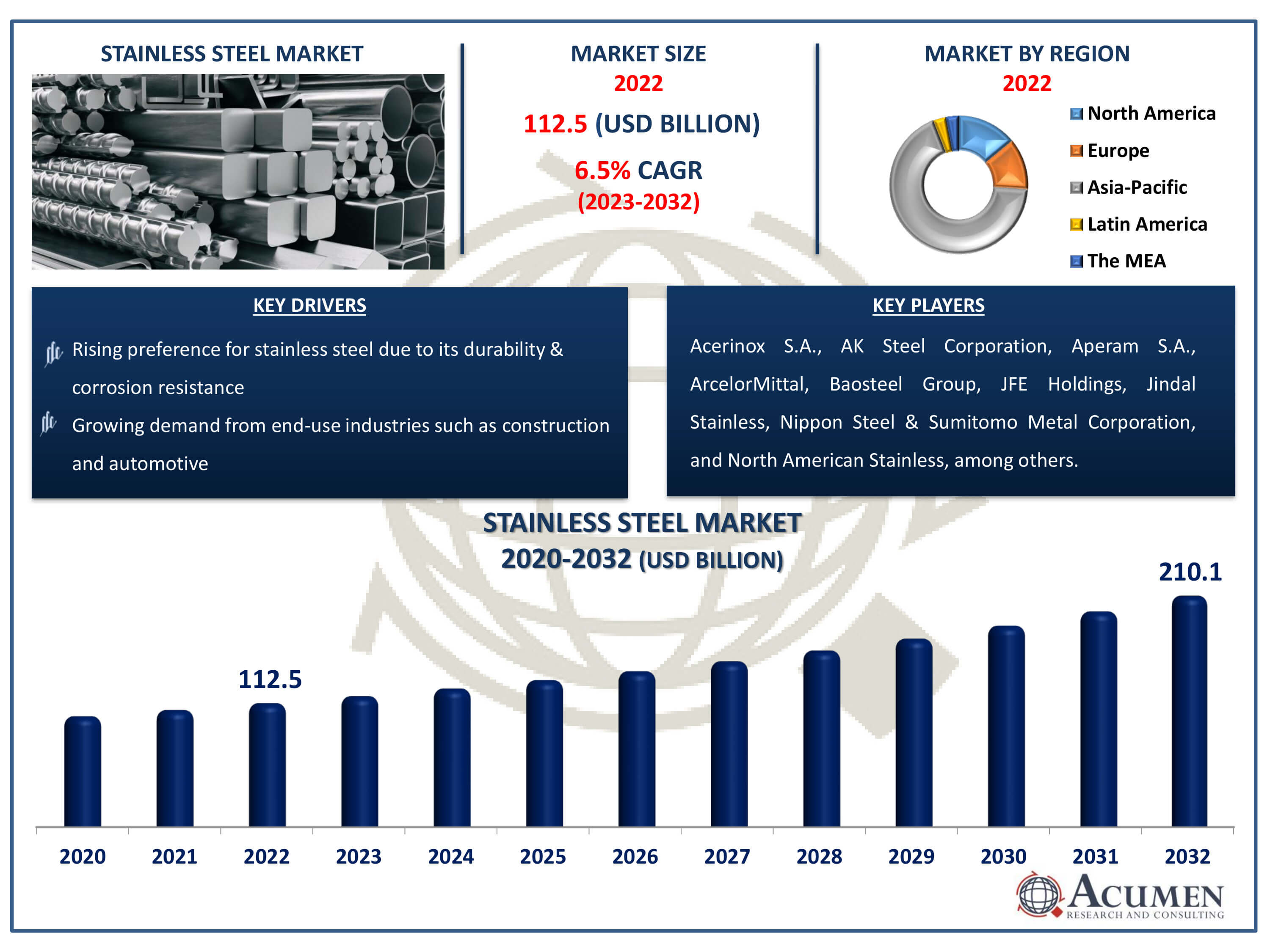

The Stainless Steel Market Size accounted for USD 112.5 Billion in 2022 and is estimated to achieve a market size of USD 210.1 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Stainless Steel Market Highlights

- Global stainless steel market revenue is poised to garner USD 210.1 billion by 2032 with a CAGR of 6.5% from 2023 to 2032

