Construction Equipment Rental Market | Acumen Research and Consulting

Construction Equipment Rental Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

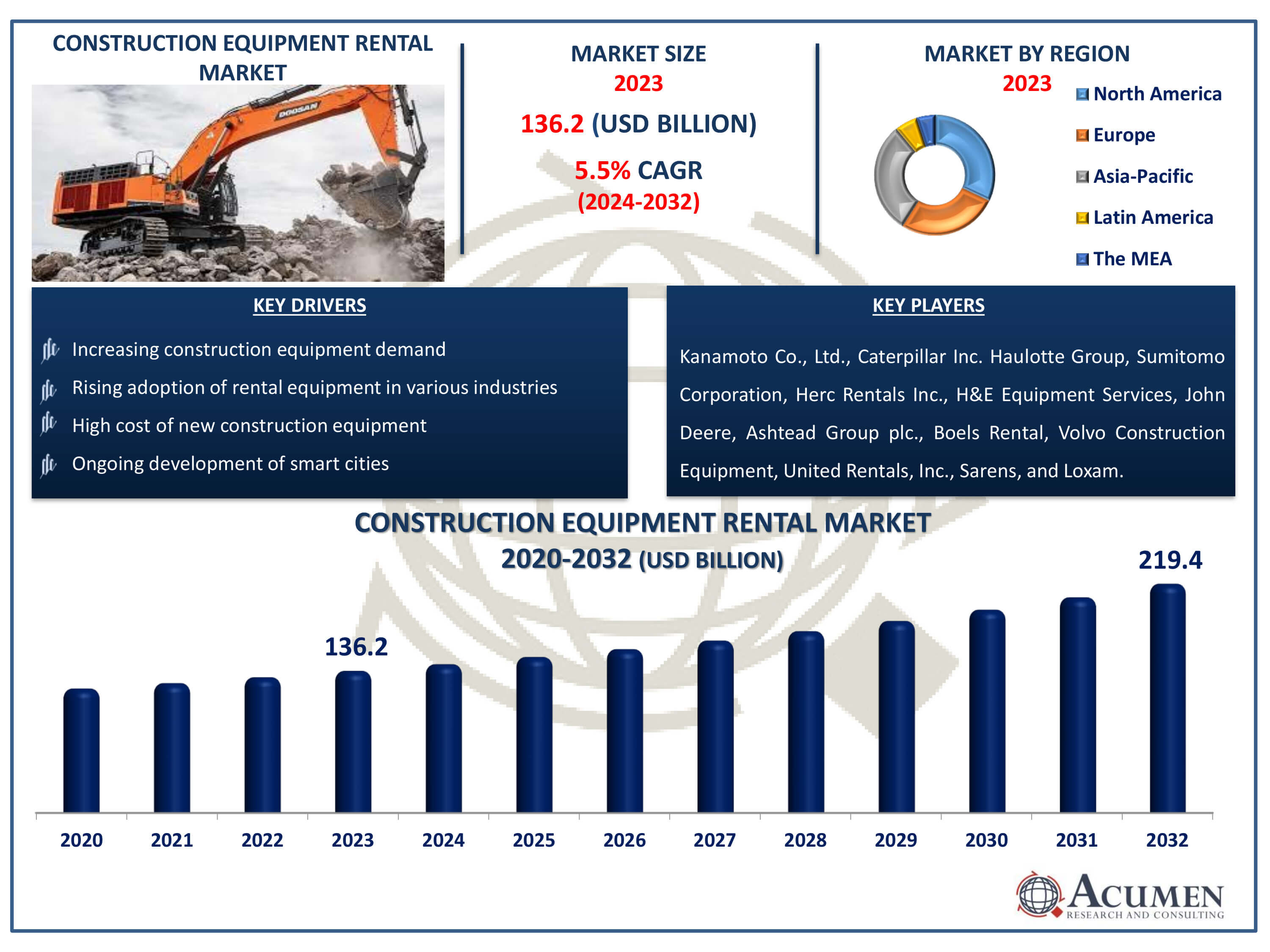

The Construction Equipment Rental Market Size accounted for USD 136.2 Billion in 2023 and is estimated to achieve a market size of USD 219.4 Billion by 2032 growing at a CAGR of 5.5% from 2024 to 2032.