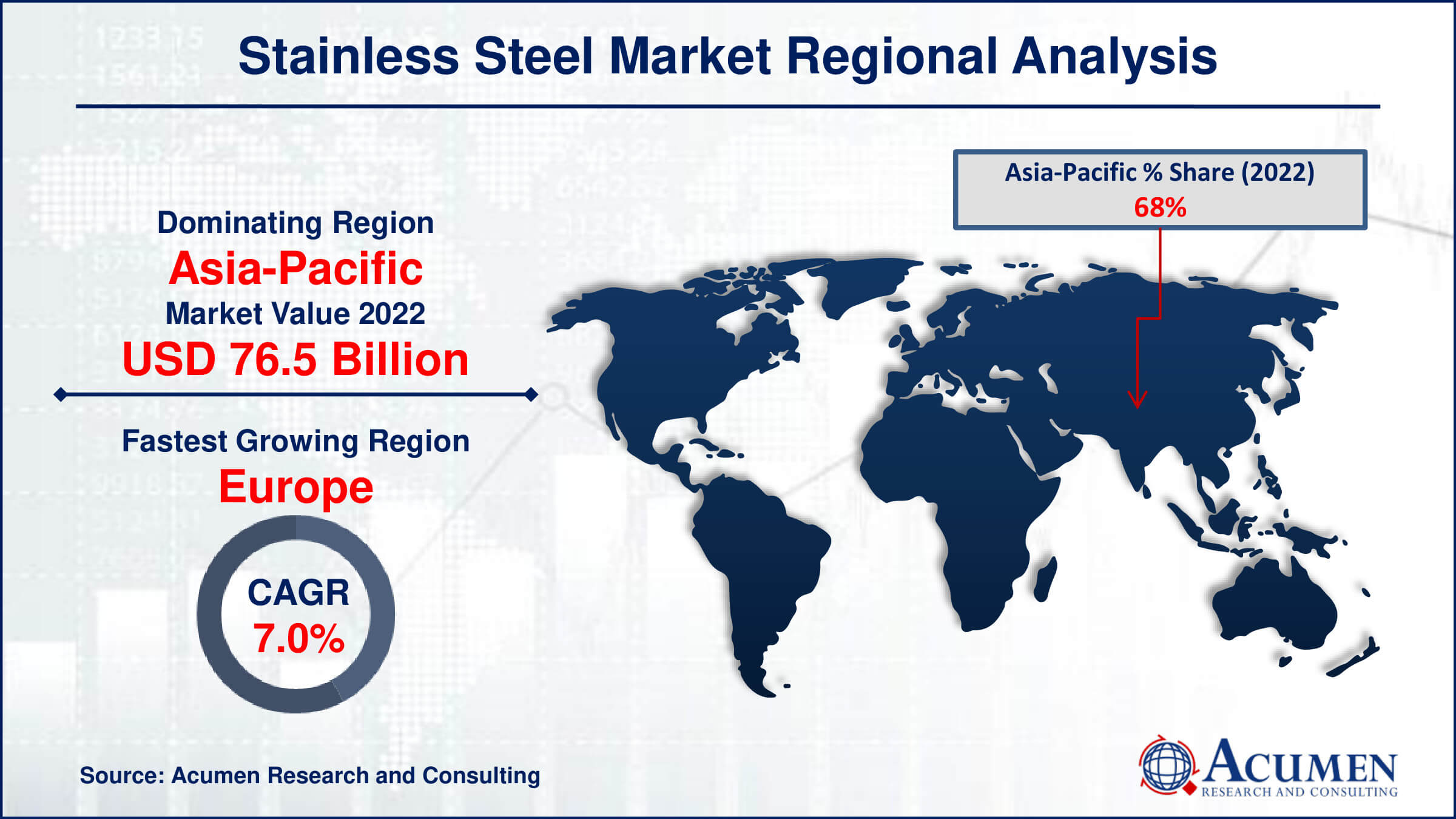

- Asia-Pacific stainless steel market value occupied around USD 76.5 billion in 2022

- Europe stainless steel market growth will record a CAGR of more than 7% from 2023 to 2032

- Among product, the flat sub-segment generated more than USD 81 billion revenue in 2022

- Based on application, the consumer goods sub-segment generated around 36% market share in 2022

- Growing focus on stainless steel in emerging economies with increasing industrialization and urbanization is a popular stainless steel market trend that fuels the industry demand