Construction Equipment Rental Market Highlights

- Global construction equipment rental market revenue is poised to garner USD 219.4 billion by 2032 with a CAGR of 5.5% from 2024 to 2032

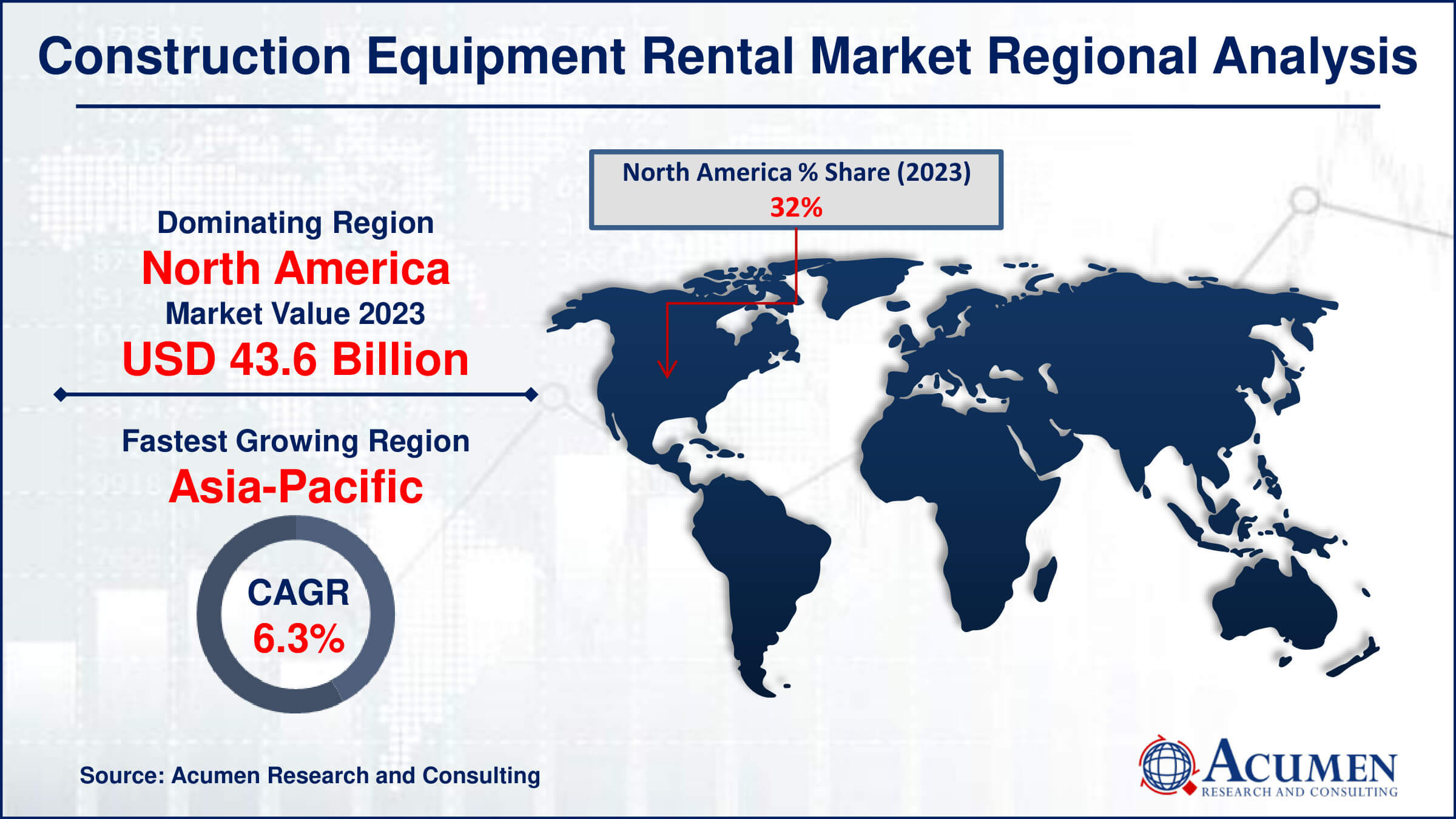

- North America construction equipment rental market value occupied around USD 43.6 billion in 2023

- Asia-Pacific construction equipment rental market growth will record a CAGR of more than 6.3% from 2024 to 2032