Stainless steel is a corrosion-resistant alloy composed of iron, chromium, and sometimes nickel, along with other metals. It is infinitely recyclable, making it a "green material" with an environmentally neutral and inert nature. Its longevity ensures it meets the needs of sustainable construction, boasting a recovery rate of close to 100%. In addition to its eco-friendly benefits, stainless steel is aesthetically appealing, highly hygienic, easy to maintain, and exceptionally durable, among other advantages. Typically, stainless steel composition includes at least 10.5% chromium, up to 1.2% carbon, and various alloying elements. Furthermore, corrosion resistance and mechanical properties can be further enhanced by incorporating elements such as nickel, molybdenum, titanium, niobium, and manganese, among others. Upon contact with oxygen, a chromium oxide layer forms on the material's surface, creating a passive layer that uniquely protects and repairs itself.

Global Stainless Steel Market Dynamics

Market Drivers

- Growing demand from end-use industries such as construction and automotive

- Increasing emphasis on sustainability and recyclability

- Advancements in stainless steel manufacturing technologies

- Rising preference for stainless steel due to its durability and corrosion resistance

Market Restraints

- Fluctuating raw material prices impacting profit margins

- Intense competition from alternative materials like aluminum and carbon steel

- Challenges associated with stainless steel production costs and energy consumption

Market Opportunities

- Expanding applications in emerging sectors like healthcare and aerospace

- Adoption of stainless steel in infrastructure development projects worldwide

- Technological innovations leading to the development of high-performance stainless steel grades

Stainless Steel Market Report Coverage

| Market | Stainless Steel Market |

| Stainless Steel Market Size 2022 | USD 112.5 Billion |

| Stainless Steel Market Forecast 2032 | USD 210.1 Billion |

| Stainless Steel Market CAGR During 2023 - 2032 | 6.5% |

| Stainless Steel Market Analysis Period | 2020 - 2032 |

| Stainless Steel Market Base Year |

2022 |

| Stainless Steel Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Grade, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Acerinox S.A., AK Steel Corporation, Aperam S.A., ArcelorMittal, Baosteel Group, JFE Holdings, Jindal Stainless, Nippon Steel & Sumitomo Metal Corporation, North American Stainless, Outokumpu Oyj, POSCO, ThyssenKrupp Stainless GmbH, and Yieh United Steel Corp. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Stainless Steel Market Insights

The properties associated with stainless steel, such as low maintenance, ease of fabrication, and aesthetic appeal, are driving the segmental market value. The growing usage of stainless steel in pre-engineered buildings for roofing and building systems, along with the increasing preference for sustainable construction, is supporting market growth. Its high-temperature resistance, ease of maintenance, and wide range of applications in industries such as automotive, aerospace, and construction are contributing to its expanding usage globally. The rising demand from various applications such as gas turbine exhaust silencers, agricultural equipment, heat exchangers, hardware, and motor shafts is accelerating market value. Furthermore, the increasing demand for stainless steel in the medical industry for instruments like kidney dishes, surgical and dental instruments, and medical equipment, including steam sterilizers, MRI scanners, and cannulas, is anticipated to drive growth over the stainless steel industry forecast period from 2023 to 2032.

The market expansion for stainless steel is severely hampered by the price instability of raw materials. The creation of stainless steel is dependent on a number of raw resources, such as nickel, chromium, and iron ore, among other alloying components. Price fluctuations for these inputs have a direct bearing on market pricing strategies, profitability, and manufacturing costs. Stainless steel producers may find it challenging to maintain competitive prices or steady profit margins when raw material costs rise or become erratic. Supply networks may be disrupted by this uncertainty, delaying delivery and manufacturing. These difficulties could therefore prevent funding for stainless steel initiatives and restrict prospects for market growth. In order to guarantee the stability and sustainability of stainless steel production, industry stakeholders must carefully monitor the raw material markets, put into practice efficient risk management measures, and investigate alternative sourcing options.

Stainless Steel Market Segmentation

The worldwide market for stainless steel is split based on grade, product application, and geography.

Stainless Steel Grades

- 200 Series

- 300 Series

- 400 Series

- Duplex Series

- Others

According to stainless steel industry analysis, the 300 series section is the largest category in the market. This series, which is highly sought after in a variety of industries, is distinguished by its chromium-nickel composition and offers great corrosion resistance and adaptability. Popular grades like 304 and 316, which are widely utilised in industries including automotive, food processing, and pharmaceuticals, are part of the 300 Series. Its broad use is facilitated by its exceptional qualities, which include ease of production, durability, and aesthetic appeal. Additionally, the 300 Series stainless steel is widely used in demanding applications that call for strong corrosion resistance and sanitary qualities, further confirming its market dominance and fueling ongoing demand growth.

Stainless Steel Products

- Flat

- Long

The flat product category has the biggest market share in stainless steel. Products made of flat stainless steel, such as sheets, plates, coils, and strips, are widely used in a variety of sectors, including consumer goods, automotive, aerospace, and construction. The versatility of these items, which are easily moulded, cut, and fabricated into various shapes and sizes to satisfy a variety of requirements, can be credited to their supremacy in the flat segment. Furthermore, flat stainless steel products are perfect for structural and decorative applications due to their outstanding surface polish, durability, and resistance to corrosion. The market is expanding due to the increasing need for flat stainless steel goods in architectural designs, machinery manufacture, and infrastructure projects. This further solidifies the market's leadership in the stainless steel sector.

Stainless Steel Applications

- Building & Construction

- Automotive & Transportation

- Consumer Goods

- Mechanical Engineering & Heavy Industries

- Electronic Appliances

- Food Manufacturing

- Others

Owing to its numerous uses in a variety of products, including cookware, cutlery, appliances, and furnishings, the consumer goods segment holds a dominant position in the stainless steel market. For the production of consumer goods, stainless steel is widely sought-after because to its resistance to corrosion, strength, and visual appeal. In kitchenware and food preparation equipment, its sanitary qualities are highly appreciated. Furthermore, because of its adaptability, stainless steel may be customized and designed in creative ways to suit a wide range of customer demands and tastes. Consumer goods continue to be a major factor driving the growth of the stainless steel market as consumers' demand for long-lasting, high-quality products grows.

Stainless Steel Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Stainless Steel Market Regional Analysis

Asia-Pacific currently dominates the industry, boasting the highest revenue share. This trend is expected to persist throughout the stainless steel market forecast period from 2023 to 2032. Notably, China, as the leading developing economy in the region, holds significant dominance in the regional stainless steel market, contributing the maximum revenue share. Following Asia Pacific, Europe emerges as the next significant market for stainless steel. In the automotive sector, particularly, environmental concerns and stringent emission reduction standards are driving regional original equipment manufacturers (OEMs) to increase the utilization of stainless steel in structural components. This shift towards stainless steel underscores the industry's commitment to sustainability and aligns with global efforts to reduce carbon emissions in the transportation sector.

Stainless Steel Market Players

Some of the top stainless steel companies offered in our report includes Acerinox S.A., AK Steel Corporation, Aperam S.A., ArcelorMittal, Baosteel Group, JFE Holdings, Jindal Stainless, Nippon Steel & Sumitomo Metal Corporation, North American Stainless, Outokumpu Oyj, POSCO, ThyssenKrupp Stainless GmbH, and Yieh United Steel Corp.

Frequently Asked Questions

How big is the stainless steel market?

The stainless steel market size was valued at USD 112.5 billion in 2022.

What is the CAGR of the global stainless steel market from 2023 to 2032?

The CAGR of stainless steel is 6.5% during the analysis period of 2023 to 2032.

Which are the key players in the stainless steel market?

The key players operating in the global market are including Acerinox S.A., AK Steel Corporation, Aperam S.A., ArcelorMittal, Baosteel Group, JFE Holdings, Jindal Stainless, Nippon Steel & Sumitomo Metal Corporation, North American Stainless, Outokumpu Oyj, POSCO, ThyssenKrupp Stainless GmbH, and Yieh United Steel Corp.

Which region dominated the global stainless steel market share?

Asia-Pacific held the dominating position in stainless steel industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of stainless steel during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global stainless steel industry?

The current trends and dynamics in the stainless steel industry include growing demand from end-use industries such as construction and automotive, increasing emphasis on sustainability and recyclability, advancements in stainless steel manufacturing technologies, and rising preference for stainless steel due to its durability & corrosion resistance.

Which product held the maximum share in 2022?

The flat product held the maximum share of the stainless steel industry.