- Among equipment, the earth moving equipment sub-segment generated over US$ 76.3 billion revenue in 2023

- Based on product, the loaders sub-segment generated around 25% construction equipment rental market share in 2023

- Low rental penetration in emerging nations is a popular construction equipment rental market trend that fuels the industry demand

Construction equipment rental is a service that involves a specific contract with terms of use, offering construction equipment to end-users for a designated period, particularly for those who cannot afford to purchase new equipment. Construction equipment primarily facilitates heavy labor at construction sites, including mining operations. For tasks such as material handling, excavation, lifting, and other heavy operations, various Products of heavy construction machinery are utilized. When selecting rental equipment, consumers typically consider factors such as material quality, project complexity, and safety. The increasing development of countries and the rising demand for infrastructure will be major driving factors for the global construction equipment market.

Global Construction Equipment Rental Market Dynamics

Market Drivers

- Increasing construction equipment demand

- Rising adoption of rental equipment in various industries

- High cost of new construction equipment

- Ongoing development of smart cities

Market Restraints

- Lack of skilled and qualified equipment operators

- Construction industry's susceptibility to an economic recession

- Stringent regulatory requirements for equipment safety and maintenance

Market Opportunities

- Increasing government spending in construction industry

- Integration of advanced technology such as IoT and AI in rental equipment for improved efficiency and performance

- Growing trend towards short-term and project-specific equipment rental solutions, driven by the need for flexibility and cost-effectiveness in construction projects

Construction Equipment Rental Industry Report Coverage

| Market | Construction Equipment Rental Market |

| Construction Equipment Rental Market Size 2022 | USD 136.2 Billion |

| Construction Equipment Rental Market Forecast 2032 | USD 219.4 Billion |

| Construction Equipment Rental Market CAGR During 2023 - 2032 | 5.5% |

| Construction Equipment Rental Market Analysis Period | 2020 - 2032 |

| Construction Equipment Rental Market Base Year |

2022 |

| Construction Equipment Rental Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Equipment, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Kanamoto Co., Ltd., Caterpillar Inc. Haulotte Group, Sumitomo Corporation, Herc Rentals Inc., H&E Equipment Services, John Deere, Ashtead Group plc., Boels Rental, Volvo Construction Equipment, United Rentals, Inc., Sarens, and Loxam. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Construction Equipment Rental Market Insights

The rising construction activity globally is expected to drive the demand for construction machinery. Over the past few years, the output of the construction industry has increased by nearly 2.5%, with further growth anticipated in the coming years. Infrastructure development has also seen a significant rise, increasing by approximately 8.5% in the past year alone. These factors are poised to boost the demand for the construction equipment rental market. This growth can be attributed to the surge in construction and mining activities, particularly in emerging economies. Additionally, the introduction of advanced Equipment equipment into rental fleets is expected to reduce acquisition and operational costs, further driving the demand for rentals.

Technological advancements in the automotive and heavy machinery sectors have introduced numerous new features to the market. Safety features such as adaptive cruise control, lane departure warning, and automated braking systems enhance driver safety. However, these safety features often come with a high price tag, which may not be feasible for many small builders and contractors. Consequently, these professionals prefer to lease construction equipment. This not only saves the cost of purchasing new equipment but also reduces expenses such as labor costs, maintenance costs, and operational expenses. Timely maintenance, repairs, and monitoring costs are also avoided.

Construction Equipment Rental Market Segmentation

The worldwide market for construction equipment rental is split based on product, equipment, application, and geography.

Construction Equipment Rental By Products

- Loaders

- Backhoes and Excavators

- Crawler Dozers

- Forklift

- Cranes

- Other

According to the construction equipment rental industry analysis, loaders play a pivotal role as the largest segment. Loaders are versatile machines used across various construction tasks, including earthmoving, material handling, and landscaping. Their adaptability to different terrains and tasks makes them indispensable for construction projects of all sizes. Loaders come in different types, such as skid steer loaders, wheel loaders, and track loaders, each tailored to specific job requirements. Their efficiency in loading and transporting materials significantly enhances productivity on construction sites. Moreover, advancements in loader technology, including improved fuel efficiency and operator comfort, continue to drive their demand in the rental market. Overall, the loaders segment remains the cornerstone of the construction equipment rental market due to its multifunctionality and widespread applicability.

Construction Equipment Rental By Equipment

- Earth Moving Equipment

- Material Handling Equipment

- Concrete & Road Construction Equipment

The construction equipment rental market can be segmented based on items into earth-moving equipment, material handling equipment, and concrete & road construction equipment. The earth-moving equipment segment has historically commanded the market. However, the material handling equipment segment is anticipated to exhibit the highest compound annual growth rate (CAGR) in recent years. Earth-moving equipment, such as excavators, enjoys significant demand worldwide due to its wide application scope in construction, mining, and agricultural sectors. Other gears in this category include skid steer loaders, excavator loaders, crawler excavators, and mini excavators, which also present attractive market potential. In North America alone, skid steer loaders account for over 75.0% of demand. These loaders feature high load capacities and engine power, enabling efficient operations in harsh conditions.

Construction Equipment Rental By Applications

- Residential

- Commercial

- Industrial

According to the application segment, the market is divided into residential, commercial, and industrial applications. In recent years, the commercial segment has emerged as the dominant application segment in the construction equipment rental market due to the increasing demand for construction equipment for the development of commercial sectors. Additionally, the industrial subsegment has experienced significant growth over the construction equipment rental market forecast period. Increasing investment and rising industrialization in economies are driving the growth of this segment. Furthermore, investments are increasing for projects such as subways, bridges, and highways, driven by the growing population and the development of smart cities, which will be key factors for the market's growth.

Construction Equipment Rental Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Construction Equipment Rental Market Regional Analysis

In terms of construction equipment rental market analysis, North America's dominance in the global industry stems from its robust infrastructure development and extensive construction activities across various sectors. With a mature rental market offering a wide array of equipment choices, the region benefits from stringent safety regulations and a continuous focus on technological advancements, driving the widespread adoption of rental equipment. The United States, in particular, commands a substantial share of the North American market, propelled by a thriving construction industry and a plethora of infrastructure projects spanning the nation.

In the Asia-Pacific (APAC) region, particularly in China, rapid growth characterizes throughout the construction equipment rental industry forecast period. This growth is primarily attributed to the region's dynamic construction machinery manufacturing sector, buoyed by the availability of advanced manufacturing facilities, competitive labor costs, and extensive production capacity. China, as a global leader in construction machinery manufacturing, exports its equipment to various regions, including Europe and other Asian countries, further bolstering the region's market growth. Additionally, robust infrastructure development initiatives across APAC nations, coupled with increasing urbanization and industrialization, contribute to the region's status as the fastest-growing market for construction equipment rental globally. This growth trajectory is expected to continue as APAC economies further invest in infrastructure development to support their burgeoning populations and expanding urban landscapes.

Construction Equipment Rental Market Players

Some of the top construction equipment rental companies offered in our report include Kanamoto Co., Ltd., Caterpillar Inc. Haulotte Group, Sumitomo Corporation, Herc Rentals Inc., H&E Equipment Services, John Deere, Ashtead Group plc., Boels Rental, Volvo Construction Equipment, United Rentals, Inc., Sarens, and Loxam.

Frequently Asked Questions

How big the global construction equipment rental market in 2023?

The size of construction equipment rental market valued at USD 136.2 billion in 2023.

What is the CAGR of the global construction equipment rental market from 2024 to 2032?

The CAGR of construction equipment rental is 5.5% during the analysis period of 2024 to 2032.

Which are the key players in the construction equipment rental market?

The key players operating in the global market are including Kanamoto Co., Ltd., Caterpillar Inc. Haulotte Group, Sumitomo Corporation, Herc Rentals Inc., H&E Equipment Services, John Deere, Ashtead Group plc., Boels Rental, Volvo Construction Equipment, United Rentals, Inc., Sarens, and Loxam.

Which region dominated the global construction equipment rental market share?

North America held the dominating position in construction equipment rental industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of construction equipment rental during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global construction equipment rental industry?

The current trends and dynamics in the construction equipment rental industry increasing construction equipment demand, rising adoption of rental equipment in various industries, high cost of new construction equipment, and ongoing development of smart cities.

Which equipment held the maximum share in 2023?

The earth moving equipment held the maximum share of the construction equipment rental industry.